Independent Livestock Analyst, Simon Quilty of Global Agri Trends shares his thoughts on where Australian cattle prices are headed over the next few years.

Australian beef export prices and cattle prices are not mutually exclusive; instead, each progressively increases in value at different rates. There is a lag period however, during which livestock prices catch up to beef prices, typically spanning six to 12 months.

The October 2023 livestock price collapse was a significant concern, and for many, the memories of this period remain vivid today. Many wonder if this type of fall will occur again.

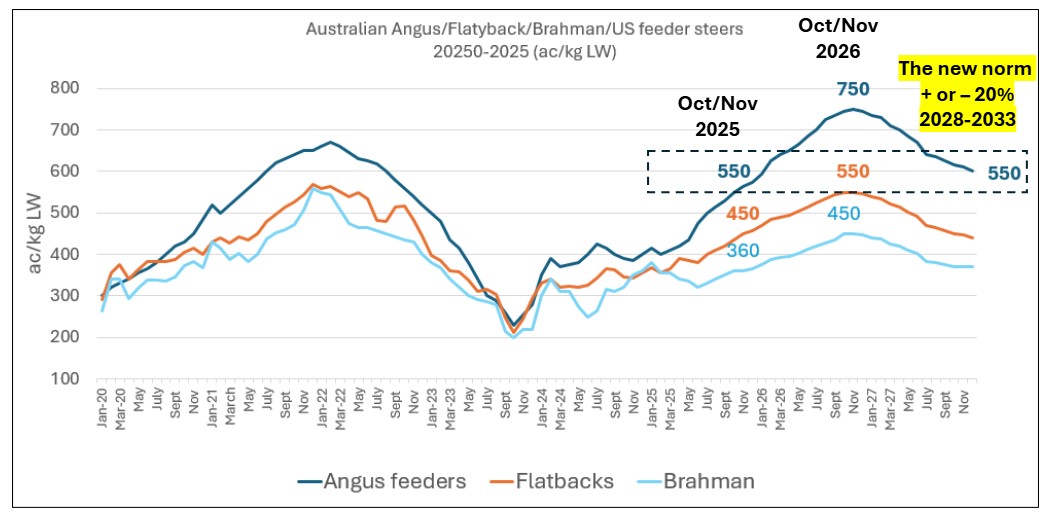

The new norm in cattle pricing will come after an expected rally over the next two and a half years, after which, global beef is likely to settle at new levels after the peak in prices is seen in late 2026 or early 2027, with an easing to more moderate levels for the period of 2028 to 2033, before a new upward cycle is expected again.

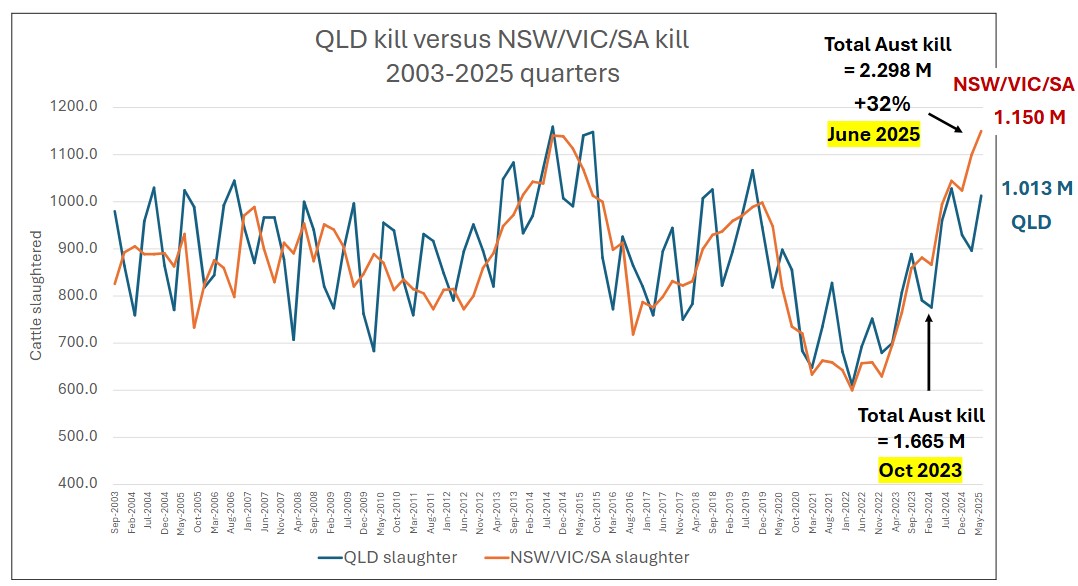

In the most recent Australian Bureau of Statistics (ABS) data for Q2 2025, we learnt that both brick-and-mortar capacity in meat processing facilities has expanded in Australia, particularly in Southern Australia.

Southern Australia’s capacity (NSW, Victoria and SA) is now greater than Queensland's capacity by 14 per cent, the first time in 20 years.

This chart shows Queensland’s kill in comparison to southern Australia. Source: ABS.

This chart shows Queensland’s kill in comparison to southern Australia. Source: ABS.

Since October 2023, when Australia’s processing sector created a bottleneck that resulted in livestock prices crashing, the abattoir capacity for sheep and cattle has increased. An additional 35 per cent in cattle capacity in southern Australia and 32 per cent higher for Queensland, and in the sheep sector, capacity is now 7 per cent greater than in October 2023.

Additionally, labour has increased significantly, with foreign availability more than doubling since Q4 of 2021, as COVID-19 restrictions eased and foreign workers were able to return to Australia.

Today in Australia, the number of available foreign labour has almost doubled compared to October 2023. We currently have 119,440 457 SID (482) Visa holders, compared to 67,760 visa holders in Q4 of 2023. This represents a 76 per cent increase in workers. The low in visa workers occurred in Q4, 2021, at 49,580.

As Australia moves down the path of rebuilding its sheep and cattle industries, these labour and capacity concerns will disappear with fewer animals to be processed.

The rise in cattle prices to date, I believe, has been sustainable; however, this trend is unlikely to continue, and a period of unsustainable prices is about to occur.

What I believe defines unsustainability is when the market moves into a supply-driven market (better defined as a lack of supply) where the scarcity of supply forces prices higher, and beef needs to be rationed among consumers.

Up until this point (today's market), supply and demand have been in balance, and higher prices have been driven by strong demand, not a lack of supply. The next phase of the price cycle is a tightening of supply, where there is no longer a balance and beef supply becomes scarce, which becomes the main driver of higher prices.

This is when the unsustainable drivers of market prices take over, and eventually supply picks up. Alternatively, cheaper meats such as pork and chicken take a greater role, and consumers start to fall away as they cannot afford the price levels – rationalisation begins to happen.

The new norm in Angus feeder steers

It's the next two and a half years where I expect the unsustainable period of the market to occur. Where typically beef prices will rise 30 to 35 per cent, peaking in October/November next year, and then fall 30 to 35 per cent. This will see prices in 2028 return to today's levels – back to a level of sustainability.

This chart shows pricing for Angus feeder steers over time. Source: Global Agri Trends.

This chart shows pricing for Angus feeder steers over time. Source: Global Agri Trends.

I am forecasting a peak in Angus feeder pricing at 750 ac/kg LW for October/November 2026, but this is not sustainable.

With Angus feeder steers, I believe the new norm will result in levels similar to today from 2028 to 2033. This would result in prices ranging from 550 to 570 ac/kg over the five-year period. This is where demand and supply will be in equilibrium. You would see prices fluctuating in a 20 per cent trading band above and below this average.

The anomaly of October 2023 has been addressed in both labour and bricks-and-mortar. The underlying fundamentals are much sounder today than they were in 2023, following the COVID-19 pandemic.

Given the high input costs that are unlikely to decline in the future, a new norm is necessary for the livestock sector to remain sustainable.

Disclaimer - important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.

More from Simon Quilty

Read other thought provoking articles from Simon, written exclusively for Livestock Now.

- The rise of Australian lamb prices

- Australian markets and the Middle East

- US tariffs imposed on global imports

- Threading the needle with US tariffs

- US tariffs and the Australian beef sector

- Wool & meat market forecasts amid tightening supply

- Australian cattle & sheep prices in 2024

- Brazil's fight for FMD free status

- Cattle prices -autumn 2024 forecast

- Finding the norm in global livestock prices

- Sheep prices-autumn 2024 forecast

- Meat demand from China- 2023 prediction

- Five key driver for 2023 livestock markets