At a glance

- Cattle markets are taking on a typical winter shape with slaughter weight cattle firming and lighter weights getting harder to sell.

- International and US beef prices have moved 10 per cent (pc) higher over the northern hemisphere summer which is strongly underpinning all our markets.

- Placements of cattle into US feedlots are now starting to fall with falls in US fed cattle supply anticipated to accelerate into year’s end.

- Brazil is quickly moving towards replacing the US as our largest competitor in our export markets.

- Export demand remains strong across our key markets with China starting to take a larger proportion of exports as US exports to China fall.

- Local cattle values remain supply driven with slaughter pushing up again processing capacity >150,000/wk.

- Heavy steers and slaughter cow markets are being supported by lack of southern supply with increased southern processor competition in northern markets.

- Feeder steer complex is tightening led by export demand for medium-fed Angus which has ratcheted up the price of heavy Angus feeders, forcing other segments to source lighter weight or heifer feeders.

- Seasonal conditions, the tight spread between feeder and heavy cattle prices and the high cost of replacement cattle is encouraging Queensland (Qld) producers to hold onto feeder steers and target grassfed export heavy steer markets later in the year.

- Restocker demand has plateaued as the first frosts hit, while northern buying was largely done earlier in the year when southern turnoff was in full flight and these types of cattle were cheaper.

Australian cattle markets have established a typical winter pattern

Slaughter and feeder ready cattle prices firming as turnoff slows across southern areas while the first of the frosts has seen demand for restocker cattle start to ease. While up until recently, cattle markets had been led by restockers, the baton has now been passed to slaughter cattle, which should hold sway through the winter months before passing the baton back to restocker in spring depending on the season.

The rise in cattle markets comes as international and US beef prices defy slowing economic growth and weakening consumer sentiment to post season highs. US wholesale beef prices are up 7pc over the last three weeks, now at their highest since May 2020, when COVID-related disruptions caused severe shortages. Much of the recent gains in the cutout have come from rounds and chucks (up 26pc and 23pc on last year) offsetting continued pressure on loin cut values.

Buyers remain cautious about the sustainability of current US cattle and wholesale beef prices. Tight supplies and strong summer demand have caused fed cattle futures to trade at a rare discount in the out-front months, reflecting the uncertainty about demand later in the year (exacerbated by rising geopolitical risks and the delayed impact of tariffs on economic growth). However, while demand concerns persist, the US industry looks to be on the path to lower production with May cattle on feed placements down 8pc on limited imports from Mexico and a 14pc decline in placements of light weight feeders.

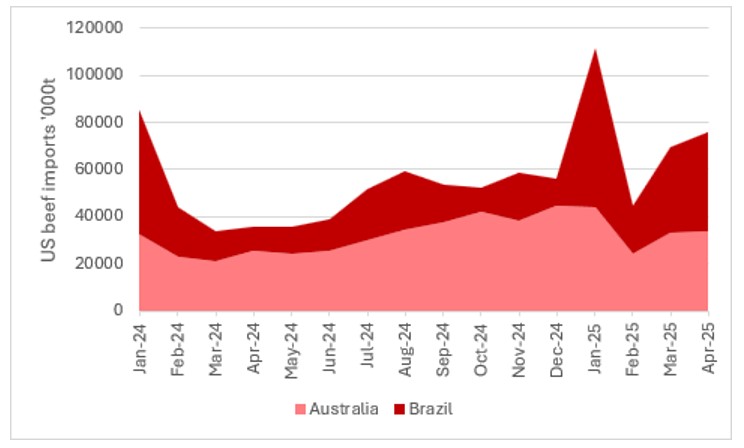

With US beef production trending lower it is creating opportunities for Australian beef in both the US and in other export markets. However, whilst US production is declining, Brazilian beef supplies have stepped up and have now overtaken Australia as the largest exporter to the US and look set to usurp the US and become our major competitor in north Asian markets over the medium term (see below).

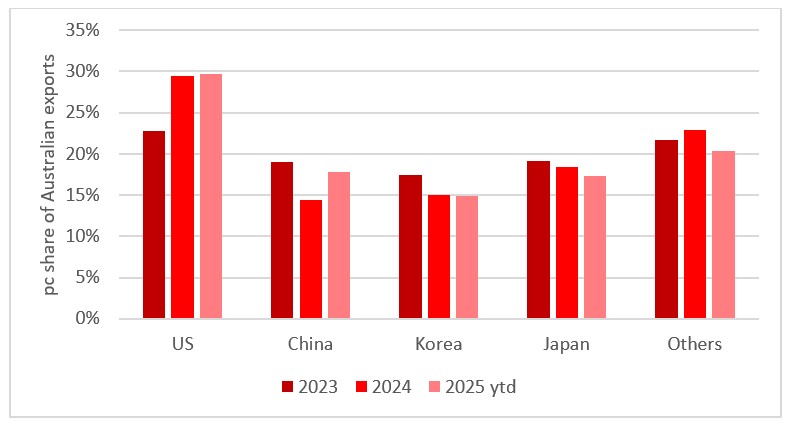

The year is almost half over. Demand from our key export markets remains fundamentally sound and has been relatively unaffected by US tariffs (see graph opposite). Most of our key markets are holding firm, with China taking more, as US beef is currently excluded from the Chinese market. Slight declines in the proportion imported by Korea and Japan may be the result of some US export beef displaced from China.

This chart shows the proportion of our beef exports shipped to each of our major markets. Source: DAFF.

This chart shows the proportion of our beef exports shipped to each of our major markets. Source: DAFF.

Here comes Brazil

Over the past few months Brazilian beef imports have quietly overtaken Australia as the number one exporter to the US. While our shipments were seasonally lower from January to April and affected by processing disruptions, this is a worrying development, given we currently enjoy a 26.3pc tariff rate advantage over Brazilian beef into the US. Additionally, South American beef trades at a 9-10c/lb discount to Australian product, indicating that South America has a significant cost advantage over Australian product (mostly from lower land values and labour costs).

Recently, Brazil was declared Foot and Mouth Disease (FMD) vaccination free by the WHO which paves the way for them to access valuable north Asian beef markets. Japan has one of the largest Brazilian expat populations in the world and there is a real push to provide access for Brazilian beef into Japan. Korea will most likely to follow Japan. Last week, Brazil received an official mission from Japanese authorities as a part of negotiations to open the Japanese market to Brazilian beef.

Australia is committed to moving its industry from a commodity supplier to a reliable and consistent supplier of high-quality product backed by world leading food safety standards. This should help us withstand the entry of lower cost suppliers, particularly as we head towards an environment of lower global beef supply as US herd rebuilding commences.

This chart shows US monthly imports of beef from Australia and Brazil. Source: USMEF.

This chart shows US monthly imports of beef from Australia and Brazil. Source: USMEF.

Local supply still the key driver

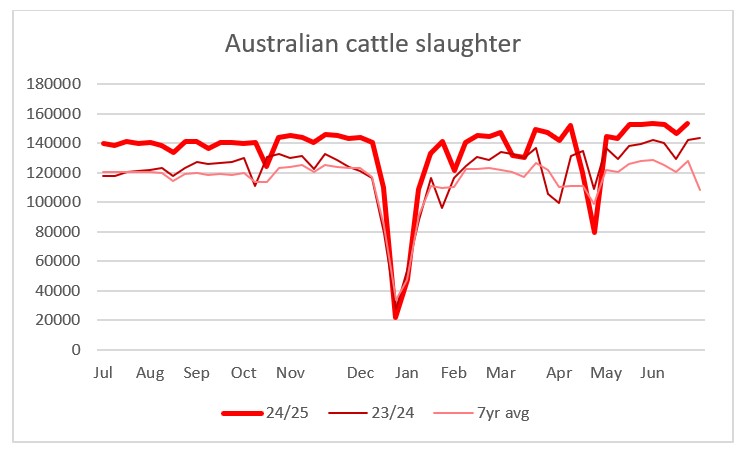

Like it has done for much of the past 18 months, supply is dictating the level of our local cattle values. In the past few weeks, local slaughter has moved above 150,000/week, pushing up against our processing capacity which continues to be capped by labour shortages. Meanwhile feedlots operate at a historically high-capacity utilisation taking advantage of globally competitive and relatively cheap grain values and solid demand for grain-fed beef.

Although overall supply remains high there are some gaps appearing in the local cattle supply complex.

Across the south, processors are struggling to source cattle of slaughter weight, sending them north to provide some competitive tension in northern markets. Southern feedlots that predominantly feed Angus cattle have forced the premium for suitable cattle to 80c/kg to $1/kg above Qld flatback cattle that are sitting around $3.80c/kg lw mark. The shortage of suitable Angus feeder steers has seen feedlotters shift to sourcing lighter weight cattle and has skewed domestic feeding programs towards heifers which has lifted prices across the entire Angus feeder market.

This chart shows weekly Australian cattle slaughter for 23/24, 24/25 and the 7-year average. Source: NLRS.

This chart shows weekly Australian cattle slaughter for 23/24, 24/25 and the 7-year average. Source: NLRS.

Although overall supply remains high there are some gaps appearing in the local cattle supply complex. Across the south, processors are struggling to source cattle of slaughter weight, sending them north to provide some competitive tension in northern markets. Southern feedlots that predominantly feed Angus cattle have forced the premium for suitable cattle to 80c/kg to $1/kg above Qld flatback cattle that are sitting around $3.80c/kg lw mark. The shortage of suitable Angus feeder steers has seen feedlotters shift to sourcing lighter weight cattle and has skewed domestic feeding programs towards heifers which has lifted prices across the entire Angus feeder market.

The discounts for coloured steers and the good conditions across Queensland are seeing many of these steers retained and grown to heavier weights, targeting grassfed bullock programs later in the year. This may see the large discount that has developed between Angus and flatback steer prices start to tighten as some Qld producers opt to feed on rather than sell feeders to the feedlots for bullock money. We have mentioned previously, as soon as the feeder steer price gets too close to the heavy steer price this becomes an option, particularly when seasonal conditions permit. The cost of replacing these steers has increased significantly the past few months which is another reason Qld producers may opt to finish feeder steers on grass.

This may help explain why we have seen the restocker market run out of steam. While the restocker price had moved firmly higher in the past couple of months, the northern feeder market has been somewhat subdued. With the first of the frosts starting the past couple of weeks and bullock prices now moving higher, Qld producers may be opting to retain feeder steers and grow to heavier weight rather than offloading and buying expensive lighter restocker cattle.

Much of the northern restocker buying was done earlier at cheaper prices with producers north of Dubbo, out through western NSW to Walgett and right through Queensland to St George, Winton, Blackhall and Longreach were very active on lighter restocker cattle in late autumn when the southern areas were in full turnoff mode.

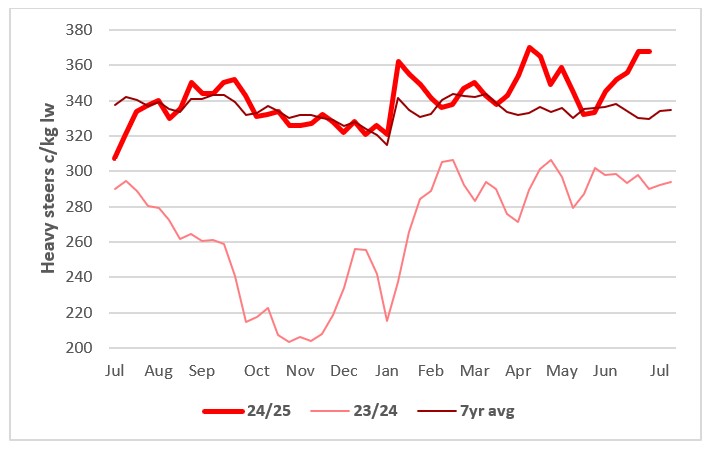

Heavy cattle availability tightens forcing prices higher

The shortage of heavy weight steers across the south has seen southern processors venture north to find suitable quality stock. One southern processor quoted $7.40/kg dw for bullocks in southern Queensland, happy to pay the freight cost of 40c/kg to drag them south, given the lack of finished stock available south of Dubbo.

This, combined with strong export beef prices and processing margins, will see the trend of higher bullock prices continue through at least the start of spring until southern producers can put weight on cattle. Although drought conditions across the south are easing, it is now too cold to grow any feed, and its unlikely southern producers will be major players in this market until later in the year when northern supplies tighten.

Winter supplies ease

Strong export beef prices and the lack of heavy weight slaughter ready cattle south of Dubbo has forced southern processors to become more active in northern markets.

This is starting to push along the heavy steer price as processors seek to maintain large kills given the strength of processing margins.

This chart shows the c/kg lw national saleyard indicator price for heavy steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

This chart shows the c/kg lw national saleyard indicator price for heavy steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

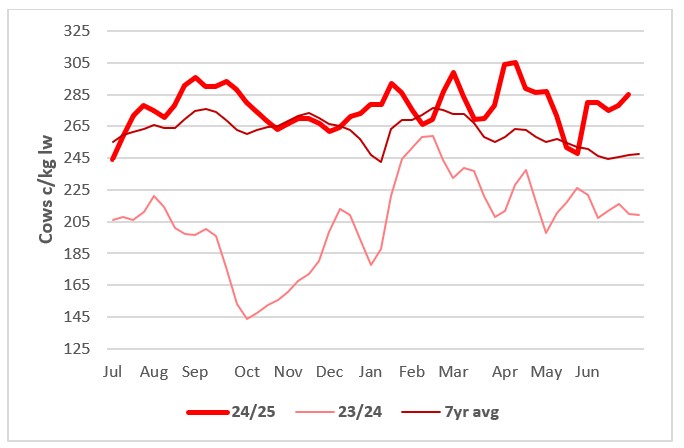

Southern processors hunt cows in northern markets

Like the trend in the heavy steer markets, southern processors ventured north to source cows with a lack of heavy weight cows across the southern region. They want heavy 600kgs plus, good solid trade cows pushing the price from $3/kg lw to $3.20/kg lw.

But at lesser weights the money drops back, to $2.80-3/kg lw for cows under 600kgs ad prices keep coming back as you go down in the weights, to cracker cows around 400-500kg which are only making $2.50/kg lw.

Some processors are trying to source cows put on feed to fill a gap in supply of good heavy trade cows, anticipated around August through to October. Lighter cracker cows that feed well are going into feedlots. The view is to bring them out in 80 days to fill the gap as northern cow supplies ease and before southern cows can put on weight through the spring.

Southern competition arrives

Southern processors are in Queensland and very active on heavy cows which has forced the price higher. Some processors, worried about cow supplies August to October, are encouraging feedlots to put light cracker cows on feed to help fill the supply shortage in 80 days, providing some indication of the futures strength of this.

This chart shows the c/kg lw national saleyard indicator price for cows in 24/25 vs 23/24 and 7-year average. Source: MLA.

This chart shows the c/kg lw national saleyard indicator price for cows in 24/25 vs 23/24 and 7-year average. Source: MLA.

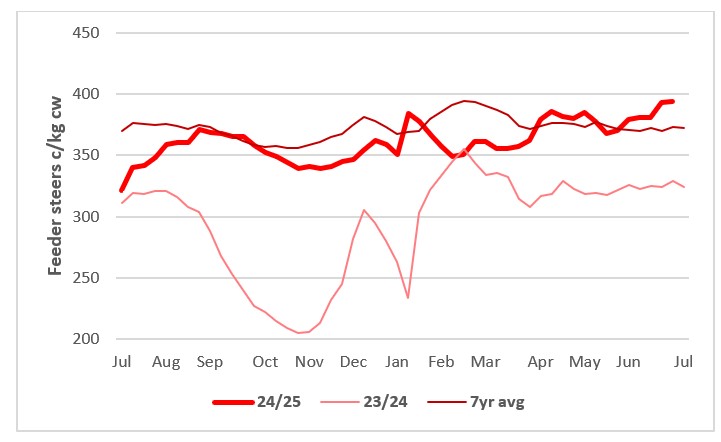

Demand strengthens across the breadth of feeder steer complex

There is a bit going on in the feeder market. Firstly, demand for medium fed Angus beef is driving premiums for heavy Angus feeders. This is likely to continue, with export demand strengthening as US beef production slips. The hike in Angus heavy weight feeder prices has driven some feedlots to source lighter weights or heifers to put on 60 to70-day programs for the domestic trade. This has narrowed the lighter weight feeder and heifer discounts.

The crossbred or flatback feeder price has been slower to move, sitting around $3.70-3.80/kg lw. However, the role in heavy steer values and the cost of replacement lighter weight weaners is seeing Qld producers opt to retain feeders and target grassfed bullock programs later in the year. A key driver is the season, which, despite the start of the frosts, is hanging on well with late season rains and mild weather seeing good herbage in many areas deep into the season. Tightening supplies of flatback feeder steers should support prices for these categories of cattle firm through winter.

Feeders in demand

Prices are now rising across the whole feeder complex, driven by demand for heavy angus steers for medium fed export programs.

This has encouraged demand for lighter and heifer feeder for shortfed or domestic trade programs.

Flatback feeder prices are beginning to rise as Qld producers to retain these cattle for grassfed heavy steer programs with the cost of replacing these now in the mid $4’s/kg lw.

This chart shows c/kg lw national saleyard indicator price for feeder steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

This chart shows c/kg lw national saleyard indicator price for feeder steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

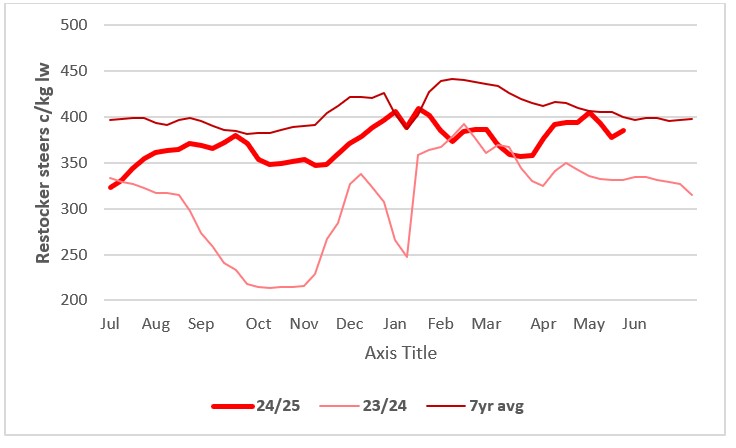

Frosts and higher prices slow northern restocker activity

The first of the frosts and the relative expense of light cattle has seen restockers pull back from this market. Producers north of Dubbo, out to western NSW to Walgett, and right through Queensland up to St George, Winton, Blackhall and Longreach were very active on lighter restocker cattle in late autumn. They picked up big lines of well-bred light restocker cattle around $3.40-$3.60/kg lw from Victoria/South Australia when the southern turnoff was in full flight. The prices of these cattle have now moved around $1/kg lw higher which has seen buying activity slow.

Given the cost of replacement cattle is over $1/kg lw, Queensland producers who would normally sell feeders and look to restock are being encouraged to feed-on. This has also impacted demand for restocker cattle which tends to decline seasonally at this time of year anyway.

Frost and replacement cost slows restocker demand

The first frosts and the relative expense of restocking cattle has seen restockers pull back from this market over the past few weeks.

Given the cost of replacement cattle is now over $1/kg, Qld producers who would normally sell feeders and look to restock are being encouraged to feed-on rather than sell to feedlots and restock with lighter cattle.

This chart shows c/kg lw national saleyard indicator price for restocker steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

This chart shows c/kg lw national saleyard indicator price for restocker steers in 24/25 vs 23/24 and 7-year average. Source: MLA.

From the rails

Read what Elders livestock representatives from around Australia are saying about the markets in their regions.

“We’ve had seven frosts in a row and the ground is hard, so not much pasture growth. The season now is developing into a typical winter.”

“There is a lot of enquiry from processors for mid fed Angus, predominantly HGP free and a little bit of enquiry for pill product. There won't be enough Angus supply to service all that demand and based on current feeder prices and grain prices, the sort of program pricing for 150-day Angus will have to start at $9/kg dw, with the movement higher in Angus feeder rates. Not that long ago it was probably down at $8.20 to 8.30/kg dw for October to November supply. There are processors chasing spot product and are willing to pay that money, but the cattle just aren’t out there.

“Program pricing for domestic trade grainfed product is at $7.80 to 8/kg dw and that'll continue to get a little bit dearer. Normally peak pricing corresponds with August, September entry. So that'll be your December/January period exit.

“There's certainly upside from $7.80 to 8/kg dw. It'll probably keep ticking 10c/kg dw every month. And for Wagyu there has been a little bit of enquiry starting to come through, but it has been tough going. There's a few contracts six months out at about that sort of $10.50 to 11/kg dw, and a little bit more if they if they are marble score 7 to 9. Heard a quote on Wagyu full bred feeders at $6.20c/kg lw up 20c/kg with purebred sitting around $5.80c/kg lw and F1’s struggling at $4.60c/kg lw, particularly if they are not aligned to any program.

“Domestic heifers seem to be now stabilising. There's more supply coming out of Queensland which is very typical for this time of year and not a lot of supply coming out of NSW and especially out of the south with the season. So, most of the supply is now swinging to the north to places like Roma and Blackall where you can pick them up at $3.50 to 3.60/kg lw.

“Heavy Angus heifers, 380kgs plus there's a lot of demand right across the board and they are making $3.90 to 4/kg lw, they're going into 120 to 150-day programs.

“The tough one are Angus steers with the seasonal conditions most of those steers have moved from the south to the north and most of those cattle won't be available until October and there are feedlots pushing prices to get supplies.

“But it’s hard to see them getting big numbers because it's a very, very difficult time of year. The market is sitting at $4.55/kg lw for a non-EU and $4.70/kg lw for an EU accredited steer, but they are tough to find even at that money.

“It remains to be seen how much supply comes through later. A lot of those 300kg black steers went up to Winton and Longreach and if they don't get a winter, some of those cattle could start running in July and August. They really need some sort of winter rain to get a bit of herbage going to get those cattle moving and its unlikely in that part of the world.” - Nik Hannaford, NSW State Livestock Manager.

NSW saleyard market indicators c/kg lw | ||||

| 26/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 359 | 372 (-13) | 334 (+25) | 307 (+52) |

| Processor cow | 289 | 280 (+9) | 273 (+16) | 216 (+73) |

| Feeder steer | 421 | 414 (+7) | 396 (+25) | 348 (+73) |

| Restocker steer | 390 | 370 (+20) | 415 (+25) | 314 (+76) |

| Restocker heifer | 318 | 331 (-13) | 333 (-15) | 244 (+74) |

Source: MLA

“The saleyard market in northern Queensland has been very mixed during the week with northern works heavily booked. Fortunes largely rely on competition from southern processors and live exporters topping up shipping commitments.”

“A recent Vietnam shipment filled relatively easily at around $3.10/kg lw with activity expected to return at slightly lower rates, although this is yet to be confirmed. So far this week we have seen high quality prime bullocks and cows slightly easier while plain secondary types are significantly lower than in recent weeks.

“No change to market conditions in Broome, albeit with some increased interest in Malaysian/Vietnam for lesser grades. 3-4 ships were loaded in mid-June out of Broome with exporters kept honest by plenty of inquiry from southern WA for crossbred feeder steers ex Kimberley Region at $3.20c/kg lw.

“Darwin live exporters have been very active mainly on Indonesian feeder and heavy feeder classes as well as Vietnam slaughter cattle. Flood Plain restockers tried to follow the market down to towards the same rates that an exportable brahman feeder steer had been attracting around $3.30/kg lw for most with some of the best cattle $3.35/kg lw, but were met with some seller resistance as quality lines of lightweight high grade brahmans have been achieving closer to $3.40/kg lw. These cattle are destined for wet season turn off (December/January) so really need to be purchased now to maximise productivity before then.” - Paul McCormack, Livestock Manager - Customer Solutions, Townsville.

“Roma had a solid yarding of 8,675 on Tuesday and Dalby had 5,300 on Wednesday with the general trend of lighter stock cheaper and any heavy weight stock firm.”

“Southern processors have entered the Queensland cow market. They want the heavy 600kgs good solid trade cows, and they've gone from making $3/kg lw to $3.20/kg lw, but the moment you step down from those weights, you're back to where the market's been sitting, $2.80 to 3/kg lw for cows under 600kgs ad prices keep coming back as you go down in the weight with a 400 to 500kg cow probably only making $2.50c/kg lw.

“Still very few bullocks getting placed into the yards. As far as feeders go, we've seen another lift in the Angus feeder price. It's been sitting around that $4.50 to 4.55/kg for the last few weeks, but it's now gone to $4.65/kg lw and flatback crossbreds are at $3.80-3.90/kg.

“For most feedlots now, you are only looking at about a couple of weeks wait and then you can place those cattle, so that’s the best it has been in terms of getting feeders in for a while.

“We are hearing that some processors are trying to source cows to put on feed to fill this gap of good trade cows expected August through to October. A lot of those lighter cracker cows that can feed well are going on to feed with a view to bringing them out in 80 days as northern cow supplies erase and before southern cows have had time to put on weight.

“The anomaly in Queensland is that southern Queensland processorsare 40c/kg dw in front of Rockhampton, which is in front of Townsville. We haven’t seen that for a long time, but they are obviously trying to combat the influence of southern works.

“Weaner steers are strong $4.50 to 4.80/kg, irrespective of what the fat job or other cattle markets are doing. Could be a bit of end of financial year buying or just grass fever. Heifers in Queensland still in the doldrums $3 to 3.50/kg lw with the odd good cross bred line getting out to $3.80/kg lw but still a long way behind the weaner steer price.

“Brahmans still in trouble and that doesn't look like changing. Everyone's less 40 to 60c/kg lw on the Brahman feeder steer at the same weight as the crossbred and that's if the feedlots will handle Brahman at all, as quite a few won't.” - Ashely Loveday, Livestock Sales Manager QLD/NT, Dalby.

Queensland saleyard market indicators c/kg lw | ||||

| 26/06/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 325 | 335 (-10) | 297 (+28) | 255 (+70) |

| Processor cow | 278 | 273 (+5) | 244 (+34) | 194 (+84) |

| Feeder steer | 368 | 372 (-4) | 367 (+1) | 303 (+65) |

| Restocker steer | 396 | 392 (+4) | 399 (-3) | 309 (+87)) |

| Restocker heifer | 312 | 318 (-6) | 312 (n/c) | 241 (+71) |

Source: MLA

“Sale numbers are slowing as markets take on a typical winter shape down here. The season through the south-east of South Australia has turned around over the past couple of weeks with several good falls of rain”.

“Feed is still short, but crops are up and going and there is some more optimism, but these conditions are not widespread through SA with a lot of stock having been moved out of the state. Prices have held firm with good restocker and feedlot buying demand on any suitable stock. Direct to works rates for bullocks and cows have firmed as supplies of slaughter weight cattle ease seasonally.” - Laryn Gogel, Livestock Sales Manager, South Australia.

SA saleyard market indicators c/kg lw | ||||

| 26/06/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 415 | 399 (+16) | 376 (+39) | 317 (+98) |

| Processor cow | 323 | 303 (+20) | 261 (+62) | 246 (+77) |

| Feeder steer | 388 | 384 (+4) | 341 (+47) | 301 (+87) |

| Restocker steer | 332 | 362 (-30) | 306 (+26) | 266 (+76) |

| Restocker heifer | 271 | 347 (-76) | 259 (+12) | 189 (+82) |

Source: MLA

“We’re a bit jealous of reports of up to 80mm of rain over in Western Australia. We would be lucky to have 80mm of rain for the whole of this year where we are in Circular Head and along the coast. We are forecast to get some more from this front as it moves east however. It’s not that the place is barren or dry, there's a bit of a green tinge and there's a little bit of growth, so there has been a bit of urea go on to get things going before it gets too cold.”

“For prime cattle which are mostly program grassfed cattle, the majority of producers have locked in contract prices at $8.40 to $8.50/kg dw.

“Better cows $5.90 to 6/kg dw for beef cows, but that market hasn't done much in the last few weeks. They'll start to run out here shortly, so we might see a bit of an uplift there.

“Restocker cattle showed a little bit of strength over this last week at Smithton and then also on AuctionsPlus last Friday.

“Better quality younger restocker steers, didn't really matter what the weight was, basically $3.80 to 4.20/kg lw for blacks, coloured cattle $3.50 to 3.80/kg lw. On heifers, again, didn't matter what the weight was, basically $3.10 to 3.40/kg, and that improved 20 to 30c/kg lw.

“Where a lot of those heifers the week before were under $3/kg lw, they've made up a bit of ground. We've had some good weather over here, a few frosts and looking for a bit of moisture to come through over the next couple of days. But we are heading towards the depths of winter where things slow down here a fair bit.” - Gavin Coombe, State Livestock Manager Tasmania.

Tasmania saleyard market indicators c/kg lw | ||||

| 26/06/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 335 | 318 (+17) | 309 (+36) | 250 (+85) |

| Processor cow | 283 | 252 (+31) | 244 (+39) | 176 (+107) |

| Restocker steer | 340 | 290 (+50) | 280 (+60) | 240 (+100) |

| Restocker heifer | 323 | n/a | 266 (+57) | 188 (+135) |

Source: MLA

“The cattle job is a bit all over the place. Cheaper in some markets and some markets are very expensive. You can get $6.50 to 6.80/kg for a cow with meat on it- what you would call a good trade cow, and high $7’s/kg dw for a bullock, but I'm talking spot prices, not the program prices.”

“The entry weight feeder steers are getting less and less, as heavy weight feeders supplies tighten. Anything with meat, the heavier they are, the more money they make c/kg and now the feedlotters are moving onto lighter weights and prices for those cattle are catching up now.

“But everyone's chasing heavier backgrounding cattle, 380 to 400kgs plus. But there's plenty of demand for everything really because we are starting to feel the impact of the dry and while it has rained, there is not a lot of feed around and it’s too cold for most areas now.” - Peter Homann, National Livestock Manager.

Victoria saleyard market indicators c/kg lw | ||||

| 26/06/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 397 | 402 (-5) | 365 (+32) | 314 (+83) |

| Processor cow | 312 | 302 (+10) | 269 (+43) | 231 (+81) |

| Feeder steer | 400 | 393 (+7) | 357 (+43) | 304 (+96) |

| Restocker steer | 361 | 360 (+1) | 326 (+35) | 280 (+81) |

| Restocker heifer | 314 | 297 (+17) | 283 (+31) | 222 (+92) |

Source: MLA

“Things have quietened down a lot over here and developing into a typical winter market with numbers back and quality mixed.”

“Most Western Australian livestock areas received good soaking rain over the last week between 15 to 80mm with 20 to 40mm falls most common. But it has turned cold, and the rain won’t grow a lot of feed now, however, it sets the hay and cropping season up for later.

“Everyone is looking for heavier feeders with the feed situation tight until they start cutting hay in September. The market is basically unchanged here on both slaughter and feeder/restocker cattle. A limited offering of heavy steers 350 to 400kg plus sold to a top of $4/kg to average $3.70/kg lw with heavy heifers at a 30c/kg lw discount to steers. The larger numbers were in the 250 to 350kg category with the steers 300 to 350kg selling to much the same prices as the heavier categories but anything under 300kgs getting discounted by around 30c/kg lw to average around $3.40/kg lw. Heifers under 300kgs were discounted by 30c/kg lw and under 250kgs were discounted by 70c/kg lw to average $2.70c/kg lw.

“The lack of interest in lighter cattle is because graziers have either stocked up earlier or are waiting until a bit later to step into the market. Some graziers were hesitant due to the stop start nature of the cropping season which took a while to get going and was still a little bit average until the last lot of rain. We can expect restockers and feedlotters to be back active again in late August/September before the hay cutting season and harvest begins in September/November and when there is a bit more pasture growth. The feedlotters will then start to come for any of the heavier feeders to put on grain when harvest supplies start to flow from November.

“Slaughter cattle prices are steady for cows ($5.50 to 5.60/kg works and $2.40 to 2.45/kg lw yards) and bulls ($2.20kg lw yards) with most supplies coming from pastoral areas.” - Michael Longford, Livestock Sales Manager, WA.

WA saleyard market indicators c/kg lw | ||||

| 26/06/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 290 | 270 (+20) | 256 (+34) | 248 (+42) |

| Processor cow | 233 | 225 (+8) | 228 (+5) | 229 (+4) |

| Feeder steer | 296 | 335 (-39) | 329 (-33) | 314 (-18) |

| Restocker steer | 338 | 333 (+5) | 282 (+56) | 257 (+81) |

| Restocker heifer | 212 | 222 (-10) | 296 (-84) | 230 (-18) |

Source: MLA

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

*Disclaimer – important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.