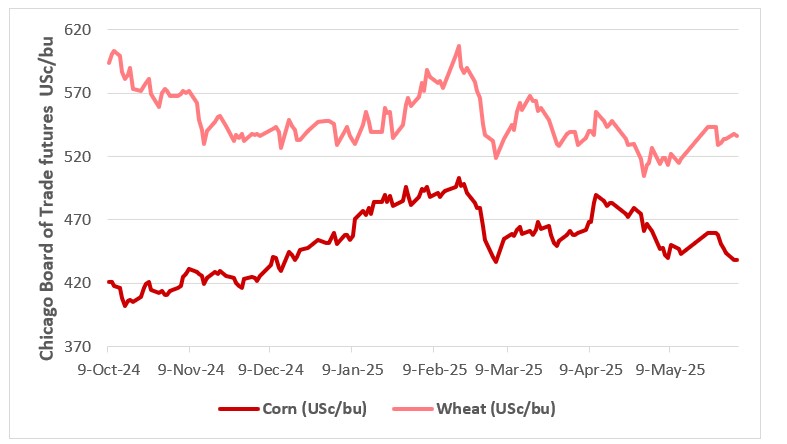

Grain markets staged a brief recovery in May before rain fell in areas that needed it, and the weather premium that had been building disappeared. Rain across northern Europe, northern China and through the US Plains largely alleviated production concerns with most forecasts now moving higher.

India is harvesting its best crop in years and south America is wrapping up a record corn and soybean harvest. Northern hemisphere spring crops have been planted early and into ideal conditions.

The only near-term crops issues are in France and Germany, where it is too dry, US and Canadian spring cropping areas and parts of southern Australia.

The most worrying aspect for global markets is that new crop Russian wheat offers are some US$15-20/t below competitive old crop bids. At this stage it looks like major exporters such as Canada, US, EU and Australia will carry higher than normal old wheat stocks into the new season.

Corn and soybeans have been dragged down by rapid planting in the US and very competitive south American offers from their recent harvest. US exporters are looking to Trump to increase biofuel mandates (biodiesel and ethanol blends) to help increase domestic demand and help replace lost export business from the US/China trade disputes.

This chart shows the USc/lb nearby CBOT futures prices for corn and wheat. Source: LSEG Workstation.

This chart shows the USc/lb nearby CBOT futures prices for corn and wheat. Source: LSEG Workstation.

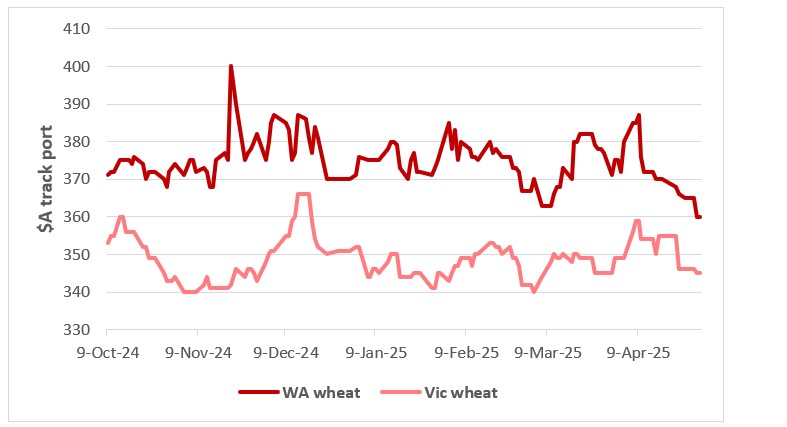

The recent improvement in seasonal conditions across parts of southern Australia has cooled local feed grain demand. This has lead to a softer tone in domestic grain markets which had been holding up despite weak export demand.

Sorghum has been a bright spot, with most of the harvest being sold at the equivalent of milling wheat values to China. With most of the southern crop now spoken for, attention has turned to central Queensland for bulk shipments. Container demand expected to mop up the balance of the crop in northern NSW and southern Queensland.

Northern winter cereal crop planting is basically finished with chickpea sowing well underway. Seasonal conditions are generally above average to excellent in southern Queensland and northern NSW.

Wheat market is tough going

Track bids lost $5-$10/t over the past fortnight with delivered bids following suit over the course of last week. It’s hard to see how this market can rally in the short term. International markets are bumping along at near enough to seasonal lows with pressure from the northern hemisphere harvest imminent. The northern zone will carry over supply from the 2024 harvest and seasonal conditions for the 2025 wheat crop are excellent across the north.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

There are still drought concerns in southern Australia, but end users in Queensland and NSW appear comfortable that they will have plenty of supply available. Current season bids for ASW1 into Brisbane had been doing well to hold between $365-$370/t but $360/t now seems to be the mark. Delivered Downs SFW1 is down from $350/t only a couple of weeks ago and is just clinging onto $342 /with plenty of bids in the $330/t’s.

New season delivered markets are hard to find, with both end users and traders happy to stand aside from bidding on the expectation of cheaper prices in the coming weeks/months. SFW1 $340/t Downs, $320/t Texas, $360/t Brisbane.

Southern delivered wheat markets were under pressure early in the week but consolidated into week’s end to finish $2/t lower. The market pressure came from rainfall that fell through southern NSW and forecasts for rain through Victoria. However, when the rain didn’t fall in Victoria, sellers retreated, and markets recovered. Liquidity was below average and engagement was low as the market waits for a start to the winter crop season.

At the close last week, ASW1 del Melbourne/Geelong was bid $380/t, SFW1 del Goulburn Valley was bid $355-360/t. ASW1 Griffith was $345-350/t, ASW1 del Murray Bridge $385/t while SFW1 del Walsley’s expected to be closer to $390/t.

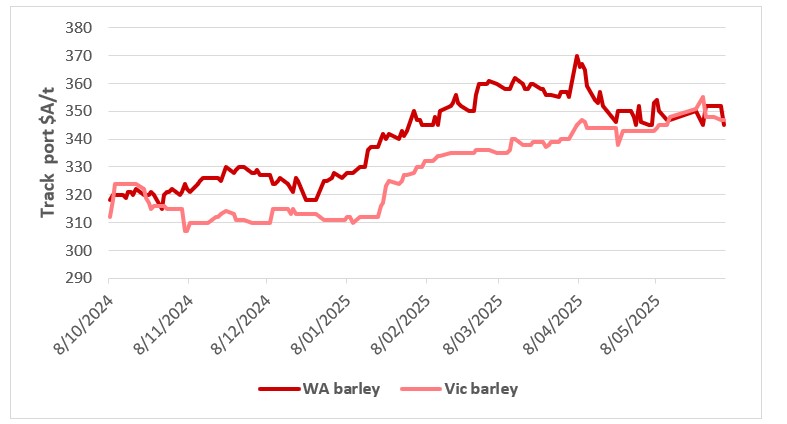

Barley shorts get filled

The barley market lost $2-5/ over the past week. There had been some demand for ex farm barley for prompt pickup over most of May which had supported the market. However, that appears to have been filled and now barley is like wheat, in that end users are well covered, and the traders are happy to sit back and wait for offers. Delivered Downs bids are down $3/t to $332/t and the market vibe is bearish. New season delivered bids are also down $5/t from last week and are now around $325-$330/t Downs feedlots.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

Central NSW barley is working into export and southern markets, but northern NSW barley is still heading to the usual feedlots in southern Queensland and northern NSW.

There is a belief that southern Australia still has an ‘adequate’ barley supply for export demand, despite the ongoing drought in South Ausralia and parts of Victoria and southern NSW. After coming off, following season opening rain in southern NSW, softer values saw buyers emerge.

Delivered Geelong/Melbourne is at $370/t for June while Goulburn Valley is at $357/t and Central Victoria at $354/t drawing some consumers back into the fray. Geelong track remains site specific but is near $350/t with some drought feeding still holding things up, but the bulk of the trade seems to be sliding lower.

Kembla has softened considerably after the rain and now seems to be near $340/t track while Newcastle is now heading closer to $300/t and along with Brisbane, heading closer to export buying levels. Kwinana and Albany are better offered than bid, with values near $340/t.

Victorian new crop track values seem to have found a level at $326—327/t over the week.

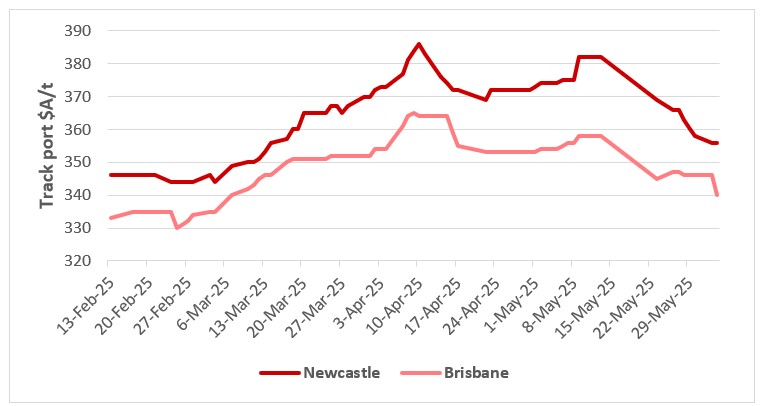

Sorghum focus shifts to central Queensland

There’s nothing new to report in the sorghum market. Bids are pretty much unchanged in the Downs and Brisbane markets but have lost a few dollars in upcountry sites like Goondiwindi and Moree. Many traders have finished their bulk export programs and growers don’t have that much tonnage left to sell. The result is a lacklustre market that is just limping. Bids are still good value relative to wheat and barley prices. SOR1 $350-$355/t del Downs packers, $320/t Narrabri, $315/t Moree.

The delivered Brisbane market closed the week bid at $380/t. Markets saw relatively few offers late in the week with merchants confirming a general reluctance by the producers to commit to sales ahead of the new financial year. The delivered Newcastle market was softer early in the week trading at $375/t for June delivery slightly below the previous weeks close.

This chart shows the track prices for sorghum delivered Newcastle and Brisbane port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for sorghum delivered Newcastle and Brisbane port in $A/t. Source: LSEG Workstation.

In Central Queensland there is a bit of harvest going on, but rain last week has pushed it back a touch. A bulk exporter has finished their delivered Mackay program last week picking up enough to cover their slot, buying around $370/t delivered port.

Market is now flat at $340-$345/t trading over Brisbane levels. Harvest should ramp up over the next two weeks if the weather stays dry. Bulk exporters may re-enter the market to top up bulk vessels ex Newcastle if they can’t accumulate enough in the Newcastle port zone.

Canola falls on weakening in offshore markets

Local markets took the lead from off-shore which pulled back on large South American crops and a lack of clarity on US biofuel policies. Uncertainty over US biofuel policy has pressured soyoil prices, which hit their lowest since mid-April.

Having lost their biggest export market in China, US farmers are now counting on Trump to increase blending mandates to keep next-crop inventories from growing. China has no buy orders for next-crop US corn, soybeans or wheat. US biodiesel plants have been running at just 51per cent of their capacity in the year through April.

Canadian canola futures succumbed to the downdraft from soyoil, dropping beneath CA$700/t for the first time in over a month. Canada is looking for some rain to alleviate moisture stress on its recently planted Spring crops. There are some moderate patchy falls in the forecast.

Aussie canola markets finished down $25/t week for the week in sporadic liquidity, but basis was also lower on the back of rain in Western Australia, as well as better production prospects in southern NSW after rainfall last week.

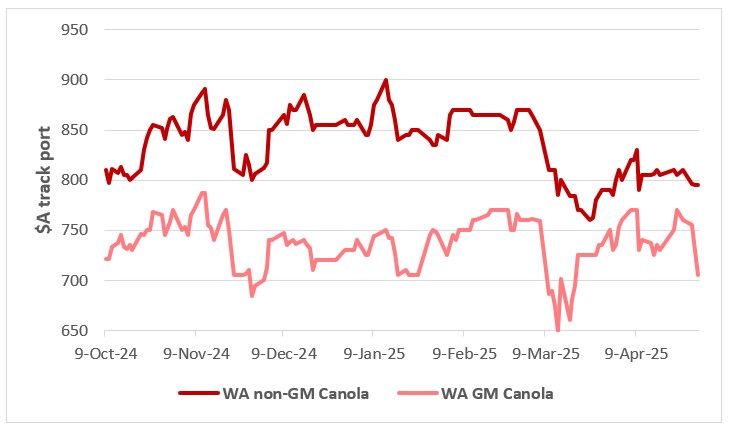

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG Workstation.

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG Workstation.

GM seed firmed slightly against non-GM. East coast markets are quoted $805-815/t for non-GM and the Adelaide zone would be around $795/t with Kwinana closer to $805/t.

New crop saw the generic Victorian/NSW/South Australian contract close the week $795/t while Western Australia is around $820/t. Discounts for GM on the east coast were expected to be around $45—50/t while South Australia and Western Australia would be around $55/t.

Pulse markets a bit fragile

The chickpea market is feeling a bit fragile. India have implemented a 10 per cent tariff on Australian chickpeas, but have just announced that they have extended the tariff exemption on Canadian yellow peas until March 2026.

Yellow peas are a part substitute for desi chickpeas at a 50 per cent discount. Combine that with pulse traders still feeling bruised by Indian traders not honouring high priced contracts in 2024/25 and there’s plenty of uncertainty about how Australian chickpeas will trade in 2025/26. Expectations are for another large Australian chickpea crop and uncertain Indian demand and pricing is a definite worry.

New season delivered Brisbane bids have fallen to $810/t from $850/t on the news of the tariff exemption for Canadian yellow peas with the premium over up country sites because of the freight advantage for bulk shipping over containers. As a comparison, Downs bids are around $750/t and traders are indicating that somewhere around $700/t Goondiwindi/Moree.

Faba Beans exporters will be interested in faba beans from Northern NSW as it doesn’t look like South Australia are likely to have much of a crop. Bids have lost $20-$30/t in the past couple of weeks but there’s still plenty of interest. Indicative bids $470/t del Downs, $500/t del Bris, $475/t Narrabri for new crop.

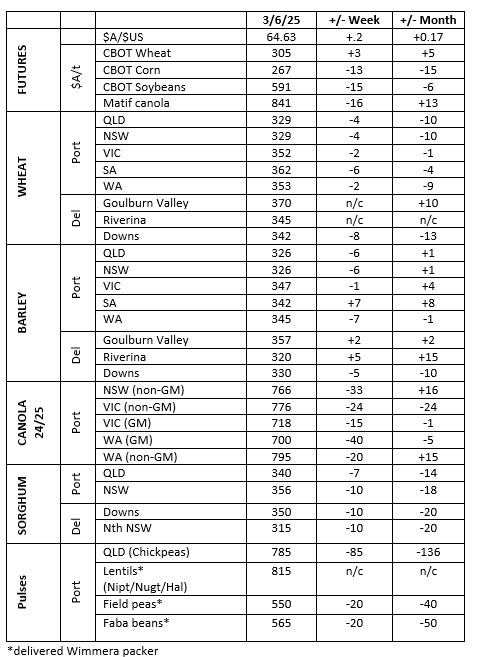

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

From the field

This months From the field spotlights the planting activities across the country as reported by Elders field staff in the regions.

Nathan Surawski, Rural Products Manager, Queensland provides the following insights into the main cropping regions of Queensland.

Inner Downs (Toowoomba)

“Across the area, about 20 per cent (pc) is planted so far, and on track with 15pc germinated in the last four days due to moisture and warmer than usual weather.”

“There is likely to be a smaller than historical winter plant with growers to hold moisture and plant summer crop with a lower than usual chickpea crop. No pest or disease so far, early mice seem under control.”

Downs (Dalby)

"Planting is around 50-60pc completed with around 80pc germinated with some replanting required. Normal rotations will be followed."

Western Downs (Tara/Miles)

"Planting is mostly finished with wheat all but done and the remainder of plant remaining is chickpeas. 85pc has germinated with around 5pc needing to be replanted in 2 to 3 weeks due to rain."

"Upside in the chickpea market (lower tariffs) has seen 25-30pc of wheat programs moving to chickpeas. Some increase in canola planting in Southern Queensland due to newer and more suitable varieties but less than 3pc of crop area is canola but still growing market and likely to continue year on year.

"Low level of disease pressure but some evidence of Yellow Spot in Wheat and Net Blotch in Barley."

Central Queensland (Dawson/Callide, Biloela, Moura, Theodore, Rolleston)

"About 30 to 40pc planted with germination in various stages."

"Still trying to get areas of cotton crop picked. Long term average likely for winter crop acres of wheat and chickpeas. No disease or pest considerations to report at this stage."

Central Highlands (Emerald, Clermont)

"Planting is pretty much all done with maybe some late wheat still to go but all is up and going. Large amounts of chickpeas, balance wheat. No disease or pest consideration with ideal growing conditions."

"Given the patchy break across NSW the crops are at varying stages. In northern NSW planting is 85 to 90pc finished, with growers moving on to chickpeas and wrapping up programs. Most crops are now germinated and are looking excellent."

"Central NSW is a little more variable with around 70pc of programs completed in eastern areas where rainfall was better. Western areas have taken a more conservative approach with around 50pc planted on the early rainfall with the balance of programs going in now after recent rainfall. Across central NSW about 35 to 45pc of crops have germinated and are looking good.

"Southern NSW is even more variable with those who dry sow largely finished with about 25pc germinated. Those that plant on moisture are only in the early stages with about 20pc of programs completed and racing the clock to get crops in to get some late season growth before yield penalties are incurred. The very mild autumn and early winter has soil temperatures higher than normal with the lack of frosts providing hope of reasonable crop establishment. Crop conditions at the end of June will give us a better indication on crop potential. In southern regions there will be marked shift away from canola plantings to wheat and barley, but most growers in northern and central NSW have planted normal rotational programs." - Adam Little, Technical Services Manager, NSW.

“Wimmera has 70pc planted, with around 5 to 10pc germinated. Canola resowing is starting this week west of Horsham. Many growers either axed canola in February or still have the seed in the shed. Another client axed 400ha of lentils last week into barley. No rain is forecast for the next two weeks, so challenging times. Horsham’s official rainfall to date is 44mm, so expect another difficult cropping season. There is 10 to 20mm forecast this week which would be very helpful to promote germination.” - Mick Preston, Rural Products Manager Horsham.

“Rain in early May has seen 95pc of programs planted with around 35pc germinated. There has been some canola dropping out of programs due to the lack of subsoil moisture and being replaced by wheat. Crops look healthy but will need regular rainfall through the season to realise yield potential.

“Fungicides and insecticides are going out with first post emergent sprays.” - John Young, Rural Products Swan Hill/Mallee.

“Good rain last week will get crops up and away 4 to 6 weeks later than ideal. Good soil moisture at 30cm and deeper due to rainfall toward end of last year. Extra rainfall is required to join up topsoil moisture with subsoil reserves. Plantings are all but finished and we should get good germination with the recent rain.”

“Like in most areas’ canola has been dropping out and being replaced by barley - roughly 20pc less canola area replaced with barley.

“No diseases or pests of note, but expecting some slug activity in near future. Falling soil temps following germination may make crops more vulnerable than usual to pests like Russian Wheat aphid in cereals and blackleg in canola.” - Rob Harrod, Agronomist, Albury.

“Overall, the broadacre cropping season has been slow to start. 90pc of the crops are planted, with most irrigated crops emerged, however only approximately 50pc of dryland crops are out of the ground.”

“Grower crop type plans have remained conservative, with a reduction in canola area of around 20pc. Generally, there has been a switch to cereals, particularly cereal hay, considering the positive demand outlook for hay as the southern and western areas stay dry. Hay stocks are very low on farms in this region, so growers are expecting solid demand and above average prices for hay this coming spring.

“So far, disease pressure has been very low, across all broadacre crop types. Pests have been typical, later than usual hatching dates, the exception being a higher-than-normal incidence of Green Peach Aphid and subsequent Turnip Yellow Virus incidence in canola crops locally.” - Matt Gready, Agronomist AIRR Echuca (Goulburn Valley).

“Seeding would be about 75 to 80pc complete across the whole Peninsula. Since the middle of May we have had a general 10 to 15mm across the lower EP, and the upper and Western EP have received about 5 to 7mm over three different rain events.”

“Those lucky enough to be under thunderstorms have registered more rainfall but they have been sparse and sporadic.

“Germination would be about 20pc at this stage, there is another small amount of rainfall forecast for the next eight days. Hopefully we can have another general 10mm across the whole EP.

“In terms of seeding, my understanding is canola hectares have been cut back by about 15pc year on year due to residue issues. Most of this has been swung into Barley.

“Lentils have not taken a backwards step, and hectares across the Eyre Peninsula will rise by roughly 5 to 8pc year on year, this has come at the expense of field peas and faba beans. - David Fleming, Area Manager Eyre Peninsula.

“Grain producers across South Australia are cautiously pushing ahead with seeding programs amid persistent dry conditions, with many adjusting inputs and delaying sowing in the hope of rain.”

“Around 70pc of producers have dry sown at least some of their crop, with 15pc intending to dry sow everything and 15pc stating they will not dry sow at all.

“Crops are currently emerging with the shallower sown crops going ok, and the deeper sown stuff struggling and needing rain for germination.

“The Mid-North and Murray Riverlands are the most at risk with 50pc of the area dry sown and the balance of sowings will be determined by the extent of rain over this coming long weekend. 20 to 40mm is the forecast for Jamestown and 10-20mm Loxton. There will be significant cereals programs for stubble cover.

“Given the lack of feed available insects are likely to be an issue that will need to be managed.” - Lyndon May, Technical Services Manager, South Australia.

“About 75pc of the crop was dry sown in Geraldton with the remainder to go in shortly, mainly in areas that were delved making it difficult to dry sow. Nothing has germinated yet, but we should see some germination in the next week or so. The far eastern areas of the Geraldton zone could do with some more rain, otherwise conditions have turned around dramatically on good rain in the last week.”

“Most are now going to continue with the planned crops as the last 30pc of break crops were being considered will now go in. There had been plans to drop lupins and canola and increase fallow areas in lower rainfall zones, but the timely arrival of rain will now see full crop programs completed.

“Lots of moths are around, so growers will need to monitor emerging crops for cut and web worms. Some Bryobia is being reported in crops out at Arrino.

“Emerged crops in the south and central areas need rain, Esperance is good. Good rainfall forecast for June - if it materialises should have the state in a fair position by the end of June.

“Big demand and pressure is likely on post emergent weed control.

“Some crops in the northern part of the Kwinana zone had some early rain, but nothing since plant and thus germinated but died. Will require some re-seeding. Many dry sown went with no herbicide so this allows crop choice flexibility ie. not committed to canola only.

“There is a slight swing back into barley in most regions this year, bringing the area up to where it was a few years ago when barley was above 20 per cent of the total crop area. Wheat area is forecast to be down a few percentage points from 2024 due to a likely reduction in overall area planted. Canola area is forecast to be up slightly from 2024 due to the very good start to the season in the southern regions of the state. - Craig White, State Advisory Services Manager, Western Australia.

“All canola is in and up. Plenty of canola is at that 6 leaf+ stage. Grass sprays and post Nitrogen applied. Cereals, wheat and barley crop stage range from germination to early tillering.”

“Our clients have mainly stuck to normal rotations given the season has been somewhat normal in comparison to recent years.

“The south coast had a good rain event last week, but the northern area missed out being cascade, Grass Patch, Salmon Gums and Beaumont. There has been some more rain this week to keep things ticking over but rainfall totals were disappointing compared to what has been forecast. Nonetheless crops have adequate moisture levels for this time of year.

“We have had the odd insect on canola, but nothing of major concern and it’s a bit too early to see what will happen with the cereals in terms of pests and disease.” - Theo Oorschot, Agronomist Esperance.