Independent Livestock Analyst, Simon Quilty of Global Agri Trends shares his in-depth analysis of the key drivers shaping livestock markets now and into the future.

There have been many challenges in Australia’s livestock sector over the last 18 months, with cattle prices falling more than 50 per cent (pc) and sheep meat prices falling in the range of 54 to 75pc - prices that would imply market failure. It is essential to understand how these falls have occurred and where the industry is going over the next 18 months and where I believe our industry will be in five years.

In short, livestock prices are likely to double from current levels due to key market drivers across cattle and sheep over the next five years.

The reasons for such drastic price declines are very similar for each sector. Firstly, the lack of labour and processing bottlenecks was the first factor that impacted markets early last year. Followed by poor markets in late 2022 and the first half of this year, and finally, by dry conditions across Australia starting in March 2023.

This analysis looks at domestic and global supply and demand drivers that will see short-term livestock price falls in Australia. However, significant tightening of global protein supplies will eventually lead to record lamb and beef prices in 2026 and 2027.

Lack of labour

It only took a mild expansion of Australia’s cattle herd and sheep flock to see the limited workforce capacity at Australian meat works tested.

When assessing cattle and sheep, there is no doubt that the sheep meat sector has been more vulnerable. To measure this, I looked at critical previous periods of other price downturns. I found that Australia’s cattle slaughter capacity (Eastern Seaboard only) was only 87,000 head per week over 68 weeks which saw a 45pc price fall. In previous price fall period's weekly capacity of 122,000 head per week resulted in declines of 45pc and less – so almost a 30pc decline in cattle kill capacity saw a more significant fall in price over the least amount of time (68 weeks).

The fall in sheep and lamb prices was even more dramatic over other similar periods, with a 57pc fall in price over 91 weeks with a capacity of only 271,000 per week, almost half the capacity of the other three measured periods.

In other words, Australia’s small stock sector's lack of labour is more severe than in the cattle sector and, as a result, has seen a much more significant impact on pricing.

Bottom line – Australia’s lack of kill capacity remains an ongoing issue. Today, processing capacity is more defined by labour than bricks and mortar. When assessing which sector is the most vulnerable due to restricted kill capacity, Australia’s small stock sector seems to be the most vulnerable and is reflected in the fall in mutton prices down by 70pc and lamb prices down by 55pc over the last year. The lack of cattle kill capacity is also concerning, and it is hoped with the proposed new capacity to come online in the next six to 12 months, this concern will ease. Sheep capacity is likely to remain unchanged in the short term.

Soft demand has challenged meat exporters

The global market downturn started in October 2022 and has seen subdued pricing ever since across most markets in Asia and North America.

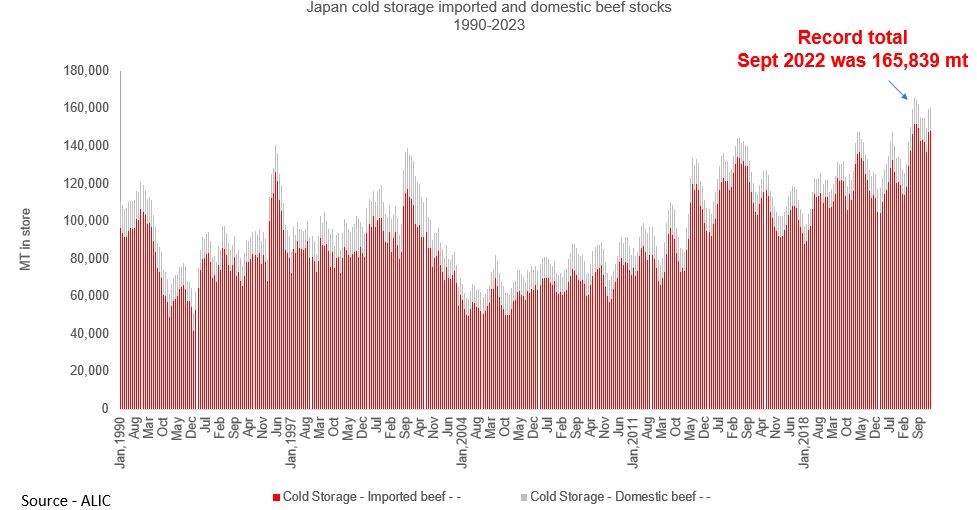

The most significant reminder of this has been the full freezers across Japan, China, and Korea. Meat is being discounted on the spot market as some frozen products near their first birthday in storage. When meat is over a year old, there will be buyer resistance in wholesale markets, and most importers will look to move this product at heavy discounts rather than hold it for longer than 12 months.

Chart showing record high volumes of frozen beef in Japan cold stores in September 2022.

Chart showing record high volumes of frozen beef in Japan cold stores in September 2022.

In addition to full freezers across Asia, Korea is also liquidating its Hanwoo herd, whereby they are paying farmers 200,000 won per cow (approx. AU$235) to bring to market before having a calf. Korea are subsidising the sale price to consumers to ensure good sales. Hanwoo beef is a high-grade beef, so Australian long-fed grain-fed Angus and Wagu products are challenging to sell this year.

Lamb has also had its challenges in both China and the US

Currently, sheepmeat frozen stocks in China are at three-year highs, and lamb and mutton prices remain subdued.

US domestic lamb cut-out values have fallen by 30pc and may have bottomed as specific import prices in recent weeks have improved slightly. Still, any of these benefits have not been passed back to farmers as lamb oversupply continues to push Australian domestic heavy lamb prices lower. Yet, US lamb prices remain steady, this points to improved processing margins in Australia.

The other underlying concern in sheepmeat markets, is Australia’s heavy reliance on China for mutton with almost 40pc of all mutton exports going to China. The recent downturn in China prices was felt heavily in Australia with a 70pc decline over the last two years.

Bottom line – Both the commodity and quality end of the beef and lamb markets look good in the long term – there are genuine challenges in the short term, namely labour and the oversupply in Asian markets that have seen freezers full of imported products. The expectation is that these stocks will take until mid-next year to be lowered.

Telltale signs exist that some of these key markets may have bottomed and are on the rise. The most significant impact on Australia’s export fortunes is liquidating the US herd. When the rain comes, the liquidation stops, and the rebuild commences, the upside in pricing will be significant. This will lift prices for the following five years to record levels for beef, mutton and lamb.

Dry conditions push prices lower

The June ABS slaughter figures show that the Australian herd moved into liquidation in Q2, with the female kill ratio now at 48pc. This is above the breakeven ratio of 47pc, at which the herd is neither liquidating nor rebuilding.

What is important to note is the small kill required to reach ‘the turning point’ in herd liquidation. This occurs when farmers have sold all the available stock they can before switching to their most valuable breeding livestock, which is the last resort that needs to be sold due to a lack of feed.

The Q2 slaughter level was the ninth lowest in 50 years and points to an Australian cattle herd that is likely to be lower than recent estimates, with the likely herd size at 26.3 million head.

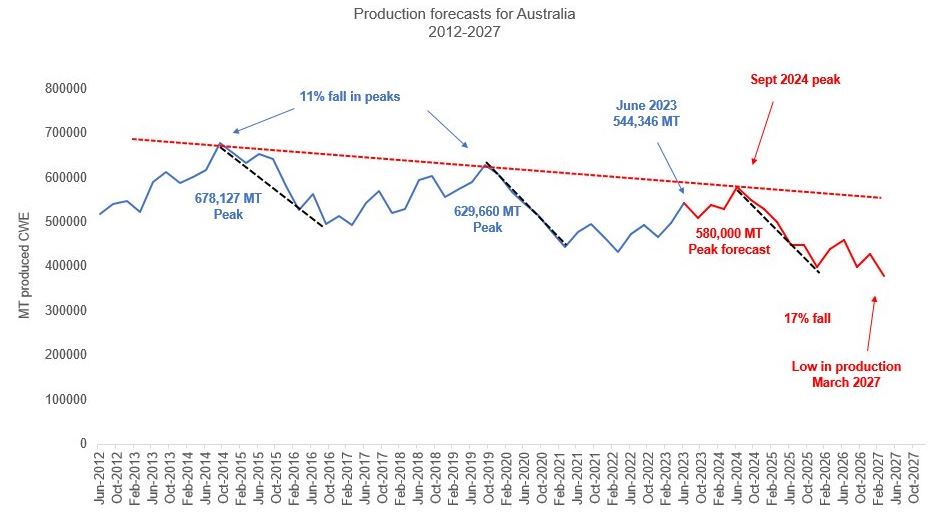

I am forecasting that the next peak in production will be September 2024. This would be exactly five years since the previous peak in September 2019, which was also precisely five years since its previous production in September 2014. Each production peak is a step lower than the previous, with a 10pc expected fall in beef production for September 2024 compared to September 2019. This is when Australia's beef supplies will be most abundant in this next cycle.

Chart showing the historic peaks in beef production and forecasting the next peak in September 2024. Source: MLA.

Chart showing the historic peaks in beef production and forecasting the next peak in September 2024. Source: MLA.

The low in Australian beef production is expected between 2026 and 2027, with production expected to be 17pc lower (393,937 MT per quarter) than the current quarterly average low of the last two years (463,782 MT per quarter). This is based on the belief that the Australian herd liquidation rate will be like the last two liquidation periods.

One of the critical guides to flock rebuilding or liquidation is the Australian cattle herd. The sheep flock and the cattle herd have moved in unison since 2010, so as the herd expands, so does the flock and vice versa. So, in Q2 this year, the Australian flock and the herd moved into liquidation.

Another critical indicator of liquidation is the Australian mutton kill, a six-month leading indicator on the female cattle kill ratio, which points to the female ratio being more than 50pc by Q4 this year.

When Australia’s female kill ratio is at 47pc, this is the equilibrium at which the herd is neither building nor liquidating. The same equilibrium point is reached when the mutton kill is at 2 million head per quarter. Above this, the flock is in liquidation and below this, in the rebuild. Australia’s flock has been in liquidation since the last quarter of 2022, so for almost a year.

Bottom line – The freezers being full in Asia, dry conditions in Australia and lack of kill capacity all point to subdued livestock prices, with the current downside in prices remaining for this year and the majority of 2024. Tighter Australian cattle and lamb supplies are inevitable, and solid global protein demand all point to when I expect the low in the supply cycle to occur. Much higher cattle and sheep prices will occur in 2025, with record prices expected in 2026 and 2027.

US drought severity and importance

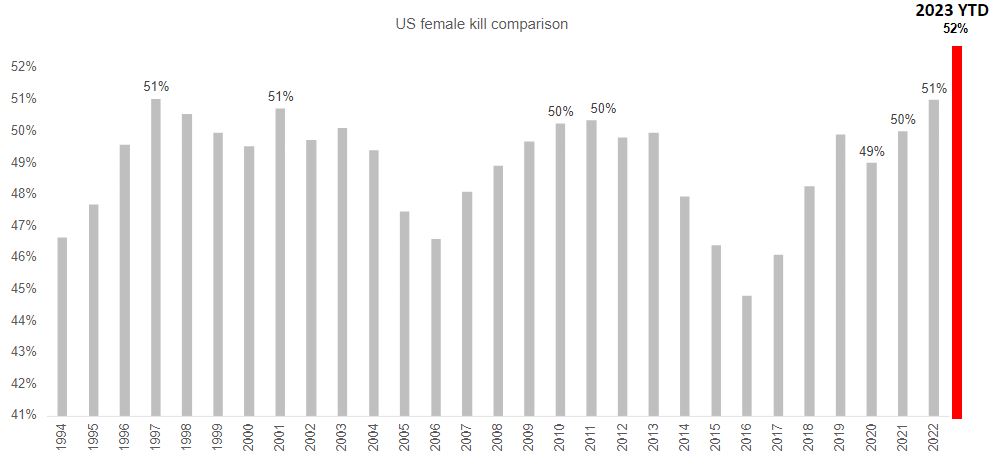

The severity of the current US drought cannot be understated. The liquidation rate of females is at a level that has not been seen in 80 years and will see the size of the US cattle herd fall to significant lows of 85.6 million or less.

A smaller US herd points to tighter beef supply and, therefore, rising prices. This price rise will be seen in both livestock and boxed beef. As a guide, I have looked at the impact of the period between 2007-2015. Drought saw a similar fall in cattle numbers and female kill ratio of 50pc, resulting in price rises over the following four years after the rain came. The difference with this current drought is that the liquidation is even more significant, with the female kill at 53pc and the slaughter even higher – which points to a lower herd, less production, lower exports and higher prices.

Australia shares 90pc of its export markets with the US, Japan, Korea, China and the US domestic market – so rising US meat prices will push Australian meat prices higher in all the markets we share. It’s also important to note that many other countries, such as New Zealand and South America, are liquidating. Uniquely, Australia’s supply is counter-cyclical, meaning we will have meat available when others won’t.

The expected beef price lift is 66pc by 2026 on Australian imported 90 CL manufacturing meat, which will be price-supportive for beef cuts. As they say, “a rising tide lifts all boats,” and this lift in grinding meat will lift all cuts.

What is also important to note is that this will also be price-supportive to lamb; boxed beef is the safety net for boxed lamb, and, in 22 years, data has fallen only half a dozen times (months) below boxed beef prices. So, rising beef prices mean rising lamb prices.

Bottom line – The severity of the current US drought will create a significant shortage of beef in global markets when the rain comes, and rebuilding commences. This will support Australian cattle, sheep, boxed beef and lamb pricing over the next five years. The US price rises of 2007-2015 are important guides of where US and global meat prices may head, with the expectation that prices will improve across both the commodity and quality ends of the beef market.

Chart showing the US female kill percentage. (USDA)

Chart showing the US female kill percentage. (USDA)

The most significant impact on Australia’s export fortunes is liquidating the US herd. When the rain comes, the liquidation stops, and the US rebuild commences, the upside in pricing will be significant.

Lack of labour and limited kill capacity remains a deep concern for Australia’s livestock sector. This was the catalyst for the start of falling livestock prices. The downturn in global markets was the second significant influence that took markets even lower in late 2022 and through most of this year. The final stage in depressed pricing has been the dry conditions that have seen more significant livestock turn-off as pastures deteriorate. All three of these challenges will remain in place until the middle of 2024.

Australia’s flock and herd are today in liquidation, which will see livestock inventory numbers fall over the next 18 months – the lower these numbers, the greater the rebound in livestock pricing when the next rebuild cycle commences for sheep and cattle.

It will be the combination of rebuilding across Australia, the US, New Zealand and Brazil in 2025, 2026 and 2027 that will see record cattle, mutton and lamb prices.

Nothing is certain, but evidence points to global beef and sheepmeat markets being in good shape for at least the next four to five years.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.