Independent livestock analyst Simon Quilty of Global Agri Trends shares his thoughts on the new norm in global livestock prices.

Figures from the Australian Bureau of Statistics for cattle and sheep reveal changing fortunes in Australia's beef herd and sheep flock.

The beef herd has gone into a holding pattern, with the female slaughter at 46.9 per cent (pc), just shy of the 47 pc breakeven, while the Australian sheep flock continues to liquidate with the mutton kill (which reflects the female kill) at a 10 year high.

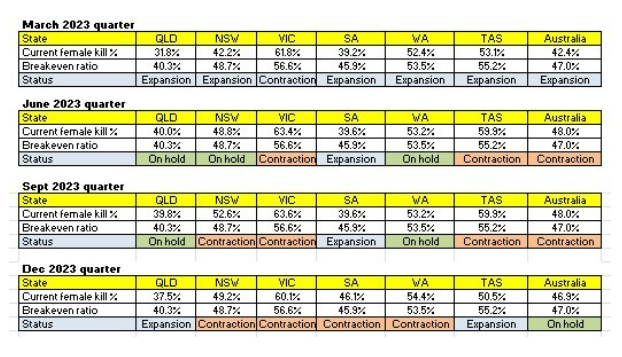

When assessing the Q4 female cattle killed by each state - four states are in liquidation - NSW, VIC, SA and WA, but with QLD and TAS rebuilding, this has offset the other states, giving Australia a neutral rebuild outcome.

These figures set the stage for a rebuild that will likely commence late this year in cattle and next year in sheep. Either way, 2025 to 2027 will be a significant year in livestock retention and assisting both cattle and sheep prices move to record levels.

When comparing finished cattle prices around the globe, Australia sits third in its value, behind Brazil and the US.

- US finished cattle is sitting at 600 ac/kg liveweight (LW) equivalent.

- Brazil is at 445 ac/kg LW equivalent

- Australia is at 390 ac/kg LW equivalent

I believe all three countries cattle are undervalued, with Australia having the greatest upside in improvement over the next three years.

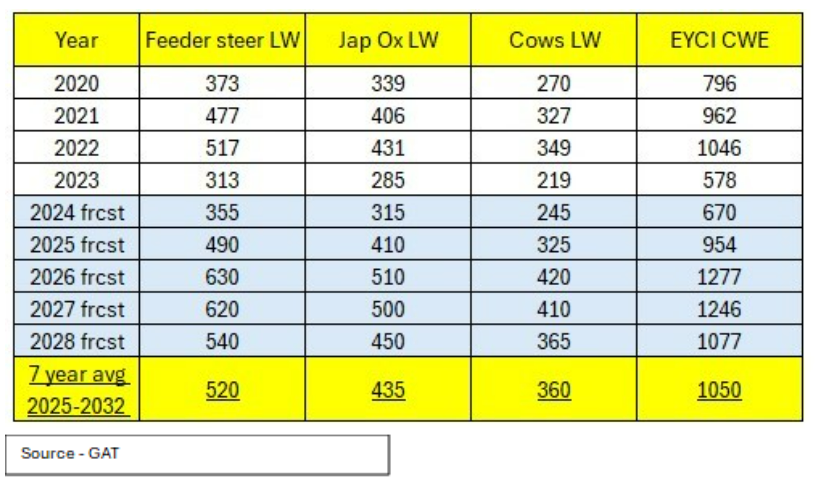

Australian cattle forecasts over the next seven years

Australia’s liquidation has slowed to a neutral state, neither liquidating nor rebuilding. The definition of Australia’s herd rebuilding or liquidating is when the female kill rises above or below a 47 pc kill ratio; when females go above 47 pc, liquidating occurs, and when below, rebuilding occurs.

Queensland received significant rain from November to January, which was in the top 10 pc of 120 years of rainfall records. During the same period, NSW rainfall was in the top 20 pc and Victoria in the top 2 pc over the same period.

So, conditions have improved, and therefore, liquidation has slowed. Given Victoria’s massive rainfall, a rebuild has been happening, but due to the excess females from NSW, it has given the impression of liquidation.

Graph shows Q4 slaughter of each state in Australia.

Graph shows Q4 slaughter of each state in Australia.

The Q4 slaughter was at 1.85 million head and is the median kill (in the middle) over the last 50 years. When assessing what this equates to in herd size, it places the herd at 26 million head if history is a guide. Given that the herd is more efficient today, it is closer to 25.5 million head.

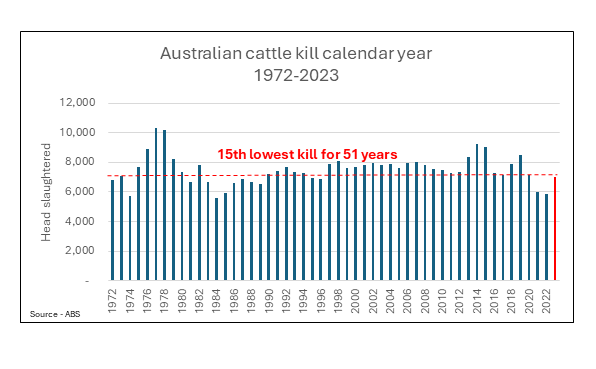

It means Australia’s total slaughter closed the year out at 7.02 million head, the 15th lowest on record for 51 years; since 1972.

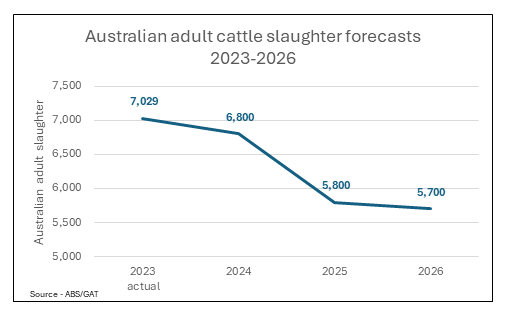

With the herd moving to a breakeven rebuild position, I expect by late 2024 that a mild rebuild will have commenced, which would see kills in 2024 fall to 6.8 million head and in 2025 a further fall to 5.8 million head as the rebuild gets going.

It should be noted that several meat packers in Australia believe the 2024 kill will be closer to 7.7 million head or higher. They believe the herd is much bigger than stated and that rebuilding, not liquidation, has happened over the last 12 months in Australia.

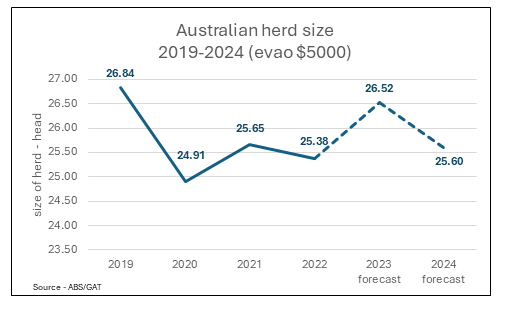

Given the ongoing liquidation in other states outlined in this week's ABS data, I see a low in the herd size this year at 25.6 M. As the rebuild commences later this year, this herd size will increase in early 2025 and grow to 2027 if conditions remain favourable.

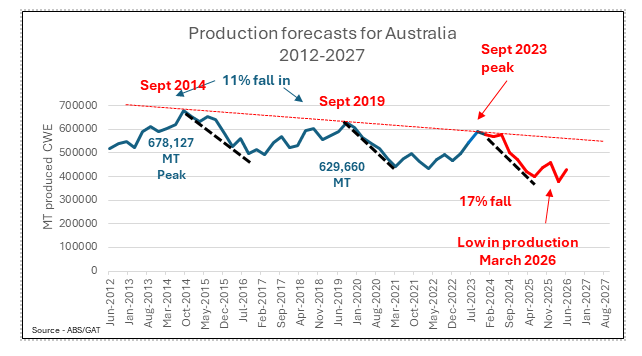

As Australia moves into a rebuild in late 2024 and early 2025, production will tighten as females are held back. I expect the low in beef production will be in mid-2026 when the rebuild moves into overdrive; this is when I believe Australian cattle prices will peak to record levels.

Graph shows Australian cattle kill calendar year

Graph shows Australian cattle kill calendar year

Graph shows Australian adult cattle slaughter forecasts 2023 - 2026

Graph shows Australian adult cattle slaughter forecasts 2023 - 2026

Graph shows Australian herd size 2019 - 2024

Graph shows Australian herd size 2019 - 2024

Graph shows production forecasts for Australia 2012 - 2027

Graph shows production forecasts for Australia 2012 - 2027

Finding the new norm for Australian cattle prices

Australian and global cattle prices are generally too low and will likely start to improve this year, but genuinely gather momentum from 2025 to 2027. This will be driven by beef supply shortages in the US, Brazil, and Australia as each country moves into a rebuilding phase in 2025.

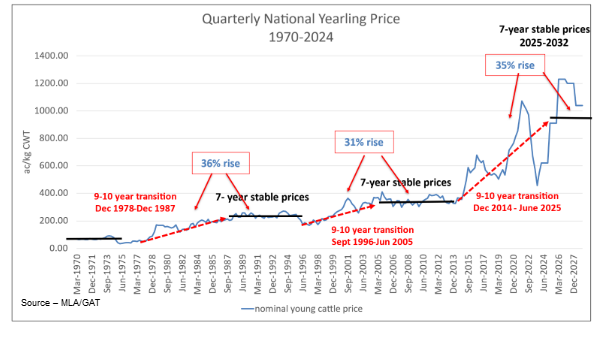

Some other critical key indicators point to Australia moving higher to a new norm between 2025 and 2032. In the past, cattle prices in Australia have moved in a 17-year cycle, where cattle prices have remained steady for seven years and then saw a 10-year rise in prices followed by another seven years of price stability. In late 2025, it will be the end of a 10-year rise and a period of seven-year stability is therefore expected (give or take 20 pc price movements in any one year).

Graph shows quarterly national yearling price 1970 - 2024

Graph shows quarterly national yearling price 1970 - 2024

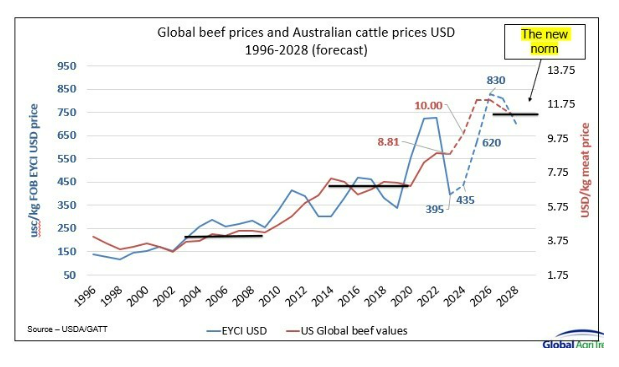

The other key indicator is global beef prices, expected to increase dramatically from 2025 to 2027. The early indication of US grinding meat, particularly fresh 90s, now at near record levels before the northern hemisphere summer demand period, will help push global prices higher along with the tightening supply across Australia, Brazil and the US.

Graph shows global beef prices and Australian cattle prices USD 1996 - 2028

Graph shows global beef prices and Australian cattle prices USD 1996 - 2028

With rising global beef prices, cattle prices will match this as livestock supply tightens and importers lift prices in pursuit of beef to meet customers' needs. This shortage will occur across all markets, including Japan, Korea, and China, as Australia competes with US beef in all these destinations head-on.

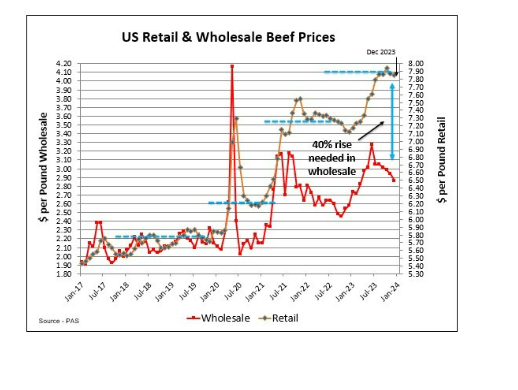

Graph shows US retail and wholesale beef prices

Graph shows US retail and wholesale beef prices

Can global consumers afford to pay these prices? The answer is yes. The 40% gap between wholesale and retail prices will narrow with tightening supply and increasing wholesale and cattle prices.

All this points to Australian cattle prices during 2025 and 2032 (over seven years) finding a new norm in pricing.

Graph shows Australian cattle prices forecast from 2023 to 2032.

Graph shows Australian cattle prices forecast from 2023 to 2032.

The peak in pricing for each Australian cattle category is expected to occur in 2026 and 2027 when the global beef supply shortage will be at its greatest.

As stated, a new norm is expected where price stability (give or take 20 pc) is expected from 2025 to 2032, the EYCI during this period is expected to average 1050 ac/kg CW, keeping in mind the previous peak was in early 2022 at 1185 ac/kg, so a number that has been seen once before. The same holds for feeder steers, Jap Ox and cow peaks occurring in 2026 at 630 ac/kg LW, 510 ac/kg LW and 420 ac/kg LW, respectively.

Welcome to the new norm.

Australian sheep forecasts over the next seven years

Graph shows Australian total lamb and mutton production 1972 - 2023 quarterly

Graph shows Australian total lamb and mutton production 1972 - 2023 quarterly

When the sheep and lamb kills WERE combined in Q4 of 2023, it totalled a record 222,651 megaton (MT). This is not on the back of a large flock but related to the highly efficient production of lambs.

Today, every Merino producer in Australia is a meat producer and a wool producer. In early 2000, it was a 1:1 ratio, meaning that for every sheep slaughtered, one lamb was killed. Today, there is a 3:1 ratio of three lambs for every sheep killed.

That is why production has reached record levels, but with that comes oversupply and poor pricing. The flock outlined is in liquidation, and another year of heavy sheep kills is expected, which will see the size of the flock fall in 2025 to 62 million head.

Therein lies a problem with Australia’s lamb sector. It is prone to a boom-bust cycle that will see a liquidation of the flock and then a rebuild. However, in that two-year rebuild period, small stock kill numbers can increase by 8 million head or 25 pc of the production capacity. This is very difficult for any processor to ramp up and, therefore, sees oversupply.

There are not enough meat workers, and a crash in lamb prices is may occur again by 2028 due to another lack-of-worker bottleneck.

The long-term breakeven on mutton kill is 7.6 million head, and in 2023 more than 9.7 million sheep were slaughtered. The expectation is that this year will continue to see a large sheep kill, at close to 8.8 million head as the flock continues to liquidate.

Graph shows Australian mutton kill and flock size 2011 - 2026 forecast

Graph shows Australian mutton kill and flock size 2011 - 2026 forecast

It should be noted that the mutton kill is made up of ewes with almost no wethers being retained. Hence, a heavy mutton kill reflects a heavy female sheep kill and liquidation, and a low mutton kill reflects ewe retention and a rebuilding process.

When assessing on a state-by-state basis, NSW has had the longest and heaviest liquidation period over seven months compared to 5 months in both VIC and SA. There has been no liquidation so far in SA.

Further liquidation is expected for most of this year, with a strong flock rebuild expected to commence in 2025.

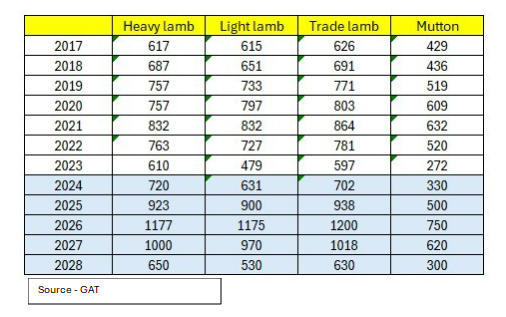

Finding the new norm for Australian lamb and mutton prices

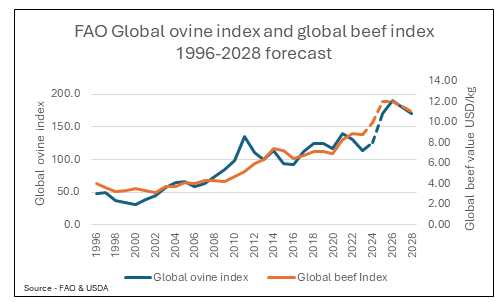

Australian lamb prices have a strong relationship with global lamb prices, therefore, global lamb prices are expected to follow with an expected increase in global beef prices.

Graph shows FAO Global ovine index and global beef index 1996 - 2028 forecast

Graph shows FAO Global ovine index and global beef index 1996 - 2028 forecast

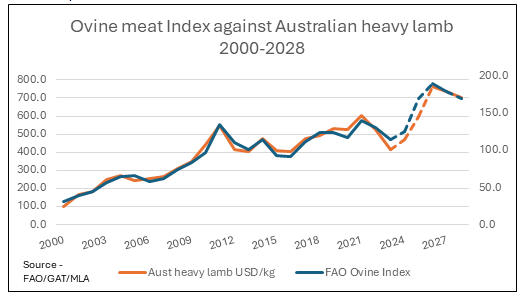

A strong correlation exists when mapping global ovine prices against Australian heavy lamb prices in USD. When extrapolating these prices out, the most significant price movements will be expected in 2025 and 2026.

Graph shows ovine meat index against Australian heavy lamb 2000 - 2028

Graph shows ovine meat index against Australian heavy lamb 2000 - 2028

Unlike beef, the price lift in lamb prices I believe will be short-lived due to the boom-bust nature of the lamb sector and the ability to ramp production up quickly when the right price signals appear, which is lamb values above 950 ac/kg CW, oversupply will occur. Within two years, lamb prices will have halved.

This dramatic price fall is due to the lack of workforce capacity in processing to handle this increased slaughter number of close to 8 million heads.

Graph shows Australian lamb prices forecast

Graph shows Australian lamb prices forecast

The lamb forecasts are bullish in the short term over the next two to three years, but as stated, this will be short-lived, resulting in a dramatic downward correction in pricing by 2028. This problem is unlikely to go away for the sheepmeat sector due to the ability to ramp up production quickly, which leads to oversupply and falling prices as both labour and markets struggle to manage the larger volumes.

Welcome to the new norm.

Please note: this article contains information of a general nature, and does not take into account your personal objectives, situation or needs. Before acting on any information, you should consider the appropriateness of the information provided, and seek advice on whether it is fit for your circumstances.