Independent Livestock Analyst, Simon Quilty of Global Agri Trends explains a flock rebuild is expected to begin in Q4 following three heavy years of liquidation.

Australia’s mutton kill remained in liquidation territory in the recent June Australian Bureau of Statistics (ABS) quarterly figures. Kills are at 2,512,000 head, sitting well above the breakeven kill of 2 million head. It is likely that in Q3, this kill will move below the breakeven rebuild/liquidation threshold, with the commencement of the flock rebuild likely in Q4 of this year.

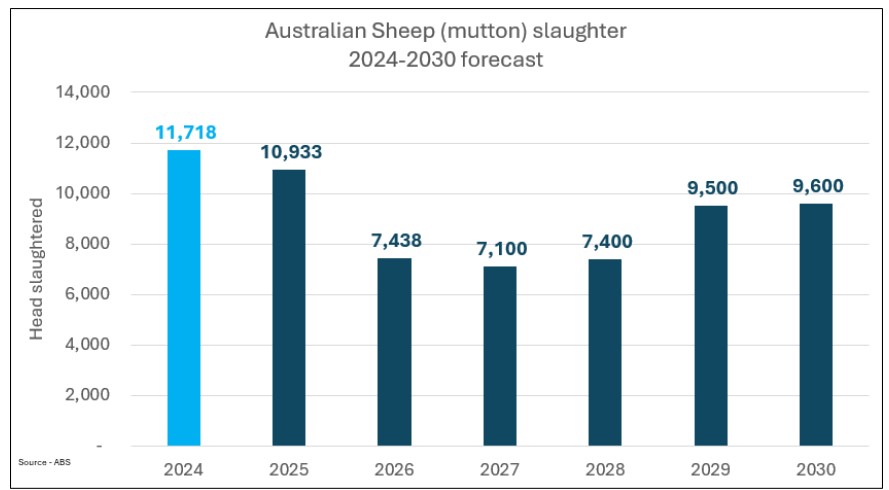

Australia’s sheep slaughter is expected to fall as the flock gets smaller. I have forecast a 32 per cent decline in Australia’s mutton kill over the next three years, following three years of heavy liquidation, during which both sheep and lamb slaughter reached record levels.

This chart shows Australia’s mutton slaughter forecast to 2030. Source: ABS.

This chart shows Australia’s mutton slaughter forecast to 2030. Source: ABS.

A significant aspect of this liquidation has been the exodus of sheep producers from the wool sector. This is most evident in the declining wool clip size, unlikely to be replaced by other growers.

The Australian Wool Production Forecasting Committee (AWPFC) estimates that the 2024/25 wool clip has fallen by 12 per cent, and next year's wool crop is expected to be a further 8.4 per cent lower. The AWPFC estimates the flock to be nearly 63 million head. The Merino flock has a dual purpose, producing both wool and meat.

These significant declines in wool production indicate a substantial decrease in the number of breeding ewes in the system and, therefore, fewer lambs.

It should be noted that the New Zealand flock size has fallen dramatically over the last 22 years, from 39.3 million head to 23.36 million head in the 2024/25 season. As a result of a smaller flock, kills have fallen dramatically. This falling lamb kill trend is likely to continue, with next year's lamb kill expected to decline by a further 1.5 per cent.

Lamb supply will become tight globally, as farmers retain females in their efforts to rebuild. Strong lamb and mutton prices are here to remain for some time.

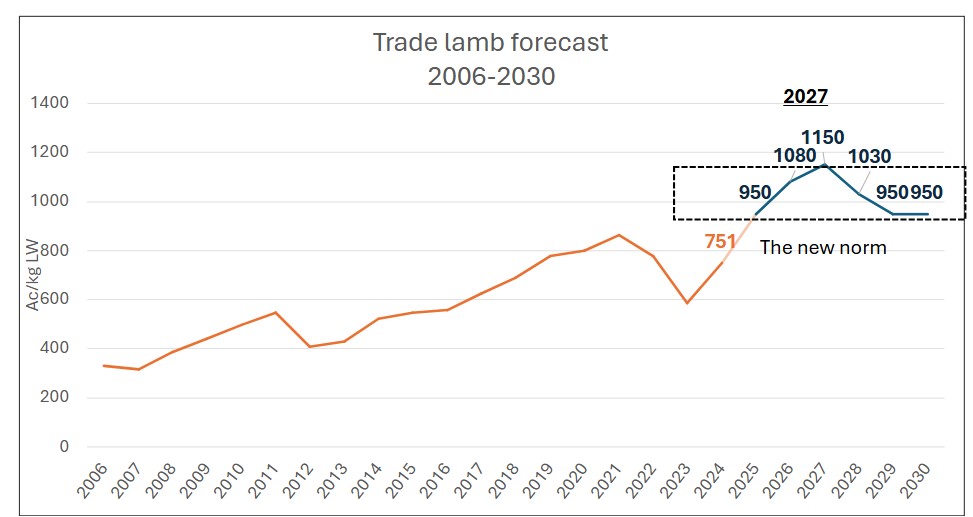

I expect a peak in lamb prices over the next two years, followed by a return to a sustainable level that I refer to as "the new norm" in lamb pricing.

The new norm for trade lamb prices, I estimate, will be around 950 ac/kg CW post-2028. This is the period in which demand and supply are also in equilibrium, with consumers able to afford lamb at these levels and farmers being able to make a profit.

This chart shows the trade lamb forecast into 2030. Source: ABS.

This chart shows the trade lamb forecast into 2030. Source: ABS.

During 2026 and 2027, lamb prices are expected to peak at 1350 ac/kg CW. These levels are not sustainable, and prices will revert back to the new norm.

There is an important caveat for this pricing: that the ‘boom bust cycle’ that the lamb sector has seen in the past, is moderated in 2028 (when it is expected). The problem is the 35 per cent fall in supply over two years will suddenly see a 35 per cent increase in supply. This creates a very difficult environment for processors to gear up to. The resulting oversupply due to not enough capacity means prices will fall further than expected.

There are some important changes to the sector that might dampen the ‘boom-bust effect’. Firstly, the exodus of many producers from the sector is due to the poor state of the wool industry. Fewer players will mean less oversupply.

Secondly, the development of the light-chilled carcase trade has enabled the market to better manage large volumes compared to previous oversupply periods, which now sees light lamb carcases moving in volume quickly into the Middle East – an important release valve in oversupply markets.

Disclaimer - important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.

More from Simon Quilty

Read other thought provoking articles from Simon, written exclusively for Livestock Now.

- The rise of Australian lamb prices

- Australian markets and the Middle East

- US tariffs imposed on global imports

- Threading the needle with US tariffs

- US tariffs and the Australian beef sector

- Wool & meat market forecasts amid tightening supply

- Australian cattle & sheep prices in 2024

- Brazil's fight for FMD free status

- Cattle prices -autumn 2024 forecast

- Finding the norm in global livestock prices

- Sheep prices-autumn 2024 forecast

- Meat demand from China- 2023 prediction

- Five key driver for 2023 livestock markets