The latest insights and information on the Australian cropping market as of October 2025 *

Global grain markets battling record crops

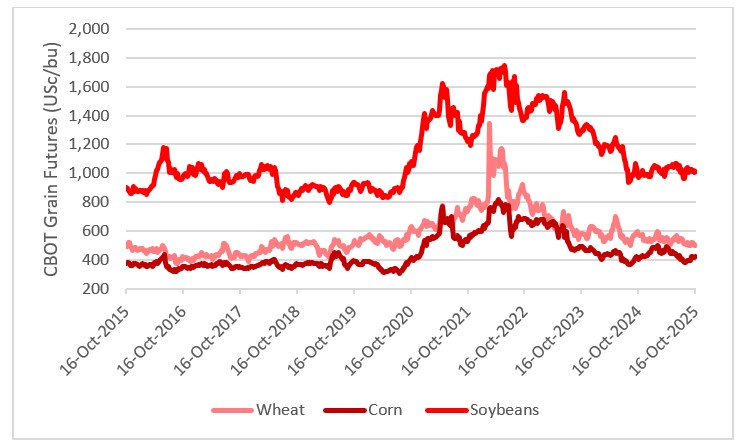

International grain markets continue to battle against unfavourable fundamentals as global winter crop estimates grow to record levels, and the world prepares to harvest a record corn crop.

Estimates of the 2025/26 world wheat crop have risen another 8 million tonnes (mt) in the past month to a new record of 818mt with increased crop estimates for Russia, European Union (EU), Argentina and Australia. As a result, global 2025/26 wheat end stocks are estimated at 270mt, higher than the previous forecast of 264mt (+2.3 per cent on last year).

Import demand is well supplied by competitive offers from most major grain export regions as they look to offload mounting wheat stocks. International wheat values have plummeted to 5year lows (squeezing profitability given the rise in input prices over this period), despite weaker competition from Russia, the world’s largest exporter. Russia has had an unusually slow start to the export season due to a poor harvest in the south, logistical issues (scarce fuel supplies due to Ukrainian attacks on Russian refineries) and slow farmer selling due to poor prices and a high Ruble.

Black Sea shipments are now picking up pace and will run into southern hemisphere harvest selling. Russia has set a slightly higher grain export quota in the second part of its export season from February to June 2026, meaning that Russian grain exports will be a lingering presence in markets well into the traditional peak southern hemisphere selling season (January to June).

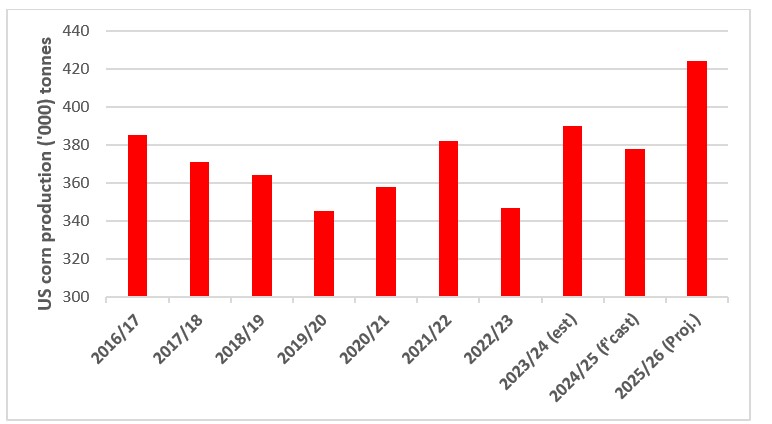

World corn values continue to be weighed down by the harvest of a record global corn crop. Prices have drawn some support from indications that US corn yields are below expectations.

The latest estimate from respected analyst Dr Cordonnier has yields of 181/acre (ac) vs 186.7/ac (Sept USDA1 estimate). With US corn exports ripping along, any further significant revision to US corn yields could have a material effect on US and global carryout stocks. At this stage however, it is unlikely that projected changes in the corn balance sheet alone will be enough to change global corn or grain market sentiment, particularly given forecast for another record south American crop in 2026/27.

This chart shows historical weekly closes for the nearby grain futures contract on the Chicago Board of Trade (CBOT) in USc/bu. Source: LSEG Workstation.

This chart shows historical weekly closes for the nearby grain futures contract on the Chicago Board of Trade (CBOT) in USc/bu. Source: LSEG Workstation.

While nearby market sentiment for cereals is weak, the vibe across the oilseed complex may be even worse. Oilseed stocks in Canada and the US are mounting as harvest wraps up and as Chinese demand for oilseeds shifts from north to south America due to ongoing trade disputes. Australian exporters are keenly awaiting some Chinese canola buying as China looks to replace Canadian canola. Discussions between Chinese and Australian officials aimed at finalising export protocols are ongoing. China has said it will lift duties on Canadian canola, if Canada lifts its levies on electric vehicles. The potential for large shifts in trade flows from sudden changes in trade policy will keep the oilseed market on the backfoot.

The nearby outlook for pulses is similar. Global pulse output is projected to expand for a second consecutive year in 2025/26 as growers are lured by high relative returns and the potential to lower input costs by including pulses in their cropping rotations. A larger Indian crop and another strong monsoon season in the offing has narrowed the production deficit across the sub-continent. At the same time a lift in global pulse production has increased export competition. International pulse values have virtually halved compared to last harvest.

The worst of it may be nigh – outlook for 2026/27 clouded by US subsidies

While market sentiment leading into our harvest is undeniably bearish, better pricing levels may be closer than you think. The adage that low prices cure low prices may ring true in 2026/27.

Looking towards next year, there are signs emerging that cereal plantings/production will take a step backwards (shift to higher value crops, resting marginal paddocks, less inputs). Wheat production is uneconomic in many regions (EU, US and Aust?) and there are significant problems developing in Russia (ie. lack of fuel, government involvement). Lower global cereal plantings in 26/27 will mean current pricing will be sensitive to any new crop production threats.

Russia, the world's leading wheat exporter, is set to reduce its winter and spring wheat sown area by over 6pc this year, in favour of growing more oilseeds. Russian farmers are moving away from wheat, which they consider less profitable due to low global prices, increased input costs and high domestic export duties. There is also talk of some pullback in US wheat plantings and even local mixed farmers are looking at a swing back into livestock, with high meat protein values and to maintain some diversification in income. Expect these trends to be mirrored across major exporting nations.

While there are no immediate threats to new crop supply, continued wet conditions threaten to delay sowing and could impact next year's wheat supply across the north China Plain. The north China Plain is a significant agricultural region in China, mainly for winter wheat and accounts for around 25 per cent of China’s total grain production.

Elsewhere it is a little dry in parts of France, central Europe, Russia and across the US soft-red winter wheat belt where winter crop planting is ongoing. But this is more than offset by ideal planting conditions across southern America.

The big wildcard in terms of future grain production will be how the US handles the current slump in profitability across its agricultural sector. Trump has hinted at direct subsidies which were used in his first term, and which have contributed to the current oversupply in global markets. The US is struggling to compete against lower cost producers in eastern Europe, southern America and Australia. Over the past decade the growth of the US biofuel industry (supported by blending mandates) has helped soak up excess US supply and help keep prices relatively buoyant. Trump’s attitude towards biofuels is unclear but his stance on global warming and the fossil fuel industry signals that he may be less supportive than previous Presidents.

So, while a bailout through direct subsidies provides a short-term solution, it doesn’t address that reform of the US farm sector is much needed and without it, subsidies will encourage US farmers to continue to overproduce in 2026/27 and beyond.

Like with Canola, Australian sorghum exporters are waiting for a step up in Chinese buying to firm local sorghum bids. Australia has a fair chance of winning some premium sorghum export business to China, with no end in sight to China’s trade impasse with the US, that has seen Chinese sorghum import demand shift from the US to Australia.

Local prices follow global values lower, southern growers need a finishing rain

Domestic grain markets have followed international prices lower (although lower $A has limited falls) on the expectations of another solid local crop and increased domestic carryout stocks. A dry finish to spring has meant that Australian crop production estimates have peaked. Western and northern regions were better than average, but with crops across the south struggling to the finish line and average at best.

Harvesting of barley has started in Queensland with reports of some chunky yields of 5 to 6 tonnes/hectare in the New South Wales/Queensland border regions. Now that harvest is in full swing, yields are now being described as “above average to exceptional” after a few quality issues with some frosting in early harvest deliveries. Wheat harvest is still two weeks away in northern production regions on both the east and west coast. With little forward sold, very weak chickpea prices and cereals not much better, those with reasonable cash flow and equity will store crops this year across the northern cropping region.

A dry spring will crimp yields across southern NSW (south of Parkes), Victoria and South Australia where crops were sown late and didn’t accumulate enough growing season rainfall to carry crops through.

While growers in the north are likely to hoard crops in the hope of a post-harvest rally, it’s a different story for growers in the south who need cash flow. Currently grower and end user pricing ideas on cereals are wide apart and not much better than breakeven for many. Those with canola will look to sell at circa $800/tonne to generate some cash flow and will dribble out cereals in the hope that we see firmer prices post-harvest. There is likely to be some harvest pressure in the south as weak sellers need to generate cash flow.

In WA, where they are expecting another solid crop, the grower is generally well sold on barley, canola and oats but has hardly sold any wheat at all.

A poll of eight Australian analysts showed a median forecast for 2025/26 Australian wheat crop at 35.3mt of wheat, 14.7mt of barley and 6.45mt of canola. For wheat, the forecast exceeds last season's production of 34.1mt and the five-year average of 33.8mt, though it remains below the record 40.5mt harvested in 2022/23. October rainfall will be critical through southern New South Wales and large parts of Victoria and South Australia to stop crop potential from going backwards. This latest estimate could prove the top as yield potential looks to have been trimmed as late southern crops, lack moisture and are being knocked around by a dry spring.

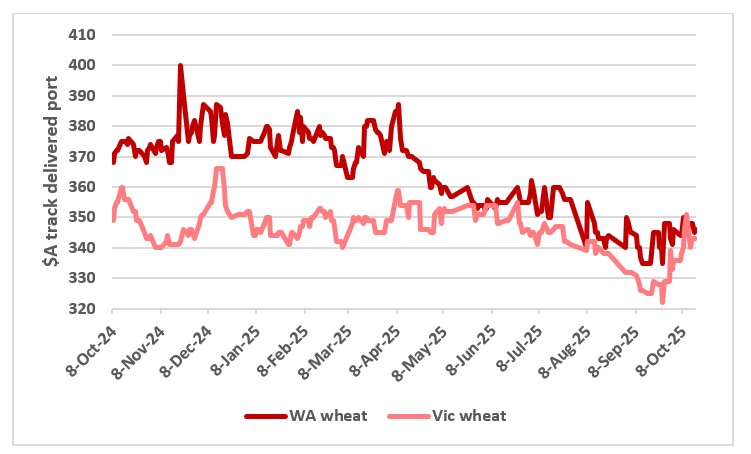

Australian wheat is competitive in export markets if the Aussie grower sells

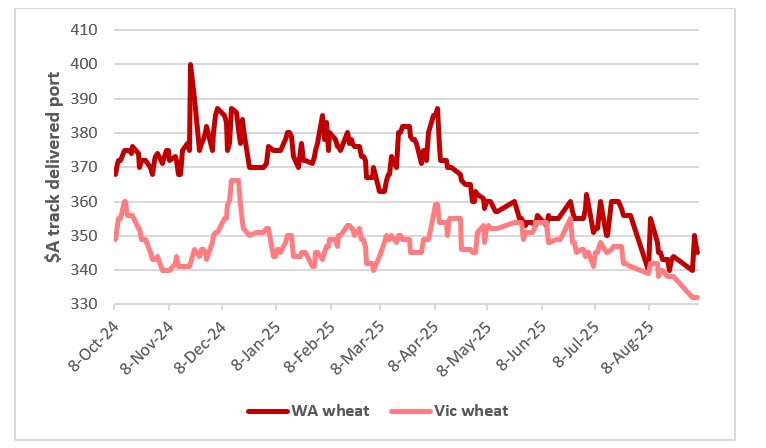

With the recent rise in Black Sea values, Western Australian (WA) wheat is now the world’s cheapest origin delivered into Asia. There is no sign yet that there is any urgency buying from the local trade, with exporters expecting plenty of wheat to be offered to them at harvest. Free-in-store port wheat bids in WA have hovered around $335 to 350/tonne the past month, moving up and down with fluctuations in the currency. It will be interesting to see how it plays out in WA this harvest. Last year the grower withheld tonnage and was able to extract premiums from exporters who held shipping slots. But this year, the world is awash with wheat and exporters may not have the margin to meet growers price demands. Wheat harvest will commence across the Geraldton port zone in a fortnight.

Across the northern feeding zone on the east coast, cereal bids are unchanged to slightly higher with dry conditions giving the market a firmer, more positive vibe. A few October shorts have lifted bids for prompt delivery and stronger southern markets have given the market a firmer feel. Delivered stockfeed wheat bids have increased by around $2 to $5/tonne to $325/tonne Downs (for limited volume and mainly with difficult execution) and $345/tonne Brisbane, while December ASW into Brisbane is up $15/tonne to be bid at $355/tonne. Track bids have risen by $2 to $5/tonne for most grades with APH2 showing the better gains. New crop bids for harvest delivery are currently some $10/t below prompt.

Southern delivered feed grain markets firmed $10 to 20/tonne to $375/tonne delivered Melbourne/Geelong in the past few weeks as grower selling has shutdown with yields back peddling and reports of crops being baled for hay. Potentially high yielding southern crops are lacking moisture to fill which may result in quality issues such as pinched grain with high screenings and low-test weights. Current wheat bids into upcountry delivered locations are flat are $315/tonne delivered Riverina end user and $345/tonne Murray Bridge.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

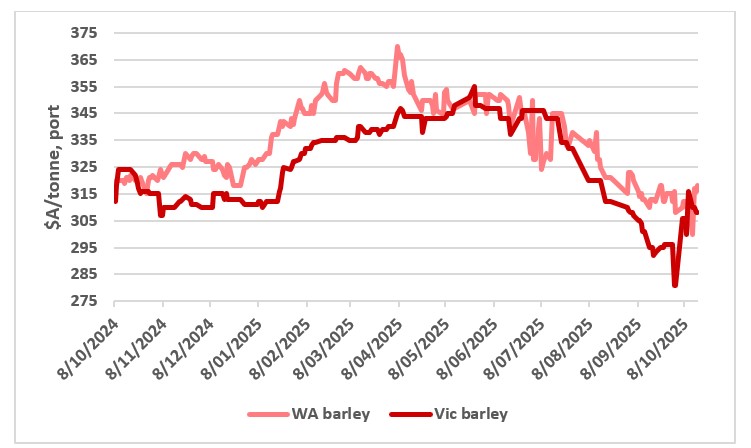

Barley a tough sell in the north

Local barley markets were a touch firmer, but bids are still hampered by weak demand (compared to wheat) and expectations of a large harvest in Queensland and northern NSW.

Bids from container packers have started to emerge at $290/tonne delivered Downs which is backed by Chinese export buying. In response to the emergence of some export demand, feed barley values have moved back over $300/tonne Downs for January/February delivery.

Malt barley bids into packers are at a $15/tonne premium. Although these prices are not exciting, it is reassuring to know that the Downs market is at export parity which will help put a floor in northern barley values.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

In southern delivered end user markets, prices have risen by $5 to 10/tonne in the past week in response to critically dry conditions which are biting into yield potential and seeing a bigger than expected area of cereals cut for hay. Like with wheat, the market has a more positive feel but the discount to SFW1 is still sitting around $25/tonne. Expect these markets to remain firm until harvest yields are known across the southern. Current barley bids are $290/tonne delivered Riverina end user, $335/tonne delivered Melbourne/Geelong and Murray Bridge.

In WA, the barley market has been dead flat at between $310 to 320/tonne FIS port the past month. China has apparently booked 25 barley vessels from WA ports, which suggest that WA barley is working into international markets at current price levels. The WA grower has some barley forward sales on at relative attractive pricing levels of $340 to 350/tonne FIS port earlier in the year and will look to deliver against these contracts to generate cash flow.

This year though, a 5 per cent lift in US corn plantings (partly because of the difficult trade outlook for soybeans) and ideal growing season conditions are leading to expectations of bumper US corn yields and record US corn production. In contrast to last year, falling corn prices have dragged wheat values lower.

This chart shows US corn production over the past decade. Source: International Grains Council (IGC).

This chart shows US corn production over the past decade. Source: International Grains Council (IGC).

Oilseed markets have been unpredictable. US soybeans values have been under pressure from a lack of Chinese buying and concerns over Trump’s commitment to domestic biofuel policies. China's soybean importers are boosting purchases from Argentina and Uruguay to fill the supply gap left by the absence of US shipments. Chinese processors may buy a record 10mt of soybeans from the two South American exporters during 2025/26. They have already booked 2.43mt from Argentina and Uruguay for shipment from September to May next year. From September 2024 to July 2025, China imported 5mt of soybeans from the two countries. So far China has not booked any US soybeans, despite US moving towards its peak supply period in the final quarter of 2025.

Chinese soybean buying shifts to south America

China's soybean imports in September reached the second-highest level on record at 12.87mt (+13.2 per cent vs last yr), following record shipments in May, June, July and August. China's imports in the first nine months of 2025 totalled 86.18mt (+5.3% year-on-year). China's soybean supply outlook has become increasingly secure, supported by a surge in purchases from Argentina during its temporary tax holiday, and continued heavy buying from Brazil. Chinese oilseed purchases from north America have fallen to nothing which is placing pressure on oilseed markets outside of China.

Global oilseed markets depressed by shift in Chinese buying

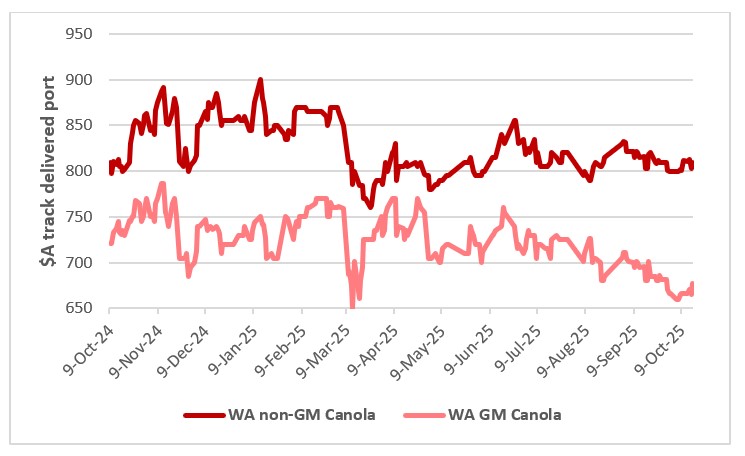

International futures remain under pressure from China putting prohibitive tariffs on Canadian canola and not buying any US soybeans. We were hopeful the Canadian tariff would spark a rally in Australian canola values (particularly as local stocks are at 20-year lows) but a small reduction in EU buying interest (shifting to cheaper soybeans and soy oil) and expectations of grower selling at harvest is keeping a lid on prices. The one positive is that canola bids are better relative to wheat and barley.

WA canola bids have firmed in recent days to $813/t FIS port to almost recover the losses of the past month, with the spread to GM a hefty $120/tonne (uncertainty over the level of Canadian competition in Australia’s non-EU export markets).

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG.

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG.

Through the east, canola bids have been creeping higher to $760 to 785/tonne for non-GM having recovered all the losses over the past month when prices were pressured by weakness across global oilseed markets.

Reports of more hay being dropped through southern NSW, Victoria and South Australia, with some struggling canola crops initially intended for grain now being baled amid the dry outlook.

Sorghum markets wait for a step up in Chinese buying

Nothing new to report in the sorghum market. Growers are well advanced with planting of the 2025/26 crop and current conditions would be leading the trade to expect above average yields. There is some Chinese buying at modest levels with the trade only interested in accumulating tonnage at their bid and not open to negotiation. Sorghum currently priced between $305 to -315/tonne Downs with delivered Brisbane $330 to 335/tonne for delivery February to April. Dept bids Moree and Goondiwindi $275/tonne and $280/tonne respectively with new crop bid at $285/tonne into Liverpool Plains depots.

Pulses battling increased export competition and easing Indian import demand

There has been a modest pickup in bulk buying activity with the first chickpea vessels for the season due out of Newcastle to non-Indian sub-continent markets. A large chickpea crop of around 2.5 million tonnes in northern NSW and Queensland is struggling to attract export interest. Indian buying is subdued by improved domestic pulse production and a lift in supply of cheaper alternatives (Canadian yellow peas and European and African peas) and quantitative controls (lack of export permits being issued) as India seeks to protect domestic prices which are some $300/t above current imported chickpea prices.

Normally Australian pulses attract buying interest from the sub-continent in a window before the sub-continent harvest in January/February, however, this year the market looks well supplied with the deficit between local production and consumption not as apparent with the prospect of two strong Indian monsoon seasons back-to-back and a flood of Canadian yellow pea imports on the back of the duty free period to end of May 2025.

Global chickpea production is projected to reach 17.8mt this season (up 1.6pc from 2024/25). Intense competition is expected in the Asian market however, which could further depress prices. Australian chickpea production is projected to increase to 2.5mt in the 2025/26 season (up 0.2mt from 2024/25). Tanzania, a major supplier of chickpeas to Asia has a zero-duty import tax on Indian chickpeas, could also compete with Australia in the Indian market. The import tax on Indian chickpeas import from Australia has been 10pc since April 2025, but India offers duty-free relief for least developed countries. Tanzania’s chickpea harvest in 2025/26 is expected to be around 170,000 to180,000t, up from 135,000t the previous season.

New season bids are also under a bit of pressure. Growers have been looking to make some forward sales but the lack of engagement from end users is making this a difficult process. It is difficult to get excited about these prices but it’s hard to mount an argument as why they should rally any time soon. We need an unexpected event to change the global wheat market sentiment. New crop bids are converging towards old crop values and maybe a little weaker as harvest nears.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

Indian pulse markets whipped around by import policies

A drought affected local harvest in 2023/24 saw India import 7.344mt of pulses in 2024/25. This was the highest ever volume in the country’s history, and saw several trade partners achieving their own record-high pulse exports to India. Among these partners, Australia emerged as a top exporter, shipping a record 1.885mt of pulses, just behind Canada at 2.2mt, Myanmar followed with 1.050mt, while Russia contributed 718,000t. Other notable exporters included Tanzania with 404,000t, Brazil with 181,000t, Sudan with 163,000t.

While yellow peas have a market size of approximately 700,000 to 800,000t, India imported around 3mt from Canada when duty-free imports were allowed. These inventories overhang the Indian market forcing Australia to look to other markets in the sub-continent and south Asia (Pakistan, UAE, Bangladesh, Turkey).

Canadian yellow peas were diverted to India from the Chinese market after China placed a 100pc tariff on Canadian peas. In 2024, Canada exported just 500,000t of peas to China, its second-largest market for this product; this is in stark contrast with 2023, when exports totalled 1.56mt.

Based on relative prices, chickpeas and yellow peas are substitutable. A large inventory of yellow peas (built under during the duty-free period) is proving to be burdensome. A section of the trade has demanded suspension of yellow pea imports.

India’s pulse import policies have been repeatedly challenged by major exporters Australia, Canada and the EU through the World Trade Organisation (WTO). Pigeon pea imports are allowed free until March 2026. From the start of April 2025, chickpeas and lentil imports attract a basic customs duty of 10pc while yellow pea imports were allowed duty free until May 31, 2025. In addition, the market is subjected to quantitative controls using the ad hoc issuing of export permits which are used to restrict imports in contravention the World Trade Organisation (WTO) trade principles.

Demand for chickpeas to markets outside India is limited to around 700 to 800,000t annually which will leave a significant export surplus in Australia unless Indian buying appears at some stage.

Chickpea values have dragged themselves off the floor, rising to $600/tonne Brisbane, $560/tonne Downs packer and $510 to $515/tonne nth NSW, well below bids of over $1,000/tonne this time last year.

A very similar story across lentil markets which have been similarly affected by weak Indian import demand with lentils struggling at $600/t port equivalent, down from over $1,000/tonne this time last year.

Local faba beans growers are still waiting on some Egyptian buying demand to show up. Egyptian imports are managed by a central buying organisation and tend to be very lumpy. Until that happens there’s not really a functioning faba bean market to sell into. Bids are well down compared to last year and unlikely to improve until Egypt comes back into the market. Indicative bids currently $390/tonne Brisbane, $360/tonne Downs packer and $325 to 330/tonne Moree and Goondiwindi.

There is unlikely to be much faba bean production in southern port and feeding zones but as a price guide, faba beans are being quoted at similar levels as in northern markets, $390/tonne port equivalent and $360/tonne upcountry packer.

WA lupin prices have eased from over $500/tonne to $350/tonne FIS WA port through the year on expectations of a large harvest and in line with the general weakening in global pulse values. However, at this price level expect solid support from animal protein markets in the south-west of WA, the EU, south Asia and Australia’s east coast where WA lupins will land at circa $550/tonne competitive with current east coast bids of around $600 to 700/t into delivered up-country end user markets.

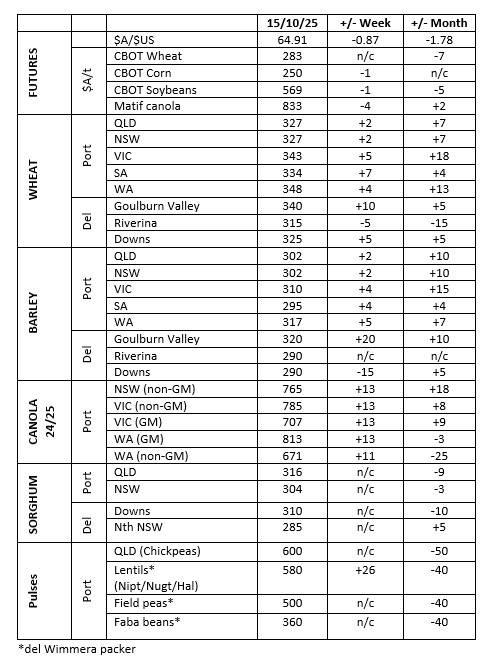

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.

Read previous reports

Cropping update - September

Cropping update - July 2025

Cropping update - June 2025