The saying used to go “when the US sneezes Australia catches a cold” and this has been true for the Australian beef industry for the past five decades as it became increasingly exposed to the global beef market. By virtue of its size and prominence as both a major exporter and importer, small changes in US beef production can have large consequences for Australian exporters. Across the span of its cattle cycle the US could move from being Australia’s biggest competitor to being our largest customer.

Currently, the Australian beef industry is benefitting from lower US beef production after its herd was liquidated due to a severe and prolonged drought in major US beef producing regions.

But while many are focussing on the decline in US beef production our attention is shifting southward to the rapid emergence of a major low-cost competitor. This week we take a deep dive into Brazilian production, what’s driving it and in which markets can Australia expect to feel it presence.

China has been absorbing increased Brazilian production

Growth in the Chinese imported beef market and increased Chinese imports of Brazilian beef have largely shielded Australian exporters from the impact of the dramatic rise in Brazilian beef production over the past 5 years. However, the impact of Chinese restrictions on Brazilian beef imports are likely to significantly increase Brazilian competition to Australia in our traditional markets from 2026 onwards.

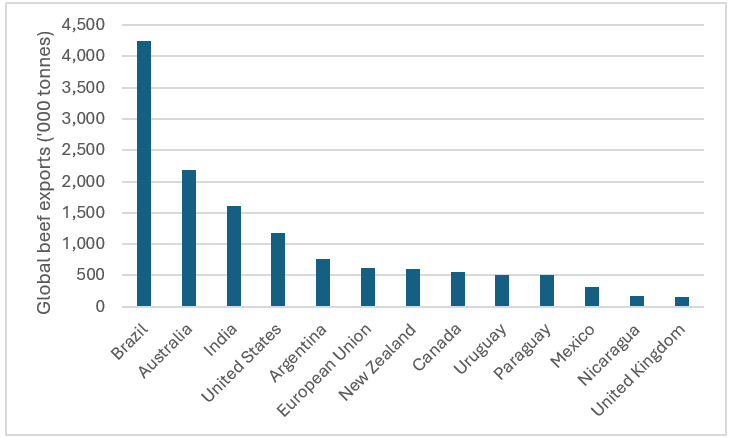

Brazil became the world’s largest beef producer in 2025, overtaking the United States for the first time after output rose well above earlier projections. Brazil was already the leading beef exporter and shipped meat valued at nearly US$17 billion in 2025.

Source: USDA

Source: USDA

Productivity gains will be the key driver of Brazilian production

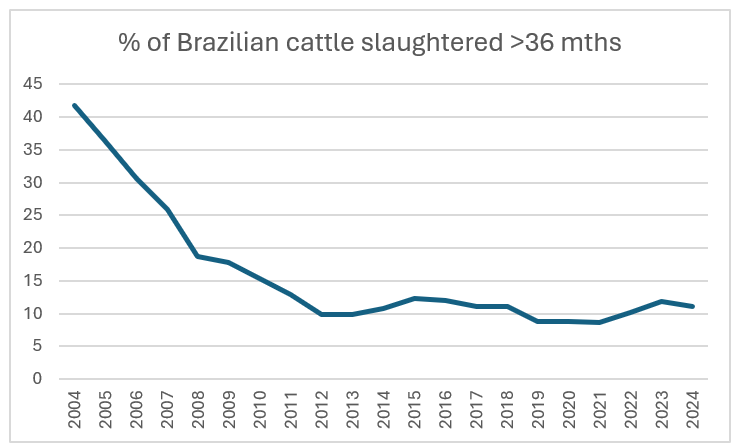

Productivity gains in Brazil are overriding the impact on beef production levels of herd rebuilding. Brazil is fattening them faster and slaughtering them younger and their cows are becoming more productive. Ten years ago, the average age of cattle slaughtered in Brazil was five years, now it is 36 months and going rapidly to 24.

Source: Brazilian Beef Exporters Association (ABIEC)

Source: Brazilian Beef Exporters Association (ABIEC)

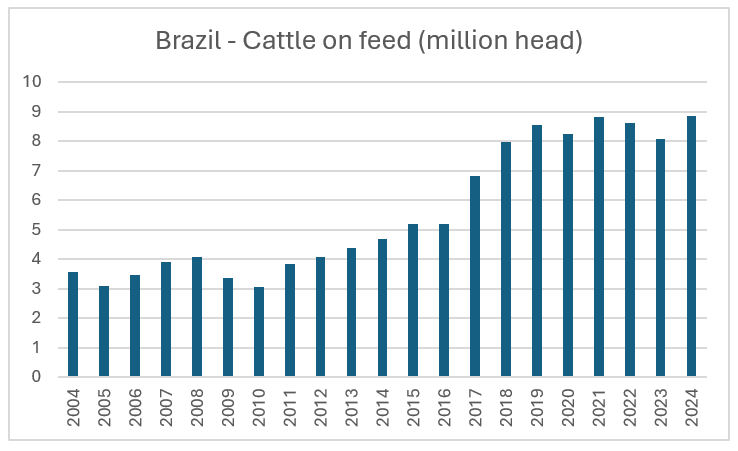

Brazil's booming corn ethanol industry is generating a byproduct known as dried distillers’ grains that has higher protein than corn and helps cattle fatten faster. Cows are becoming pregnant more often as farmers adopt more efficient insemination techniques, allowing producers to slaughter more animals without increasing herd size. Brazil has 192 million cattle, well over double the US herd of 94 million head. Higher productivity in Brazil will allow output to expand without increasing cattle numbers or increasing area.

Source: Brazilian Beef Exporters Association (ABIEC)

Source: Brazilian Beef Exporters Association (ABIEC)

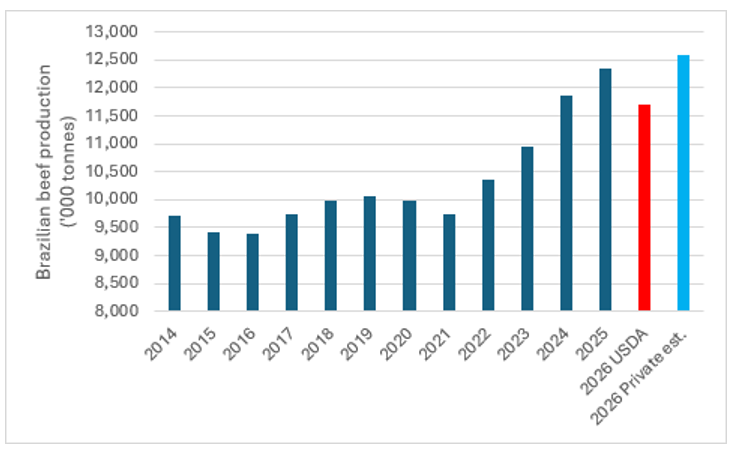

Changes in Brazilian production to determine the direction of global beef prices

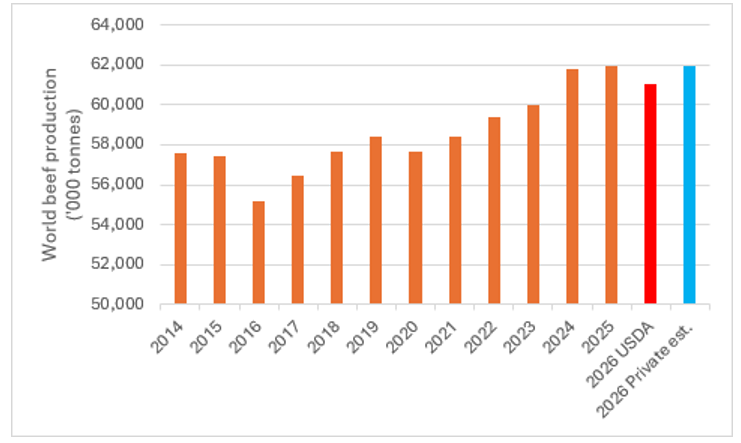

The outlook for global beef prices in the medium term will hinge on whether Brazil can avoid a production downturn. The USDA expects output in the world's six biggest beef producers to fall in 2026 by a combined 2.4 per cent - the biggest annual drop in decades - after rising 0.4pc in 2025 with the USDA estimating that Brazilian production will fall 5.3pc to 11.7mt carcass weight equivalent this year.

However, USDA’s estimates diverge markedly from some private analysts that suggest Brazilian beef output could rise (due to productivity gains) again to around 12.6mt in 2026, reducing the decline in production across the top six producers to just 0.2pc. The divergence in estimates is significant, equating to almost 50 per cent of Australia’s annual beef export volume.

Source: USDA & private analyst estimates

Source: USDA & private analyst estimates

Source: USDA & private analyst estimates

Source: USDA & private analyst estimates

Brazilian beef industry proves forecasters wrong

The Brazilian beef industry has a habit of confounding forecasters. In 2025 the consensus was that Brazilian beef production would decline by 5pc - it rose by 4pc. The difference in actual production vs forecasts across an industry this size is not insignificant, it equates to about the size of Australia’s total beef production.

My south American contacts are not suggesting that Brazilian beef production is going to take a step backwards in 2026.

This is a comment from a market participant in Brazil, “We are not seeing any production cuts in Brazil, it is quite the opposite. Margins are a bit better compared to the last cycles, and even though there are quotas under discussion, none of the producers are taking that into consideration and local prices are still beneficial for cattle. The Mercosur-EU trade deal recently signed has put a bit more of confidence into the system.”

Brazilian beef gaining access to Australia’s traditional markets

Chinese restrictions on Brazilian beef export volumes will increase Brazilian efforts to open new markets and diversify its beef exports. Brazilian beef lobby, the Brazilian Association of Beef Exporting Industries (ABIEC), is expecting Brazilian beef exports to remain stable in 2026 compared with last year, projecting shipments between 3.3 million and 3.5 million metric tonnes this year. Volumes not sold to China, will be redirected to other markets or shipped to countries Brazil is attempting to access.

The recently announced EU-Mercosur trade deal has paved the way for increased access for south American beef to the EU market, whilst efforts are well progressed to open north Asian markets to Brazilian beef.

Brazil was officially recognised as free of foot-and-mouth disease (FMD) without the need for vaccination by the World Organisation for Animal Health (WOAH) in mid-2025. This certification paves the way for negotiations with more demanding export markets. Japan is currently reviewing Brazilian protocols for beef imports and with this certification, there are no remaining technical barriers.

The opening of the Japanese market to Brazilian beef appears imminent. The Japanese government will conduct a follow-up audit to assess Brazil's beef sanitary system in March 2026, as part of the process to open its market to Brazilian products, Brazil's Agriculture Ministry said 26 December 2025. Brazilian beef would enter Japan under Most Favoured Nation (MFN) status and incur a tariff rate of 38.5pc. Once Brazil gains access to Japan, the Korea market would also likely soon follow.

Talks are also under way to increase shipments to the Philippines and Indonesia, with Indonesia expected to clear some 18 Brazilian plants to export after officials inspected Brazilian processing facilities.

ABIEC expects the US, the second-biggest market for Brazil's beef last year after China, to buy 400,000 tonnes in 2026, up from 270,000 tonnes in 2025.

Brazil has ability to quickly transform its beef exports

Shelf-life challenges for now, will restrict the extent of Brazilian competition in Australia’s premium chilled beef export markets. However, the Brazilian industry is investing in cold chain technology and this, combined with increased access to premium markets, will likely see increased Brazilian competition in these markets sooner than later.

Brazil has shown a remarkable ability to rapidly transform its agricultural sector. Although its beef industry faces challenges, such as a chequered food safety records and a lack of established grading and traceability systems, to name a few, you would be brave to bet against it overcoming these.