Elders' Business Intelligence Analyst Richard Koch discusses the recent beef import restrictions imposed by China and the effects they will have on the global beef markets.

China’s announcement of beef import restrictions will reshape global beef markets for years to come. Trade flows are already being distorted as Chinese beef prices lift to drag beef exports off other markets as importers rush to position themselves ahead of restrictions.

As restrictions bite, the net effect will be up to 100,000t of Australian beef and 600,000t of Brazilian beef will be looking for a new home outside China sometime in 2026. While Australian exporters should be able to pivot away from the Chinese market, it won’t be without consequence. Without doubt the major impact will be the secondary impact of increased Brazilian beef exports in non-Chinese markets.

Growth in Brazilian exports to China has largely shielded Australia from the impact of rising Brazilian production in recent years. These restrictions will accelerate Brazilian efforts to open alternative markets and diversify its beef exports and will expose Australia to the full force of competition from rising Brazilian beef production and exports.

The timing of the impacts of Chinese restrictions will be determined by, when and if, major exporters adopt quota management systems. Brazil is considering implementing a quota management system that would restrict monthly exports to 80,000t, resulting in Brazil having to find new alternative markets for up to 60,000 tonnes of beef each month and discussions are underway in Australia about the merits of a self-imposed quota management system.

Background

To protect its domestic beef industry, the Chinese Government will restrict beef imports to 2.7 million tonnes in 2026, roughly in line with the record 2.87 million tonnes it imported in 2024. Restrictions will be applied through country specific quotas with exports above country specific quotas levied at a prohibitive 55 per cent (pc) tariff.

Quota Volume (1,000 tons) | 2026 | 2027 | 2028 | Actual imports from Jan-Nov 2025 |

|---|---|---|---|---|

| Brazil | 1,016 | 1,028 | 1,151 | 1,329 |

| Argentina | 511 | 521 | 532 | 436 |

| Uruguay | 324 | 331 | 337 | 188 |

| New Zealand | 206 | 210 | 214 | 110 |

| Australia | 205 | 209 | 213 | 295 |

| United States | 164 | 168 | 171 | 55 |

| Other countries | 172 | 175 | 179 | |

| TOTAL | 2,688 | 2,742 | 2,797 | |

| Additional Tariff Rate | 55pc | 55pc | 55pc |

Source: Chinese Ministry of Commerce.

The quota-tariff mechanism has been clumsily constructed (appears based on historic volumes pre-2024) and doesn’t consider changes in the Chinese beef trade in 2025 or the various segments of the Chinese imported beef market. For example, the US has been granted a quota of 164,000t despite being essentially excluded from this market.

These quotas don’t recognise that Australian beef imports do not compete with Chinese domestic product and is mainly high-end grass or grain finished chilled product destined for food service or retail.

Major exporters to China, Brazil and Australia, have been granted quotas well below their 2025 shipment levels. Australian exports to China surged in 2025, gaining share at the expense of US beef after China allowed export permits to expire at hundreds of US meat plants in March 2025. Australian beef exports to China stood at 273,000 tonnes in 2025, up 42 pc compared to 2024. Brazil has been allocated a quota of 1.1 million tonnes against 2025 shipments of closer to 1.7 million tonnes.

Direct impact on Australian exporters

Based on where things stand currently, (US beef exporters not having access to China) it is likely that Australia’s export volumes to China will be affected – by up to 100,000t. Some of this volume would need to find another market which would make the impact the difference in export returns from China vs returns from the next best market.

China is a very important non-HGP (hormone growth promotant or no pill cattle) and grainfed market. It takes around 50 per cent of Australia’s total grainfed exports and while Australian exporters should be able to pivot to other markets, it won’t be without consequence. It is likely that local feedlots and processors will move away from China specific feeding programs as a risk management strategy and this may adversely impact demand for certain cattle types.

For example, it could impact the willingness of feedlots to actively seek HGP free heifers which are well suited to short to mid-fed programs for the China market or Wagyu and Angus cattle without EU accreditation for long fed programs aimed at the Chinese market. Already we are seeing increasing premiums for EU accredited cattle as these can be redirected to programs aimed at European markets if access to China is restricted.

The industry is currently discussing options to impose a self-imposed quota management system to ensure the industry optimizes exports to China in terms of timing and value.

Secondary impact of increased Brazilian export competition in non-Chinese markets

Growth in the Chinese imported beef market and increased Chinese imports of Brazilian beef have largely shielded Australian exporters from the impact of the dramatic rise in Brazilian beef production and exports.

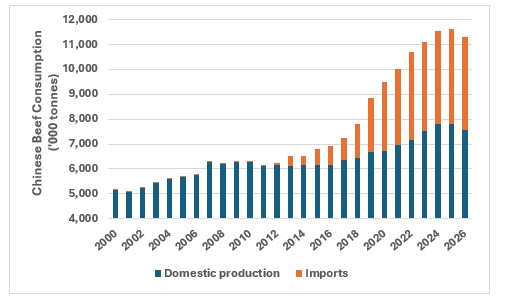

This chart shows the sources of Chinese beef consumption. Source: USDA

This chart shows the sources of Chinese beef consumption. Source: USDA

China is currently the largest destination for Brazilian beef exports. In 2025, Chinese imports of Brazilian beef totalled 1.7 million metric tonnes, representing 48.3 pc of Brazil's export volume. That volume is about 600,000 tonnes higher than the Brazil’s new Chinese quota, meaning that Brazil will need to diversify exports to non-Chinese markets sometime in 2026. Chinese restrictions on Brazilian beef import volumes will accelerate Brazilian efforts to access alternative markets and diversify its beef exports.

Brazilian beef lobby, the Brazilian Association of Beef Exporting Industries (ABIEC), is expecting Brazilian beef exports to remain stable in 2026 compared with last year, projecting shipments between 3.3 million and 3.5 million metric tonnes this year. Volumes not sold to China, will be redirected to other markets or shipped to countries Brazil is attempting to access.

Brazil was officially recognized as free of foot-and-mouth disease (FMD) without the need for vaccination by the World Organisation for Animal Health (WOAH) in mid-2025. This certification paves the way for negotiations with more demanding export markets.

Brazil has been recently authorized to export beef to Vietnam while the opening of the Japanese market to Brazilian beef appears imminent. The Japanese government will conduct a follow-up audit to assess Brazil's beef sanitary system in March 2026 with Brazilian access to Japan likely to commence in the new Japanese financial year starting in April.

Talks are also under way to increase shipments in the Philippines and Indonesia, with Indonesia expected to clear some 18 Brazilian plants to export after officials inspected Brazilian processing facilities. ABIEC expects the US, the second-biggest market for Brazil's beef last year after China, to buy 400,000 tonnes in 2026, up from 270,000 tonnes in 2025.

Expect Brazilian export volumes to the US to match the heavy export volumes in March to May 2025 prior to Trump increasing the tariff on Brazilian beef to 76.3 pc.

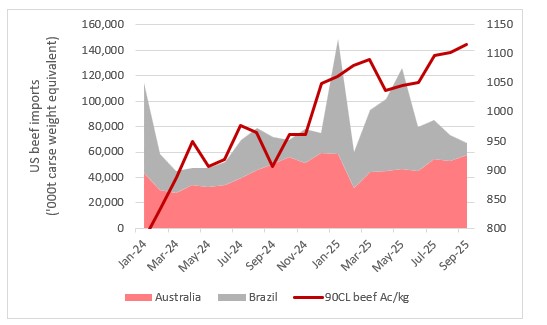

During this period in 2025, when Australian faced increased competition from Brazilian beef imports, US imported lean manufacturing beef prices were $9 to 9.50/kg compared to around $12/kg currently.

Shelf-life challenges for now, will restrict the extent of Brazilian competition in our premium chilled beef export markets. However, the Brazilian industry is investing in cold chain technology and this, combined with increased access to premium markets, will likely see increased Brazilian competition in these markets sooner than later.

This chart shows US beef imports from Australia and Brazil vs the 90CL beef price in Ac/kg. Source: USDA

This chart shows US beef imports from Australia and Brazil vs the 90CL beef price in Ac/kg. Source: USDA

Productivity gains driving the rise in Brazilian beef production and exports

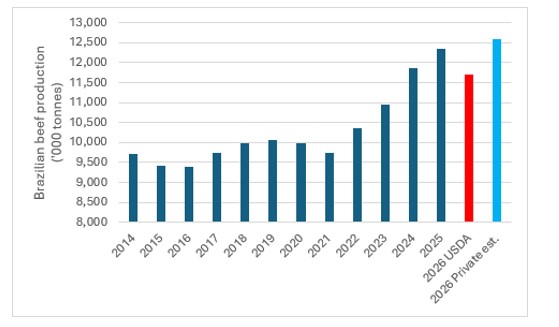

Since 2021, Brazilian beef production has increased by 2.6 million tonnes - the size of the entire Australian beef industry.

Productivity gains in Brazil are allowing it to expand beef production while herd rebuilding. Brazil is fattening them faster and slaughtering them younger and their cows are becoming more productive. Ten years ago, the average age of cattle slaughtered in Brazil was five years, now it is 36 months and moving rapidly to 24.

The outlook for global beef prices in the medium term will hinge on whether Brazil can avoid a production downturn. The USDA expects output in the world's six biggest beef producers to fall in 2026 by a combined 2.4 pc - the biggest annual drop in decades, after rising 0.4 pc in 2025. The USDA expects Brazilian production to fall 5.3 pc to 11.7mt carcass weight equivalent this year.

However, USDA’s estimates diverge markedly from some private analysts that suggest Brazilian beef output could rise (due to productivity gains) again to around 12.6mt in 2026, reducing the decline in production across the top six producers to just 0.2pc. Brazil also has the capability to increase export levels by diverting product away from its domestic market – currently Brazil only exports 32pc of its production.

What to expect

Chinese beef export restrictions have the potential to cool Australian beef export returns and cattle prices when they take effect. They will lower Chinese demand for Australian beef and increase competition from displaced Brazilian beef in markets outside China. They will accelerate Brazilian efforts to open new markets and diversify its beef exports, and this will expose Australia to the full force of competition from rising Brazilian beef production and exports.

These restrictions are already redirecting trade flows and will force Australian feedlots to pivot away from China specific feeding programs, potentially affecting demand for wagyu/angus feeders and increasing demand for cattle that are suitable for feeding for other markets ie. EU accredited feeders which have already seen a rise in demand and premiums above other feeders.

Without doubt the major impact will be the secondary impacts of increased Brazilian beef exports in non-Chinese lean manufacturing beef markets.

During the March-May period in 2025, when Australia faced increased competition from Brazilian beef imports in the US before Trump increased Brazilian tariffs, imported lean manufacturing beef prices in the US were $9-9.50/kg compared to around $12/kg currently.

Expect prices for cows and cattle suited to manufacturing beef markets to come under pressure from the impact on returns of increased competition from Brazilian beef. Expect the spreads between well finished heavy steers suitable for premium chilled markets and cows/secondary steers suited to frozen manufacturing beef markets to widen.