Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian sheepmeat market this winter.

Abnormally dry seasonal conditions in large sheep and lamb producing areas south of Dubbo in New South Wales saw a continuation of heavy turnoff through autumn. A lack of stock water and tightening fodder supplies forced producers to turnoff lambs earlier than normal. This saw lamb prices underperform against our forecasts in early autumn. By the end of autumn however, lamb values started to improve strongly as processors struggled to fill kill schedules.

An improvement in seasonal conditions across southern Western Australia contributed to an easing in supplies. In particular, in relation to the corresponding period last year when more than 400,000 sheep and lambs were trucked over the Nullarbor for processing over east.

Due to heavy flock liquidation, mutton was heavily discounted compared to lamb. Strong mutton processing margins increased processing demand for mutton during the autumn period. This saw mutton values improve at a greater rate than lamb, which narrowed the mutton discount from around 50 per cent (pc) to around 30 pc through autumn.

Export demand for sheepmeat remained relatively strong despite increased prices through autumn. In price sensitive markets like Iran there has been a marked shift in demand from lamb to mutton, while demand from China has begun to improve after a lull in 2024. Demand from the US remained consistently strong in line with strong prices across the entire US meat protein complex.

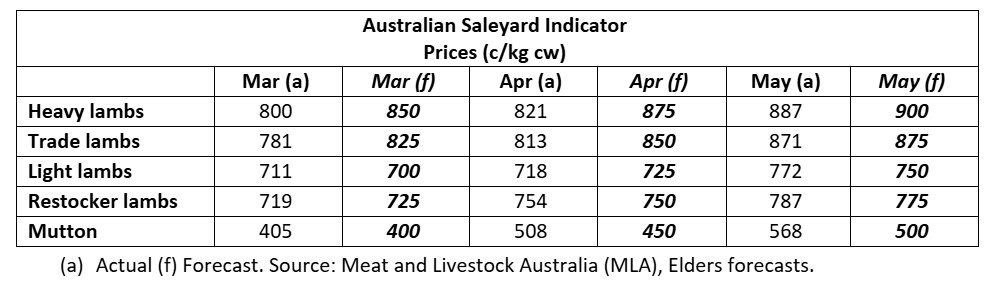

Table comparing actual and forecast Australian saleyard figures for different categories of sheepmeat. Source: Meat and Livestock Australia (MLA), Elders forecasts.

Table comparing actual and forecast Australian saleyard figures for different categories of sheepmeat. Source: Meat and Livestock Australia (MLA), Elders forecasts.

The realisation that the days of heavy flock reduction and large lamb numbers are quickly coming to an end has caught the local processing sector off guard and sent sheepmeat prices to record levels through June.

Heavy flock liquidation the past two years has seen up to 20 pc less ewes joined this year.

Early joined ewes (last October/November) that lambed in February/April were mostly joined in good condition. Depending on the area and operator (those that supplementary fed ewes), they achieved reasonable marking and weaning rates with some close to normal. The variance in weaning rates will be quite large, with ewes joined in average condition producing well below normal weaning rates.

Welcome rain through the Riverina and central west of NSW over the last month has improved the seasonal outlook. This should allow the genuine late winter/spring lambers to avoid the very poor results that many had feared. Through the western district of Victoria and south-east South Australia however, there is genuine concern that weaning rates will not match marking rates, as ewes running out of feed don’t seem to be mothering lambs too well.

Expect the central west of NSW and above into southern Queensland (as well as the western Riverina Hay-Ivanhoe) to be the major suppliers of the first winter sucker lambs. In the next few weeks lambs will go onto fodder crops with the top draft of suckers being ready in some numbers by August.

Given the experience of last year, there will be a reluctance to shear lambs and feed on, given the good prices available for store and light lambs and the cost and work of getting lambs to heavier weights. This may place pressure on the light and store lamb markets through the forecast period. However, provided prices for heavy and trade lambs hold up and grain prices remain relatively low, ensuring reasonable feeding margins. This will underpin demand and place a floor in prices for light and store conditioned lambs.

Although supplies of heavy and trade weight lambs are expected to be much lower than in recent years, processing margins are currently being squeezed with marginal operating costs being in the vicinity of $9 to $10/kg cw.

There are very few markets where sheepmeat demand is inelastic (where demand is unaffected by price). In most cases Australian imported sheepmeat competes with indigenous flocks and although better quality, there is a price point where it becomes too expensive. Sheepmeat is part of the global meat protein complex and demand can be affected by its relative competitiveness to other meat proteins. Already some markets like Iran have shown resistance to higher sheepmeat prices during 2025.

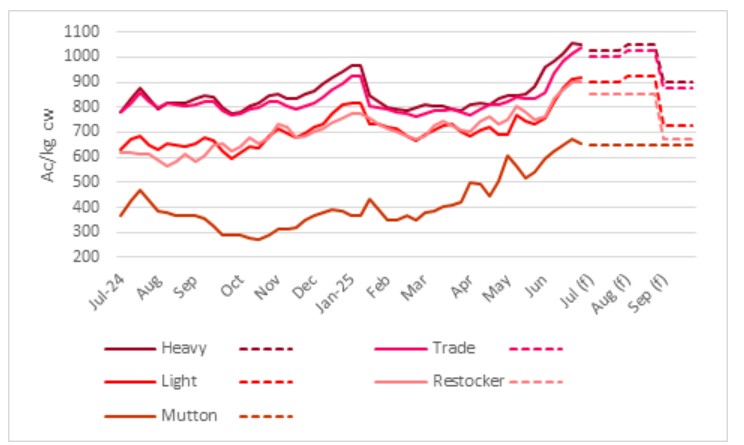

This chart shows the national saleyard indicator prices and price forecasts for major sheepmeat livestock categories in c/kg dressed weight. Source: Meat and Livestock Australia (MLA), Elders forecasts.

This chart shows the national saleyard indicator prices and price forecasts for major sheepmeat livestock categories in c/kg dressed weight. Source: Meat and Livestock Australia (MLA), Elders forecasts.

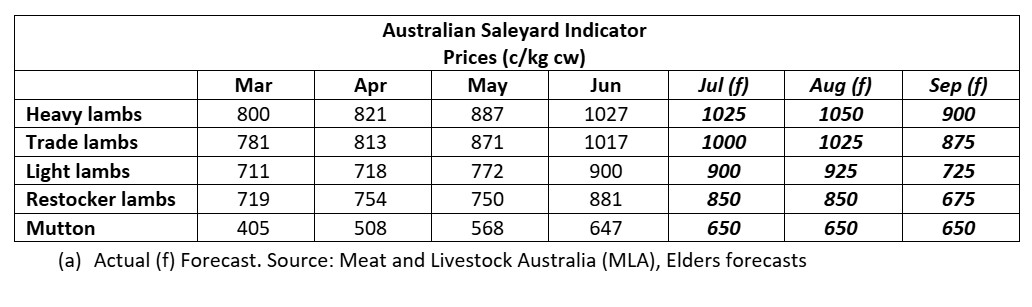

A slowing in international demand for lamb and tighter processing margins will see sheepmeat values pullback from current high prices as new seasons supplies start to hit the market in September. This will pull values back from their current levels by the end of the forecast period. Prices for heavy and trade weight lambs will be supported by the relative tightness in supply of heavier weight lambs with current tough seasonal conditions making it difficult for producers to put weight on lambs until pastures start growing at the start of spring.

Table showing March to May actual, and forecast July to September Australian saleyard figures for different categories of sheepmeat. Source: Meat and Livestock Australia (MLA), Elders forecasts.

Table showing March to May actual, and forecast July to September Australian saleyard figures for different categories of sheepmeat. Source: Meat and Livestock Australia (MLA), Elders forecasts.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.