Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian sheepmeat market this spring.

Two years of heavy flock liquidation, combined with tough seasonal conditions across major lamb producing areas in southern Australia, has contributed to a marked shortage of lambs this past quarter that looks set to extend well into the back end of the year.

Lower ewe joinings, lower lambing and marketing percentages (particularly from later autumn drop) combined with limited available pasture has meant that the lower number of lambs available have been slower to market and are at lighter weights than normal. The season is running around 6 to 8 weeks behind normal. This has seen lamb prices trade well above expectations through the winter quarter, with the peak supply of new seasons lambs now expected in the October/November period.

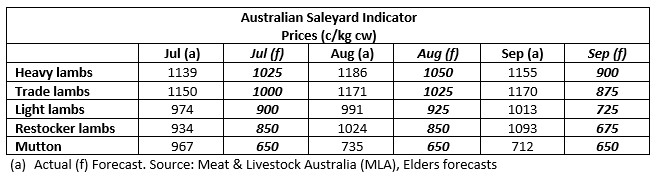

Our forecasts have underestimated price levels through the quarter, particularly in September, when we were expecting a flush of new season supplies to help cool prices. The shortage in lamb supply has been more pronounced than expected and then lateness of the season has also been unexpected.

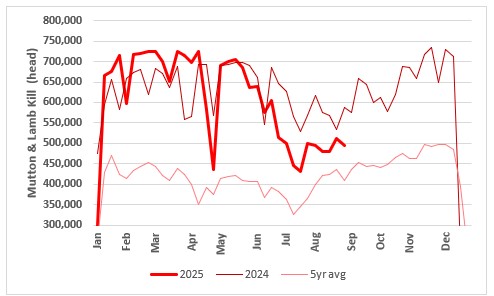

A quick look at sheepmeat processing levels shows a sharp drop off since June. This explains the reason for the sudden rise in values across the sheepmeat complex. Generally, supplies begin to improve seasonally in September and into the end of the year. While some recovery in supply is anticipated through spring, volumes will remain constricted compared to recent years.

This chart shows Australian weekly sheepmeat slaughter in 2025 vs 2024 and the 5-year average. Source: NLRS.

This chart shows Australian weekly sheepmeat slaughter in 2025 vs 2024 and the 5-year average. Source: NLRS.

Table showing actual and forecast Australian Saleyard Indicator Prices for sheepmeat (c/kg cw) for July, August and September. Source: MLA and Elders Forecasts

Table showing actual and forecast Australian Saleyard Indicator Prices for sheepmeat (c/kg cw) for July, August and September. Source: MLA and Elders Forecasts

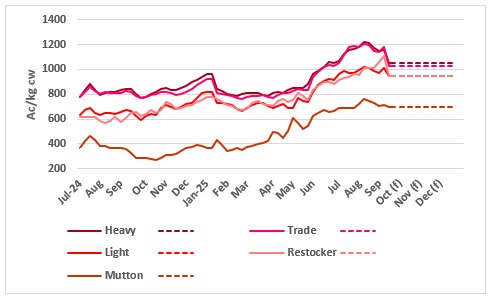

Forward contract prices of above $10/kg carcase weight (cw) into year’s end for suitable weight slaughter lambs will underpin lamb prices at historically high levels through the spring forecast period.

The major threat to current pricing levels will come from the weak processing margin environment, with some works reportedly operating at around breakeven margins.

On current indications, processors will continue to operate in a tough environment to maintain throughput and retain staff. Generally, higher meat protein costs will assist in maintaining lamb’s competitiveness, notwithstanding the recent steep increase in prices across the sheepmeat complex.

This chart shows the national saleyard indicator prices and price forecasts for major sheepmeat livestock categories in c/kg dressed weight. Source: Meat & Livestock Australia (MLA), Elders forecasts.

This chart shows the national saleyard indicator prices and price forecasts for major sheepmeat livestock categories in c/kg dressed weight. Source: Meat & Livestock Australia (MLA), Elders forecasts.

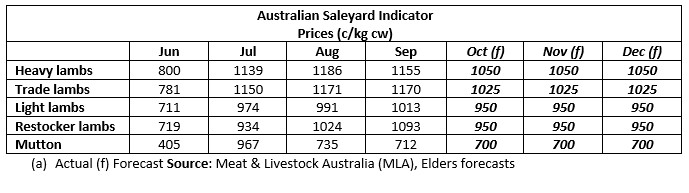

With sheepmeat values expected to hold and grain prices falling, lamb feeding margins look to be maintained through the end of the year. Barley prices have fallen by around 10 per cent in the past quarter to below $300/t ex farm and look set to fall further into harvest. Given bulging global feed grain stocks, there is the possibility prices will fall to around $250-280/t ex farm by harvest, representing the cheapest local grain values since the 21/22 harvest. Improving margins will underpin increased levels of local lamb feeding and support the market for light and store lambs, with feeders currently contracting store lambs at $5/kg liveweight, delivered to South Australian and Victorian feedlots into year’s end.

Export markets for lamb appear to be holding up well, except for Iran, where exports have fallen from 19,000 tonnes to around 5,000 tonnes for the year to August. Overall total Australian lamb exports are back just 8,000 tonnes for the year to August to 242,000 tonnes. Higher value markets through north America, Asia and Europe (mainly UK) are taking an increased proportion of export volumes, suggesting higher per tonne lamb export returns in 2025 relative to recent years.

Table showing actual and forecast Australian Saleyard Indicator Prices for sheepmeat (c/kg cw). June to December. Source: MLA and Elders Forecasts

Table showing actual and forecast Australian Saleyard Indicator Prices for sheepmeat (c/kg cw). June to December. Source: MLA and Elders Forecasts

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.