Independent livestock analyst Simon Quilty of Global Agri Trends shares his thoughts on how ‘Operation Midnight Hammer’ could affect Australian beef and sheepmeat.

In the last week, the United States military conducted ‘Operation Midnight Hammer’ which involved bombing three Iranian nuclear sites based in Fordow, Natanz, and Esfahan.

The three sites contained uranium enriched to up to 60 per cent purity. This is a mildly radioactive level, but a short step away from weapons grade, which is where the genuine concern lies for Israel and the US.

As a result, two possible scenarios could unfold, each with their own potential impacts on Australian beef and sheepmeat.

The first is if the conflict is confined to Israel and Iran and is resolved within weeks, then the market impact will likely be minimal across sheepmeat and beef.

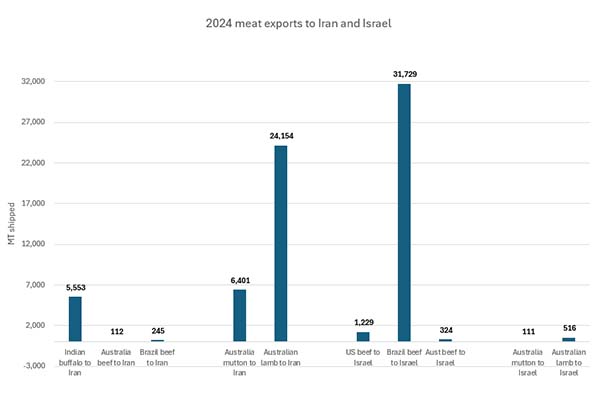

Australian lamb exports to Iran have more than halved this year compared to last year, whereas this year's mutton exports to Iran from Australia have almost doubled. The cheaper mutton is being substituted in Iran for lamb. The expectation is that overall sheepmeat exports to Iran remain at 30,000 MT this year, which is still 18 pc of the Middle Eastern market and 6 pc of global sheepmeat markets.

Graph showing 2024 meat exports to Iran and Israel. Source: DAFF/GAT.

Graph showing 2024 meat exports to Iran and Israel. Source: DAFF/GAT.

In terms of Australian beef, exports to both Israel and Iran are minimal, with Israel taking 324 MT last year, and Iran even less, at 113 MT.

The second possible scenario is if the conflict is prolonged and spreads across the entire Middle East, halting trade in beef and sheep meat everywhere, then the impact on global markets will be far more significant.

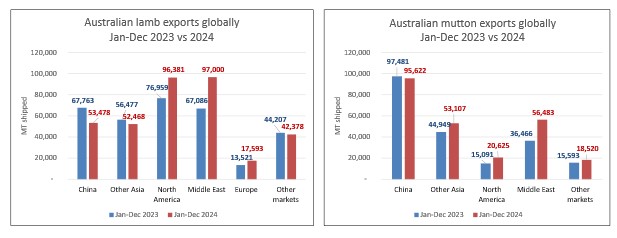

In this worst-case scenario, the impact would be significant, given that the Middle East accounts for 27 pc of lamb exports. More importantly, it takes light lambs, specifically those weighing 14 to 18 kg CWE. As a result, with a widespread, protracted conflict, light lamb carcasses are likely to be forced back onto the Australian domestic market. Given that lamb carcases make up 50 pc of the Middle East lamb exports, this would be a significant impact on local lamb pricing. Some of this impact would be absorbed by heavy lamb lotfeeding, but not all, and lower prices could be expected. Other cuts would be displaced into other markets, such as legs, shoulders, shanks, and racks, with the US being the likely destination. Once again, with an increase in volume, this might dampen prices.

Two graphs comparing lamb and mutton exports globally January to December 2023 compared to 2024. Graph one shows Australian lamb. Graph two shows Australian mutton. Source: DAFF.

Two graphs comparing lamb and mutton exports globally January to December 2023 compared to 2024. Graph one shows Australian lamb. Graph two shows Australian mutton. Source: DAFF.

With scenario two, mutton is under the same type of pressure should a large-scale escalation occur and Middle East exports slow or come to a halt. Mutton exports to the Middle East make up 26pc of total global mutton exports from Australia. A heavier reliance on China as an alternative in the mutton market would significantly increase the likelihood of a price correction. Once again, mutton carcases remain the largest single item of mutton sold in the Middle East, accounting for 63pc of the market share. These may also end up back on Australia’s domestic market if the alternative markets are unable to absorb the volume.

The impact on beef under scenario one would be minimal, given the small size of beef markets in both Iran and Israel.

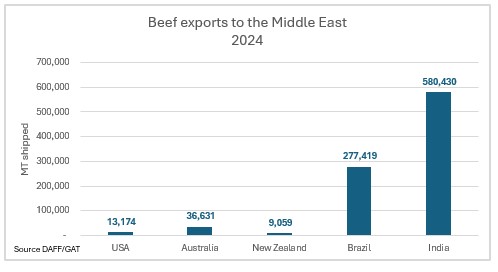

Scenario two is far more concerning for beef at both the commodity end and quality end of the market. A widespread escalation could result in a significant volume of Indian buffalo and Brazilian beef being displaced back into China and the US, as well as Asia, with the net effect being to lower Brazilian and Australian grinding meat prices.

Graph showing beef exports to the Middle East in 2024. Source: DAFF/GAT.

Graph showing beef exports to the Middle East in 2024. Source: DAFF/GAT.

Under scenario two, the elite end of the market could also be impacted, particularly on striploins, ribeye, and tenderloins. The Middle East plays a critical role in ensuring these items are not oversold into key markets, such as the US chilled grain-fed market. When this critical outlet is removed, oversupply is likely. The other beef items will be easier to diversify.

There are no winners for the global meat trade in these types of conflict, and the best-case scenario is that the win for Israel and the US over Iran is swift and decisive to ensure trade gets back on track quickly. There is no doubt that the chilled trade remains vulnerable for beef and sheepmeat as airspace access becomes increasingly complex with the escalation of the conflict.

So far, the impact on trade has been minimal. Long may this continue.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.