Independent analyst Andrew Woods of Independent Commodity Services explains that rising fine Merino production hasn’t offset the decline in broader categories, which has driven up price ratios for both fine and broad Merino wool.

Key points:

- Increases in fine Merino production have not offset falls in broad Merino production in recent decades.

- Falling broad Merino production has pushed up price ratios for broader Merino prices over time

- In contrast the market for finer Merino wool has been growing with price ratios trending higher.

Wool production and sheep numbers are under extreme downward pressure in Australia at present. Sheep numbers are also under downward pressure in New Zealand, South America, the USA, UK and Europe. Low wool prices (cyclical), higher costs (structural) and attractive alternative enterprises are driving the change.

Let's look at what change in Merino wool production might look like.

Australian Merino production

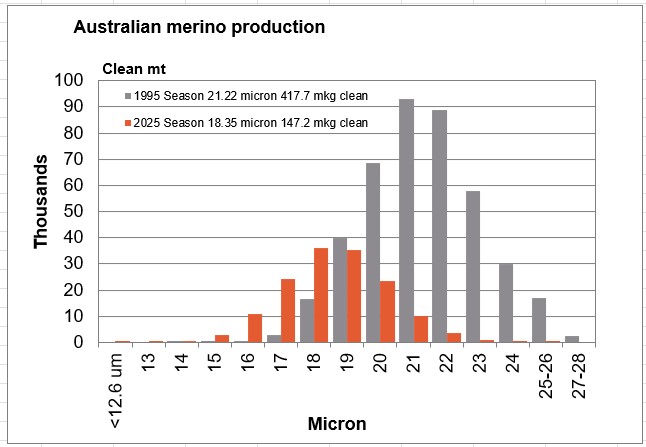

The chart opposite shows Australian Merino production through Australian Wool Testing Authority (AWTA) volumes, filtered for Merino production and adjusted to clean volumes, in the mid-1990s and for last season, some 30 years later.

While fine Merino volumes have grown, the overall clip has shrunk by two thirds with most of the 21 micron and broader production disappearing.

This chart shows Australian Merino production through AWTA volumes

This chart shows Australian Merino production through AWTA volumes

South African production has moved finer as well, with South American production reacting to the low crossbred prices of the past five years by a combination of slashing production (Corriedale/Polwarth) and moving finer.

The lesson from this is that fine Merino volumes may continue to increase in size, but it is unlikely they will replace losses in production of broader Merino micron categories, meaning the overall clip will shrink further.

A question often asked is “when will lower supply begin to push up price?” The answer to this hinges upon what is meant by “push up price”.

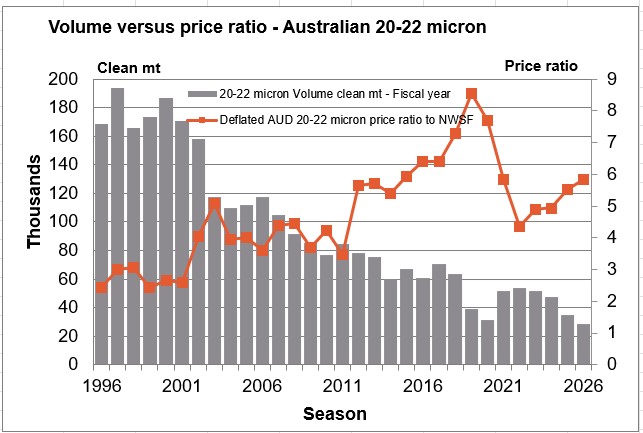

Volume vs price ratio - Australian 20-22 micron

The chart opposte shows the annual auction volumes of 20 to 22 micron wool sold in Australia from the mid-1990s to this season (projected) along with the ratio of the average price of all the 20 to 22 micron wool sold to an average price of cotton, polyester, acrylic and viscose (NWSF).

This chart shows the annual auction volumes of 20 to 22 micron wool sold in Australia

This chart shows the annual auction volumes of 20 to 22 micron wool sold in Australia

As the volumes has fallen the price ratio has trended higher, with the Covid downturn in combination with the bounce in supply following the 2017-2019 drought interrupting things. The upward trend in the price ratio has reappeared in recent years, as volume has once again trended lower.

Wool is one apparel fibre amongst many, so wool prices ultimately will follow the general direction of the wider apparel fibre market complex. The 20-22 micron price has been reacting to lower supply by achieving a higher price ratio to the other major apparel staple fibres.

Wools ain’t wools

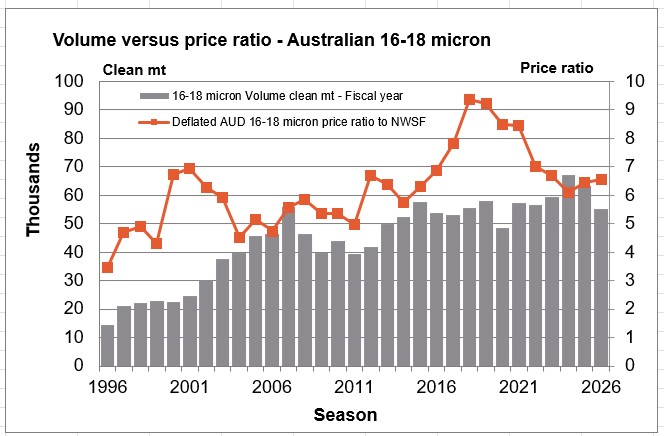

The chart opposite is similar to the one above, but looks at the volume and price ratio of 16 to 18 micron wool sold at Australian auctions.

The volume trend for 16 to 18 micron has been a rising one for the past three decades, with the price ratio actually gently trending higher, with some significant cycles higher and lower around the trend.

This chart shows the annual auction volumes of 16 to 18 micron wool sold in Australia.

This chart shows the annual auction volumes of 16 to 18 micron wool sold in Australia.

There is some correlation to changes in volume and the price ratio. The ratio weakens when volumes rise above trend and the ratio increases when the volume falls below trend. Unlike the 20 to 22 micron market which is buying a higher price ratio (and price) with lower production, the 16 to 18 micron categories have a growing market. This is a much healthier prospect.

What does this mean?

The term ‘wool’ covers a wide range of fibres from 10 to 60 microns, which are clearly quite varied. During the past three decades the supply of broad Merino wool has trended lower, and continues to do so.

While this has pushed the relative price of broad Merino wool to other fibres higher, it has not prevented farm resources being deployed elsewhere. In contrast the market for fine (sub 19 micron) Merino wool has grown, but the growth in fine Merino wool has not offset the loss of broad Merino volume. The overall size of the Merino clip appears likely to continue to shrink, with the emphasis being on finer wool.

Disclaimer - important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.