Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian summer grain market.

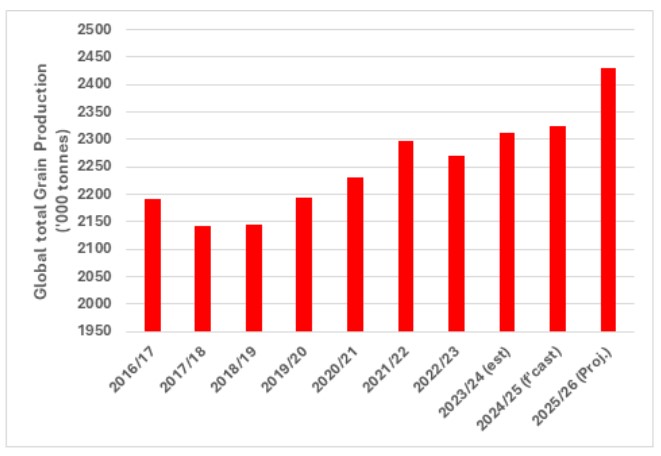

International grain markets continue to battle against unfavourable fundamentals as global grain production estimates grow to record levels, as shown in the first graph below.

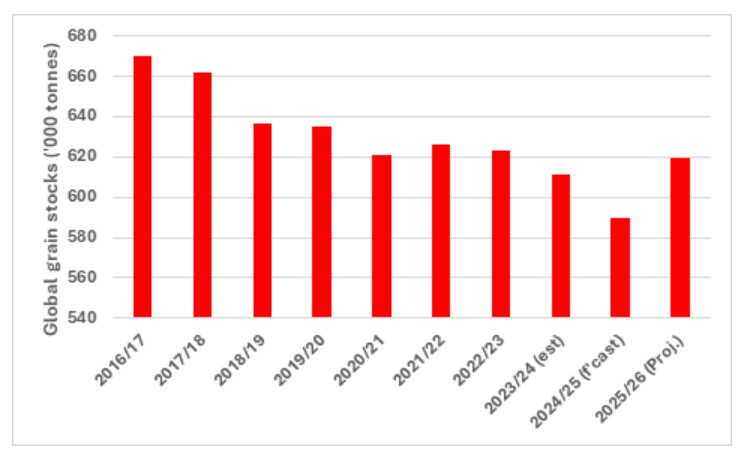

Record crops across North and South America and solid crops in Europe and Australia will increase grain stocks carried into 2026/27, despite solid levels of demand. This is reflected in the second graph below.

This chart shows global production of major grains in ‘000 tonnes per summer cropping period from 2016 to 2025/2026. Source: International Grains Council.

This chart shows global production of major grains in ‘000 tonnes per summer cropping period from 2016 to 2025/2026. Source: International Grains Council.

This chart shows global end stocks of major grains per summer cropping period from 2016 to 2025/2026 in ‘000 tonnes. Source: International Grains Council.

This chart shows global end stocks of major grains per summer cropping period from 2016 to 2025/2026 in ‘000 tonnes. Source: International Grains Council.

Import demand is well supplied by competitive offers from most major grain export regions as they look to offload mounting stocks. Large sporadic importers in India and China have produced good crops over the past two years bolstering stocks and reducing the need for grain imports. International grain values have plumbed to five-year lows.

Lower prices should start to impact production (less plantings and lower inputs), but so far producers are combatting lower prices by boosting yields. All indications point to another large production year in 2026/27 with northern hemisphere winter crops planted into adequate soil moisture and heading into dormancy in above average condition. A large southern hemisphere summer plant is underway with estimates for another large plant and near record production.

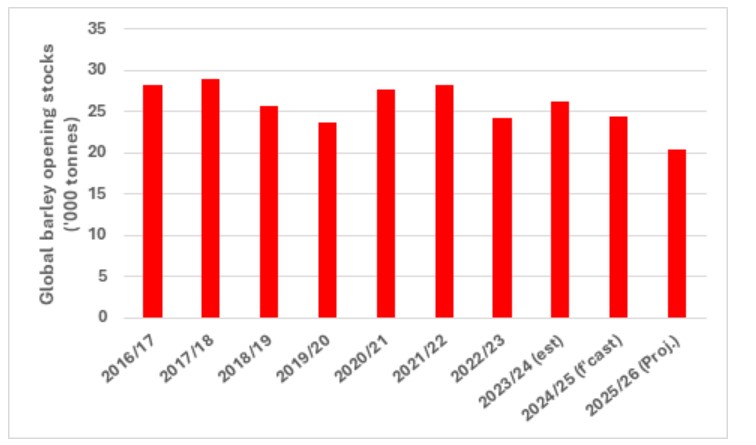

While the global wheat and corn balance sheets look heavy, the outlook barley is more promising.

Global barley area keeps shrinking, down by almost 15 per cent over the last six seasons, led by cuts in Iraq, Morocco, Russia, and Ukraine. Supply has failed to meet barley usage in recent years, with stocks bridging the gap. There could be solid export prospects for Australian barley after Argentine supplies clear the market in early 2026.

This chart shows global barley opening stocks per summer cropping period from 2016 to 2025/2026 in ‘000 tonnes. Source: International Grains Council.

This chart shows global barley opening stocks per summer cropping period from 2016 to 2025/2026 in ‘000 tonnes. Source: International Grains Council.

While nearby market sentiment for cereals is weak, the vibe across the oilseed complex may be even worse. Oilseed stocks in Canada and the US are mounting as harvest wraps up and as Chinese demand for oilseeds shifts from north to south America due to ongoing trade disputes. Australian exporters are keenly awaiting some Chinese canola buying as China looks to replace Canadian canola, with discussions between Chinese and Australian officials aimed at finalising export protocols ongoing. The potential for large shifts in trade flows from sudden changes in trade policy will keep the oilseed market on edge entering 2026.

The nearby outlook for pulses is no better. Global pulse output is projected to expand for a second consecutive year in 2025/26 as growers are lured by high relative returns and the potential to lower input costs by including pulses in their cropping rotations. A larger Indian crop and another strong monsoon season in the offing has narrowed the production deficit across the sub-continent, at the same time a lift in global pulse production has increased export competition. International pulse values have virtually halved compared to last harvest and India are toying with higher tariffs and import restrictions to support its domestic prices and protect farm incomes.

Australian production

The Australian Bureau of Agriculture and Resource Economics and Sciences (ABARES) raised its forecast for Australian 2025/26 wheat production by 1.8 million tonnes (mt) to 35.6mt. The barley production estimate was raised by 1.1mt to 15.7mt and canola production by 800,000t to 7.2mt, due to timely spring rainfall at critical growth stages and mild spring temperatures in most cropping regions. Wheat production is now set to be 4 per cent above last year's 34.1mt, 29 per cent above the 10-year average and the third largest on record. Barley output should come in 18 per cent above 2024/25's 13.3mt, 33 per cent above the 10-year average and be the biggest ever. The canola harvest is on track to be the second largest on record, beating last year's 6.4mt by 13 per cent and the 10-year average by a whopping 50 per cent.

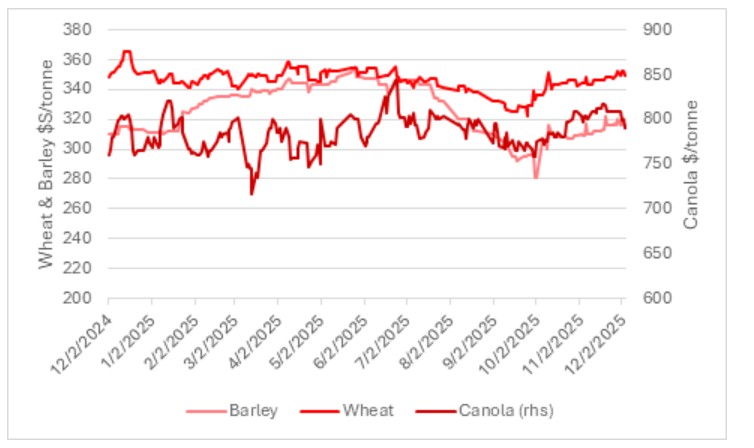

Domestic grain prices followed international prices lower for much of the year on the expectations of another solid local crop and increased domestic carryout stocks. Since the commencement of harvest price movements have been governed by the pace of grower selling.

This chart shows track port Geelong prices for wheat, barley and canola in Australian dollars per tonne. Source: CGX.

This chart shows track port Geelong prices for wheat, barley and canola in Australian dollars per tonne. Source: CGX.

Wheat prices remain firm with traders and end users trying to extend coverage on limited grower selling. Barley bids are holding as exporters try to attract tonnage into the system.

Canola values are under a bit of pressure from weaker international values, a lift in grower selling and a stronger Australian dollar. Future canola pricing will be dependent on whether we see a lift in Chinese buying.

There’s been a definite increase in sorghum buying interest with China again in the market to buy Australian sorghum just like they’ve done over the past 5 years, despite US milo and Argentinian sorghum being cheaper.

The local pulse trade to India is paralysed by fears that the Indian Government will lift tariffs to protect the prices of its local crop with chickpeas and lentils prices easing after immediate export commitments were filled.

Faba bean prices are being constrained by weak Egyptian demand as there remains some stock available in Egypt from last campaign. Local stockfeeders have shifted to lupins due to better availability this year and because they work better in feed rations even though they are $100/t dearer.

Slow grower selling, particularly across northern feed zones has seen prices appreciate moderately following harvest as end users endeavour to cover December/January requirements.

The delayed harvest across southern port zones has seen some end user shorts emerge which has seen old crop cereals values maintain a $20/t premium to new crops. As harvest progresses, growers are selling malt barley and canola with the bulk of wheat harvest in the south another week or two away.

In the west, growers are focussed on harvesting a near record crop and prices have held firm to slightly lower on controlled grower selling.

Looking ahead with another lift in both international and domestic stocks, despite a projected lift in domestic usage, only slow grower selling will see prices hold at current levels. Most of the pressure on prices will be in the south where growers need to sell a larger percentage of the harvest to generate cash flow. Outside of the south, sales through the first quarter of 2026 will be controlled until new crop production potential can be assessed which will support current price levels. Prices should rise modestly through the summer quarter as local end users lift bids gently to encourage farmer selling.

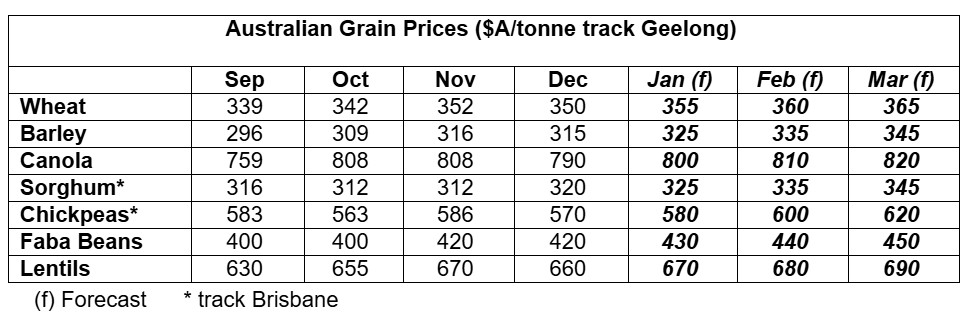

This table shows prices for various grains and commodities. Source: Clear Grain Exchange.

This table shows prices for various grains and commodities. Source: Clear Grain Exchange.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.