Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian cattle market this winter.

Australian cattle markets did well to navigate through the chaos of the autumn quarter. Markets were supported through March by a lack of weight across the south and disruptions to northern supplies as Cyclone Albert bore down on south-east Queensland and northern NSW. Good rain across parts of Western Australia and north of Dubbo in NSW later in the month also helped prices. North-west Queensland dealt with historic rains that caused widespread flooding and destroyed fences and transport infrastructure.

Markets gathered momentum through April under much the same influences (lack of weight in the south). They were propelled higher in the aftermath of the floods, as the flow of cattle across Queensland was disrupted. This saw slaughter and feeder markets rise, as processors were forced to pay up to secure nearby supplies, unable to access supplies already purchased in holding yards. At the same time, northern restocker activity picked up, as producers north of Dubbo right through Queensland eyed large lines of well-bred light southern at attractive replacement costs.

But by May, as Queensland dried out and as first musters were completed, northern cattle started to run. There was also another hike in southern turnoff, as many southern producers began to run out of stock water and trimmed herds back to their core nucleus breeders. At the same time, slaughter cattle supplies in Queensland bulged as processing levels through April were affected by a series of short processing weeks and were already behind, after losing almost a week from the impacts of Cyclone Albert. May saw slaughter markets come under pressure. At the same time though, understanding that the decline in slaughter markets was relatively short-term, feedlots and restockers continued to buy, encouraged by mild autumn conditions and once in a generation seasonal conditions north of Dubbo.

Fluctuations in Australian slaughter cattle prices through autumn were purely driven by local supply as international beef prices continued to strengthen driven by US consumer demand which sent US cattle and beef prices soaring to record levels (with US consumers buying not impacted by Trump’s trade policies, despite weakening consumer sentiment). Feeder and restocker markets held firm as the medium-term outlook for Australian beef and cattle prices continued to strengthen driven by higher US demand for beef and a weakening in US export competition.

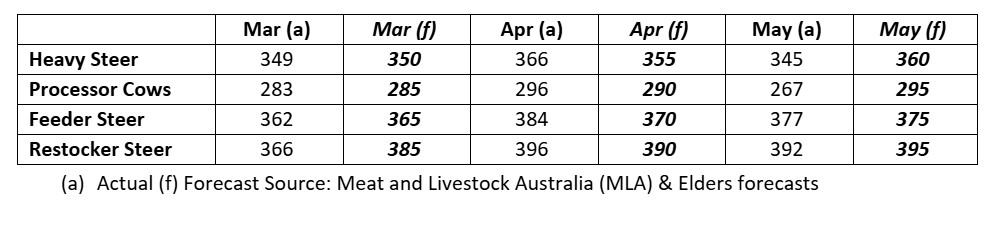

This table shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

This table shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

The outlook for Australian cattle prices through the winter quarter and into early spring is strong. Drought conditions are easing across much of the south, reducing forced turnoff (except for parts of SA/north-western Victoria and far western NSW). Southern processors are becoming increasingly active in northern markets as supplies of slaughter weight cattle in the south continue to tighten. Even though some southern areas have received planting rain, it was too late to encourage much pasture growth and supplies of slaughter ready cattle from southern areas will be constrained until the end of the forecast period.

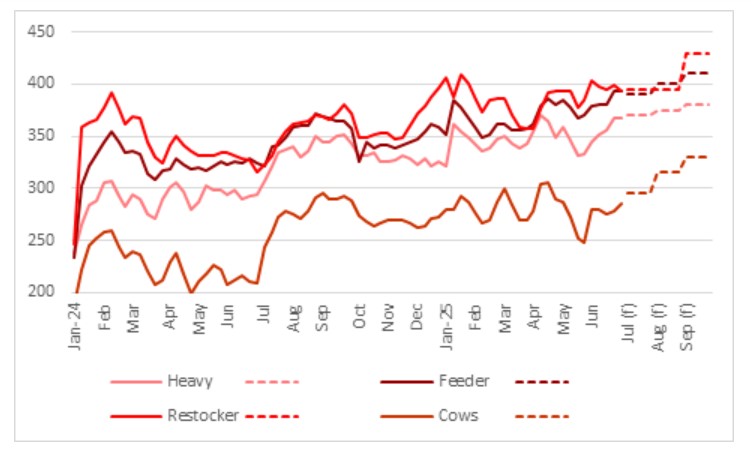

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

The processing sector is being encouraged to maintain high kills as processing margins expand as international beef prices are rising at a greater rate than local prices. Heavy supplies of cattle from the north will continue to cap local prices as Australian turnoff is pushing up against processing sector capacity limits which continue to be constrained by labour shortages at around 155,000 per week.

Cows are likely to see the greatest appreciation in value through the forecast period as northern turnoff eases seasonally. Southern producers are likely to have fewer cull cows available, having culled deeply into core breeding herd over the past few years, leaving a relatively young southern herd.

Feeder cattle prices will be pushed along by strengthening export market demand as US competition eases. Increased export demand for medium-fed beef has pushed Angus steer premiums to 80c to $1/kg above flatback feeders. This has driven a lift in prices across the entire feeding complex, as feedlotters targeting other markets become more active on lighter weight steers, while domestic trade has started to skew its purchases towards heifers.

Helping the flatback feeder market is the relatively small premium to heavy cattle prices and the high cost of replacement lighter weight weaner cattle, This is seeing Queensland producers opt to retain feeders and target grassfed bullock programs later in the year. This will supress the heavy steer market toward the end of the forecast period and lift feeder steer values pushing the feeder premium above 20c/kg lw.

Restocker cattle values led local cattle markets through autumn, however, with much of the northern market buying done and these cattle becoming relatively expensive, demand has slowed. This has coincided with the first of the frosts in Queensland and a period where restocker demand eases seasonally as pasture growth slows. However, on the expectation that international beef demand remains solid and slaughter cattle values remain firm, with any sort of a spring across the south, availability of these cattle will tighten dramatically, and demand will strengthen as southern producers look to restore productive capacity.

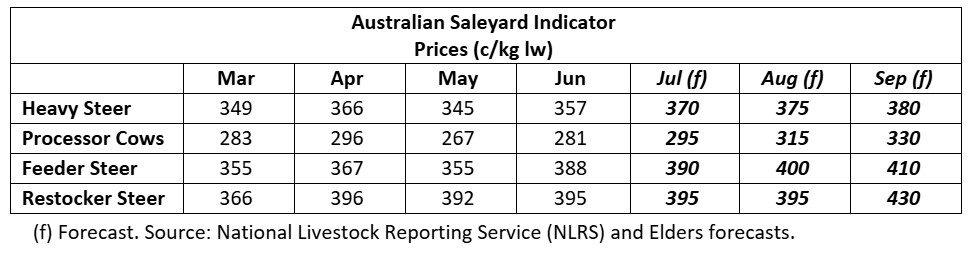

Table showing March to May actual, and forecast July to September Australian saleyard figures for different categories of cattle. Source: Meat and Livestock Australia (MLA), Elders forecasts.

Table showing March to May actual, and forecast July to September Australian saleyard figures for different categories of cattle. Source: Meat and Livestock Australia (MLA), Elders forecasts.

The main threat to forecasts of strengthening prices across the entire cattle complex will be a sharp retracement in US beef demand. This would be in line with weaker US consumer sentiment, as the US and global economy slows as the Trump Administration trade policies take effect. While this is my expectation over the medium term, the relative value of Australian beef versus US beef will hold the industry in good stead.

Local supply and demand will also play a major role in determining the level of Australian cattle values over the forecast period. Large Queensland turnoff (a result of herd expansion over the past five good seasons) pushing up against processing capacity limits, limiting processing competition for cattle. A favourable spring in the south would aid in further lowering supplies, moving southern producers to rebuild productive capacity after two years of well below average rainfall.

At this stage there doesn’t seem to be a desire by the local processing industry to further expand processing capacity which is a constraint to higher Australian cattle prices.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.