Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian cattle market this spring.

Australian cattle prices performed strongly throughout the winter quarter of 2025. They were driven by increased demand for Australian beef from US and China and a lack of suitable weight cattle across southern Australia. This has caused increased southern competitor activity in northern markets and ensured increased export market returns have flowed through the supply chain to the producer.

US beef demand, driven by increased retail spending on home-cooked beef, superior eating experience vs other proteins, increase in high-protein trends, and low-fat diets promoted by fitness influencers, has been extraordinarily strong through the past quarter. US beef consumption has increased, despite significantly higher prices, while US beef production has fallen, lifting US demand for imported beef.

The availability of imported product in the US remains limited, in part due to US tariff policies (imposition of a 75.8 per cent tariff on Brazil) but also due to lower availability of New Zealand beef (as NZ cow slaughter slows seasonally) and the acceleration of US herd rebuilding (causing declining US cow kill). US fed beef supply has been constrained by lower imports from Canada and the screwworm ban on Mexican feeder steer exports to the US since late 2024. Australian beef exports to the US have surged 26 per cent in the year to August 2025.

The other key driver of Australian beef demand has been the lift in Chinese imports since US beef was effectively banned from China as part of the ongoing trade dispute with the US. So far this year, Australian beef exports to China have increased 51 per cent.

Australian cattle prices increased 60 to 80c/kg lw over the forecast period with our forecasts understating the extent of these gains.

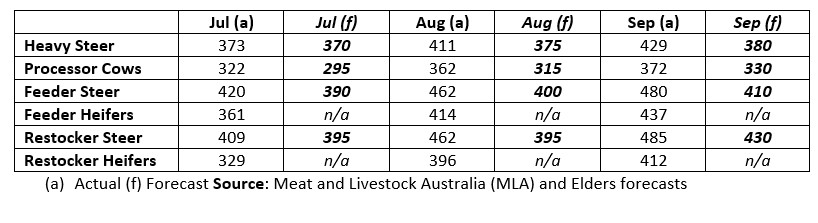

Table showing Australian saleyard indicators for cattle, actual and forecast for July, August and September. Source: NLRS and Elders forecasts.

Table showing Australian saleyard indicators for cattle, actual and forecast for July, August and September. Source: NLRS and Elders forecasts.

The best price gains have been for lighter restocker cattle, non-HGP slaughter cattle for the Chinese market and for EU accredited and straight Angus feeder steers which have pushed into the mid $5/kg lw owing to the tightness in availability of these types of cattle from traditional southern supply areas.

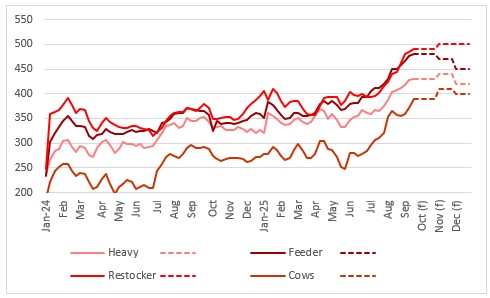

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) & Elders forecasts.

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) & Elders forecasts.

The outlook for Australian cattle prices through the spring quarter remains strong, however, we expect the recent firmer price trend to begin to moderate, with prices consolidating at around current levels.

Prices for heavy steers and feeder cattle will be affected by a seasonal lift in supplies, as the northern turnoff ramps up as temperatures increase. Demand will slow as year-end buying programs are completed prior to the wind down of the northern processing season between mid-December and mid-January. Supplies out of the south should soon start to increase as temperatures warm through spring and pasture availability increases, allowing southern producers to finish stock.

Cow values are likely to outperform through the forecast period, as international demand for Australian lean beef continues to rise and as northern cow turnoff eases seasonally. Cow supplies across the south will remain constrained as southern producers opt to retain cows to rebuild herds.

Restocker cattle values continued to lead markets through winter. The trend in restocker values herein will be largely determined by the strength of the southern season. Although seasonal conditions are gradually improving, large parts of South Australia and Victoria, and southern NSW remain in drought and will need a kind spring to ensure good pasture growth into summer. The high cost restocker cattle, cash flow limitations and seasonal uncertainty may limit restocker cattle values through spring. Restocker heifer values should continue to narrow the premium to steers owing to their value as a future breeding unit, given the promising medium-term outlook for Australian cattle values.

The main threat to forecasts of strong prices across the Australian cattle complex through spring will come from a fall in US beef demand. US beef demand has been central in driving higher global beef prices over the past year. Economic signals out of the US continue to be mixed with latest jobs data being well below levels required to keep the US unemployment rate steady. With employment being closely correlated with spending, we may be moving into a period of weaker US consumer spending. So far there have been no signs of this impacting consumer expenditure on beef.

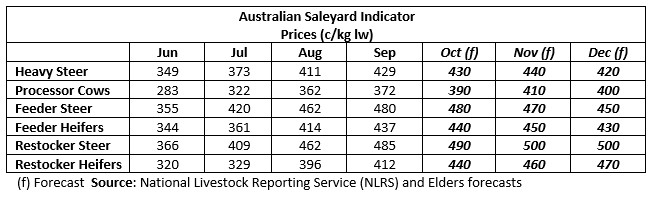

Table showing Australian Saleyard Indicator Prices (c/kg lw). Source: National Livestock Reporting Service (NLRS) and Elders forecasts

Table showing Australian Saleyard Indicator Prices (c/kg lw). Source: National Livestock Reporting Service (NLRS) and Elders forecasts

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.