Elders Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian cattle market this summer.

Buoyant beef export market conditions, tight availability of slaughter weight cattle in southern Australia, strong feedlot profitability and improving seasonal conditions across key livestock areas in south-eastern Australia have driven a late spring surge in local cattle prices (up 6 to 14 per cent).

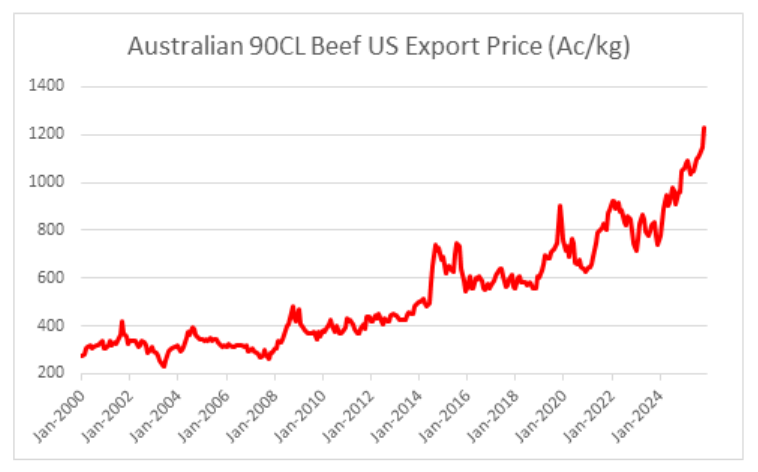

National saleyard indicator prices for slaughter cattle categories reached record levels owing to extraordinary export market conditions (Australian 90CL export prices into the US gained nearly $1A per kilo during spring) and tightening local supplies of export slaughter cattle. The imposition of a 40 per cent tariff on Brazilian beef exports to the US reduced Brazilian export volumes, increasing demand from the US for Australian lean beef.

This chart shows Australian 90CL beef export prices to the US in Ac/kg. Source: MLA.

This chart shows Australian 90CL beef export prices to the US in Ac/kg. Source: MLA.

Weakening grain prices and strong export demand for Australian grain-fed beef has created strong feedlot profitability which has underpinned feeder cattle demand. Lower turnoff out of US feedlots has created opportunities for Australian grain-fed beef within the US and in global export markets as US export competition recedes. The continuing ban on US beef exports into China has seen a 50 per cent lift in Australian grain-fed export volumes to China since Q2 2025.

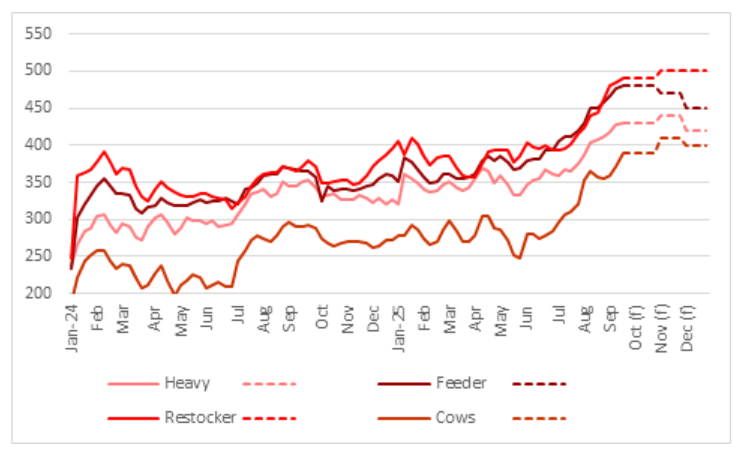

As seasonal conditions have improved through key livestock areas of south-eastern Australia, so has demand for restocker cattle. So far, demand has favoured steers with restockers looking to replenish cash flow by purchasing light steers to trade into feedlots in the first half of 2026. Feeder and restocker heifer discounts continue to be large (60-100c/kg lw) indicating that southern producers are hesitant about rebuilding herds given seasonal uncertainty and cash flow constraints.

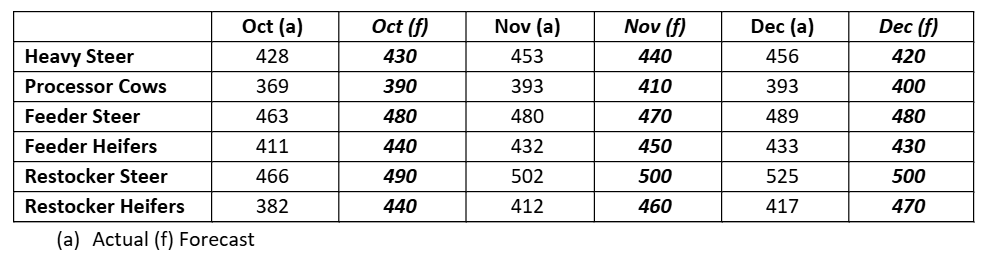

Our spring price forecasts have largely mirrored actual price movements, except for heifers, which remain undervalued vis-à-vis other cattle categories. We anticipate there may be some cooling in price levels towards the end of the year as activity slows seasonally.

Restocker cattle prices which performed strongly during the spring as conditions improved across South Australia and Victoria are reliant on summer rainfall and mild summer temperatures. A hot and dry summer would see increased turnoff and lower prices while a soft summer with regular rainfall would see restocker activity strengthen across the south.

The Bureau of Meteorology (BOM) suggests that for much of the east coast of Australia, and across the southern states, there is no clear signal in the rainfall forecast, meaning roughly equal chances of above or below average rainfall, over the three months to February.

This table shows actual and forecast cattle prices for various categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

This table shows actual and forecast cattle prices for various categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

This chart shows national saleyard indicator prices and Elders price forecasts for major cattle categories. Source: Meat and Livestock Australia (MLA) and Elders forecasts.

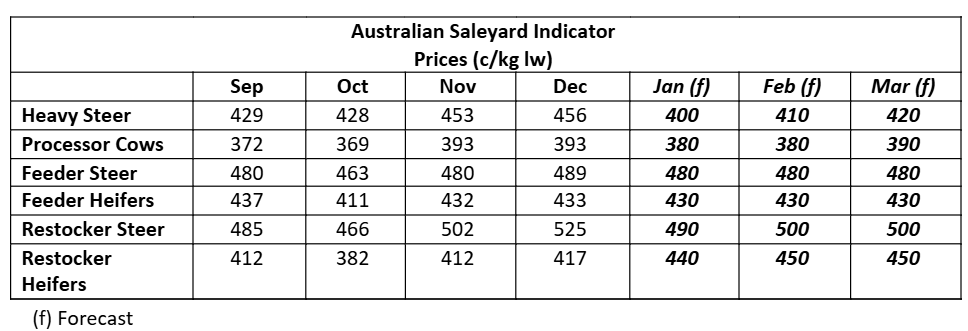

In contrast to the spring quarter, the outlook for Australian beef export returns has dimmed a little with the likelihood of increased export competition from Brazil in the US and prospects for a higher Australian dollar and weaker US demand for beef. Offsetting these factors to some extent will be tight supplies of local slaughter cattle through the first part of 2026, however, our forecasts suggests that there will be a moderate cooling in cattle prices through the summer quarter of 2026.

With Trump moving to remove the 40 per cent tariff on Brazilian beef imports, Brazilian beef will only face the 26.4 per cent above quota tariff in the US. This will likely restore Brazilian beef imports back to previous levels (about equal with Australia) and provide a lift in competition for Australian beef exports, putting some pressure on Australian beef export returns.

Another significant change affecting our forecasts compared to the spring quarter is the outlook for the Australian dollar. A spike in local inflation has raised prospects of a tightening in local interest rates in 2026, whereas most other major economies are expected to maintain an easing bias. Increasing interest rate differentials will attract capital flows into Australian bond markets and stoke demand for $A. A consensus of 38 economists sees the Australian dollar rising to just shy of 69 US cents by the end of 2026.

A discussion about Australian beef and cattle prices would not be complete without some warning about the importance of US beef demand. The US consumer has been the bedrock of the lift in global beef prices over the past two years, increasing beef consumption despite significantly higher prices. However, there are some signs that US beef demand may be starting to weaken amid cost-of-living pressures and record beef prices. US beef prices have been easing the past few months (aided by the removal of tariffs) despite lower US beef production, signalling that waning consumer sentiment may be starting to take its toll on US beef demand. We expect to see some pullback in US beef demand through 2026.

While the Australian cattle complex will be supported by falling US production in 2026 this is likely to offset by increased competition from Brazil. Possible export restrictions by China that may affect global beef trade flows could also present challenges to Australian beef and cattle prices in 2026, although these impacts are more likely towards the end of 2026.

With Australia the world’s second largest beef exporter, changes in trade policy can have a major influence on prices for Australian beef and cattle. Recently, China has extended its investigation into beef imports to January 26, 2026. The most likely scenario is some form of safeguard on imports from Brazil to protect its domestic cattle industry (Australian beef exports are higher value and do not compete directly with domestic beef). Currently, Brazil is the major exporter to China exporting over 1.3 million tonnes of beef annually vs Australian exports of around 250,000t. Any substantive restrictions on Brazilian exports to China would likely see Brazilian exports diverted to north American markets, further increasing export competition against Australian beef in the US imported beef market. The US will also be pressing China to restore export licenses for US processing facilities which could also impact Australian exports to China in 2026.

Another potentially limiting factor to higher Australia cattle prices in 2026 are local processing bottlenecks. Growth in herd numbers across northern Australia over the past 4 to 5 years have exceeded growth in processing capacity, which leaves the cattle producing sector exposed in the event of forced turnoff due to dry conditions. With growth in the herd and the ongoing lift in feedlot numbers, the processing sector needs to reinvest some of its profits from the past two years to improve infrastructure so that the industry is not exposed to processing bottlenecks. Apart from skilled labour, the other major constraint to lifting kill levels across the north is inadequate chiller and freezer capacity.

This table shows Australian saleyard indicators and forecasts. Source: National Livestock Reporting Service (NLRS) and Elders forecasts.

This table shows Australian saleyard indicators and forecasts. Source: National Livestock Reporting Service (NLRS) and Elders forecasts.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.