Independent Livestock Analyst, Simon Quilty of Global Agri Trends shares his thoughts on movements in Australia’s sheep sector.

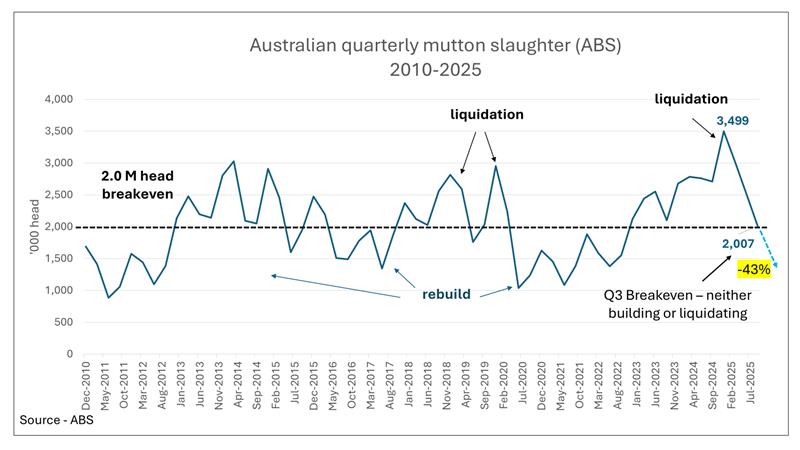

Last week's Australian Bureau of Statistics (ABS) data revealed that mutton slaughter reached the breakeven point for liquidation and rebuilding at 2 million head. Given the momentum of tight supply in lamb and mutton, not easing in the weekly data, it would be a fair assumption that the rebuild has commenced in Q4, the quarter we are in.

This chart shows Australian quarterly mutton slaughter from 2010 to 2025. Source: ABS

This chart shows Australian quarterly mutton slaughter from 2010 to 2025. Source: ABS

Both lamb and mutton slaughter have fallen off a cliff, down 27 per cent (pc) and 43 pc, respectively, and with lighter carcass weights, production has fallen even further.

None of this is a surprise, given the dryness of southern Australia over the last two years and the heavy turnoffs we have seen. My forecast for July/August next year of 1350 ac/kg CWE for heavy lambs and trade lambs is still on track.

How sustainable is this? It's important to note that much of today's higher livestock pricing is due to strong demand, and the further higher prices moving forward will be more due to tighter supplies, the hallmarks of a rebuild.

But, as with any rebuilding period, prices rise 30 pc and fall 30 pc. These prices are ultimately unsustainable, as livestock numbers will build over three years, leading to lower prices.

I believe the long-term price trade/heavy lambs will settle at 950 ac/kg CWE in 2028 to 2033. I call this the new norm, and it is sustainable for producers and processors.

Last week's ABS data supports this view of stronger lamb and mutton prices over the next three years until prices fall back to the new norm, ensuring a sustainable future.

Disclaimer - important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.