Independent analyst Andrew Woods of Independent Commodity Services explains that very fine Merino prices remain strong amid record supply.

Key points:

- It is not all doom and gloom for wool, with very fine Merino prices enjoying strong prices and record supply.

- Supply continues to grow for these categories so demand must also be growing in order to support price, unlike the broader Merino categories where higher prices have been stimulated by a crash in supply during recent decades.

As a fibre, wool covers everything from 11 micron to 65 micron, a wide range of breeds, fibres, end uses and value. This article takes a look at one section of the wool spectrum which is enjoying strong prices and rising volumes, which is a good definition of a boom.

In the early 1990s, Barry White on ABC radio exhorted Australian wool growers to “go finer”. He was basing his advice fundamentally on the trend in European fabric weights during the 1980s which trended lower, requiring lighter yarn which in turn required finer wool. Something the introduction of containers in shipping and objective measurement for greasy wool allowed early stage processors to focus on. Since that exhortation the average fibre diameter of the Australian Merino clip has fallen from around 21 to 22 micron to 18 to 18.5 micron, with most of the broader Merino production disappearing. However, it has not been all smooth sailing.

Average seasonal auction price

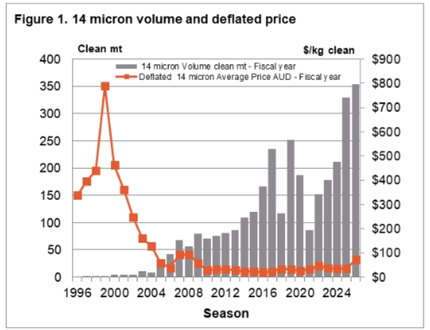

The graph opposite shows the average seasonal auction price (deflated and all in) for 14 micron wool, from the mid-1990s onwards, along with the volumes sold at auction (the current season uses the data to October, projecting the full 2025-26 season from there).

In the 1990s 14 micron was on the edge of the Merino micron distribution with annual auction sales under 5 clean tonnes per season and prices ranging from $150 to $300 per clean kg (similar in volume to vicuna from South America).

This chart shows the average seasonal auction price for 14 micron wool, and the volumes sold at auction.

This chart shows the average seasonal auction price for 14 micron wool, and the volumes sold at auction.

As volumes started to increase in the 2000’s the auction price collapsed to around $30 by 2010. Many traditional superfine growers started to leave the industry. Despite the exodus and the new lower price levels, supply has continued to trend higher during the past two decades, and this season despite record high volumes the price, in deflated terms, has returned to near 2008 levels.

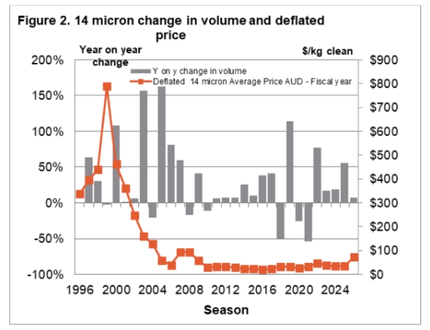

Change in 14 micron volumes and price

The graph opposite takes a closer look at the change in 14 micron volumes and price. In this schematic the yearly change in volume is shown along with price. Annual volume was increasing by up to 150 pc in the 2000s, putting immense supply pressure on price, which crumbled. In the past decade, volatility in volume has continued, at much lower levels. This means that while supply is growing, it is growing at a slower rate and demand has a much better chance of adapting which it clearly has been doing.

This chart shows the change in 14 micron volumes and price over time.

This chart shows the change in 14 micron volumes and price over time.

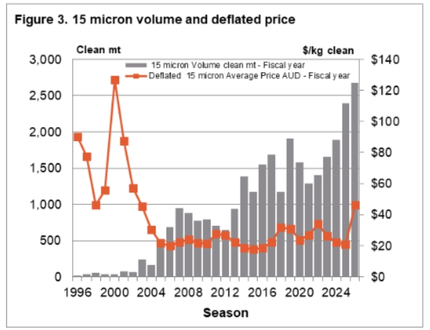

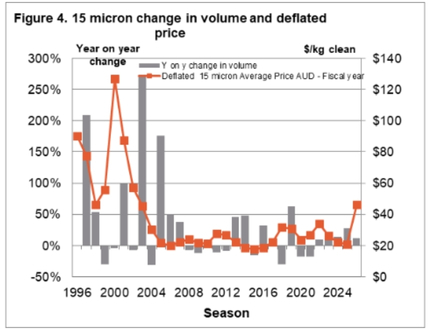

Change in 15 micron volumes and price

The graphs below repeat the exercise for 15 micron wool, with a similar story. The average 15 micron price this season, in deflated terms, is doing even better and has returned to 2003 levels despite record volumes.

This chart shows the average seasonal auction price for 15 micron wool, and the volumes sold at auction.

This chart shows the average seasonal auction price for 15 micron wool, and the volumes sold at auction.

This chart shows the change in 15 micron volumes and price over time.

This chart shows the change in 15 micron volumes and price over time.

It is a common refrain in the wool industry that “we were told to go finer, and looked what happened”! The implication is that prices fell from when supply increased, so going finer was a waste of time. The Australian experience for wool on the very fine edge of the Merino clip is that multi-year increases in supply in the order of 50 pc to 250 pc will crush price (imagine if the lamb market did this – there would not be enough slaughter capacity). After falling the 14 and 15 micron prices steadied and found a level, even as supply continued to trend higher. Now supply is rising at a more sustainable level.

Given the nature of wool production, there will be seasons of over and under supply, and given the nature of wool demand, there will be periods of weak and strong demand, so the current conditions of rising prices and record supply (as good as it gets) will not last forever. Figures 1 and 3 show that some farmers have managed to make very fine wool production work, focussing on productivity and not boom prices to carry their enterprises.

What does this mean?

The Australian experience for Merino micron categories at the very fine edge of the distribution during the past three decades shows that as supply picks up, price falls especially when the initial price levels are multiples of cashmere prices. After the crash in price, the market has adapted to the higher volumes with price steadying. Demand has grown in step with supply, occasionally getting out of alignment. In the current market this sliver of the wool industry is doing very nicely.

Disclaimer - important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.