Welcome to our 2025 Commodity Market Review, compiled by Elders analyst Richard Koch. This comprehensive review provides insights into the key trends, challenges, and opportunities that shaped Australian commodity markets throughout the year, helping you stay informed and prepared for what lies ahead.

Cattle

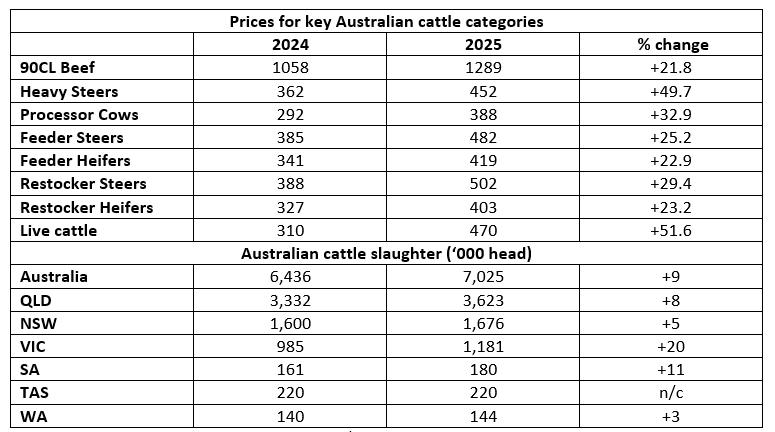

Cattle prices have been significantly stronger across all major cattle categories driven by strong international demand for Australian beef.

Large heifer price discount suggests that there is no widespread herd rebuild underway as yet.

2025 has been a demand driven rally with Australian slaughter and production increasing throughout the year.

National Livestock Reporting Service slaughter for the year to the first week in December has slaughter up 9 per cent (pc) with SA and Victoria proportionally higher due to seasonal conditions.

- Australian Bureau of Statistics year to September beef production is up 13 pc

- Australian cattle on feed up 7 pc (September 2024 vs September 2025)

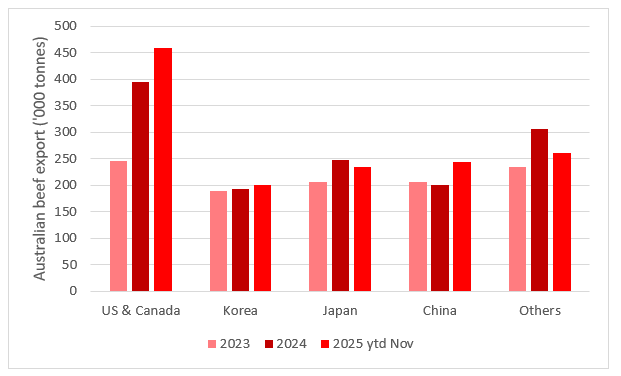

- Australian beef exports for the year to November up 15 pc, with export performance driven by north America, China and to a lesser extent UK

- North America up 21 pc

- China up 44 pc

- Japan up 2 pc

- Korea up 10 pc

- Other Asia down 7 pc (predominantly Indonesia which is down 24 pc)

- EU up 92 pc (predominantly UK which is up 333 pc)

- Australian live cattle exports down 4 pc

This chart shows Australian beef export volumes to major markets. Source: DAFF.

This chart shows Australian beef export volumes to major markets. Source: DAFF.

- Australia continues to benefit from lower US beef production which is down 3 pc in 2025 as it enters the rebuilding phase of its cattle cycle. Lower US production is providing opportunities for Australian beef in both the US and in other export markets as competition from US beef retracts.

- US beef exports down 10 pc

- US beef imports up 26 pc

- US cattle imports down 51 pc (due to the screwworm ban on Mexican feeder cattle)

- US beef imports from Brazil up 72 pc

- US beef imports (excluding Australia) up 25 pc

- The Australian beef industry has been the beneficiary of favourable trade policy developments in 2025 with China not renewing export permits for US beef which saw Chinese importers switch to Australian beef. The prohibitive 40 pc tariff imposed on Brazilian beef imports to the US mid-year sharply curtailed Brazilian beef shipments to the US and lowered competition against Australian lean beef in the US.

Source: MLA national saleyard indicators in c/kg carcase weight.

Source: MLA national saleyard indicators in c/kg carcase weight.

Sheep

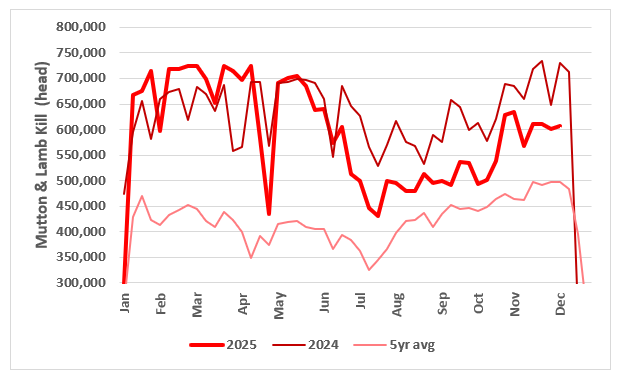

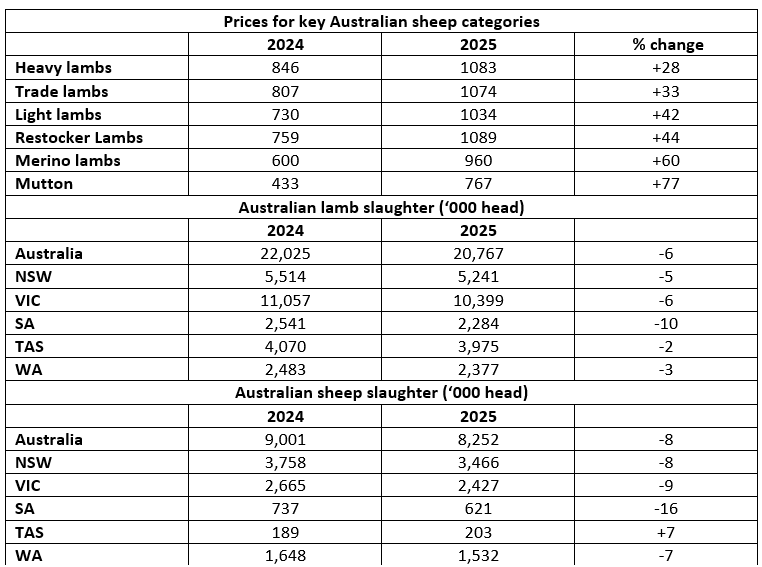

- In contrast to cattle, sheep and lamb values saw a supply driven rally in 2025.

- Two years of flock liquidation owing to poor prices and mixed seasonal conditions led to lower ewe joinings in 2025 and persistent seasonal challenges through the year meant lower lambing and marking percentages.

- Australian sheep and lamb slaughter started to fall significantly from mid-year owing to the smaller 2025 lamb cohort.

This chart shows Australian sheep and lamb slaughter 2025 vs 2024 and five-year average. Source: NLRS.

This chart shows Australian sheep and lamb slaughter 2025 vs 2024 and five-year average. Source: NLRS.

- Australian Bureau of Statistics year to September lamb production is down 6 pc, no change in mutton production.

- Australian lamb exports year to November were down 5 pc with an increased proportion of exports diverted to north America, China and the UK away from lower paying markets in the Middle East.

- North America up 2 pc

- China up 18 pc

- Middle East down 32 pc (predominantly Iran down 78 pc)

- Other Asia up 2 pc

- EU up 40 pc (predominantly UK up 42 pc)

- Australian live sheep exports down 9 pc

- Australian mutton exports year to November down 15 pc:

- North America down 20 pc

- China down 38 pc

- Middle East down 6 pc

- Other Asia down 6 pc

- EU up 80 pc (predominantly UK up 100 pc)

- Australian live sheep exports down 9 pc

- Australian sheepmeat exports are being supported by lower domestic production in the countries we export to and lower production in NZ our main export competitor as land use shifts away from lamb production to forestry and dairying.

- NZ lamb exports to the year ended September 2025 were down 5 pc. Better access into the premium EU market has meant that NZ exports were diverted away from north Asia and north America, creating further opportunities for Australian exporters in those markets.

- EU up 6 pc

- North Asia down 13 pc

- North America down 5 pc

Source: MLA national saleyard indicators in c/kg carcase weight.

Source: MLA national saleyard indicators in c/kg carcase weight.

Grain

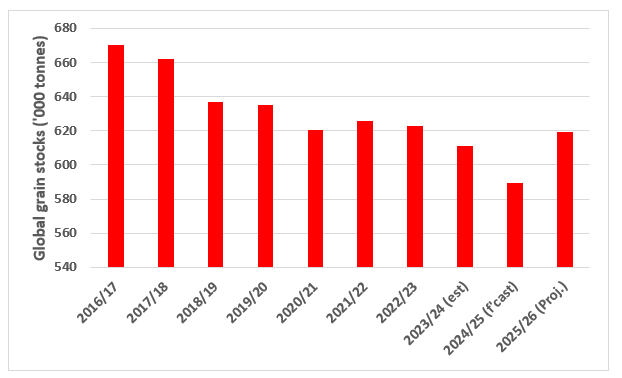

- Global grain markets have been weighed down by strong global production. Total world grain production will rise 4.5 pc this year, contributing to a 5 pc rise in grain stocks.

- As part of this, wheat production will rise 4 pc as will wheat stocks.

- Global barley production will also increase 6 pc while stocks are estimated to increase 30 pc.

- Canola production is estimated to have increased 7 pc contributing to a 10 pc increase in stocks.

- Current production estimates for crops in 2026/27 are similar to 2024/25 estimates, although northern hemisphere winter crops have a long way to go, they have been planted into ideal conditions and head into dormancy in good health.

This chart shows global grain stocks from 2016/17 through to projections for 2025/26. Source: International Grains Council (IGC).

This chart shows global grain stocks from 2016/17 through to projections for 2025/26. Source: International Grains Council (IGC).

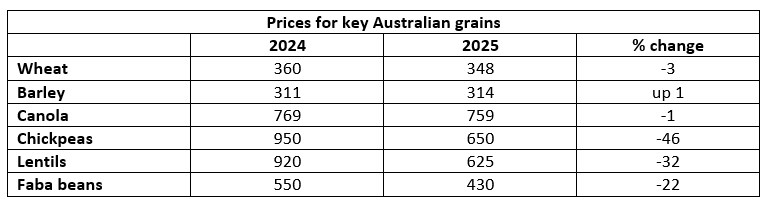

This table shows prices for key Australian grains.

This table shows prices for key Australian grains.

Wool

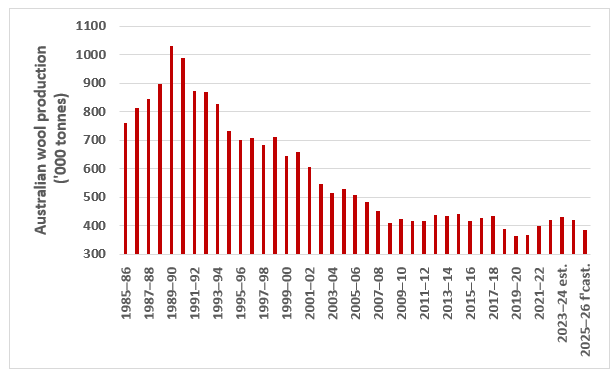

- Like with sheepmeat, liquidation of the breeding flock in 2023 and 2024 due to seasonal conditions and poor prices has meant lower numbers of sheep shorn and lower wool production.

This chart shows Australian wool production over the years between 1985/86 through to projections for 2025/26. Source: ABARES.

This chart shows Australian wool production over the years between 1985/86 through to projections for 2025/26. Source: ABARES.

- A year-on-year decline in shorn wool production in 2024/25 was estimated for all states ranging from declines of 18.4 pc in both WA and SA to 1.1 pc in Tasmania. NSW was down 7.9 pc, Victoria down 9.3 pc and Queensland down 8.9 pc.

- AWTA wool test volumes for the 2024/25 season were down by 11.7 pc on a year-on-year basis.

- For 2025/26 sheep numbers shorn are expected to fall by another 8 pc.

- 2025/26 wool production in Australia is expected to decline another 10 pc with proportionally higher falls in SA and Victoria due to seasonal conditions.

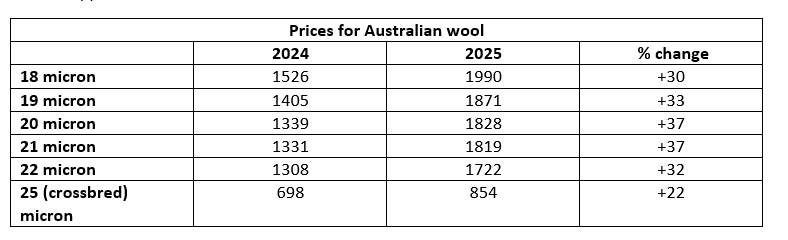

- Prices were best for medium microns while demand for finer wools was affected by cost-of-living pressures and declining demand in the premium apparel market.

- Prices and demand for wool improved from spring as lower volumes became apparent and as apparel manufacturers became more confident about global economic growth and apparel demand.

This table shows prices for Australian wool.

This table shows prices for Australian wool.