Independent livestock analyst Simon Quilty of Global Agri Trends shares an update from his recent trip to South America, when he visited Chile, Peru, Uruguay, Argentina, Brazil and Paraguay.

The trip allowed me to gain a deeper understanding of each country's cattle cycle, its challenges and opportunities, and most importantly, to assess the potential threat these countries pose to Australia’s export future in beef and sheep meat.

At the onset of my trip, Brazil announced that it was on the path to becoming Foot and Mouth Disease (FMD) free without vaccination.

This is a monumental stride for Brazil, and the implications for Australia, the US, and other global suppliers of FMD-free meat are profound.

Brazil's potential to supply a significant volume of meat could lead to substantial market shifts and potential price fluctuations in the future.

Brazil's two most important markets for beef access are Japan and Korea, which are dominated by the US and Australia. In 2023, South Korea was the number one destination for US beef, Japan was number two, and Australia’s beef destinations ranked second and fourth – two critical markets.

| 2023 shipments of beef to Japan and Korea | ||

|---|---|---|

| MT shipped | Australia | United States |

| South Korea | 188,923 | 233,066 |

| Japan | 206,802 | 198,525 |

It is important to note that chicken and pork can be exported from Brazil to South Korea and Japan. However, pork is restricted from Santa Catarina and only exported to South Korea and Japan. So, there is precedent with other meat products from Brazil in both South Korea and Japan.

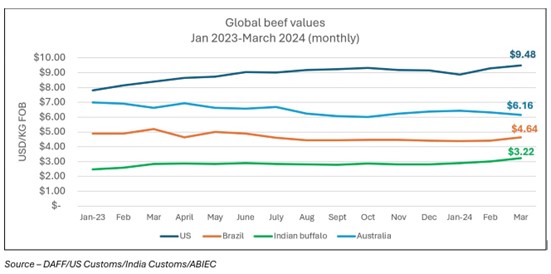

Graph showing global beef values per month January 2023 to March 2024. Source: DAFF/US Customs/India Customs/ABIEC

Graph showing global beef values per month January 2023 to March 2024. Source: DAFF/US Customs/India Customs/ABIEC

When looking at price differentials between Australia, the US, Brazil, and India, the price spread between Brazil and Australia/US is enormous. This is due to Brazil's status with FMD by vaccination and the lack of access to key markets such as Japan and South Korea.

With access to these markets, I expect Brazil's prices would lift, and both Australian and US prices would likely fall, given the enormity of supply and the desire for Brazil to ‘buy its way’ into the market.

One of Brazil's challenges in exporting to Asia has been the long voyage times of 35 to 40 days. This has been particularly relevant to the chilled beef trade, which has seen limited shelf life due to these long voyages and effectively made this out of reach for Brazilian exporters.

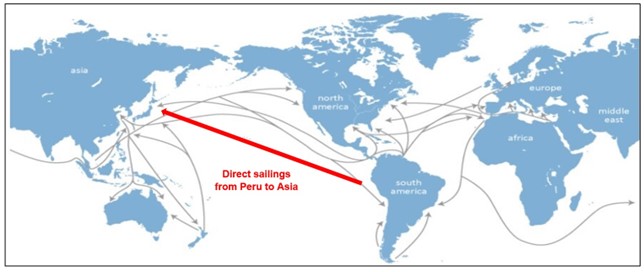

Map showing direct sailing route Peru to Asia

Map showing direct sailing route Peru to Asia

The development of the new mega-port in Chancay, Peru (60 miles north of Lima), is expected to shorten this voyage time by 15 days or more, enabling beef exports to reach Japan and Korea within 21 days.

This is a significant step forward, and South American countries could become important players in chilled beef to Asia.

Getting to Chancay is complicated, with the presence of the Andes making access to Peru difficult for many South American countries. Therefore, further infrastructure would be required on roads and in processing facilities built near the port – but this would not be impossible.

The other important option is exporting out of Chile, which can also be exported directly into Asia in a timely fashion. Trucking to Chile has its challenges, but it is done regularly, and Brazil has sent some chilled products to Asia.

The key for Brazil to achieve this goal is for WOAH to give its approval.

Once this is obtained, individual countries such as Japan or Korea might inspect Brazil to ensure that It is truly free of the need for vaccination.

As a guide, Brazil announced it was free from foot-and-mouth disease with vaccination in December 2017. Within six months, the OIE (known as WOAH) announced Brazil was free of vaccination in May 2018. So, there is precedent to show that next year's date of May 2025 is achievable.

Is vaccination necessary?

This is the question being asked by those within Brazil and surrounding countries.

Uruguay stands out in the South American meat and livestock sector as the sole country with full access to all countries with vaccination. Many in South America are asking why not simply seek access to these countries with vaccination as Uruguay has done.

Uruguay has retained this status and not a ‘vaccination-free status’ because they know how vulnerable they would become if there were no vaccination. FMD spreads incredibly quickly, and the ability to regain their current status would be set back many years if this were to occur.

The scepticism from surrounding countries is due to the porosity of borders with northern countries such as Bolivia and Columbia, where FMD is still present. They believe the movement of cloven-hooved animals (which can all carry FMD) is challenging to control, particularly in jungle regions during flooding.

These comments might also protect their markets, hoping Brazil does not expand its global footprint.

The bottom line

The recent meetings between Japan and Brazil cannot be underestimated, particularly if Japan can coerce Brazil into restricting deforestation. As a reward, access to Japan is a real possibility. Both would gain kudos on the global environmental stage.

If Japan should accept Brazil’s beef, given that Brazil already ships chicken and pork to Japan, it would not be surprising for South Korea to follow suit quickly. The real prize for Brazil is the chilled grain-fed market that was once out of reach due to the extended shipping distances between South America and Asia; due to significant investments, this is now achievable.

One of Brazil's fundamental challenges is the duties it is likely to incur in Japan and Korea. Currently, Uruguay's duty into Japan is 38.5 per cent, and into Korea, 40 per cent; Brazil is expected to be subject to the same duties. Given these cost-prohibitive duties, Uruguay's beef exports to both destinations are small, and Brazil would be no different.

Scepticism by surrounding countries is often seen between competing supply countries. However, should Brazil obtain its FMD-free status, it can be assumed that the border controls between northern Brazil and its neighbours will increase dramatically.

Brazil is acutely aware that any breach of this status, once achieved, will be difficult to regain. This ambitious plan aims to be an equal player to Australia and the US in global markets in terms of price and quality.

The Achilles heel of this plan is that Brazil's northern neighbours may not have the same ambitious plans, and therefore, the vulnerability of these porous borders will remain.

Please note: this article contains information of a general nature, and does not take into account your personal objectives, situation or needs. Before acting on any information, you should consider the appropriateness of the information provided, and seek advice on whether it is fit for your circumstances.