Elders’ Business Intelligence Analyst Richard Koch outlines his outlook on the Australian grain market through harvest and beyond.

International grain values have struggled over the past few months amid very competitive grain offers out of Europe and dramatic improvements in global crops.

Only a flare up in the Ukraine/Russian conflict and increased buying by China of US corn and soybeans ahead of a Trump Presidency have provided support. As Chinese buying slowed, prices forfeited much of their gains with canola values a key casualty.

Slow grower selling and a weaker Australian dollar have prevented falls in local grain prices. Australian growers have focussed on harvesting crops (that have mostly exceeded expectations) and have concentrated on selling chickpeas, canola and barley to satisfy cash flow needs. Given the lack of export demand, local end users are comfortable waiting for the grain to come to them, particularly in the northern region where there is the prospect of a bumper sorghum crop around the corner.

Global crops improve dramatically

Within a month, the US winter crop ratings went from the worst on record to the highest in six years. 55 per cent (pc) of the cropis now rated in good to excellent condition.

Similarly, the monsoon arrived across South America in the nick of time, allowing record plantings of corn and soybean across both Brazil and Argentina. And it hasn’t stopped raining, with forecasts for the Brazilian soybean production expected to rise from 150mt in 23/24 to 170mt in 24/25.

Crops in Australia and Argentina were improved by late spring rain, while a let up in rainfall allowed mainland Europe to finish its winter planting on time.

Satellite imagery has confirmed that the Chinese winter wheat crop is in good shape with moderate temperatures and adequate moisture supporting forecasts of a 142mt crop vs USDA at 146mt. India’s crop has been planted into adequate soil moisture with estimates of 112mt crop vs USDA at 113mt but weather in January through to April will be crucial for yields.

Only the Black Sea crop that was planted into less than adequate has a question mark with estimates that Russian wheat production would be around 80mt well back on +90mt crops of a few years back.

Over 37 pc of the Russian crop is in poor condition vs 4 pc at same time last yr and 8 pc long-term average.

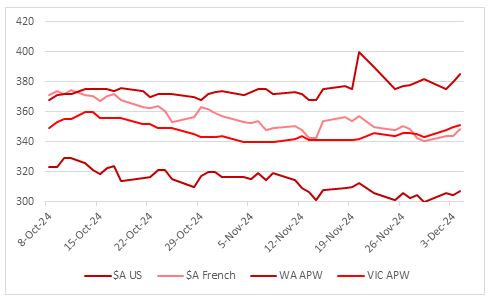

This chart shows US and French wheat prices in $A/t vs milling wheat (APW) prices at WA and Victorian ports. Source: LSEG Workstation.

This chart shows US and French wheat prices in $A/t vs milling wheat (APW) prices at WA and Victorian ports. Source: LSEG Workstation.

Will lower Russian sales push export business to Australia?

Looking ahead we should soon see a sharp retraction in Russian export activity as new export quotas and higher export duties come into effect in February. This will sharply cut Russian export volumes from around 5 million tonnes to 1 to 2 million tonnes per month. At this stage though, EU and Argentine suppliers look set to step in and fill the void, leaving a question mark over export demand for Australian grain.

There is though, a question mark over the quantity and quality of European grain while cheap Argentine grain may find its way to China, opening opportunities for Australian exports into our traditional southeast Asian, Middle Eastern and North African milling wheat markets.

On current offers, Australian values would need to fall from current levels to win significant export business.

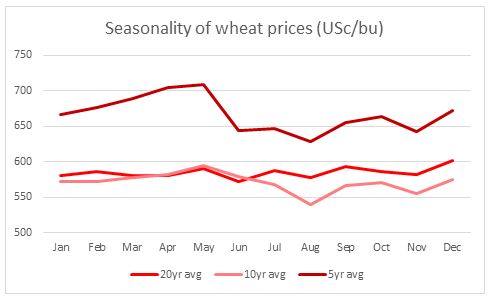

The best prospect for higher prices in the near term is for growers to target sales in the northern hemisphere spring period in March to May where some price volatility is normally apparent. This is a critical period for global crops and is where northern hemisphere winter crop yields are made. It's also when northern hemisphere summer crop planting occurs and where winter crop planting happens in the southern hemisphere. The emergence of Black Sea exporters in recent years has changed the seasonality of global wheat prices with the highest prices being in the March to May period before the Black Sea wheat harvest.

Feed grain markets appear capped

Although the level of domestic grain use has never been higher in Australia, local markets look they will be well supplied with little competition apparent from export markets at current values. Large corn crops across north and south America have more than made up for European crop losses and have kept the lid on global feed grain prices.

In Australia, feed grain values will struggle to rally with a large sorghum crop about to be harvested and plenty of grain unsold across the northern region. In the south, recent rain has grain market analysts anticipating around 2.5 to 5mt of wheat will be downgraded which will mean southern feed grain markets will be well supplied.

This graph shows 20-year, 10 year and 5-year averages for wheat prices.

This graph shows 20-year, 10 year and 5-year averages for wheat prices.

Canola prices have been volatile amid uncertainty

Canola has been an interesting study this year. While cereal grain prices have been relatively stable, oilseeds have been anything but.

Oilseeds are very politically sensitive. With China being a significant importer of North American canola/soybeans, any retaliatory tariffs would impact these exports. Chinese buying to build up safeguard stocks ahead of a Trump Presidency (and tariffs on China), artificially pumped up the North American oilseed market and now demand has plateaued with Chinese buying shifting to South American soybeans.

Europe’s balance sheet is set up to take a lot of Australian canola this year, but outside of Europe, canola values may get dragged down due trade issues with Canadian canola.

| European Union Rapeseed Balance Sheet | |||

| 23/24 (million tonnes) | 24/25 (million tonnes) forecast | ||

|---|---|---|---|

| Production | 19.7 | 17 | Poor crop |

| Use | 25.7 | 24 | Lower useage shift into other oilseeds |

| Imports | 6 | 7 | More imports required |

| -Ukraine | 3 | 2.5 | Lower production |

| - Australia | 2 | 3 | Increased exports have we got enough EU eligible canola? |

| - Others | 1 | 1.5 | |

There has been talk of Chinese sanctions (in retaliation for Canadian tariffs on Chinese electric vehicles) on Canadian canola for months. Any moves by China are likely to push Canadian canola into markets in competition with Australian. Currently, Canada exports canola exports 4 to 5mt of canola per year. These would need to find a home elsewhere if Canadian canola is banned from China.

Canadian canola oil might also get caught up in Trump’s proposed tariffs on Canada. With 90 pc of Canadian canola oil exported to the US, this would be devastating for the Canadian crushing industry with the most likely impact lower global canola prices.

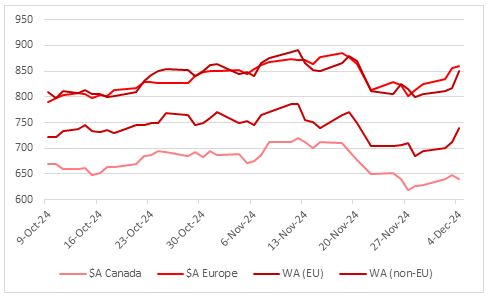

This graph shows European and Canadian canola prices in $A/t versus price of WA canola EU vs non-EU. Source: LSEG Workstation

This graph shows European and Canadian canola prices in $A/t versus price of WA canola EU vs non-EU. Source: LSEG Workstation

The issues canola has outside of Europe are apparent when looking at the widening spread between Canadian and European canola values. Australian values have done well to avoid most of the volatility; however, the downside risks remain significant.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.