Elders' Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian cattle market this winter.

After holding their own for much of autumn, under pressure from heavy supply and stagnant global beef prices, local cattle prices finally succumbed the past week.

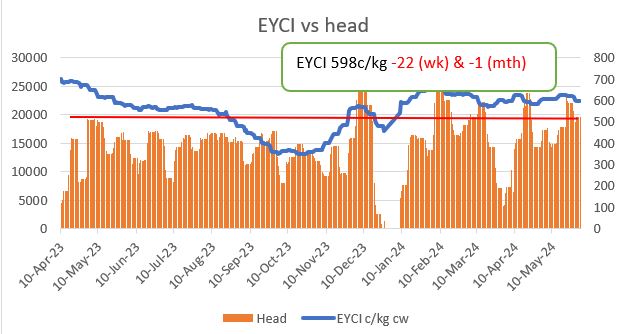

Prices for slaughter cows (-7.5 per cent) and restocker heifers (-10 per cent) bore the brunt, under assault from a large turnoff of female stock ahead of winter. Prices were 1 to 3 per cent lower across the entire complex with slaughter ready stock fairing best. The EYCI has slipped to 598c/kg, down from 620c/kg a week ago.

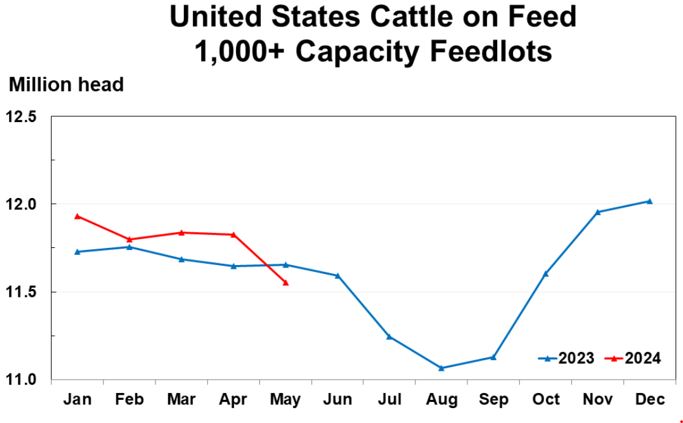

The good news is that there are indications that conditions across the international beef sector are about to improve. US cattle on feed have slipped below year ago levels for the first time this year as US feedlotters aggressively marketed cattle this past month and didn’t fully replace them.

Despite plenty of concern (cost of living, high price relative to white meat), US beef demand appears to be holding. The amount of beef in US cold stores was the lowest April figure in 10 years and 10 per cent below the five-year average, while US beef cut-out values have strengthened despite solid feedlot sales. At the same time, US imported lean beef values have stabilised and should soon improve as availability of NZ beef declines seasonally, making Australian imported lean beef the only game in town.

With signs that there may be looming hole in US beef availability, it was no coincidence that China moved to reinstate five Australian beef processors to the approved list of abattoirs last week.

Elders market view

Local cattle prices should start to grind higher over the next quarter as the southern turnoff eases, US feedlot beef production backs off and northern hemisphere beef demand improves through the summer grilling season.

Southern turnoff torches cow prices

This chart shows the Australian saleyard cow indicator price vs 90CL cow beef export price to the US.

This chart shows the Australian saleyard cow indicator price vs 90CL cow beef export price to the US.

A heavy seasonal turnoff of females across the main eastern states has dragged local cow prices lower the past month. At the same time, imported lean beef values to the US have eased, no doubt due to large southern hemisphere supplies.

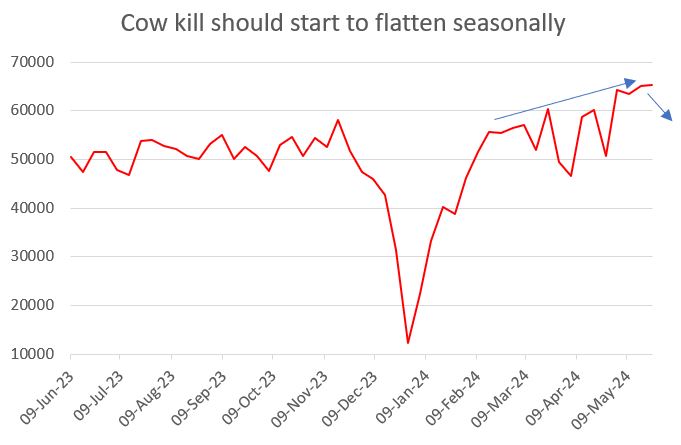

Graph showing that cow kill should start to flatten seasonally.

Graph showing that cow kill should start to flatten seasonally.

Local cow availability should soon start to flatten seasonally and allow the cow market to recover.

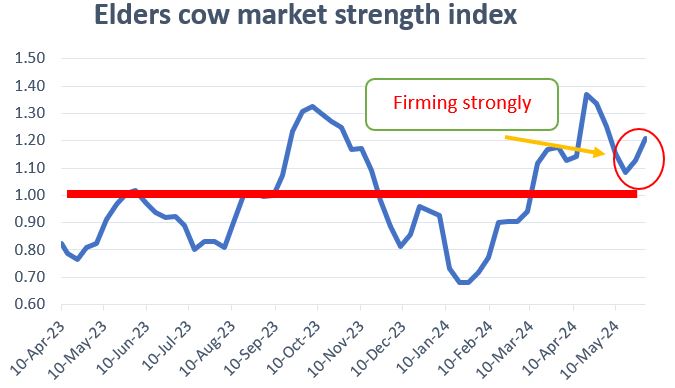

This chart shows a proxy index of the cow processing margin.

This chart shows a proxy index of the cow processing margin.

Assisting the market to recover will be an expansion in processing margins.

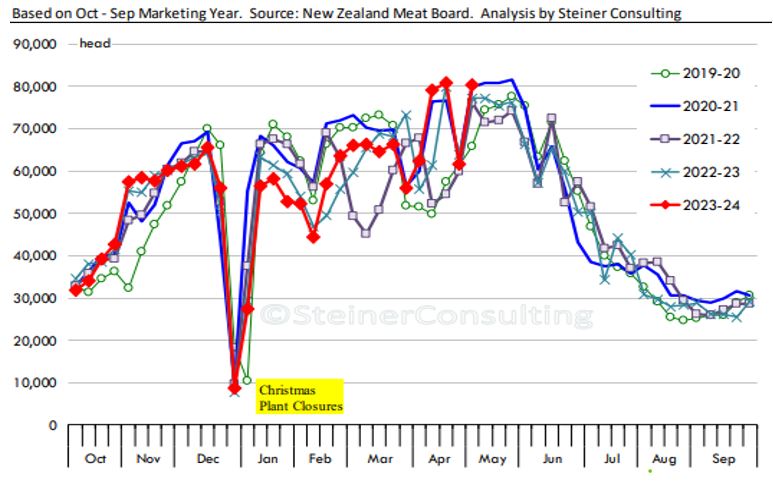

This chart shows the NZ weekly cow kill and the seasonal decline that starts each June. Source: Steiner Consulting

This chart shows the NZ weekly cow kill and the seasonal decline that starts each June. Source: Steiner Consulting

Australia should also expect less competition in the US as NZ cow slaughter falls off a seasonal cliff.

Good signs for heavy export cattle

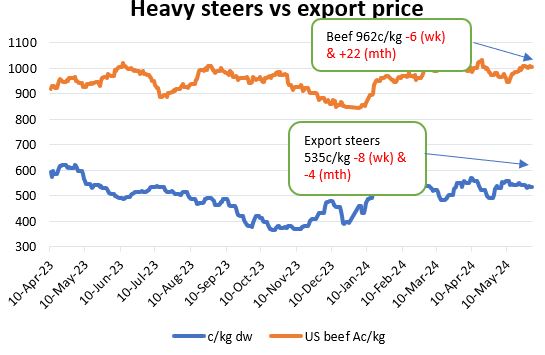

Australian heavy steer values have done well to resist the pressure from a heavy turnoff of northern cattle.

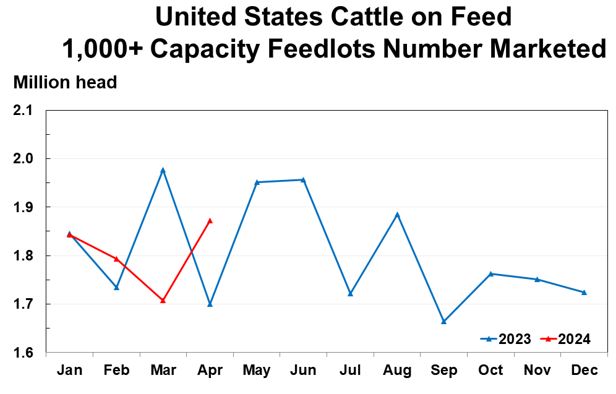

This chart shows the number of cattle sold out of US feedlots in April vs last year. Source: UDSA/NASS 24 May 2024

This chart shows the number of cattle sold out of US feedlots in April vs last year. Source: UDSA/NASS 24 May 2024

In addition, US feedlotters marketed cattle aggressively into their summer and international demand has held firm.

This chart shows the heavy export steer saleyard indicator price vs the US beef cut-out price in Ac/kg which is a proxy for our north Asian beef export price.

This chart shows the heavy export steer saleyard indicator price vs the US beef cut-out price in Ac/kg which is a proxy for our north Asian beef export price.

Over the next quarter we should see less beef come out of US feedlots as cattle on feed numbers decline. This will mean less US export competition for Australian beef into north Asia and should pave the way for an improvement in prices.

This chart shows a proxy index of the heavy steer processing margin.

This chart shows a proxy index of the heavy steer processing margin.

The Elders heavy steer market strength index recovered the past month, reflecting some improvement in export markets conditions.

This chart shows the number of cattle in US feedlots this year vs last year.. Source: UDSA/NASS 24 May 2024

This chart shows the number of cattle in US feedlots this year vs last year.. Source: UDSA/NASS 24 May 2024

These should continue to improve as US feedlot beef supplies start to ease.

EYCI holds firm despite larger than year ago supplies

Prices for young domestic trade and feeder cattle are above year ago levels despite higher supplies. This indicates some optimism across the feed-on markets both from graziers and feedlotters. Graziers are no doubt buoyed by a more favourable seasonal outlook than last year, while feedlotters are eyeing an improvement in international beef market conditions.

This chart shows the Eastern Young Cattle Index (EYCI) vs number of cattle in calculation of the EYCI

This chart shows the Eastern Young Cattle Index (EYCI) vs number of cattle in calculation of the EYCI

The latest local cattle on feed report showed record numbers of Australian cattle on feed, poised to take advantage of reduced competition from the US feedlot sector.

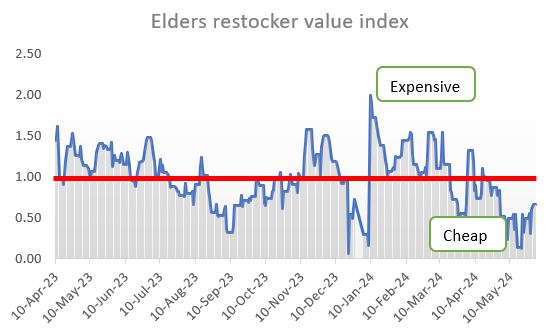

Restocker cattle should buy support at these levels

Restocker cattle markets have been heavily supplied as southern producers offload excess stock ahead of winter. The late and weak autumn break in many areas has prompted some producers to bite the bullet and quit stock rather than feeding them through winter.

This chart is a measure of the relative price of restocker vs feeder steer national indicator prices.

This chart is a measure of the relative price of restocker vs feeder steer national indicator prices.

Southern restocker cattle should start to attract northern interest at current prices as the economics of feeding them to heavier weights stack up for any producer with excess feed.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.