Elders’ Business Intelligence Analyst Richard Koch discusses his data driven forecast for the Australian cattle market this summer.

Key points

- Supplies to moderate as producers hold cattle as seasonal conditions improve.

- International beef market to remain stable capped by continued large US fed cattle supply.

- Increased demand from north America for lower cost items to offset weakness in Asia and depressed demand for higher valued items.

- Australia benefitting from our price competitiveness vs US cattle.

- Trump tariff impact uncertain but net positive for Australian beef industry in short-term.

- Modest gains in slaughter cattle values as processor competition lifts for tighter supply.

- Feeder and restocker price premiums move back to normal as restocker activity lifts on improved cash flows from a good harvest and cattle price improvements.

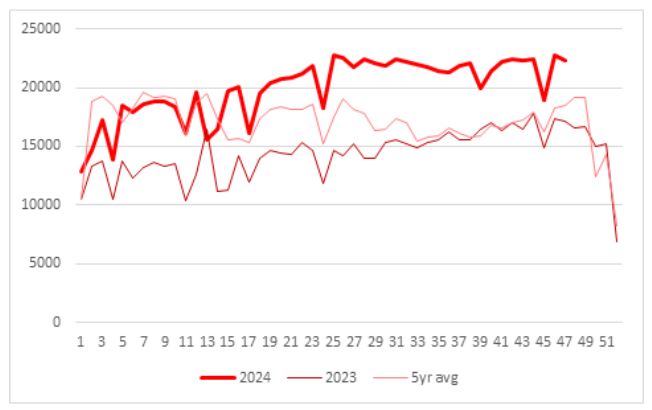

Our spring cattle price forecasts were thwarted by ongoing dry weather that led to a continuation of very high local slaughter levels, particularly through Victoria (39 per cent (pc) higher than last year and 16 pc above the five-year average). This meant slaughter cattle prices were 30 to 40c/kg lw below our expectations, even though our beef continued to sell well in international markets, as processors did not have to compete too hard to fill kill schedules.

This chart shows Victorian weekly cattle slaughter in 2024 compared to 2023 and the 5-year average. Source: NLRS.

This chart shows Victorian weekly cattle slaughter in 2024 compared to 2023 and the 5-year average. Source: NLRS.

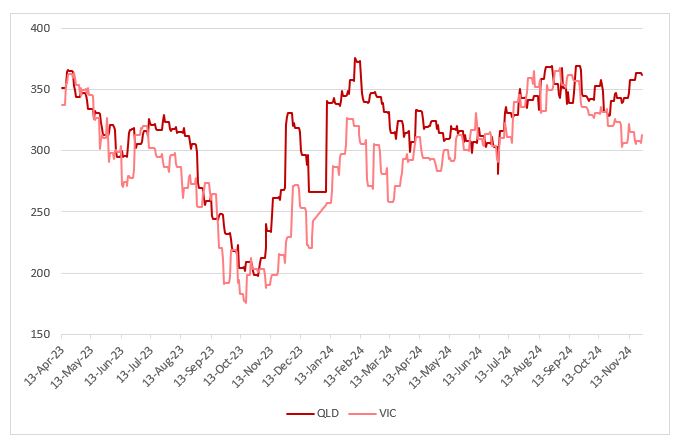

This good rain at the end of the forecast period, and particularly, the strong, early start to the northern wet season, has Queensland prices heading back towards our forecast levels. In the south, however, prices remain subdued as producers continue to turnoff stock early and in large numbers. The need for cash flow has southern processors and feedlots fully booked through to the end of the year, which is keeping Victorian prices supressed and dragging down national saleyard averages.

The need for cash flow has southern processors and feedlots fully booked through to the end of the year, which is keeping Victorian prices supressed and dragging down national saleyard averages.

The effect of the large selloff in the south can been seen when comparing feeder steer prices. Last week, the Queensland saleyard feeder steer indicator was 360c/kg lw, compared to 306c/kg lw in Victoria.

This chart shows the feeder cattle saleyard indicator price in Queensland vs Victoria (c/kg lw). Source: MLA.

This chart shows the feeder cattle saleyard indicator price in Queensland vs Victoria (c/kg lw). Source: MLA.

Reduced restocker activity

The other trend that was notable for its absence in the past quarter was the ongoing lack of restocker activity. Producers were either well stocked with cattle they decided to grow out after the crash in prices in the second half of 2023 or lacked confidence in the season to take the risk on store stock.

| Sep (a) | Sept (f) | Oct (a) | Oct (f) | Nov | Nov (f) | |

| Heavy Steer | 347 | 350 | 331 | 360 | 327 | 370 |

| Processor Cows | 291 | 290 | 268 | 300 | 267 | 310 |

| Feeder Steer | 365 | 380 | 337 | 400 | 343 | 420 |

| Restocker Steer | 372 | 380 | 350 | 420 | 356 | 440 |

Queensland set to lead prices higher through summer quarter

The very strong start to the northern wet season will be the dominant force in cattle markets through the summer quarter. Significant widespread rain from the WA Kimberley through the NT and pastoral areas of SA, northwestern Qld, and central and southern Queensland all the way down to Gippsland in Victoria looks set to impact cattle supply through the first quarter of 2025.

In Queensland, increased live export activity out of Cloncurry and Townsville has boosted demand for a tightening supply of cattle as Queensland producers decide to hold back cattle from the market over summer quarter to add weight.

We expect to see a lift in northern restocker activity through the summer quarter. Weak restocker demand has shown up in a tight spread to slaughter cattle values, very weak prices for secondary cattle and an unusually large discount for heifers. As cash flows strengthen from a strong grain harvest and improved cattle prices through 2024, we should see a lift in restocker demand in 2025, with northern restockers active in southern markets if the current Victorian price discount persists. We may be seeing the best restocker market opportunities for years to come.

Strong international demand for lower cost beef

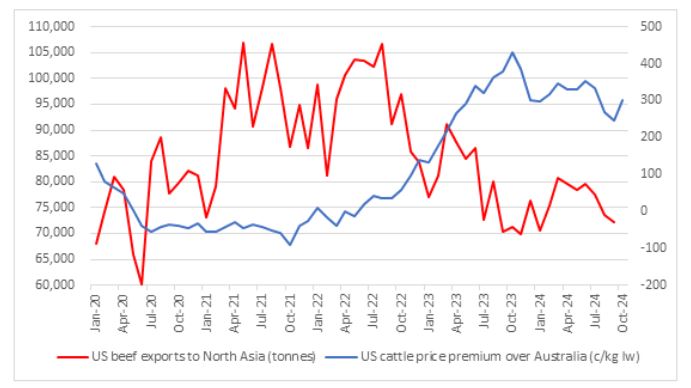

International beef markets have been remarkably stable for much of 2024 at levels supportive of Australian cattle and beef prices. While prices and demand across Asia and for high valued beef remain subdued, this has been mostly offset by strong demand from north America for lower cost beef items.

Driving demand for Australian lean beef is lower US cow slaughter as the prolonged US drought finally ends and producers stopped liquidating herds. While liquidation has ended, there remains little evidence that US herd rebuilding is underway as US feedlots remain full of heifers. The US beef sector has done a remarkable job of maintaining beef production levels with a much lower beef herd by feeding cattle to heavier weights.

US feedlots continue to be well supplied with cattle, and we expect the maintenance of solid US fed beef production levels through, at least, the next quarter. This and signs of consumer resistance to higher prices will cap global beef prices through the early part of 2025.

In the US, processors are having trouble passing on the high cost of fed cattle to US consumers. JBS Swift reports that due to the high cost of US cattle its US beef processing margin was just 1.9 pc in the last quarter compared to 9.8 pc in Australia and 11.6 pc in Brazil.

Supporting Australian cattle and beef prices through the early part of 2025 will be our continued competitiveness against the US. US fed steer prices carry around 300c/kg lw premium over current Australian values which is creating opportunities for price competitive Australian beef in both north Asia and within the US.

This chart shows US beef exports to Asia vs the US cattle price premium compared to Australia. Source: USDA and MLA.

This chart shows US beef exports to Asia vs the US cattle price premium compared to Australia. Source: USDA and MLA.

While cattle and beef prices have enjoyed a period of relative stability through 2024, there are signs this is about to change.

International beef markets to weather Trump storm

Last week, Trump announced he was going to apply a blanket 25 pc tariff on imports from Canada and Mexico in a bid to get those countries to better control contraband and illegals crossing into the US.

Canada and Mexico have a significant trade in cattle and beef with the US, sending over 1.6 million cattle and nearly 1.2 million tonnes of beef to the US for the year so far. This tariff could seriously unsettle the US and global beef market if implemented.

A tariff on Mexican feeder cattle would be supportive of US cattle prices with Mexican cattle making up around 5 pc of US feeder cattle supplies. Displaced Canadian beef would mostly likely compete aggressively with Australian beef in Asia. In the US, Australian exports may benefit from higher US beef and cattle prices.

Summer price trend will be higher, supplies will determine by how much

The strong, early start to the northern wet season that has produced significant, widespread rainfall for the north and unseasonal rainfall across the south will be a game changer for Australian cattle prices that have been battling against heavy turnoff and a lack of restocker interest for much of 2024.

Part of the reason for heavy turnoff in 2024 were cattle held back from the market after heavy price falls during the second part of 2023. We have now moved these cattle and supplies should moderate through the first part of 2025. This should see weekly slaughter levels fall back below the current level of 145,000 head per week. Tightening supply will create increased processor competition as the industry seeks to maintain kills, pushing slaughter cattle categories 20 to 30c/kg lw higher through the summer quarter.

As the season evens out and supplies ease, feeder and restocker premiums will move back to longer-term averages. Restocker prices will be boosted by the relative attractiveness to slaughter values and increased activity from northern restockers whose cash flows are boosted by a bumper winter harvest. Feeder and restocker values will increase by 40c/kg lw over the forecast period.

| Australian Saleyard Indicator. Prices (c/kg lw) | ||||||

| Sep | Oct | Nov | Dec (f) | Jan (f) | Feb (f) | |

| Heavy Steer | 347 | 331 | 327 | 335 | 345 | 350 |

| Processor Cows | 291 | 268 | 267 | 275 | 280 | 285 |

| Feeder Steer | 365 | 337 | 343 | 365 | 375 | 385 |

| Restocker Steer | 372 | 350 | 356 | 370 | 385 | 400 |

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.