Independent Livestock Analyst, Simon Quilty of Global Agri Trends shares his forecast for sheep prices over the short and long term.

Lamb and mutton markets are on the rise as good rains across Australia give hope to sheep producers that growing conditions will improve in the coming months.

So much of the lamb and mutton industry’s price issues have come from oversupply and the lack of slaughter capacity, as well as poor markets.

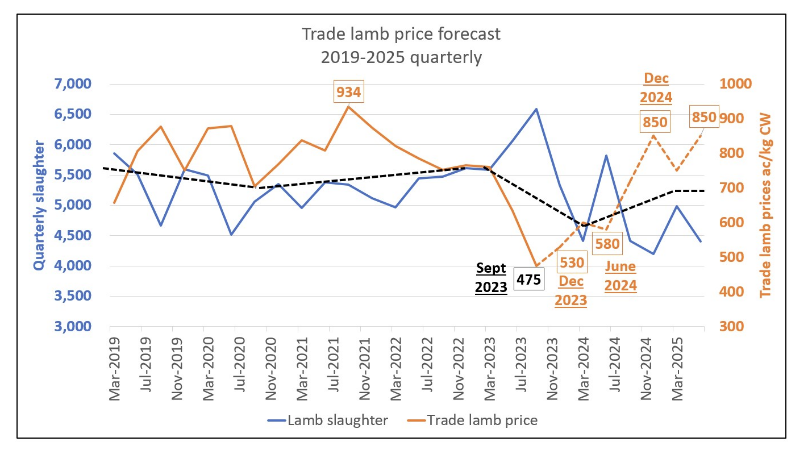

With continued liquidation of the breeding flock the lamb kill is expected to fall over the next six quarters, which points to higher prices. Lamb has an inverse relationship to supply – as supply falls, prices are expected to move higher.

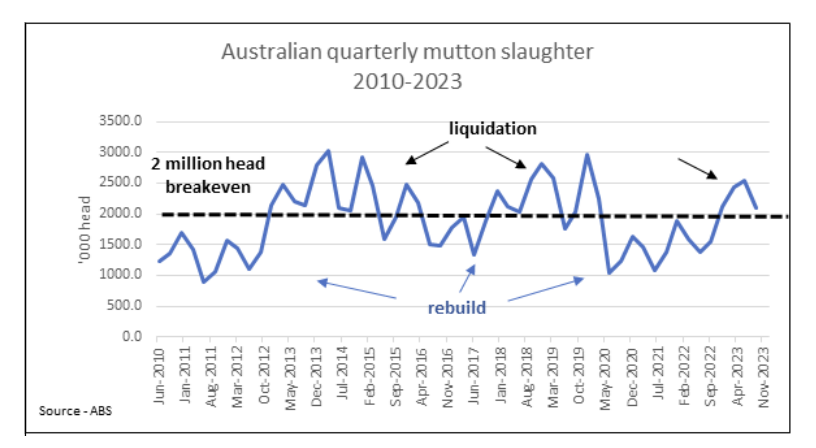

Australia’s mutton kill reflects the female kill as most wethers are sold as lambs, so when the mutton kill moves above 2 million head, this reflects liquidation of the breeding flock. With liquidation comes less joining and fewer lambs.

Graph shows Australia’s quarterly mutton kill from 2010 to 2023. Source: ABS.

Graph shows Australia’s quarterly mutton kill from 2010 to 2023. Source: ABS.

In the most recent September quarter, a record lamb slaughter occurred at 6.6 million head which saw a low in lamb prices with a quarterly average of 475 ac/lg carcase weight (CWT). With liquidation over the last four quarters, this will see falling lamb numbers for at least all of 2024 and at least the first half of 2025.

Graph shows the average forecast price of trade lambs in Australia. Source: ABS, MLA, GAT.

Graph shows the average forecast price of trade lambs in Australia. Source: ABS, MLA, GAT.

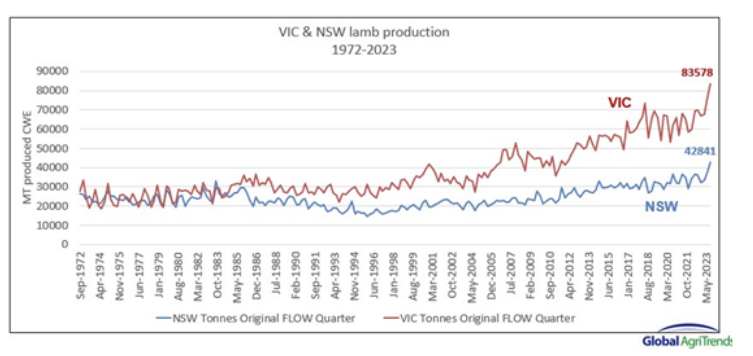

Australia’s lamb production is at record levels, and it should be noted that Victoria dominates this role with almost twice as many lambs produced (yet Victoria has almost half the flock size as NSW 14.6 million, in comparison to 27.1 million respectively). Victoria’s dominance is for several reasons. It is largely driven by the Merino flock and its dual role in wool and meat production, the greater presence of composite breeds that produce three lambs in two years, excellent lambing rates and three extraordinary years of pasture growth.

Graph shows lamb production across Victoria and New South Wales. Source: ABS.

Graph shows lamb production across Victoria and New South Wales. Source: ABS.

For lamb prices to remain at strong levels in 2025, 2026 and 2027, the economies of key export markets need to rebound and the high inventories in freezers across Asia need to fall.

It also should be noted that with the recent low-price levels for lamb, for many mixed sheep and cropping enterprises there has been talk of exiting sheep and increasing cropping. This is anecdotal evidence and needs to be watched closely through the ABS changing land-use data to see if there is any validity to this trend. If so, this will add to the expected tightening supply going forward.

In brief, I believe lamb prices have bottomed and stronger prices are expected going forward as supply tightens. However, to ensure prices remain sustainable, global inventories of meat stocks need to fall and demand from key markets needs to improve for prices to continue their upward trend in 2025, 2026 and 2027.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.