Independent Livestock Analyst, Simon Quilty of Global Agri Trends shares his forecast for cattle prices over the short and long term.

In recent weeks, good rain has seen growing optimism amongst livestock producers across the eastern seaboard, with cattle prices improving by 14 to 38 per cent (pc) depending on the category in the last four to six weeks.

With rain comes hope, and for many, there is now a growing belief the worst of the Australian drought is behind us. The weather experts have been talking about a dry late summer and autumn, but this rain has given the belief that any short-term dryness can be overcome with supplementary feeding and more importantly, better growing conditions are not far away.

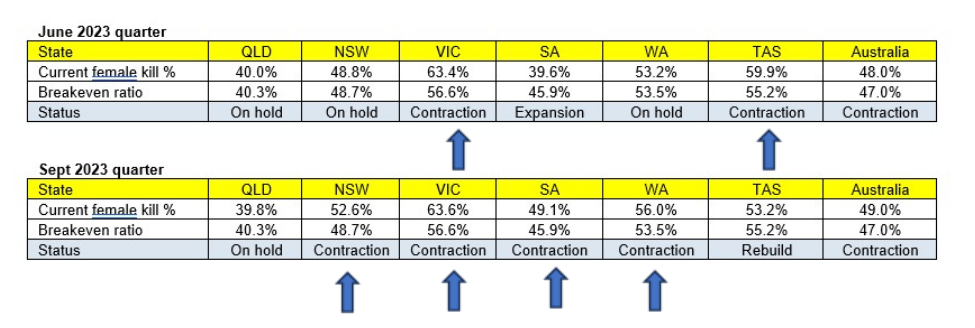

September slaughter figures from the Australian Bureau of Statistics also give me even greater hope of a strong rebound occurring. This is likely to happen sooner than later because the herd liquidation increased in Q3 lifting the female kill ratio to 49 pc from 48 pc (47 pc is the ratio of break-even where neither rebuild or liquidation occurs).

Source: ABS

Source: ABS

What is important to note is that since the previous quarter, four states moved into liquidation, compared to only two states in Q2 this year. With greater liquidation comes a greater need to rebuild with depleted cattle numbers. When analysing which states have been most severely impacted, I believe NSW is by far the most vulnerable with the greatest liquidation. Victoria’s increased liquidation is due to Victorian processors buying New South Wales cattle, which highlights New South Wales’ loss of cattle is even greater than originally thought.

This is a repeat of what happened in the 2018 and 2019 drought where New South Wales led the liquidation but also led the recovery in the rebuild, where New South Wales restockers brought large volumes of female cattle interstate to speed up their own herd rebuild.

I think history will repeat itself and once again New South Wales will drive Australia’s cattle herd rebuild, the difference is that the availability of cattle interstate is much more limited, and as a result will see cattle prices move higher as restockers fight over a smaller ‘herd pie’.

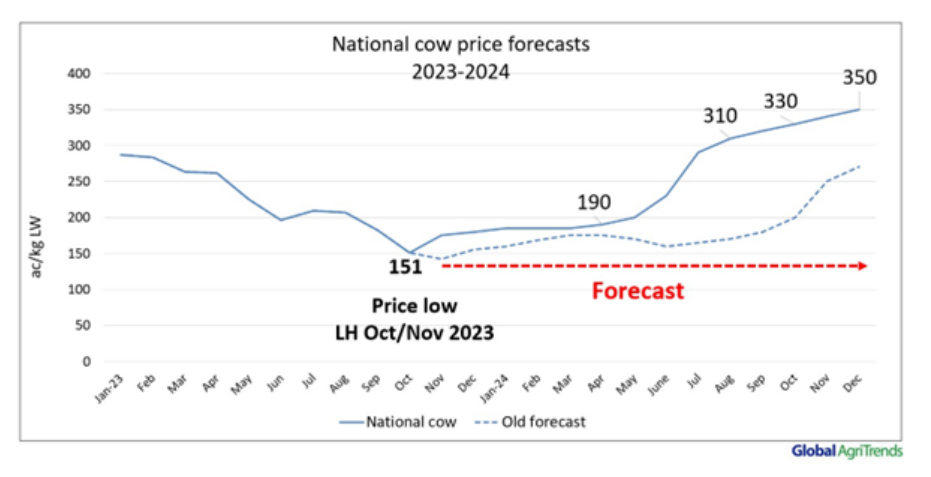

Chart shows national price forecasts for cows. Source: MLA, GAT.

Chart shows national price forecasts for cows. Source: MLA, GAT.

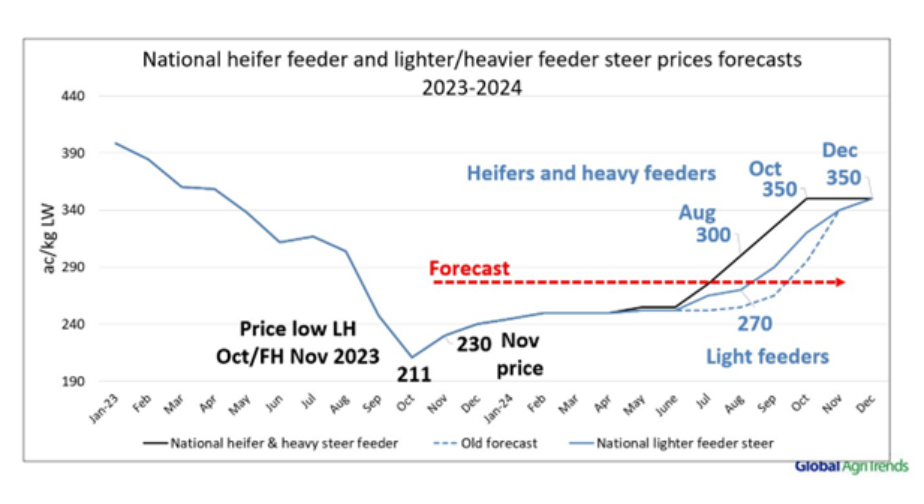

Chart shows national heifer and steer price forecasts. Source: MLA, GAT.

Chart shows national heifer and steer price forecasts. Source: MLA, GAT.

It should be noted that I believe the higher prices in 2024 will be driven by both a lack of cattle supply and the growing kill capacity in the beef sector, where an expected additional 25,000 head per week is expected to come on stream by mid-2024.

For improved prices to be sustainable in 2025, 2026 and 2027 it will require overseas beef markets to have lowered their heavy frozen inventory stocks and global demand to have improved.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.