Welcome to the Elders Insights' Weekly Market Summary for the week 2 February to 8 February 2026. We recap what’s happened on the Australian commodity markets over the past week and influencing factors.

Weather

The past week has seen significant rainfall of 25 to 100mm (with up to 300mm in isolated areas of the Northern Territory) through northern Australia and the interior and into western and central New South Wales. The forecast is for further widespread heavy rainfall for much of Australia over the next week. If it eventuates, it will have a major impact on livestock markets, assuring a northern season and delivering rainfall to some of the most drought affected areas of Australia. The rain will also bring relief to areas of southern Queensland and north New South Wales that have been dry since late 2025. Rainfall of 25 to 100mm is also expected for much of the Western Australia wheatbelt this week which would deliver much needed subsoil moisture, particularly to the north-eastern wheatbelt that relies on summer storms to provide subsoil moisture store ahead of the winter cropping season.

Get weather forecasts for your region on Elders Weather.

Australian Dollar

The Australian $ ($A) was back up over 70USc this morning recovering well from an acute deleveraging of higher-risk assets Friday night that saw the Australian $ briefly under 69USc. Traders are expecting a hawkish tone on local interest rates from a heavy week of public RBA engagements. Markets this week will be digesting the implications of Japan's weekend election (that saw a controversial, high spending conservative Government returned) and will brace for top-tier US data releases with retail sales due Tuesday, unemployment Wednesday, weekly initial jobless claims Thursday and CPI Friday.

Livestock

Cattle markets were mixed this week with participants having one-eye on the weather forecast. The feeling was that processors were keen to ease slaughter markets but didn’t pull the trigger, wary about the impacts on supply of widespread heavy rainfall through northern Australia. There was some renewed restocker activity prompted by buying ahead of potential widespread rainfall. The US manufacturing beef market held firm last week despite a pickup in Brazilian offers as competition from Oceania was limited with Australian and NZ exporters focussing on sales to China ahead of import restrictions.

Read about this, and more in the Latest cattle market report.

Lamb values were similarly mixed. Slaughter lamb values were off a bit but restocker and light lamb prices strengthened as restocker activity picked up with the promising rainfall forecast.

View livestock for sale and our sales calendar listings.

Grain

Not a whole lot of change. South America is harvesting a record corn and soybean crop with strong yields in Brazil offsetting potential crop losses in Argentina, where it has been hot and dry since mid-December. Soybeans led grain markets after Trump said last week that China had raised its target for US soybean purchases from 12mt to 20mt. Traders suggest there is no commercial logic for China to expand US soybean purchase with cheaper Brazilian harvest supplies available. The gesture is largely seen as political to smooth the path for a productive meeting between the US/China in April.

Looks like Australia could hold the whip hand on global barley exports ahead of the next northern hemisphere harvest. EU is almost out and Black Sea exports are slow (weather, port attacks, high fuel costs and slow grower selling) and Turkey and Algeria are buying this week. Argentina might have a bit to sell but Australian barley should dominate. Barley will be increasingly difficult for exporters to get out of the hands of VIC/SA growers at sub $280/t farm, while anything close to a feed zone is pulling close to wheat values or about $20/t better than track which growers are keen to sell into.

Apart from the brighter prospects for Australian feed barley exports, WA wheat markets were much firmer Friday, gaining $9/t to $332/t APW FIS Kwinana, the best price since mid-December when harvest ramped up. Presumably, there is some export shorts buying to fill nearby shipments. With local grower selling slow but stocks high, there will be short-lived pricing opportunities as traders pay up to fill short positions. India export buying ahead of its harvest in March has seen some spikes in the price of local lentils and chickpeas.

Trade your grain at your price on the secure GCX platform.

Spotlight on: EU barley exports

The main point of interest for the local grain market this week was the news out of Europe on feed barley. EU barley exports could reach a 10-year high this season. Reversing the usual price structure, feed barley is attracting better prices than milling wheat. Supporting feed barley values has been strong feed demand in the Middle East and China, limited availability of Black Sea barley and weak brewing demand in Europe. The European Commission increased its monthly estimates of EU barley exports in 2025/26 by 9 per cent (pc) last week to 11mt, which would be the highest since 2015/16. Turkey has switched from a barley exporter to importer this year and is due to hold another import tender this Wednesday. An import purchase by Algeria this week could also yield more EU sales. However, the export window for western European barley could soon close with supplies tightening and competition from southern hemisphere suppliers increasing.

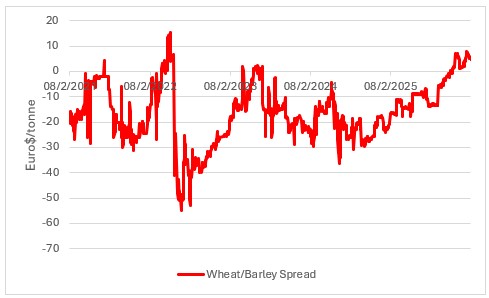

This chart shows the spread between French wheat and barley prices in $Euro/tonne. Source: LSEG Workstation

This chart shows the spread between French wheat and barley prices in $Euro/tonne. Source: LSEG Workstation

Wool

The Australian wool market found solid support this week. The Eastern Market indicator (EMI) finished 12c/kg higher at 1,677Ac/kg, benefitting from a slight weakening in the $A, with the EMI in $US unchanged. So far this year, the EMI has risen by 462c/kg (38pc) in $A and by 417c/kg (54.9pc) in $US. Underpinning strong gains in wool values was lower supply. The total weight of wool tested for January 2026 compared with January 2025 was down 20.8pc while test weights were down 10pc for the period July 2025 to January 2026 compared with the same period last season.

Learn the many ways we support wool growers.

Sugar

Sugar prices fell to a 3-month low last week with London sugar slumping to a 5-year low as the outlook for global sugar surpluses continues. Last week analysts from sugar trader Czarnikow said they expect another global sugar surplus of 3.4mt in the 2026/27 crop year, following an 8.3mt surplus in 2025/26.

Cotton

International cotton prices fell 2.3pc for the week to 61.79USc/lb, mostly pressured by broad commodity market weakness and $US strength. USDA’s export sales report for the week put US cotton exports at 249,800 bales, short of the 300,000 bales needed to excite the market. The cotton market seems content to wait for this Thursday’s USDA S&D report that might show cotton losing acres to soybeans in the upcoming US planting season.

Learn about the many ways Elders helps cotton growers.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.