The latest insights and information on the Australian sheep market as of November 2025

Spring lamb supplies rise belatedly

It took almost the entire spring, but in the past few weeks new season lamb supplies have been hitting the market in larger numbers which has acted to cool lamb prices. Prices have steadied after falling from historic highs from mid-September as larger spring supplies flushed onto the market. Prices have settled in the $10 to 10.50/kg dressed weight (dw) range for lamb while mutton values have consolidated around $6.50 to 7/kg dw.

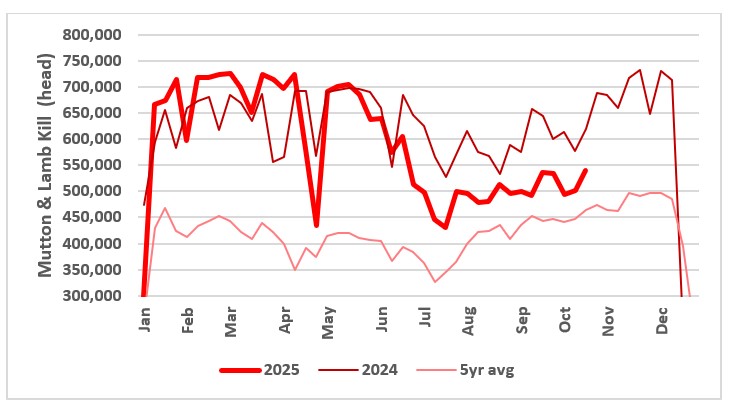

The toll of heavy flock liquidation over the past two years is clear with slaughter running behind last year by around 15 per cent(pc) since the start of June. This could represent the structural adjustment in supply that the lamb industry will need to overcome in the next couple of years. Another failed spring across southern lamb producing areas will further delay the rebuild. Currently Meat and Livestock Australia (MLA) are suggesting that lamb slaughter will fall another 2.2 pc in 2026 after a 5.8 pc decline in 2025 which, in our view is optimistic. Our expectation that supply will fall to 15 to 20 pc below 2024 levels.

While southernmost lamb areas (western district of Victoria and south-east South Australia) are fairing reasonably well season wise, outside of this, the spring has failed to deliver sufficient rainfall (although the outlook has improved in the past couple of weeks) to ensure pasture growth to see lamb producers though until autumn. Producers in affected areas will be calculating available feed and assessing whether to offload stock at store weights into feedlots rather than take a punt on unseasonal summer rain. For those who have fed through autumn the past couple of years, offloading store lambs at current values for someone else to feed on will be a preferred option, allowing them to focus on maintaining their core breeding flock.

Expect increased numbers of store lambs to hit the markets through November and December, potentially leading to lower store lamb values. The lack of slaughter weight lambs will continue to support heavy export and trade lamb values through to the end of the year.

Ewe sales across Australia the past month were expected to provide a measure of the intent of the industry to rebuild. Although they got off to a reasonable start with much promise, the lack of spring rainfall saw demand wither and the promise of $500/head ewes was short-lived. The results of the ewe sales could be best described as patchy with the right article (modern dual purpose merino ewe) selling to reasonable demand but others selling for not much more than meat value.

Sheepmeat exports are hanging in there, with lamb shipments down 4 per cent (lamb slaughter down 5.4 pc) and mutton down 11 pc (slaughter down 11 pc) year to date, falling mostly in line with lower slaughter rates. Exports have shifted away from price sensitive markets in the Middle East to higher value destinations in the European Union (EU), Asia and the US.

Talking with a domestic processor, export markets have the capacity to pay the equivalent of $10 to 12/kg dw, but it is hard to extract the same value for middle cuts (racks etc) from the domestic market which is mainly focussed on legs and shoulders. An operator with a boning room associated with a domestic discount retailer has cut their orders from over 100 to 25 lambs per week.

Chart shows combined lamb and mutton kill 2025 vs 2024 and five-year average. Source: MLA

Chart shows combined lamb and mutton kill 2025 vs 2024 and five-year average. Source: MLA

Increased NZ focus on EU market creates opportunities for Australia

In 2024/2025, Australian sheepmeat exports made up 54 per cent (pc) of the global exports, while exports from NZ made up 31pc. Therefore, supply dynamics in Australia and NZ, therefore, largely determine the global supply of lamb and mutton.

Total sheepmeat production in NZ is forecast to decline by another 1.9 pc in the upcoming 2025–26 season, as land use shifts to higher value forestry and dairying. Lower production is crimping NZ exports, which fell fell 4.8 pc year-on-year in 2024–25 to 393,475 tonnes, and are forecast to fall another 1.9 pc in the upcoming season to 357,000 tonnes - the smallest NZ export total in 15 years.

At the same time, improved market access is shifting the distribution of NZ exports. NZ signed a Free Trade Agreement with the European Union (EU) which came into effect on 1 May 2024. This has provided an increase in the tariff free quota for NZ sheepmeat into the EU. Due to this, and a shortage of sheepmeat in the EU, exports from NZ into the EU increased by 14 pc in 2024–25 to 74,097 tonnes.

In the context of lower NZ production and increased focus on the premium EU market, NZ exports into markets outside of the EU fell by 10 pc. NZ exports to China fell by 11 pc in 2024–25, while to the US, exports fell by 10 pc over the same period.

This presents an opportunity for Australian exporters to build market share in sheepmeat export markets outside the EU. Australian exports have been gradually shifting with 65 pc of total sheepmeat exports now going to high-value markets (USA, UK, Korea, UAE) — up from 55 pc in 2022.

The United Kingdom (UK) is now Australia’s fastest-growing premium lamb market, driven by UK Free Trade Agreement, chilled rack demand and NZ supply shortfalls.

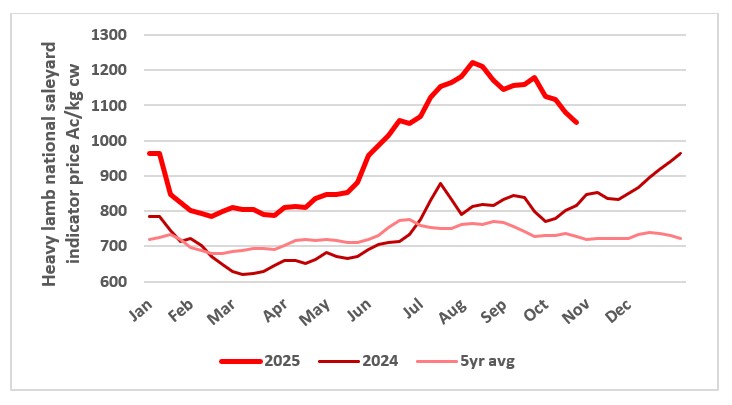

Heavy lamb values will begin to stabilise as supplies will be constrained by the mixed spring conditions while demand from export processors should remain firm.

This chart shows the national saleyard indicator prices for heavy lambs in 2025 vs 2024 vs five-year average

This chart shows the national saleyard indicator prices for heavy lambs in 2025 vs 2024 vs five-year average

Domestic market resists higher prices

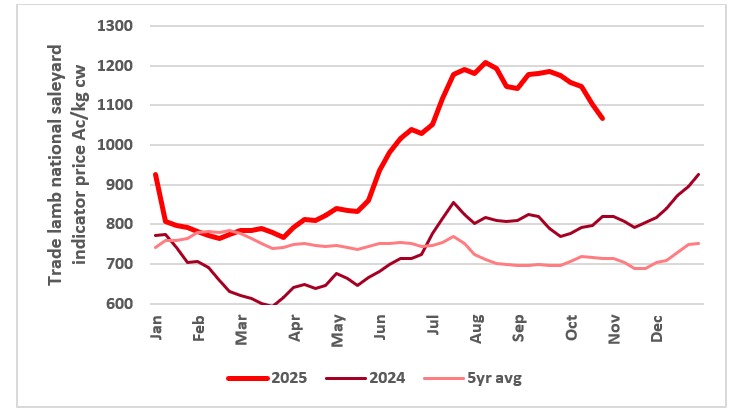

Lower supply and increased export market focus has forced domestic retailers to compete for supply which has kept the pressure on trade lamb values.

Although increased new season spring lamb supplies have allowed saleyard prices to ease since mid-September, supply will tighten into year’s end with many areas not having enough pastures to get lambs to desired weights with some graziers opting to turnoff lambs in store condition or at lower weights to conserve feed for breeding flocks.

This chart shows the national saleyard indicator prices for trade lambs in 2025 vs 2024 vs five-year average. Source: MLA.

This chart shows the national saleyard indicator prices for trade lambs in 2025 vs 2024 vs five-year average. Source: MLA.

Light lamb export volumes contract as prices rise

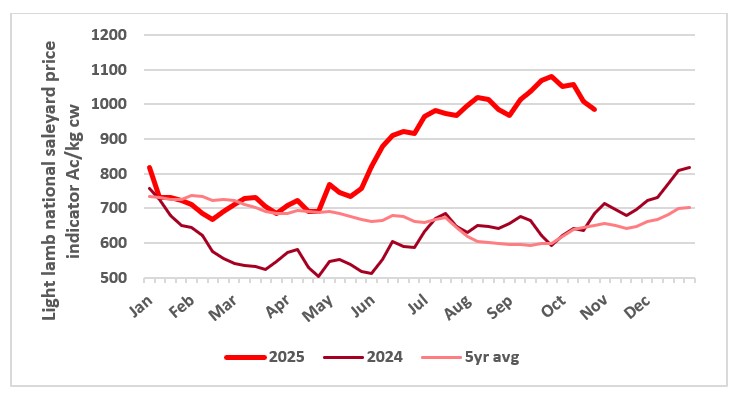

The Middle East and North Africa (MENA) region has historically been an important market for frozen and chilled Australian lamb and mutton, with Australian exports in the region going back more than 50 years.

Its ability to accept large volumes of lighter lamb has been important in times of drought or heavy Australian lamb turnoff where there are excess volumes of light lambs available for processing. However, at the same time, it is Australia’s most price sensitive market, with export volumes much more sensitive to Australian livestock prices and product availability than other key markets with export volumes peaking in 2023/2024 when Australia was oversupplied with lighter lambs and prices fell.

As slaughter and availability of lighter lambs has contracted in 2025, export volumes to MENA have fallen. For the year to September, Australian lamb exports to MENA have fallen 31 per cent to 52,000 tonnes.

This chart shows the national saleyard indicator prices for light lambs in 2025 vs 2024 vs five-year average. Source: MLA

This chart shows the national saleyard indicator prices for light lambs in 2025 vs 2024 vs five-year average. Source: MLA

Lot feeding demand to absorb larger store lamb supplies

Sheep lot feeding is on the rise as more producers look to deliver consistent growth and heavier carcases. By finishing lambs on high-energy rations in confinement, feedlots reduce variability, shorten finishing times and produce more uniform carcases that align with processor specifications. For abattoirs, this can mean better efficiency on the chain and improved yield per head.

The promise of lower grain prices this harvest and solid slaughter lamb values will support growth in lamb feeding in 2025, helping to underpin demand for restocker lambs. With seasonal conditions again mixed across major lamb producing areas and store lamb values resolute, many graziers will opt for early turnoff this season, hoping to preserve feed for nucleus breeding flocks.

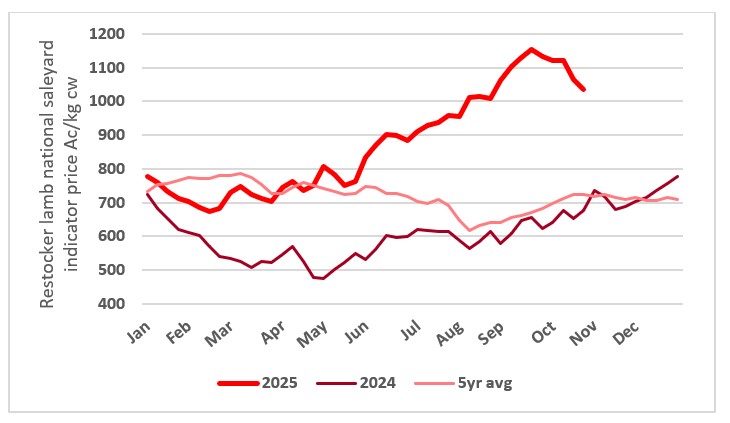

This chart shows the national saleyard indicator prices for restocker lambs in 2025 vs 2024 vs five-year average. Source: MLA

This chart shows the national saleyard indicator prices for restocker lambs in 2025 vs 2024 vs five-year average. Source: MLA

Mutton prices to stabilise as supplies remain constrained

Sheepmeat supplies are entering a new stage, particularly through pastoral areas which have been major contributors to supply in the past couple of years owing to dry conditions.

At Jamestown in South Australia (which draws from SA pastoral areas), the September ewe sales carried just 6,000 ewes, half of which were from a dispersal sale. This sale would normally have 18 to 22,000 sheep. There have been two fortnightly sales in Jamestown cancelled during spring, which is unprecedented and reflects the number of sheep moved out of its drawing area over the past two years.

Most sheep numbers are now coming out of the Mildura area where conditions are getting desperate through Pooncarie and Wentworth. There were 25,000 head at Ouyen sale last week, slightly below the record of 27,000 head two weeks ago. Normally these sales are wrapped up by October, but there are plans to hold another two sales on 6 and 13 November. These numbers will pull up quickly with some rain.

Now that there has been some rain in the north-west of SA, there will be a reliance on numbers coming out of Broken Hill. But graziers in those areas are only a rain away from retaining numbers and possibly buying some sheep back in.

With the recent improvement in the seasonal outlook for southern Australia (with the persistent high finally moving out of the Australia Bight) sheep supplies may tighten further as graziers move to rebuild flocks. This should see mutton values sustained at historic highs through to the end of the year.

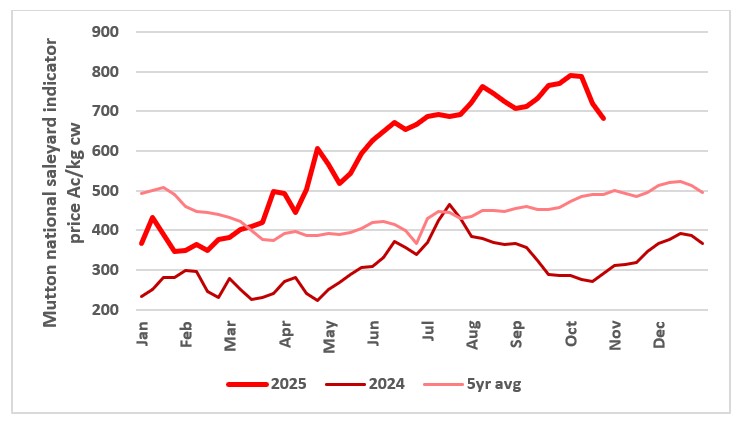

This chart shows the national saleyard indicators prices for mutton this year vs 23/24 and seven-year average. Source: MLA

This chart shows the national saleyard indicators prices for mutton this year vs 23/24 and seven-year average. Source: MLA

From the rails

Read what Elders livestock representatives from around Australia are saying about the markets in their regions.

"Lamb supply declined a little (6,300 head down 1,400head vs 8,700 head at this sale last year, down -28 per cent) and quality was mixed throughout with 3150 (50pc of yarding) new seasons offered."

"The trade new season lambs were well presented but the old season selection were mainly plainer stores lines with a run of trade weights and few heavy lambs. All the buyers were operating, and competition was sound with the market slightly dearer. Light new season lambs to restockers were around firm and sold from $130 to $227/head.

"Medium and heavy trade weight lambs were $3 to $4/head dearer and averaged 1090c to 1120c/kg dw. Heavy trade sold from $250 to $277/head. While extra heavy weights sold from $277 to $330/head. Trade weight old lambs sold from $240 to $254/head.

"Mutton numbers increased and quality was mixed while prices were stronger. Medium Merino ewes sold from $140 to $154/head or 670c to 730c/kg cwt. Heavy first cross ewes sold from $178 to $262/head or $6.30 to 7.50c/kg dw." - Ben Emms, Livestock Manager, Emms Mooney.

| NSW sheepmeat saleyard indicatorsc/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 1163 | 1045 (+118) | 1129 (+34) | 855 (+308) |

| Trade | 1131 | 1071 (+60) | 1183 (-52) | 819 (+312) |

| Light | 1059 | 1004 (+55) | 1091 (-32) | 708 (+351) |

| Restocker | 1146 | 1077 (+69) | 1140 (+6) | 784 (+362) |

| Merino | 997 | 1066 (-69) | 938 (+59) | 612 (+385) |

| Mutton | 799 | 720 (+79) | 828 (-29) | 332 (+467) |

Source: MLA

“It is wet here this morning (3 November) and raining heavily which is perfect for the southern part of our region where there is feed everywhere.”

“Two weeks ago, I mentioned that sentiment was a bit subdued and people were hesitant to jump in and buy given the uncertain season, well that seems to have changed in the last week or 10 days. We have seen a shift in market confidence, and I think everybody's made their mind up that the weather pattern has changed for the better.

“I bought a load of lambs out of Ballarat last week and they averaged $5.11/kg lw but by the end of the week you would have nearly needed $6 to buy the same lambs which gives you an indication of how quickly sentiment has changed.

“The flow of lambs is still very subdued. This week last year we yarded 37,000 lambs at Ballarat and the same week this year we had 11,000. So that probably puts in perspective how slow the flow is and an indication of the lack of numbers through central Victoria.

“So the view's changed and graziers are looking for something to buy instead of lightening off numbers.” - Nick Gray, State Livestock Manager Victoria/Riverina.

| Victorian sheepmeat saleyard indicators c/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 1101 | 1086 (+15) | 1097 (+4) | 821 (+280) |

| Trade | 1097 | 1058 (+39) | 1088 (+9) | 824 (+273) |

| Light | 1025 | 1007 (+18) | 933 (+92) | 718 (+368) |

| Restocker | 1086 | 1031 (+55) | 1078 (+8) | 736 (+350) |

| Merino | 941 | 893 (+48) | 812 (+129) | 603 (+338) |

| Mutton | 720 | 659 (+61) | 804 (-84) | 340 (+380) |

Source: MLA

“We've had a little bit of rain over the weekend and with harvest it may cause a few little issues. Numbers are starting to dry up pretty much for us in the north of the state.”

“We are going to get about 10,000 listed in the next Jamestown sale Thursday week. We have missed two of our four fortnightly spring sales which we have never seen that before, which gives an indication where the numbers are.

“Some very solid pricing at Murray Bridge last week. The top end of the kill lambs was probably a little bit off on the previous week's money at $10.20 to 10.70/kg dw, but very, very strong on feeder lambs with a lot of support from network.

“It’s the first time we have had that sale and the 7000 lambs sold to a top of $254/head but averaged $221/head across the sale. The market was up comfortably by $10 to 15/head with little first cross lambs 34kgs live selling to $201/head which is $6/kg lw which was up a step.

“With numbers starting to dry up, and a bit of feed through the hills, which is getting people to restock. So yeah, just looking outside the box a little bit, still see some real value in some under lighter conditioned ewe Hoggets, still buying them for that $160 to 200/head that you can join up in 6 to 8 weeks. Reckon there's a fair bit of value in that because I think there is going to be a bit of a run late on ewes because there's nothing left in the north for anyone.

“The mutton kill market is still strong with a processor back in there at $7.50/kg dw on heavy mutton which you can’t complain about, given historically we are at the peak of the season in terms of supply.” - Damien Webb, Livestock Sales Manager SA.

| SA sheepmeat saleyard indicators c/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 1047 | 1036 (+11) | 1137 (-90) | 829 (+218) |

| Trade | 1042 | 1041 (+1) | 1130 (-88) | 753 (+289) |

| Light | 989 | 934 (+55) | 973 (+16) | 722 (+267) |

| Restocker | 1039 | 1008 (+31) | 1153 (-114) | 861 (+178) |

| Merino | 935 | 861 (+74) | 932 (+3) | 674 (+261) |

| Mutton | 597 | 592 (+5) | 763 (-166) | 273 (+324) |

Source: MLA

“Our lamb price has come back to around $9.60 to 9.70/kg dw. I think the pullback will be very short lived, another fortnight might see the shortage reappear on those good heavy type lambs and trade lambs.”

“WA store lambs continue to move east in a big way, and the demand seems to be cranking up again.

“Mutton is sitting around that $6.80/kg dw. A little bit better support at the ewe sales on that older range of ewes 3.5 to 4.5years old, from the processors. So that’s keeping the sheep side of it honest with our first live export boat sailing today. They are paying $165/head for younger wether lambs, 35kgs plus to average 38kgs and up to $210 to 220/head on the heavier type wethers for the boat trade, which is injecting a little bit more competition. We're expecting at least one more shipment prior to Christmas.” - Wayne Peake, Livestock Manager WA

| WA sheepmeat saleyard indicators c/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 985 | 985 (n/c) | 1047 (-62) | 728 (+257) |

| Trade | 949 | 967 (-18) | 1091 (-142) | 636 (+313) |

| Light | 942 | 918 (+24) | 799 (+143) | 524 (+418) |

| Restocker | 996 | 968 (+28) | 1197 (-201) | 399 (+597) |

| Merino | 820 | 708 (+112) | 870 (-50) | 436 (+348) |

| Mutton | 644 | 656 (-12) | 642 (+2) | 224 (420) |

Source: MLA

“Tassie has had some variable weather over the past month with rain and bushfires. Bushfires in the south-east where it has been dry. Since then, we have had 50mm through the northern midlands and then rain through the southern part of the state that desperately needed it. So that was a bit of a game changer and there has been follow-up rain through the state since then. There was also a bit of snow down to 900 metres…so we have had it all.”

“The market came off about 50c/kg dw before the rain, with better quality suckers sitting at $11.20/kg dw and lighter types $10.80/kg dw and anything suitable for the paddock selling for $170 to 210/head.

“The mutton price has eased $8 to 25/hd to $5.50 to 5.60/kg dw, so it’s just sort off cooled off the last couple of weeks.

“But after the rain and with more in the forecast the market regained last week’s losses to average $40 dearer at Powranna last week. Restockers paid $135 to $166 for light lambs while processors paid 226 to $284 for trade lambs and $276 to $320 for heavy new season lambs. The selection of old lambs was mixed and the best made $248 to $272 while light made $160 to $180.

“There was a much smaller number of 580 mutton (782 less) and market recovered last week’s losses to be $20 to $40 dearer. Extra heavy sheep made $174 to $222, heavy $178 to $190, medium $156 to $174, light $112 to $142 while restockers paid $40 $80 for very light sheep.” - Gavin Coombe, Livestock Manager Tasmania.

| TAS sheepmeat saleyard indicators c/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Trade | 1128 | 967 (+167) | 1015 (+113) | 743 (+385) |

| Light | 953 | 867 (+86) | 1006 (-53) | 707 (+246) |

| Restocker | 999 | 1056 (-57) | 968 (+31) | 570 (+429) |

| Mutton | 670 | 585 (+85) | 814 (-144) | 238 (+432) |

Source: MLA

| Queensland sheepmeat saleyard indicators c/kg dw | ||||

| 3 Nov 25 | +/- week | +/- month | +/- year | |

| Lambs | ||||

| Heavy | 788 | 931 (-143) | 1060 (-272) | 742 (+46) |

| Trade | 959 | 879 (+80) | 1081 (-122) | 772 (+187) |

| Light | 758 | 788 (-30) | 1056 (-298) | 602 (+156) |

| Restocker | 637 | 742 (-105) | 846 (-209) | 595 (+42) |

| Mutton | 483 | 550 (-67) | 636 (-153) | 231 (+252) |

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

*Disclaimer – important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.