Apart from a brief rally, grain markets have remained under pressure from increasing estimates of northern hemisphere winter grain production, the start of the northern hemisphere winter harvest, the wrapping up of a record South American corn and soybean harvest and improving summer crop conditions across the northern hemisphere.

Although global stocks to use remain tight and prices will be sensitive to anything that threatens supply forecasts, at this stage, despite record consumption, large crop estimates have end stocks in a more comfortable position at the end of the 25/26 season than currently.

Adding to pressure on prices are some recent trade policy developments that will increase competition in Australia’s traditional wheat export markets. These include:

- the European Union cutting imports quotas of Ukrainian wheat by up to 80 per cent to address concerns of its farmers. This is likely to drive Ukraine growers to sell more to markets in Asia and Africa,

- the Argentine Government extended lower export tax on wheat and barley of 9.5 per cent through March 2026,

- the Russian Government abolishing its tax on wheat exports that has been in place since 2021 to protect its domestic market from price spikes and to discourage excessive exports, and

- the Indonesian Flour Producers Association has committed to doubling its annual purchases of US wheat over the next five years as part of tariff negotiations with the US.

In addition, significant potential importers like India and China have recently harvested large crops. India’s crop is projected to climb to 117.5mt, up from a previous forecast of 115.1mt and the prior season’s 113.3mt. While the Chinese crop seems to have withstood a period of extremely hot and windy weather ahead of its harvest.

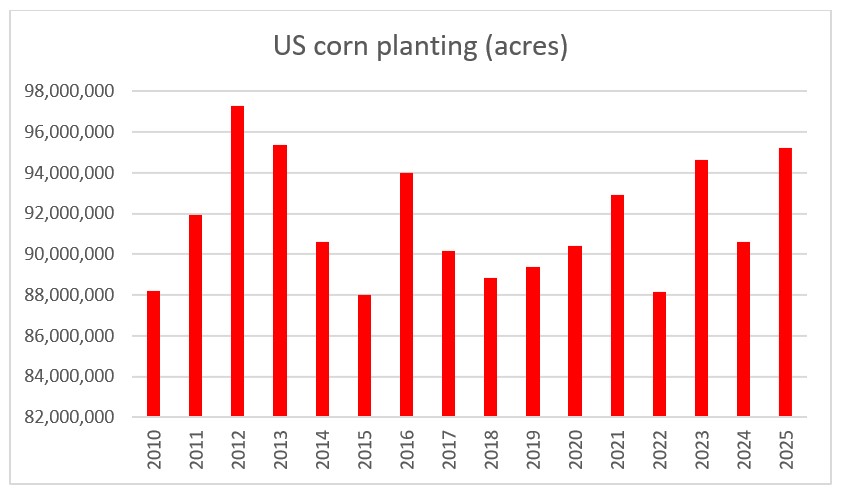

With wheat stocks situation likely to improve, tightening corn stocks that supported global grain markets during 24/25 look set to increase with the USDA projecting a significant 5per cent lift in US corn plantings, meanwhile US corn crop ratings have improved to 74per cent good to excellent condition, the highest for this time of year since 2018.

This chart shows the USDA estimates of corn acres planted in the US for the 25/26 season. Source: USDA.

This chart shows the USDA estimates of corn acres planted in the US for the 25/26 season. Source: USDA.

Grain markets will be looking for outside impetus to shake things up as fundamentals are not supportive.

Local cereal bids are barely holding in a slow-moving market, losing $5 to 10/t as crop conditions improve. Although end users are happy to extend coverage at current price levels, there is little engagement from growers and consumers need to pay over the bid to entice selling.

The sorghum market continues to drift along on very thin trade. Persistent rainfall through Central Queensland is holding up harvest, where the bulk of the action appears to be with $353/t Gladstone the highest bid on the east coast.

The new crop chickpea market is a touch lower despite reasonable buying interest from traders, but growers are unwilling to forward price and take on production and quality risk at $300/t below last years prices.

In the south, crop conditions are preventing too much trade with bits and pieces moving to feeders, but growers are keen to retain stock until they are confident that they will get a crop.

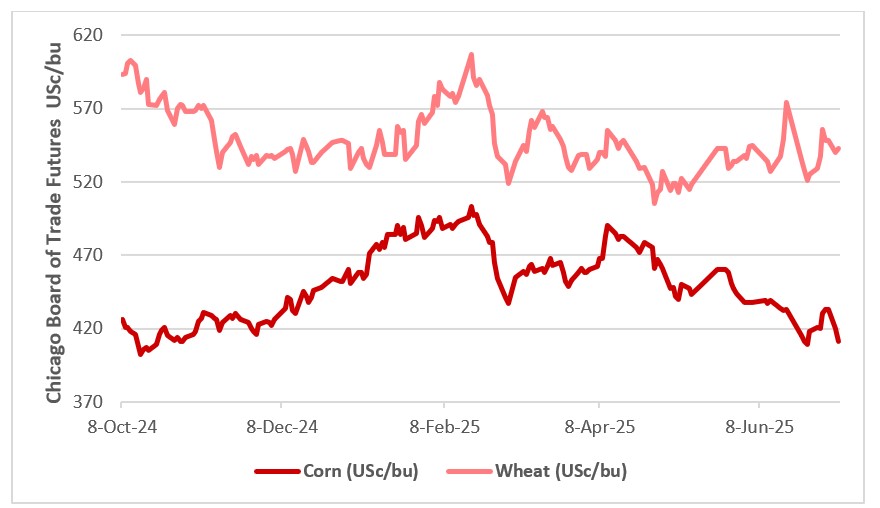

This chart shows the USc/lb nearby CBOT futures prices for corn and wheat. Source: LSEG Workstation.

This chart shows the USc/lb nearby CBOT futures prices for corn and wheat. Source: LSEG Workstation.

Wheat getting squeezed lower

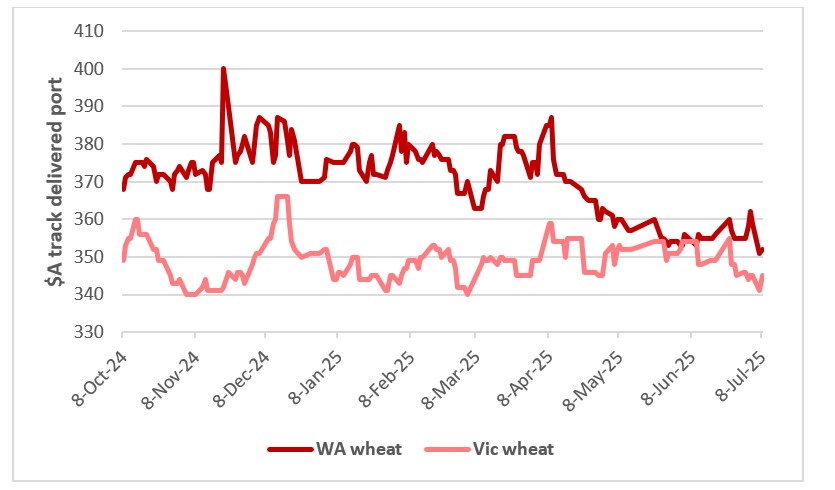

Most of the action is centred around domestic feed markets although there is some export activity on higher protein wheat.

There has been a bit of track wheat selling the past week to 10 days – generally over the bid - slowly getting volume away, particularly on higher protein wheat. H2 will find premiums and while bid with APW1, will trade above that value (export bound) and APH2 or APH1 will find a buyer well over the bid. Del Downs feedlot buyers for July delivery were paying around $345/t last week, but this was under pressure by week’s end with the market currently quoted around $340/t in thin trade.

Local end users are covered for the next few months into harvest. The trade is buying bits and pieces as required to cover their sales but are seeing enough selling from growers so that they don’t feel the need to bump their bids any higher.

There are still big numbers of livestock on feed both in the north and south putting a floor in the price for feed wheat.

Southern markets are still carrying a little domestic premium, but this is under pressure as the southern crop improves. Markets are working off Melbourne at $365/t delivered, putting Murray Bridge $380/t, Goulburn Valley $360/t, central west NSW and Riverina $320-330/t.

New season markets are also unchanged but under pressure. Delivered Downs is bid at $340/t for January/February delivery. Feedlots are again happy to sit back from the market in the hope/expectation that the market will move lower in the coming weeks and months.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for APW wheat delivered WA and VIC port in $A/t. Source: LSEG Workstation.

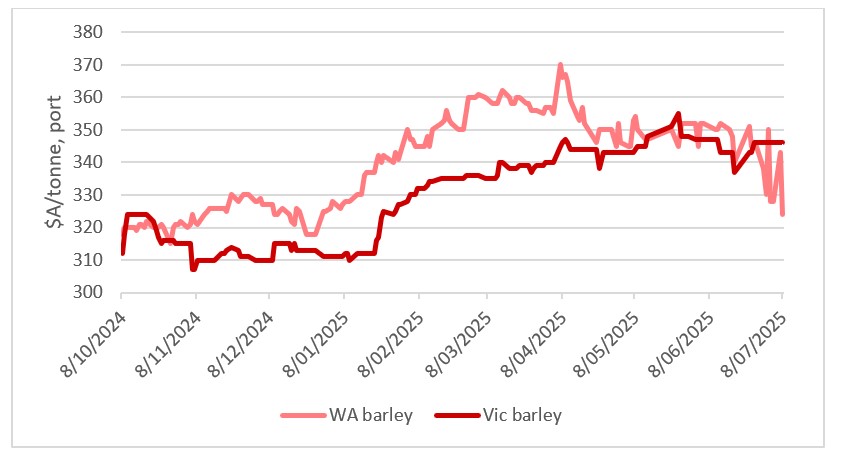

Barley still moving to feeders

Barley delivered end users is holding at $320 to $325/t Downs for the nearby months. Track bids have lost a little bit of ground.

Feedlots are largely covered all the way through until harvest and the trade are happy to wait for sellers rather than chase the market. New season bids are at similar values to old crop with the Downs market bid at around $325/t and border feedlots $305/t for January delivery.

Southern markets are holding onto a domestic premium given the crop remains in the balance and any rain that arrived was too late for pasture growth. Elders agents report that the green is painted on with very little pasture available for livestock feed.

There have been reports of sporadic interest in Black Sea barley from China. Ukrainian barley quotes surged to a one-month high during the week on strong demand coupled with short covering, as famer supplies were tight amid slower harvesting progress compared to last year.

FOB-Odesa quotes for feed barley climbed to an almost one-month high and were set at $202 to 208/t for July-August delivery compared to $196 to 202/t last week, pushed up by strong sales to China.

There were talks three or more ships of Ukrainian barley sold to China for July-September delivery during last month. Ukrainian barley sales to China for July-September deliveries estimated by the market players between 450,00 and 600,000t so far.

No sign of any interest in Australian barley with the domestic premium being paid by feeders enough to keep it at home, given competitive quotes from other major barley exporters.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

This chart shows the track prices for feed barley delivered WA and VIC port in $A/t. Source: LSEG Workstation.

Canola resumes down trend

After spiking with oil prices, canola has resumed its down trend as northern hemisphere crops improve.

European rapeseed prices have declined by €30/t to €467/t with the rapeseed harvesting campaign well underway in Europe. Yield reports are raising expectations for a production recovery to around 19.5mt (last year was around 17.5mt). Romania is expected to have a record harvest, and France’s yields are higher than anticipated.

Canadian canola futures have been easing as rain hit significant parts of Western Canada, with weakness in Chicago soyoil speeding the decline. Rain fell in some parts of Western Canada over the weekend, and many areas have forecasts for significant rainfall this week. Traders said canola will be in a twitchy weather market until at least late August. Despite rainfall in recent days, Western Canada remains in a multi-year dry cycle. Traders said crops are doing fine if they get some rain each week, but few crops can handle more than ten days without rain.

Sounds like most of the Australian canola belt, although our moment of reckoning won’t come until temperatures warm up in September.

Most local old crop canola business should be all but wrapped up and east coast growers will be reluctant to engage given patchy emergence, slow growth and a lack of subsoil moisture across the south. In the north, canola crops have been slow to emerge with some waterlogging affecting growth. Although there is some time for crops to catch up, we will need some mild weather and sunny days to get some growth vigour.

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG.

This chart shows the non-GM and GM canola price delivered WA port in $A/t. Source: LSEG.

Pulse market focus shifts away from India

Given bulk shipments to India in November/December, and the subsequent imposition of import tariffs, most Australian pulses are now being exported in containers to non-Indian destinations. From January to May, Australia exported 96,648t of chickpeas, including 45,791t to Pakistan, 33,000t to India, 6,884t to the UAE. Lentil exports from January to May amounted to 194,528t, including 73,634t to Bangladesh, 43,471t to Sri Lanka, 30,754t to India, 26,733t to Pakistan.

It’s very quiet in the chickpea market. Old crop bids are similar around $815/t Downs packer and $800/t Goondiwindi for anyone that still has tonnes to tidy up.

New season bids have also eased a touch. Traders are interested in buying but growers have no interest in selling at these values. We need some renewed buying demand out of India to spark something in the market. The bids are showing that the market focus is on early chickpeas with discounts increasing as the delivery period moves into November/December.

Buyers will be interested in faba beans from Northern NSW as it doesn’t look like South Australia are likely to have much of a crop. Indicative bids $460/t Downs, $475/t Bris, $440/t Goondiwindi, $460/t Narrabri.

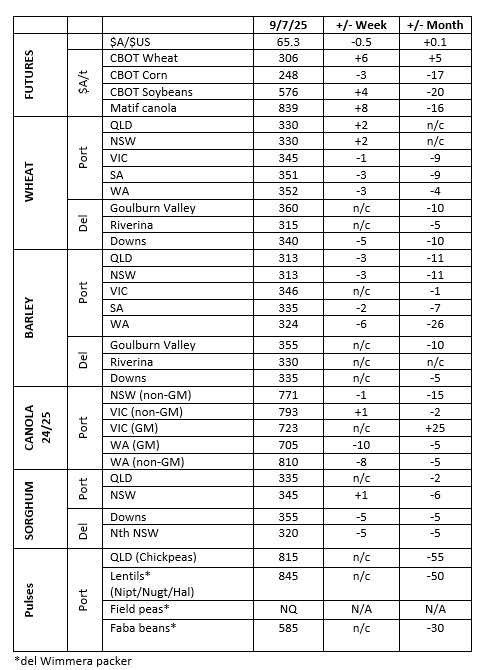

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

This table shows grower trade bids for grain in major Australian grain markets. Source: Clear Grain Exchange.

From the field

This months From the field spotlights the planting activities across the country as reported by Elders field staff in the regions.

Winter planting has progressed well through central Queensland, the Western Downs and Goondiwindi in Queensland with similar across northern NSW with crops are up and looking well established. If anything, a move towards chickpea and pulse crops after large winter cereal programs in recent years. Inner Downs and through Liverpool Plains harvest is still progressing with wet weather hindering harvest pace and leaving a few sorghum crops still to be harvested.

“Crops are in fair to good condition with slow germination on heavy soils on good June rainfall 50 to 110 mm. Pasture growth is very poor. autumn sown pastures have struggled and barely emerged with June growth very slow.

“Canola final germination now through with at least 70 pc late germination. Crop stage is staggered cotyledon - 6 leaf. Cereals are 100 pc established but 2 to 4 weeks behind with growth Stage 2 leaf to early tillering. Faba beans are very slow

“Minimal replanting has been required and not much ground has been left fallow.

“There is very little slug activity so far. Red legged earth mite activity in newly sown pastures. Pasture Cockchafers in high numbers in isolated areas (including Argentine Scarab including red headed and black headed cockchafers).

“Conditions are getting wet along and south of Hamilton Highway. Frost and poor weather are significantly delaying weed control activities.” - Mick Walsh, Elders Agronomist, Ballarat.

“Most crops are up and out of the ground. Anything sown prior to Anzac Day has emerged well up and going, however started to feel the pinch of moisture stress prior to the Kings birthday weekend rain.

“Crops sown after Anzac Day and prior to the 30 May have had a split germination of around 50 to 70 pc establishment, the rest of the establishments have occurred after the June long weekend rainfall. In this time the soil temperature fell from 15 to 8.5 degrees which has seen the growth of all emerging crops significantly slow down. We have started to see some seedling blackleg in later established canola.

“Heavy fogs and frost have really limited the spraying days which will hamper the control of weeds in particular rye grass in canola. Very hard to make decisions when 50 pc of the canola is at 8 leaf and then 50 pc is at cotyledon stage.” - Anton Mannes, Elders Senior Agronomist, Bendigo.

“Cereals have jumped out of the ground. Canola is 90 pc emerged and lentils have had a very even establishment. Beans are slow, and establishment varies from 40 to 80 pc.

“There is isolated slater and snail damage in canola. Earth mites & lucerne flea sporadic. Ascochyta in lentils. Run of frost this week will make early grass control in legumes difficult.

“Crops are approximately 3 to 4 weeks later than normal but soil temp and forecasted frosts over the next week will slow development further. For now, the lower north has enough moisture for the next 5 to 6 weeks without any drought stress, which will help get good levels of weed control, but we will need a decent finish. We have no carryover soil moisture so we will need above average rainfall for the season and some luck in timing of those rains to achieve average yields.” - Craig Prior, Elders Agronomist, Roseworthy.

“The state of the crops across the NSW regions are very mixed, so I have divided the regions up so you can gain a better understanding of the situation.

“Northern NSW to the border:

- 95 pc planted

- 98 pc germinated

- Large areas are fallow have received good in fallow rainfall.

- General crop conditions are fair to good. There is some insect and disease pressures within crops, but moisture levels in the soil profile are good.

“Central West NSW:

- 65 pc planted

- 70 pc germinated

- Cotton and summer crop fallows will be storing good moisture on the back of recent rainfall.

- General Crop conditions are Fair to Good. There is some insect and disease pressures within crops, but moisture levels in the soil profile are fair to good.

“Tablelands:

- 70 pc planted

- 65 pc germinated

- Fallowed areas require respray on the back of recent weed germinations.

- Frosts have also caused some minor damage to late sown crops.

- General crop conditions are fair. There is a lot of insect and disease pressures within crops, but moisture levels are good on the back of recent rainfall.

“Southern Slopes:

- 45 pc planted

- 65 pc germinated

- Fallowed areas require respray on the back of recent weed germinations.

- Frosts have also caused minor damage to late sown crops, with damage not yet fully known.

- General crop conditions are poor to fair. There is insect and disease pressures within crops, with soil moisture profiles limited.

“There have been changes to crop rotations due to conditions, with late season plants of barley, triticale, wheat, and late forage oats been sown instead of canola.

“Disease/pest considerations – green peach aphids, black Beatles, scarabs and cockchafers are present in the Tablelands, Central-West and northern regions.” - Adam Little, Elders Technical Services Manager, NSW.

“Crops are in fair condition with good germination, albeit 6 to 8 weeks late. Pasture conditions are very poor.

“Some African black beetle activity to the east of the region. Earthmites and various aphids out and about and need to be kept under observation. Some early signs of the usual fungal diseases such as septoria and blackleg.

“Overall, we are six to eight weeks behind due to the late start. There is about a 30 pc chance that cereals, and particularly barley, could still achieve above average yields if all the planets line up in terms of seasonal conditions up to harvest.

“Broad leaf crops such as canola, faba beans and lupins, I believe will all suffer a yield penalty (30 to 50 pc) due to the late start, even if we do receive average conditions from now on.

“Rainfall in most areas has been sufficient to date for crops. However larger totals going forward would be required for all crops to reach the yield potentials mentioned.

“Soil temps at 40 cm are generally all below 10oC now, so it’s slow progress at the moment.” - Rob Harrod, Elders Senior Agronomist, Albury.

Read previous reports

Cropping update - June 2025

Cropping update - May 2025

Cropping update - March 2025