Local slaughter cattle markets have been at the mercy of domestic supply considerations through May.

Ongoing forced turnoff across the south has coincided with the start of northern turnoff, creating a situation where both southern and northern processors have sufficient supplies of local cattle to draw from. This has pressured Australian cattle prices downward in the past month, despite international cattle and beef prices continuing to rise. This situation has not been helped by the disruptions to processing in Queensland during March/April from a combination of cyclone Alfred, Queensland floods and the run of short processing weeks which has contributed to the backlog of northern cattle.

The situation has been a little different for feeder steers and restockers. For feeder cattle there is a wide divergence between northern and southern cattle with an almost $1/kg liveweight (lw) premium for southern feeder steers (Angus) above the flatback feeder cattle price. This reflects the differences in supply with flatback cattle in abundance while there is a shortage of Angus feeders of entry weights across the south, given the season. On restockers, northern buying activity on lighter well-bred stock has put a floor in this market and has absorbed the large, forced turnoff from southern areas.

Over the past week, good rain through central and southern NSW with more forecast, has lifted southern markets as widespread forced liquidation eases for now. The rain has fallen just in time for producers in these areas and will germinate dry sown winter crops and give struggling forage crops a bit of a kick along before it gets too cold. While not a panacea, the rain will offer markets a reprieve from large numbers that have beset southern yards for the past couple of months.

Until we see a widespread break across southern Australia, the focus of local markets will continue to be supply with works not having to compete too hard to obtain stock. A slowing in supply though would put the spotlight back on processing margins and how much margin processors are willing to compete away to maintain throughput. We expect southern slaughter cattle supplies to soon ease and encourage southern processors north to obtain stock to maintain kills. This should see northern and southern slaughter cattle prices converge again to some degree taking into consideration transport costs.

US beef market is the key driver

Australian beef processing margins are strong, as international beef demand remains robust led by the US market. US cattle and beef prices have soared in recent months supported by record US beef demand which has more than made up for a reduction in export demand for US beef. The US is Australia’s biggest customer but also our largest competitor in key north Asian markets.

In recent years, the strength of the US market has underpinned global meat prices leading to the US consuming more of its own beef and creating opportunities for Australian beef in international markets.

US export demand has been slower in 2025. So far, the US has exported 277,600 tonnes of beef this year, nearly 7 per cent less than the same time in 2024. While exports to countries like South Korea and Canada have remained strong, tariffs have slowed sales down, particularly to China. Total export sales to China are currently 32 per cent behind 2024.

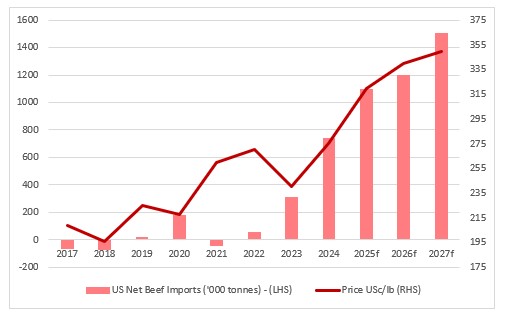

At the same time of increased beef demand, the US is about to start herd rebuilding with drought over the past 4 to 5 years reducing its beef herd to the lowest level since the 1960s. The impact of herd rebuilding in the US in the short to medium term will be lower US beef production as US producers hold heifers back from feedlots. This will see US net beef imports (difference between its import and exports) rise and will underpin strong demand for Australia beef both in the US and in global beef market as US competition subsides.

This chart shows US net imports in ‘000 tonnes vs US beef import prices in USc/lb. Source: USDA

This chart shows US net imports in ‘000 tonnes vs US beef import prices in USc/lb. Source: USDA

While US beef demand is currently strong, this situation could change. Any decline in consumer confidence or US household financial health could weaken demand, forcing packers to lower bids. Recent surveys in the US have shown a sharp decline in consumer sentiment. So far this has not translated into weaker demand for beef with lower consumer sentiment not being reflected in actual purchasing behaviour. Over the next month or so we will begin to see the impact of tariffs on US retail prices which could trigger a change in consumer behaviour and worsen consumer sentiment.

A slump in US beef demand is the key risk to the current rosy outlook for global beef prices. The option for Australia to divert significant volumes of product away from the US market in the event of a weakening in demand appears limited with the economies of our large Asian customers struggling

Asian economies struggling

Japan's Gross Domestic Product (GDP) for the first quarter of 2025 contracted by 0.2 per cent (pc) compared to the previous quarter and by 0.7 pc vs last year — much steeper than the forecast 0.2 pc contraction.

The Bank of Korea (BOK) cut rates Monday as economic activity contracted in the last quarter by 0.2 pc compared to the previous three months.

And while China’s economy is faring better, and it has increased purchases from Australia given the effective ban on US beef exports with their non-renewal of US beef export licenses, its beef sector is struggling and it’s doubtful they have the appetite to significantly increase imports.

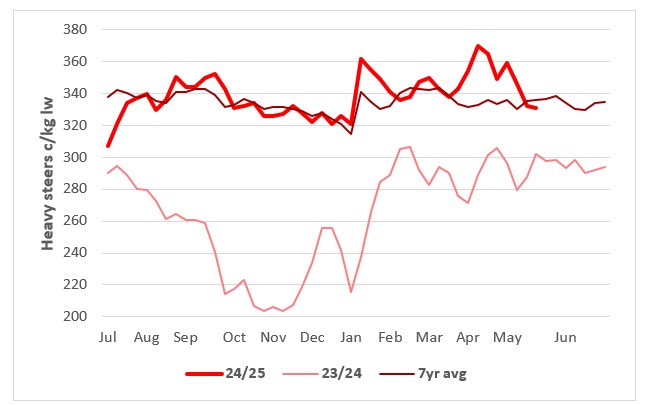

Heavy steer prices struggle under weight of numbers

Good Queensland supplies are keeping the pressure on slaughter cattle markets. A widespread autumn break across southern areas would reduce forced liquidation and send southern buyers north to fill slaughter schedules and aid prices in reversing recent declines. Demand for Australian slaughter cattle is being underpinned by firm US beef demand (which is ignoring declining US consumer sentiment) and good opportunities for Australian beef in north Asia and China as US exports contract.

Australian heavy steer prices should grind higher over the next few months as southern supplies tighten.

Prices weighed down by supply

Large supplies of heavy steers as the northern turnoff season gets underway have seen prices pullback.

Increased southern processor buying activity in northern markets should reverse this price trend over the next few months.

This chart shows the c/kg lw national saleyard indicator price for heavy steers in 24/25 vs 23/24 and 7year average. Source: MLA.

This chart shows the c/kg lw national saleyard indicator price for heavy steers in 24/25 vs 23/24 and 7year average. Source: MLA.

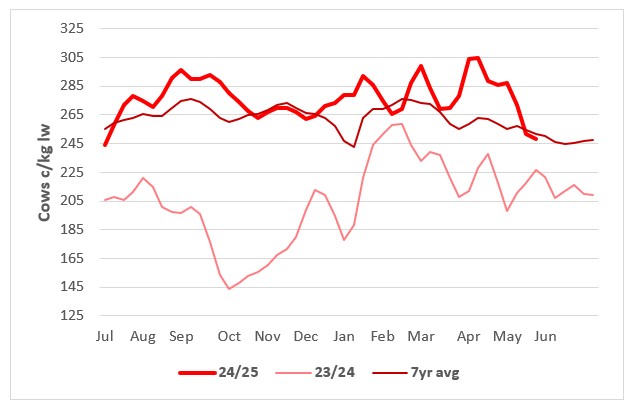

Cow markets begin to firm in the south as rain eases offload

Direct to work quotes for cows in Queensland were back to $5.20/kg cw and $5.90/kg cw for heavy steers. This created the incentive for southern meat buyers to get their cars serviced to head north with good heavy cows up to $3.25c/kg lw in southern yards ($6.50c/kg cw equivalent). Southern processors were reportedly active in Queensland yards last week but very selective on what they took home. The arrival of southern competition should help stem falls in cow values across Queensland which have shed 20-30c/kg lw in recent weeks under weight of numbers.

Competition needed

The recent uptick in southern cow values combined with a fall in northern cow values will encourage increased southern processors activity in Queensland and force northern and southern slaughter cow prices to converge taking into consideration transport costs.

This chart shows the c/kg lw national saleyard indicator price for cows in 24/25 vs 23/24 and 7year average. Source: MLA.

This chart shows the c/kg lw national saleyard indicator price for cows in 24/25 vs 23/24 and 7year average. Source: MLA.

Southern feeders shift towards heifers

Northern feedlots are full of cattle and have an abundant supply of local flatback cattle as the northern turnoff season gathers momentum.

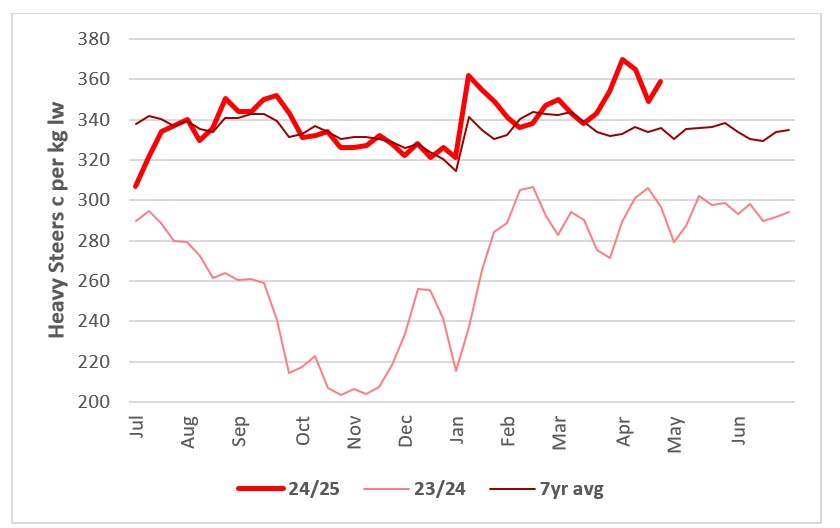

In contrast, supplies of suitable southern feeder cattle are very tight. The flat national price trend for feeder steers below, incorporates rising southern prices and falling prices in the north. While the premium to Angus is likely to be maintained, if northern feeder prices fall to below a 20c/kg premium to heavy steers, northern producers could opt to feed these cattle to slaughter weights on grass, pending cash flow considerations.

Divide between north and south Increases

Last month we talked about the Angus premium moving out to 50c/kg lw reflecting the difference between northern and southern feeder supplies.

This has continued to widen to around $1/kg lw and may widen even further in coming months, given the scarcity of suitable Angus feeders.

This chart shows the c per kg lw national saleyard indicator price for heavy steers in 24 per 25 versus 23 per 24, and the seven-year average. Source: MLA.

This chart shows the c per kg lw national saleyard indicator price for heavy steers in 24 per 25 versus 23 per 24, and the seven-year average. Source: MLA.

Northern restockers upgrade herds

On restocker cattle, northern feedlot backgrounder and restocker buying activity has put a floor under prices and has allowed the market to absorb the heavy off load of cattle from the south. Our southern agents have been active on light well-bred cattle, buying out of the western district of Victoria and moving them to St George, Blackhall and Longreach in Queensland.

Early this week, light heifers were the big mover at Wagga yards gaining around 30c/kg lw to sell to $3.85c/kg lw. The price correction on these better-quality light steers and heifers might force a rethink with some Queensland producers now considering agistment rather than punting on cattle. The availability of attractively priced well-bred southern restocker cattle is encouraging some Queensland producers to upgrade their breeding herds, offloading lower or older quality stock and replacing them with better lines from the south.

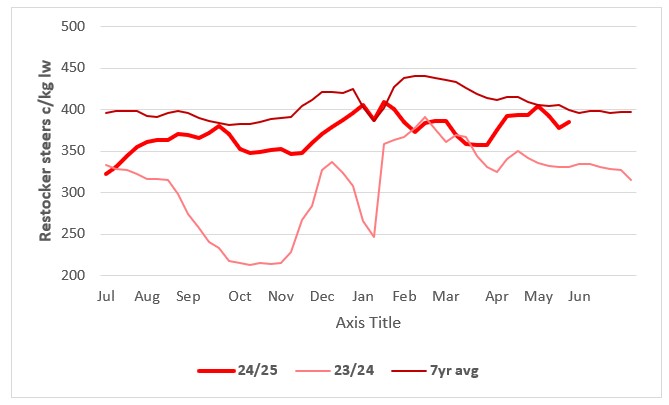

Restocker cattle still good value

Northern restocker activity in southern markets has seen restocker values strengthen.

Expect northern restockers to continue buying as southern store cattle markets will most likely remain tough with the autumn break already too late to generate pasture growth for many.

This chart shows c/kg lw saleyard indicator prices for Victorian and Queensland restocker steers. Source: MLA.

This chart shows c/kg lw saleyard indicator prices for Victorian and Queensland restocker steers. Source: MLA.

From the rails

Read what Elders livestock representatives from around Australia are saying about the markets in their regions.

“With the rain over the past fortnight numbers in northern New South Wales markets have tightened and cattle markets have gained around 20c/kg lw across all types."

"Good heavy Angus steers are most sought after moving to $4.60c/kg lw with spillover support coming for feeder heifers.

"Northern restockers still active on lighter cattle with prices holding firm and buyers having to venture further south to obtain decent numbers.

"Slaughter cows and heavy steers have gained around 20c/kg lw in the yards just on lower numbers but works quotes have held steady.

"There will be a shortage of suitable feeders heifers in the south at least until spring with southern feedlots forced to head north into northern NSW and southern Queensland to obtain suitable supplies, which should keep these markets firm.

"The recent rain will help slow forced turnoff in the south with the recent rain, while not providing any immediate feed at least providing confidence that there is light at the end of the tunnel for those feeding with the prospect of a winter crop.” - Nik Hannaford, Elders NSW State Livestock Manager.

NSW saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 334 | 342 (-8) | 341 (-7) | 295 (+39) |

| Processor cow | 277 | 252 (+25) | 289 (-12) | 203 (+74) |

| Feeder steer | 402 | 385 (+17) | 390 (+12) | 338 (+64) |

| Restocker steer | 421 | 330 (+91) | 376 (+45) | 319 (+102) |

| Restocker heifer | 335 | 308 (+27) | 319 (+16) | 275 (+70) |

Source: MLA

“With the commencement of the Queensland turnoff season, Queensland slaughter cattle markets have quickly come under pressure. Last week we spoke about a Vietnam boat order executed out of Townsville at $3.40/kg lw, the new boat order was at $2.90-2.95/kg lw and was quickly filled to give you an idea of how much this market has come back.”

“Cows across northern Queensland similarly affected, back 20c/kg lw to $2.40-2.45/kg lw northern yards and about 20c/kg lw more in the south. Bullocks have come back to around $3.10-3.20c/kg lw in the southern yards if you can get a booking. Most Queensland works are reporting that they are booked out till August. Southern buyers were active in Queensland saleyards last week but were very selective on what they took home concentrating on heavy cows.

“Like trends in fat cattle markets, flatback or northern feeder cattle have been falling while southern or Angus feeder cattle have been firming, reflecting the difference in availability. After being on par at the end of last year, Angus feeder premiums have moved out to $1/kg lw, with Angus feeder prices moving higher to $4.60/kg lw, in contrast to flatback feeders which have fallen to $3.60/kg lw Downs.”- Scott Mawn, State Manager Queensland/NT.

Queensland saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 302 | 290 (+12) | 322 (-20) | 258 (+44) |

| Processor cow | 242 | 240 (+2) | 276 (+34) | 202 (+40) |

| Feeder steer | 372 | 350 (+22) | 370 (+2) | 307 (+65) |

| Restocker steer | 385 | 386 (-1) | 384 (+1) | 326 (+59) |

| Restocker heifer | 311 | 296 (+15) | 328 (-17) | 268 (+43) |

Source: MLA

“With the bulk of the turnoff now over, numbers through the yards have started to ease, although cows are still making up around half the yarding. Quality is mixed but prices have been holding as rain eases numbers through southern New South Wales and parts of Victoria with forced turnoff from those areas easing. Any good quality cattle with weight and shape have been selling well to processors.”

“However, fodder is in extremely short supply and if strong rainfall doesn't occur and cattle feed doesn't grow quickly, we will commence a further sell down of the cow herd.

“Northern restockers have been active on lighter cattle with many producers opting to sell at the better price levels of recent weeks rather than having to feed through winter. Retained heifers for breeding are increasingly being off loaded into feedlots.

“Some areas of South Australia have been picking up the odd fall of rain and with temperatures remaining unseasonably warm its hoped that there might be some late season pasture growth. The focus for many has been finishing planting with the hope that they can jag enough rain to germinate crops with forecasts suggesting a wet June. At least if they can get crops away there may be some light at the end of the tunnel.

“Expect cow numbers to slow down in the south as rain brings hope. Most of the cows being sold were the oldest age groups either being in calf for spring calving or with a little autumn calf.

“I expect this to slow up providing we see another 10mm of rain next week. Feed is showing to be very slow and a lot of the 20-30mm last week has already dried up with our sub soil moisture being non-existent.” - Laryn Gogel, Elders Livestock Sales Manager, South Australia.

SA saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 380 | 370 (+10) | 345 (+35) | 308 (+72) |

| Processor cow | 276 | 254 (+22) | 256 (+20) | 218 (+58) |

| Feeder steer | 355 | 330 (+25) | 339 (+16) | 302 (+53) |

| Restocker steer | 312 | 246 (+66) | 326 (-14) | 255 (+57) |

| Restocker heifer | 234 | 246 (-12) | 326 (-90) | 2251 (-17) |

Source: MLA

“Tasmania market has been steady on slaughter cattle, but the store market has been at the whim of the weather. “

“In early May much needed soaking rain of 15-25mm across the northern part of Tassie, in the main of the restocker or grower areas, gave the flagging cattle market a bit of support. Tassie works have plenty of numbers in front of them with the dry and with the turnoff of dairy cows before winter.

“The hope is that the rain will provide a bit of growth before it gets too cold. Although there was snow on the mountains early May but the weather cleared up quickly with nice balmy days for the rest of the week, 19-20 degrees and overnight temps 8-10 degrees which is allowing the ground temperatures to stay warm to allow a bit of growth before winter.

“A couple of frosts mid-May week took the wind out of the restocker market with rates back 20-30c/kg lw on steers and heifers.

“Last week, rain of +25mm added up across a few days over the island, with isolated falls up to 40mm, will help with soil temperatures still warm enough to allow for some late autumn growth.

“Direct to works prices are steady at $7.20/kg cw for program yearlings and $6/kg cw on the better cows and $4.70-4.80/kg cw for the better dairy cows. Store cattle markets have slowed with limited numbers offered last week but we did see a 20-30c/kg lw firmer trend on AuctionsPlus last Friday with heifers selling to $3.50-3.60/kg lw and steers $3.70-3.80/kg lw with lighter steers pushing towards $4/kg lw.” - Gavin Coombe, State Livestock Manager Tasmania.

Tasmania saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 312 | 340 (-28) | 294 (+18) | 261 (+51) |

| Processor cow | 253 | 223 (+30) | 248 (+5) | 171 (+82) |

| Feeder steer | 270 | 275 (-5) | 315 (-45) | 184 (+86) |

Source: MLA

“In early to mid-May northern opportunity buyers stepped into the market for light well-bred cattle and paying $3-3.10/kg lw for heifers and about $1/kg lw more for the steers across southern markets. These cattle are coming from the western district and south-east South Australia and represent future supplies of feeder cattle from these areas.”

“This activity continued into late May with buying out of the western district of Victoria for consignment to St George, Blackhall and Longreach in Queensland. Well-bred light restocker cattle have been the big movers in southern markets with heifers at Wagga yards gaining around 30-40c/kg lw to sell to $3.85c/kg lw early this week. The price correction on these better-quality light steers and heifers might force a rethink with some Queensland producers now considering agistment rather than punting on cattle.

“In southern slaughter markets, cows are $6.20/kg cw and up to $6.50/kg in places and $7.50/kg cw for grassfed steers & heifers and program cattle to $8.20kg cw. You can still get a kill organised in a week or 10 days and they're all killing full numbers.

“Once we get a rain in Victoria, processor supplies are going to tighten considerably. We have probably lost 30% of our stock numbers so numbers are going to tighten into winter as most saleable stock has been moved out of the area.” - Peter Homann, National Livestock Manager.

Victoria saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 385 | 361 (+24) | 374 (+11) | 314 (+71) |

| Processor cow | 287 | 259 (+28) | 296 (-9) | 212 (+65) |

| Feeder steer | 367 | 356 (+11) | 371 (-4) | 308 (+59) |

| Restocker steer | 357 | 323 (+34) | 343 (+14) | 286 (+71) |

| Restocker heifer | 312 | 263 (+49) | 265 (+47) | 238 (+74) |

Source: MLA

“In early to mid-May despite Western Australia looking for rain to keep the season going, there was some better interest in feeders and store cattle with feedlots active on the heavier stock while grass fatteners were keen to own lighter cattle with producers from the Great Southern actively looking for cattle that they can put away for later in the year.”

“But the weather has since turned cold with cool nights and the first of the frosts and markets have backed off with grazier demand easing. Feeder and restocker cattle 280-380kgs fell around 10c/kg lw to $3.80/kg lw for steers and $3.30/kg lw for heifers.

“Hopefully, the good widespread rain forecast for Western Australia this week, and some warmer late autumn weather will allow pastures to get away and encourage graziers back to the market.

“Cows at the works have held $5.50-5.60/kg cw but are under pressure at the yards around $2.45/kg lw with the arrival of greater number of Kimberley cattle. The same can be said on heavy bulls which have pulled back to $2-2.20/kg lw.” - Michael Longford, Livestock Sales Manager, WA.

WA saleyard market indicators c/kg lw | ||||

| 27/05/2025 | +/- week | +/1 month | +/- year | |

| Heavy steer | 256 | 317 (-61) | 300 (-44) | 210 (+46) |

| Processor cow | 228 | 247 (-19) | 248 (-20) | 198 (+30) |

| Feeder steer | 329 | 346 (-17) | 346 (-17) | 253 (+76) |

| Restocker steer | n/a | n/a | n/a | n/a |

| Restocker heifer | 296 | 163 (+133) | 268 (+28) | 1104 (+192) |

Source: MLA

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

*Disclaimer – important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.