Read the latest insights and information on the Australian cattle market for February 2026*.

Competitive landscape set to change in 2026

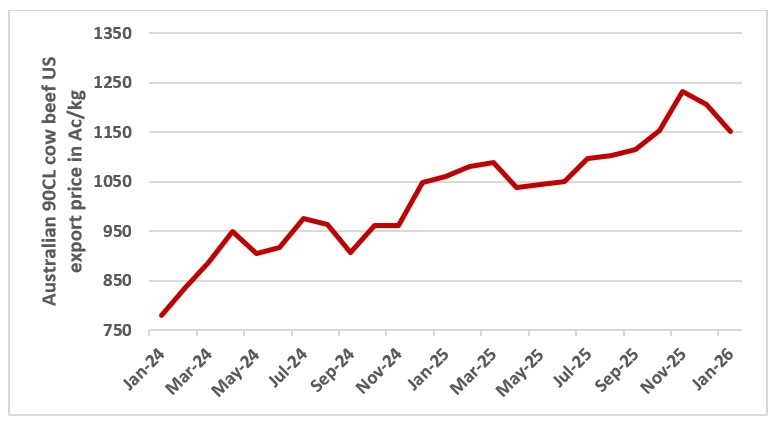

Australian cattle prices have started the year moderately (-5 per cent) weaker. Very hot and dry weather from central Queensland right down the east coast has meant markets have been well supplied, while a much stronger Australian dollar has clipped beef export returns (down 4 per cent or 50Ac/kg to 1150Ac/kg).

Despite challenges from floods and extreme heat, the industry is off to a flying start.

January 2026 processing levels (556,000 head) are above last year and well above historical January levels (5-year average 450,000 head). Exports were off to a similarly strong start with January tonnage hitting an all-time high for the month, at 84,343 tonnes (up 4 per cent on last year and +20 per cent on the 5-year average) with all major export markets performing strongly.

This chart show export prices to the US for 90CL Australian cow beef in Ac/kg. Source: USDA

This chart show export prices to the US for 90CL Australian cow beef in Ac/kg. Source: USDA

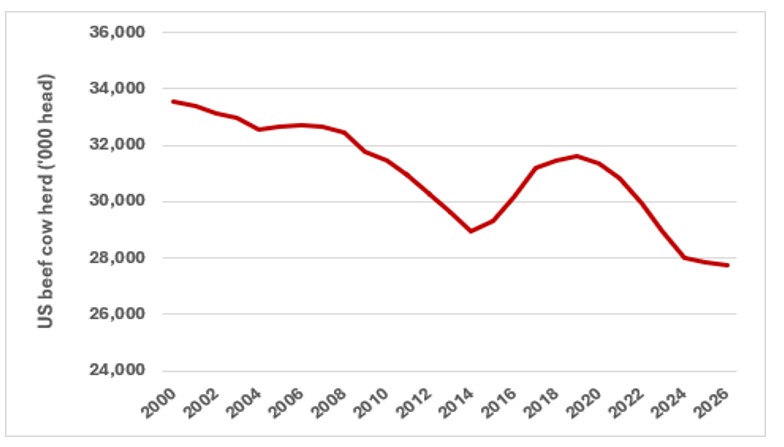

Solid export demand over the past two years has been supported by falling US production and this trend is unlikely to reverse any time soon. US cattle inventories fell a further 0.4 pc in 2025, signalling that the US industry has yet to commence any serious herd rebuilding, meaning that US beef supplies will remain constrained for at least another two years.

This chart shows the US beef cow inventory as of 1 January 2026. Source: USDA

This chart shows the US beef cow inventory as of 1 January 2026. Source: USDA

Lower US beef production will underpin solid export demand for Australian beef over the medium term, however, China’s announcement that it would impose beef import restrictions will lead to a change the competition landscape in 2026.

China will restrict annual beef imports to 2.8mt through country specific quotas with above quota imports subject to a 55 per cent tariff. The major consequence will be to limit exports from its major suppliers Australia (quota of 206,000t vs exports of around 300,000t) and Brazil (quota of 1.1mt vs exports of 1.7mt). Around 100,000t of Australian beef and 600,000t of Brazilian beef previously ear marked for the Chinese market will need to be diverted to other markets.

Australian chilled beef exports displaced from the Chinese market should be readily diverted to alternative markets without too much consequence (see heavy steer comment), given opportunities created by lower US fed beef production in 2026.

The largest impact of China’s beef import restrictions will come from changes in Brazilian beef export flows. Increased Chinese imports of Brazilian beef have shielded Australian exporters from the impact of rising Brazilian beef production over the past five years. Chinese restrictions on Brazilian beef imports are likely to accelerate their efforts to diversify beef exports (mostly lean frozen manufacturing beef) and significantly increase Brazilian competition in commodity beef markets in 2026 and onwards.

Brazil is close to implementing a quota management system that would restrict monthly exports to China to 80,000 tonnes. This would leave Brazil having to find new alternative markets for up to 60,000 tonnes of beef each month. Australia would likely feel the impacts of increased Brazilian competition in non-Chinese markets as soon as Chinese restrictions become effective. Although discussions have taken place about the merits of Australia implementing a self-imposed quota management system, it is unlikely that this will be in place in 2026.

In contrast to last year, when the Australian beef and cattle industry had supportive headwinds courtesy of favourable trade policy developments (US beef locked out of China and the US imposing a prohibitive tariff on Brazilian beef imports), the competitive landscape in 2026 has changed. US beef is likely to regain access to the Chinese market mid-year while Brazilian competition is likely to intensify in markets outside China. A significantly higher Australian dollar will add to our export market challenges in 2026.

What might develop is a two-speed export market where higher quality chilled beef values rise (driven by opportunities for Australian chilled exports arising from lower US fed beef production) but beef values fall in commodity or manufacturing beef markets (frozen manufacturing beef) where Brazilian beef exports have access.

How will this manifest in Australian cattle markets in 2026? Feeders and finished steers targeted at high quality grain and grassfed chilled programs should hold relatively firm but cows and secondary steers destined for global commodity beef markets will come under pressure.

Lower US fed beef production to underpin Australian heavy steer values

Underpinning firm demand for slaughter ready heavy steers through 2026 will be the decline in cattle on feed in the US. The US is our major competitor in global chilled high quality beef markets.

The January USDA Cattle on Feed report reveals a sharp decline in US feedlot inventories to 11.45 million head down 3.2 per cent year over year, the 14th consecutive month of declining feedlot inventories and the lowest levels since 2018.

December feedlot placements were down 5.4 pc from a year ago, the ninth consecutive month of lower placements. Lower calf numbers (US beef cow herd shrunk another 1 pc in 2025) and the ongoing ban on Mexican feeder cattle due to the New World Screwworm ban have limited cattle on feed placements and will limit US fed cattle slaughter well into 2027.

US feedlot marketings in December were higher than last year, up 1.8 pc year over year, following an 11.9 pc drop in November. This is the first increase in monthly marketings in eight months. US feedlots have been managing declining placements by holding cattle in feedlots longer. Despite declining overall numbers, US feedlots are front loaded with cattle (cattle on feed +150 days are 25 pc higher than last year). This has contributed to a sharp 7 pc lift in average carcase weights (increased from 840lbs to peak at 900lbs in December) through 2025 which has partly offset the impact of lower US cattle slaughter on fed beef production.

US beef production fell by 3.6 pc in 2025 and based on lower cattle inventories. A similar decline is expected this year, although currently the USDA is only suggesting a 1 pc fall. US choice beef cut-out values are currently 11 pc higher than last year and, despite concerns over weak US consumer sentiment and beef being expensive compared to white meat protein, US beef demand shows no sign of weakening.

Lower US grain-fed beef production is creating opportunities for Australian exporters – Australian chilled beef exports rose 16 pc in 2025 with the major contributors to growth exports to the US, China and the UK.

Further supporting Australian finished cattle values are the mixed seasonal conditions across southern Australia which is contributing to the tight supply of heavy weight slaughter ready cattle in the south.

Like the past couple of years, southern processors will need to supplement cattle supply from northern areas, providing competition for northern processors and assisting firm heavy steer demand and values.

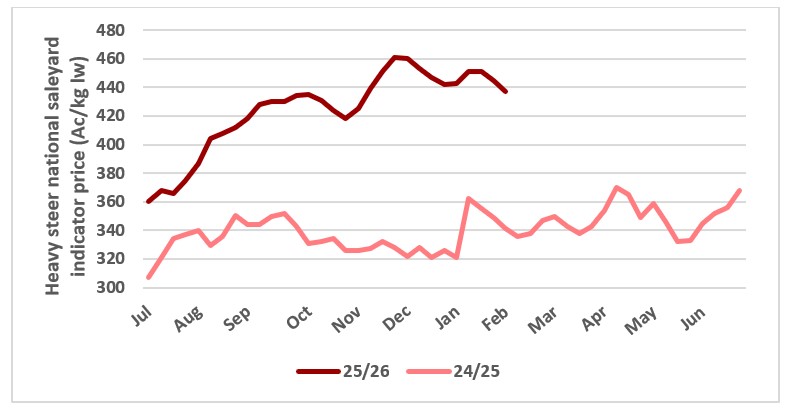

Heavy steer values eased moderately during January to be around 440c/kg liveweight (lw) in saleyards down around 10c/kg lw or 810-840c/kg dressed weight (dw) in over the hooks markets, down around 20c/kg dw.

This chart shows the national saleyard indicator price for heavy steers in 24/25 vs 25/26. Source: MLA

This chart shows the national saleyard indicator price for heavy steers in 24/25 vs 25/26. Source: MLA

Less US competition and tight supplies in south to support prices

Lower placements into US feedlots will continue to constrain US beef production, creating opportunities for Australian exporters as competition from US beef in chilled grain and grassfed beef export markets recedes.

Tight supply of suitable heavy weight slaughter ready cattle across southern Australia will create firm demand for these cattle from Australian processors.

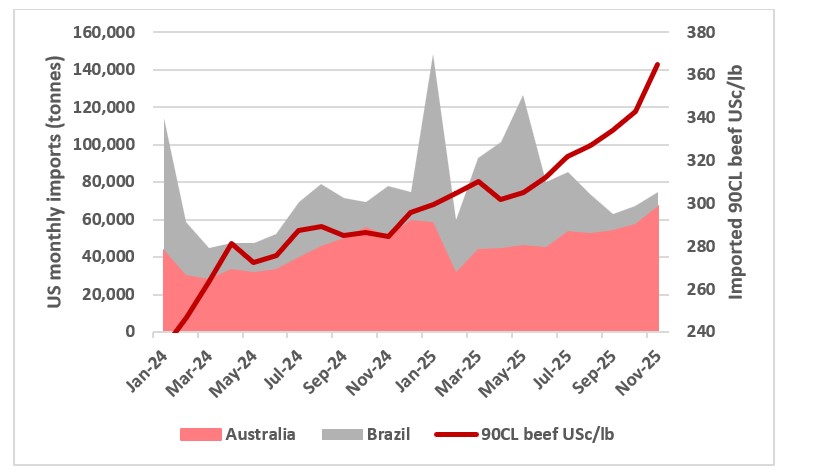

Manufacturing beef markets firm as exporters target China

Prices for both domestic US and imported lean beef in USD have remained firm in USD terms entering 2026 as US end users struggled to source supplies. Strong demand from China continues to impact trade with seasonally lower offerings from Oceania focused on satisfying Chinese demand ahead of the imposition of Chinese import restrictions.

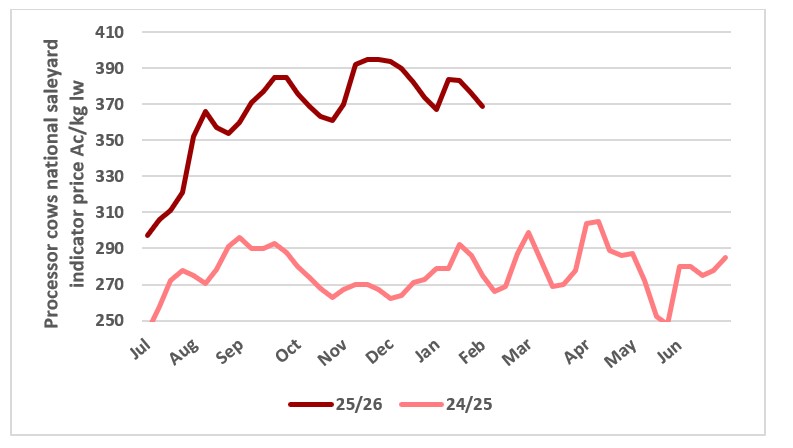

However, while demand for imported beef remains firm, the higher Australian dollar has crimped returns for Australian exporters (90CL cow beef into the US has fallen 4 pc or 50Ac/kg to 1150Ac/kg in January) which has compressed processing margins, limiting the amount processors are willing to pay for suitable stock. Local cow values have fallen in line with export returns to be 370c/kg liveweight (lw) in saleyards or 730 to 790c/kg dw (dressed weight) in over the hooks markets, down 20c/kg lw or 40 to 50c/kg dw.

Complicating manufacturing beef trade dynamics will be the likely presence of increased supplies of frozen Brazilian beef. Recently Indonesia has authorised another 14 Brazilian plants to export to Indonesia bringing the total to 52.

Indonesia has also announced 2026 import permit allocations which provide preferential access for boxed beef imports from Brazil (75,000 tonnes) and reduced allocations for other suppliers including Australia which has been allocated 75,000 tonnes to be shared between Australia, the US and New Zealand.

This chart shows US beef import volumes from Brazil and Australia vs prices for 90CL imported beef in USc/lb. Source: USDA

This chart shows US beef import volumes from Brazil and Australia vs prices for 90CL imported beef in USc/lb. Source: USDA

Brazil is well progressed in obtaining access to the Japanese and Philippine markets and will likely play a much larger role in the US imported beef market once Chinese import restrictions become effective. With food affordability such a widespread economic issue, conditions are ripe for Brazil to obtain improved export market access.

Increased Brazilian competition in Australia’s traditional manufacturing beef markets will pressure manufacturing beef prices throughout 2026 and will limit prices processors can pay for cows and other stock suited to manufacturing beef markets.

Australian dollar & Brazilian competition to create headwinds in commodity beef markets

Increased Brazilian competition and a stronger Australian dollar will pressure commodity beef prices throughout 2026, limiting the prices processors can pay for cows and other stock suited to these markets.

This chart shows the national saleyard indicator price for cows 24/25 and 25/26. Source: MLA

This chart shows the national saleyard indicator price for cows 24/25 and 25/26. Source: MLA

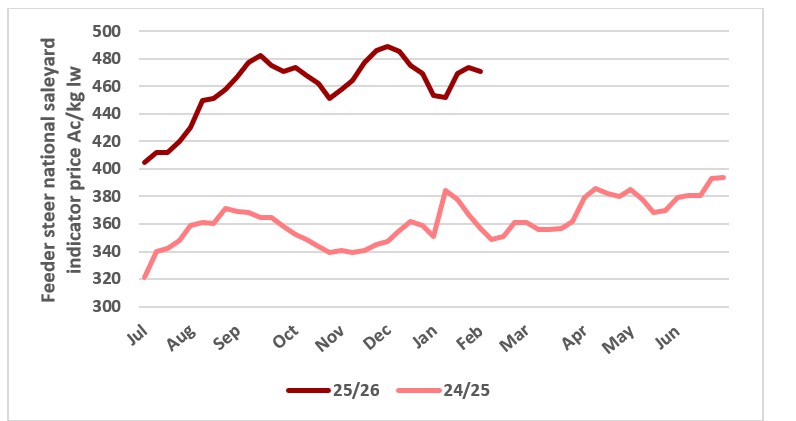

Feeder prices stabilise as final run of northern cattle hit market

Tightening seasonal conditions and very hot weather from Tambo across to Rockhampton in Queensland and all the way to South Australia has taken a toll on the feeder cattle market, which has adopted a more cautious tone in the past couple of weeks. A lift in supply as operations moved back into full swing after Christmas/New Year period and a sharp lift in the Australian dollar combined with news of the Chinese import restrictions have seen feeders take stock.

Some have cautioned that the market is only a good rain away from firming again with longer-term demand dynamics in favour of strong demand for grain-fed beef and hence feeder cattle demand (see above discussion around falling numbers of US cattle on feed).

Feedlot buyers were quoting +400kg flatback feeder steers on the Darling Downs between 475 to 495c/kg lw – about 20c/kg lw less than pre-Christmas rates.

Southern Angus feeder prices have taken a 20 to 30c/kg lw hit in the past fortnight, with feeder steers quoted between 470 to 490c/kg lw while southern crossbred steers (no indicus) were being quoted about 460c/kg lw.

Saleyard rates have held up better with the national saleyard indicator around 470c/kg lw and just below its year high of 490c/kg in November.

China’s beef import restrictions are still causing some uncertainty in the feeder market, with feedlot operators adopting different strategies. Several mid-fed Angus programs have been ditched, and many have dropped their premiums for HGP-free cattle.

The uncertainty associated with the Chinese market has encouraged yard operators to pursue EU-accredited feeder cattle to target European markets. Premiums for EU accredited feeder steers above Angus have increased to 20c/kg lw since the China announcement.

There has been some discussion between Australian exporters and Chinese importers about sharing the burden of the above quota tariff, presumably on cattle locked into long feeding programs and likely to exit feedlots and enter China after mid-year when the quota tariff is likely to be triggered.

Feeder rates under pressure

A combination of increased supply and some tightening in feedlot margins owing to a firmer Australian dollar has seen feedlot operators take a more cautious approach and has seen some rates under pressure.

Long-term underlying demand dynamics remain favourable and most anticipate a bounce in feeder prices on any significant widespread rain event.

This chart shows the national saleyard indicator price for feeder steers in 24/25 and 25/26. Source: MLA

This chart shows the national saleyard indicator price for feeder steers in 24/25 and 25/26. Source: MLA

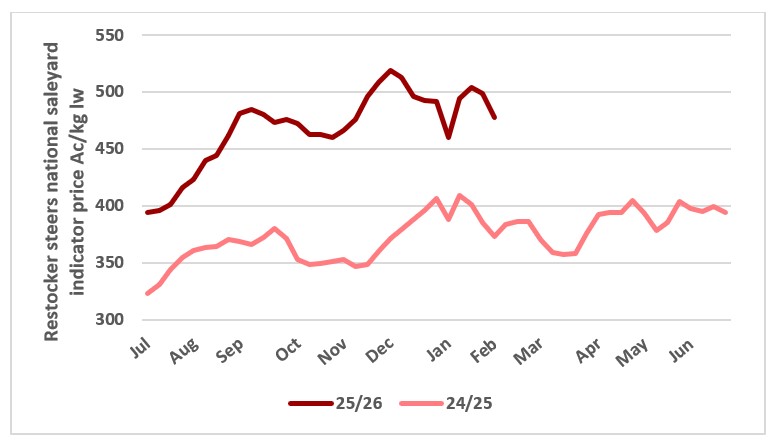

Restocker confidence solid, but tentative

A review of the southern weaner sales provides a good insight into the state of restocker demand. Weaner weights were up by 15 to 20kg after a good late spring which followed a tough autumn and winter.

Steers across all weight ranges made from $5 to $6/kg lw with a tight spread of pricing across breeds and weight ranges. The was little in distinct breed-based price variance with Hereford and British X cattle all selling well to be the equivalent or only 10 to 15c/kg lw less than straight Angus. Weaned EU accredited steers were keenly sought by processors, feedlots and bullock fatteners and generally sold to +20c/kg lw premium over other cattle types.

In contrast to last year, a good proportion of the southern weaner offering sold to local backgrounders (Gippsland, the Western District of Victoria and south-east SA) hoping to take advantage of the turnaround in the season. Northern buyers were active in sales around the NSW/Victorian border, but freight costs prevented Queensland orders from getting a look in further south.

Heifers performed well and sold much closer to steers than they did last year with somewhere between $4.50 to $4.70/kg lw paid to buy decent runs.

In the past few weeks, restocker cattle markets have lost momentum as the weaner sales wrapped up and as conditions turned progressively hotter and dryer.

Restocker markets lose momentum

Hot and dry weather through January has impacted restocker cattle demand with prices falling sharply the past fortnight.

Areas south of central Queensland and through most of NSW and northern Victoria have endured a prolonged dry spell since late last year which has taken its toll on restocker activity.

This chart shows c/kg lw national saleyard indicator price for restocker steers in 24/25 and 25/26. Source: MLA

This chart shows c/kg lw national saleyard indicator price for restocker steers in 24/25 and 25/26. Source: MLA

From the rails

Read what Elders livestock representatives from around Australia are saying about the markets in their regions.

“Just heading from Rockhampton down to Charleville and it's good to see the country south of us is very good. We've had good rain through the north.”

“Interesting that the processors are expecting some southern competition sooner than later.

“Tending to see better prices at the smaller sales like Claremont and Murgon compared to Gracemere and Emerald. Flatback crossbred feeders seem to be making between $5 to 5.40/kg lw at the small sales while the same steers might average $5/kg lw at the bigger sales.

“Feedlots are trying to ease the feeder job but $4.80 to 4.85/kg lw Downs is not buying any cattle with saleyards holding an edge $4.80 to 5.10/kg lw.

“Restocker weaners start from $5/kg but there's not a lot of them coming through and mostly second class. Any good weaners are still making $5.50 to 6/kg lw but they are hard to find.

“Heifer job starting to get subdued again, though good in places, it's hard to read.

“Central all the way north and across to the coast is good. But the west from Augathella to the border is ordinary and in need of rain. There is a good system in the forecast, so here’s hoping the west gets some to kick start their season and the rest of Queensland gets some follow-up.”-Chris Todd, Branch Manager Western and Central Queensland.

QLD saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

| Heavy steer | 456 | 433 (+23) | 438 (+18) | 341 (+115) |

| Processor cow | 363 | 366 (-3) | 355 (+8) | 268 (+95) |

| Feeder steer | 481 | 472 (+9) | 477 (+4) | 367 (+114) |

| Restocker steer | 507 | 496 (+11) | 494 (+13) | 402 (+105) |

| Restocker heifer | 403 | 403 (n/c) | 413 (-10) | 304 (+99) |

Source: MLA

“Tamworth had a stand-alone Elders feeder cattle sale, 6,000 cattle one agent. Very hot but the sale was pulled forward, and they were all sold in three hours, all big lines. Virtually every steer had a five in front of it, except for British X feeders that sold for $4.85 to 4.95/kg lw.”

“The first lane started at 515kgs down to about 400kgs and they all sold for a bit over $5/kg lw. They all had a 5 and not much over 5, rock-solid right through $5.30/kg for EU black weaners.

“Heifers were the surprise, heavy heifers, $4.50 to 4.75/kg lw and lighter heifers between $4.30 to 4.40/kg lw.

“They sold like hotcakes, good buyer turnout with plenty of feedlots and professional backgrounders in that area.” - Peter Homann, National Livestock Manager.

NSW saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

Heavy steer | 435 | 433 (+2) | 412 (+23) | 330 (+105) |

Processor cow | 360 | 363 (-3) | 379 (-19) | 270 (+90) |

Feeder steer | 461 | 466 (-5) | 450 (+11) | 346 (+115) |

Restocker steer | 447 | 443 (+4) | 440 (+7) | 349 (+98) |

Restocker heifer | 390 | 384 (+6) | 427 (-37) | 274 (+116) |

Source: MLA

“Limited sales here last week due to the heat. I don't ever, ever remember Naracoorte being cancelled, but it was about 48 degrees that day.”

“Mount Gambier did go ahead, and everything was dearer, which reflected the lower numbers on offer last week due to the heat more than anything else.

“At the most recent weaner sales across the south-east, backgrounding calves were $4.60 to 5.20/kg lw with some good lighter EU types around 260kgs that sold to $5.30 to 5.60/kg lw.

“Heifers were $4.40 to 4.80/kg lw with restocker heifers going back to a bull out to $5.10/kg lw. Good heavy feeder steers were in the high $4’s/kg lw and your feeder heifers were bringing $4.50 to 4.60/kg lw for the best of them.

“All in all, it's business as usual. We have beef field days coming up this weekend, which sort of commences stud season and we will be flat out with bull sales on every corner for the next 2 to 3 weeks. But here’s hoping to a bit of a softer week weather wise.” - Laryn Gogel, Livestock Sales Manager, South Australia.

SA saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

Heavy steer | 458 | 460 (-2) | 450 (+8) | 340 (+118) |

Processor cow | 372 | 395 (-23) | 394 (-22) | 264 (+108) |

| Feeder steer | 439 | 466 (-27) | 438 (+1) | 327 (+112) |

| Restocker Steer | 429 | 460 (-31) | 418 (+11) | 299 (+130) |

Restocker heifer | 406 | 407 (-1) | 333 (+73) | 228 (+178) |

Source: MLA.

"The cattle job is still humming on quite nicely on those farm assurance program type cattle that are still sitting around $8.70 to 8.80/kg dw direct to works. They've been desperately trying to pull it back, but the numbers aren't quite allow allowing them to do that.”

“Straight to the abattoir good cows are $7.60 to 7.80/kg and that nearly buys everything with a bit of condition or weight.

“Back to the paddock weaner calves are $5.50 to 5.60/kg lw for steers with a bit of weight and quality. Heifers are $4.70 to 4.80/kg lw for those better standard types. Good black heifers making $5 to 5.20/kg lw and anything not black you can take off 20 to 30c/kg lw.

“Overall going very nicely, it a true January. The state's drying out, had a lot of wind and had a bit of weather come through over the weekend which brought temps down to 12 to 13 degrees. But that's Tasmania.” - Gavin Coombe, State Livestock Manager, Tasmania.

TAS saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

| Heavy Steer | 438 | 419 (+19) | 395 (+43) | 293 (+145) |

| Processor cow | 357 | 359 (-2) | 353 (+4) | 267 (+90) |

Source: MLA.

Victoria/Riverina

“Southern weaner sales have been satisfactory all things considered. Results got a bit better as they progressed and moved from the north-east to the Western District and across to Gippsland. Most of these weaners were bought by local backgrounders and will stay at home which is a change from the last few years. Prices ranged from $5 to 6/kg lw consistently.”

“There is still a good body of feed through most cattle areas of Victoria, but it thins out as you head north into the Riverina, with particularly the eastern Riverina feeling the pinch. Stock water will be the major issue, and this combined with some very hot days and dry medium-term weather forecasts, have tempered market enthusiasm. We have the Ballarat weaners sales to go over the next couple of weeks before we move into the mountain calf sales in March.

“While there is likely to be more heavy cattle around Victoria than the last couple of years, many herds have been trimmed significantly so numbers of heavy slaughter weight cattle will again be limited this year across Victoria and the Riverina.” - Nick Gray, State Livestock Manager Victoria/Riverina.

VIC saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

| Heavy steer | 455 | 449 (+6) | 466 (-11) | 343 (+12) |

Processor cow | 375 | 378 (-3) | 404 (-29) | 269 (+106) |

Feeder steer | 442 | 440 (+2) | 474 (-32) | 304 (+138) |

Restocker steer | 414 | 426 (-12) | 442 (-28) | 291 (+123) |

| Restocker heifer | 375 | 401 (-26) | 435 (-60) | 264 (+111) |

Source:MLA

“We had our first bull sale last week with Lawson Angus sale kicking off last Friday. They sold 78 out of the 84 head to average out at $10,314 with a top price of $40,000. The remainder of the bulls sold post sale. Prices were up $1875 on last year’s average; the vendors were very happy. Being one of the first sales it has given confidence in the up-and-coming bull sales.”

“Feeders have come back slightly on last year, heifers ranging from $3.20 to $4.15/kg lw to average $3.72/kg lw, and steers ranging from $3.40 to $5.42/kg lw to average $4.55/kg lw. A mixture of feed lotters and graziers purchasing.

“Prices at the abattoirs, over the hooks are very much the same as pre-Christmas at $7.00/kg cw for heavy steers and $6.60/kg cw for cows. The supermarkets currently are sitting on $8.50/kg cw.

“Restockers are back into full swing. Numbers are very strong throughout the sale yards. Good Angus breeding heifers are making between that $1400 up to about $1800/head.” - Michael Longford, Livestock Sales Manager, Western Australia.

WA saleyard market indicators c/kg lw | ||||

| 05/02/26 | +/- week | +/- month | +/- year |

Heavy steer | 356 | 358 (-2) | 340 (-16) | 276 (+80) |

Processor cow | 313 | 311 (-2) | 320 (-7) | 212 (+101) |

Feeder steer | 398 | 372 (+26) | 396 (+2) | 281 (+117) |

Restocker steer | 366 | 355 (+11) | 244 (+122) | 176 (+190) |

Restocker heifer | 343 | 303 (+40) | 298 (+45) | 233 (+110) |

Source: MLA.

*Disclaimer – important, please read:

The information contained in this article is given for general information purposes only, current at the time of first publication, and does not constitute professional advice. The article has been independently created by a human author using some degree of creativity through consultation with various third-party sources. Third party information has been sourced from means which Elders consider to be reliable. However, Elders has not independently verified the information and cannot guarantee its accuracy. Links or references to third party sources are provided for convenience only and do not constitute endorsement of material by third parties or any associated product or service offering. While Elders has exercised reasonable care, skill and diligence in preparation of this article, many factors including environmental/seasonal factors and market conditions can impact its accuracy and currency. The information should not be relied upon under any circumstances and, to the extent permitted by law, Elders disclaim liability for any loss or damage arising out of any reliance upon the information contained in this article. If you would like to speak to someone for tailored advice specific to your circumstances relating to any of the matters referred to in this article, please contact Elders.