Harvest is mostly complete across Australia, with some unseasonably wet conditions lingering in the eastern and central states, while it remains dry in the west. For more detailed forecasts in your region, visit Elders Weather.

There are good premiums available for certain commodities and grades as now all eyes look towards other grain-producing countries who are having unseasonably hot and dry conditions.

Read on for more on local conditions from our Technical Services Managers and catch up on the latest grain price movements from Clear Grain Exchange (CGX).

From the field

"Broadacre harvest is finished in Western Australia.

“It has been dry, windy and hot so there is very little summer spraying or any other activity going on. We are seeing a normal summer for the WA agricultural regions.”

Bill Moore, Elders Technical Services Manager, Western Australia.

“Summer rainfall has continued into Jan 2024 with 15 to 80mm across much of the state, to top up the already above average rainfall in November and December.

“Eastern Eyre Peninsula, YP, and the Mallee had the most significant rainfall events of 100 to 200mm and the Naracoorte region getting constant thunderstorms, which have interrupted harvest and downgraded much of the cereals down to feed quality.

“The summer rains have provided confidence in the low to mid rainfall zones to maintain canola and pulses in their rotation and the improved varieties herbicide tolerances for this environment such as Hyola Battalion XC canola with the Clearfield and Truflex traits, and the new GIA Thunder, Leader and Lightning imi-tolerant lentils.

“Summer weeds and self-sown winter crops ha vealready seen at least one nonselective herbicide knockdown prior to Christmas and the cool weather has been conducive to good spraying conditions. The main summer weeds, have been fleabane, heliotrope, sow thistle, prickly lettuce and any other random thistle along with melons, wireweed, convulvulus, pigweed etc.

“In some regions it was a surprise to how much self-sown cereal and pulses, mainly lentils, germinating in the stubble indicating a high percentage of lost grain from wind or potentially the harvest operation, and livestock didn’t really get a chance to pick up any grain prior to the rains which may contribute to the observation.

“Hopefully growers can get across their paddocks and control many of these self-sown crops to reduce any foliar disease carryover, but there will be likely green bridges on fence lines and creeks what will be hosting pests and diseases for the upcoming winter crop.

“The summer rain has also highlighted some of the benefits of products used in the winter crop such as Overwatch controlling fleabane in the summer phase, which will be a focus of our agronomy team over summer on the previous crop’s herbicide impact on summer weed.

“The traditional herbicides for summer weeds such as the glyphosate range, Tricloypyr (Garlon) and Fluroxypyr (Starane) have been in high demand and some adjuvants and water conditioners such as SOA having been under supply pressure, but the likes of 24D Aminne, Esters, paraquat and Group 14 spikes such as Carfentrazone supply has been sufficient. It will be important to keep close to your local store to make sure you have supply for the most efficacious products for your weed spectrum.

“New products, such as the improved Nufarm Amicide Advance sister Dropzone are welcomed to the market to improve off target issues with its formulation improving the optimal droplet range of 150 to 720 micron and helping in the speed of uptake, data also indicating the mixing partner is also benefiting from Dropzone formulation which also has a low odour compared to other 24D formulations.

“Our agronomy team will be attending the GRDC updates in Adelaide on 6 to 7 February, and will sharing in the latest research our grain industry has to offer. We look forward to kicking off the 2024 season with some normal summer weather.”

Lyndon May, Elders Technical Services Manager, South Australia.

Stand-off in gran markets

Nathan Cattle, Managing Director for Clear Grain Exchange shares his thoughts on the current grain market and what’s been happening on the exchange.

A stand-off has emerged in grain markets early in the New Year.

Buyers have lowered their bid prices over recent weeks, and growers have generally been reluctant to follow them all the way lower.

The pull back in bids has been more significant in the eastern states as the drought premium that existed in northern areas has eroded given rains are generating grass growth, summer crop plantings and moisture for this year's winter crops.

Some harvest quality concerns have also seen buyers pull bids back as they assess crop quality.

WA prices were holding relative to the rest of the country, but buyer bids have also pulled back more recently.

Growers are returning from the festive period and questioning the pull-back, most appear reluctant to follow it lower and are rightly creating their offer price so buyers can see where they would sell.

Growers have a say in the price and are now offering grain for sale in volume at prices they would sell at. This provides a price signal to buyers as to what price they can buy volume.

Whilst buyers have pulled their bids back, they continue to search and look at parcels of grain offered for sale.

Demand for grain remains. The amount of grain that will be exported and consumed domestically this year has not yet been bought.

For growers with off-spec and lower grades of grain, remember Australia does not produce enough feed grain for its domestic use let alone the growing offshore feed grain demand.

Hence typically many lower grades of wheat will trade at ASW1 values at some stage after harvest.

With this in mind, ASW1 becomes an important price indicator for many growers with grain.

What is ASW1 wheat worth?

Just before Christmas US soft red winter wheat (similar quality to Australian ASW1 wheat) was trading in volume into China, and in the New Year there are rumours they’re in the market for more.

Quoted US export values for soft red winter wheat at time of writing equate back to approximately A$405-410/t FIS in WA and A$375-380/t Track in eastern Australia for ASW1 type wheat.

Recent traded prices for Australian APW1 and ASW1 wheat have been A$410/t and A$400/t FIS respectively in WA, and A$375/t and A$360/t Track respectively in eastern Australia.

If you have grain in warehouse - you can offer it for sale at your price on Clear Grain Exchange, no matter what grade it is or where it is – what have you got to lose?

If you have grain stored on farm - you can offer it for sale on igrain!

Let’s get as many buyers as possible trying to buy Australian grain from growers. You can influence this by OFFERING your grain for sale so they can all see it and try to buy it.

Login to your CGX or igrain accounts to see more price information and what’s traded.

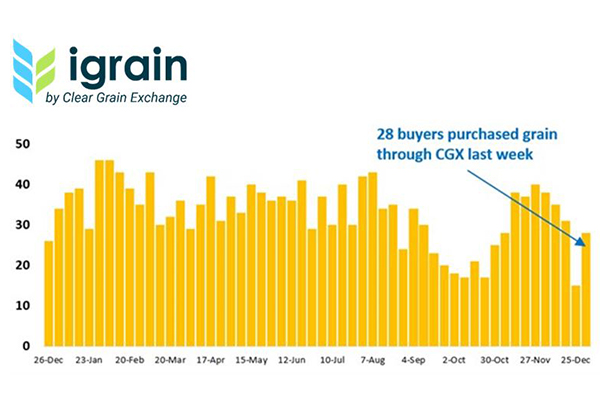

28 buyer businesses purchased grain through Clear Grain Exchange (CGX) last week. Australian grain remains competitive internationally and so continues to attract plenty of buyers. When looking to sell grain, ensure you offer it for sale rather than selling into published bids.

28 buyer businesses purchased grain through Clear Grain Exchange (CGX) last week. Australian grain remains competitive internationally and so continues to attract plenty of buyers. When looking to sell grain, ensure you offer it for sale rather than selling into published bids.

Market indicators

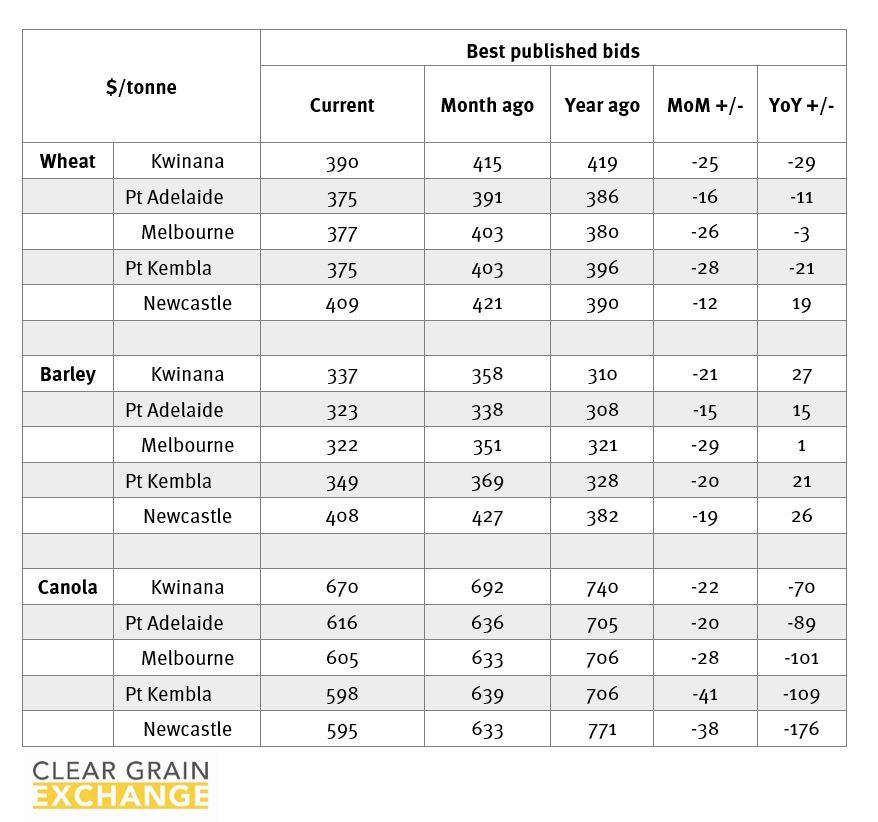

Table shows best published bids and actual traded grain prices from Clear Grain Exchange. Sources - Clear Grain Exchange

Table shows best published bids and actual traded grain prices from Clear Grain Exchange. Sources - Clear Grain Exchange

Want to control the selling price of your grain?

Clear Grain Exchange (CGX) is a secure and independent online exchange that allows you to set a price for your grain and market to all buyers.

It’s free to register and offer your grain at your price, pay nothing until your grain is sold.

To register or find our more contact click here or call 1800 000 410

“The best thing about CGX is you set your own price. I sell wheat and barley through CGX and usually achieve above the market value as advertised in the current market”

Jeff Burgess, grain grower, South Australia

Learn more about Jeff's experience with Clear Grain Exchange.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.

/cropping_landscape.jpg)