Local supplies drive sheep and lamb prices

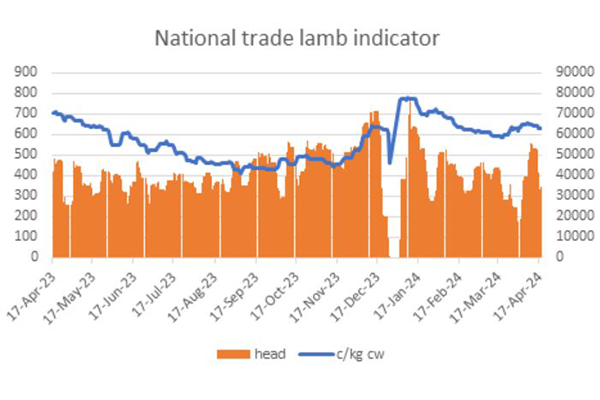

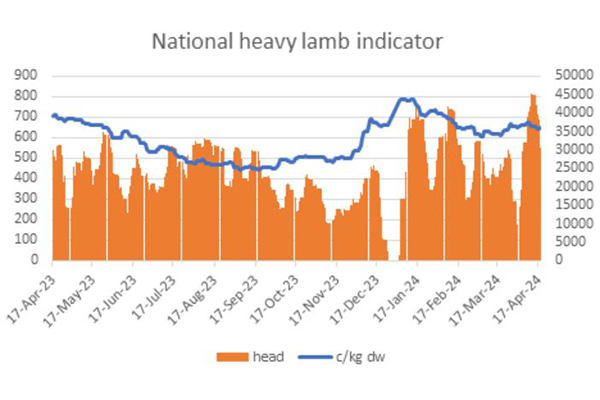

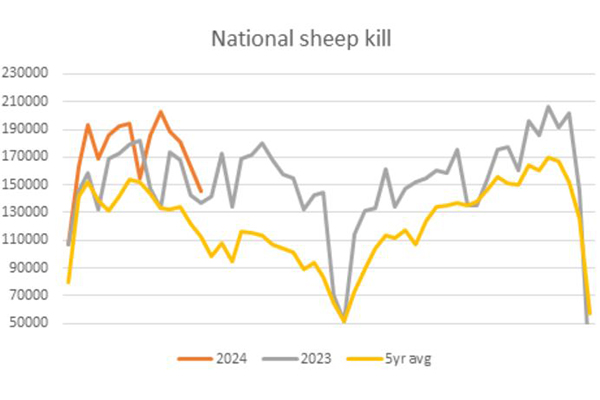

Although lamb prices recovered the past month, they remain weighed down by large supplies. Lamb slaughter remains unseasonably high and well above the 5 year average. Reports indicate that some restocker and feeder demand was evident for good quality trade lambs, particularly in New South Wales and Victoria to feed on for heavier export weights.

Supplies should start to ease as we head into winter, however, the spring promises another large lift in supplies. MLA is expecting lamb production to peak this year. Hopefully, the lower prices are buying lamb some local demand.

The absence of live sheep demand and tight seasonal conditions across Western Australia necessitating turnoff of sheep and lambs has seen a large differential between WA and east coast sheep and lamb prices to the extent that trucking east is working.

As we publish this report, first markets this week have seen lighter Muslim kill (MK) lambs destined for Middle Eastern markets back $20 to $40 per head on concerns over air freight as a result of the Iran/Israeli conflict. Heavy lambs destined for North American markets have held their value or were even a little stronger.

Trade lamb indicator c/kg lw

| 18 April | +/- week | +/- month | +/- year | |

| QLD | 630 | + 135 | + 98 | - 26 |

| NSW | 638 | - 19 | + 43 | - 56 |

| VIC | 627 | - 17 | + 35 | - 92 |

| TAS | 601 | - 8 | + 30 | - 77 |

| SA | 579 | - 34 | + 56 | - 139 |

| WA | 481 | - 23 | + 26 | - 49 |

Table shows trade lamb indicator. Source: MLA

Graph shows national trade lamb indicator.

Graph shows national trade lamb indicator.

Graph shows the national heavy lamb indicator.

Graph shows the national heavy lamb indicator.

Heavy lamb indicator c/kg lw

| 18 April | +/- week | +/- month | +/- year | |

| NSW | 641 | + 28 | + 14 | - 66 |

| VIC | 665 | + 2 | + 63 | - 48 |

| SA | 650 | - 6 | + 89 | + 7 |

Table shows heavy lamb indicator. Source: MLA

Restocker lamb indicator c/kg lw

| 18 April | +/- week | +/- month | +/- year | |

| NSW | 543 | - 82 | - 13 | - 71 |

| VIC | 528 | - 66 | - 28 | - 93 |

| SA | 540 | + 60 | + 114 | - 31 |

| WA | 271 | - 4 | - 45 | - 65 |

Table shows restocker lamb indicator. Source: MLA

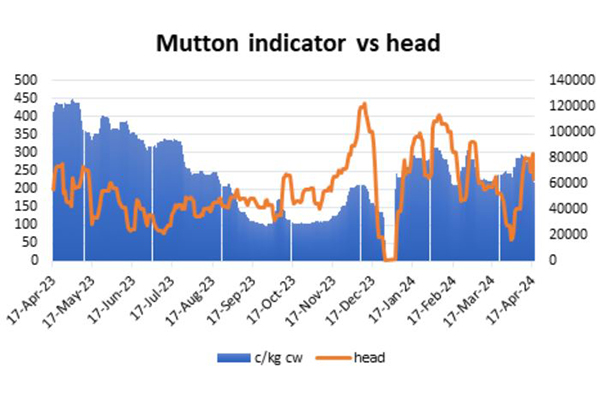

Sheep prices supported by a seasonal easing in supply

Buyers were reluctant to pay over $100 per head for any sheep regardless of weight. This has seen the recent rally in sheep prices run out of steam. The $10 to $20 per head pullback in values at recent sales could be related to concerns over freight routes into the Middle East. A seasonal decrease in supply should lend support to mutton values over the next few months.

Graph shows mutton indicator versus head.

Graph shows mutton indicator versus head.

Sheep indicator c/kg lw

| 18 April | +/- week | +/- month | +/- year | |

| QLD | 129 | - 53 | - 70 | - 210 |

| NSW | 236 | - 67 | - 8 | - 140 |

| VIC | 235 | - 57 | - 5 | - 230 |

| SA | 243 | + 52 | + 89 | - 197 |

| TAS | 218 | + 13 | + 48 | - 165 |

| WA | 71 | - 11 | - 15 | - 149 |

Table shows sheep indicator. Source: MLA

Graph shows national sheep kill for 2023, 2024 and a five year average.

Graph shows national sheep kill for 2023, 2024 and a five year average.

Anzac Day to dull processor demand

Anzac Day next week will end the run of short processing weeks in April. If you are considering selling cattle in the leadup, make sure you speak to your local Elders agent to get an idea of processing schedules in your local area as it could impact processing demand.

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.