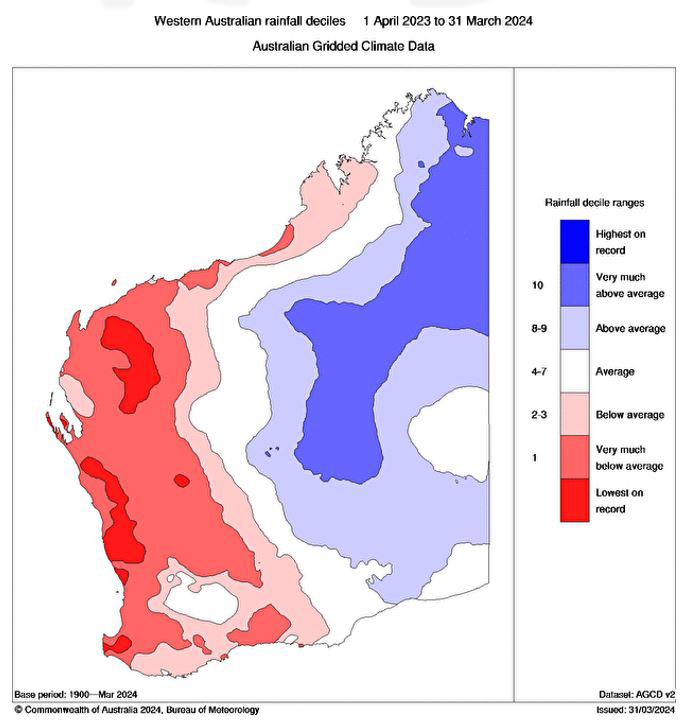

Parts of the great southern, south-east and south-west Western Australia have only recorded 5mm since last August.

To illustrate how widespread the dry has been, Denmark which is a 447mm rainfall area has run out of water. The unprecedented dry has decimated stock water supplies and feed reserves.

Chart shows Western Australian rainfall deciles. Source: BOM.

Chart shows Western Australian rainfall deciles. Source: BOM.

Traditionally very safe and often wet areas of the WA south-west and Great Southern, endured a very dry spring. These are key hay growing regions and WA hay yields and production were thrashed by 50 per cent. In response to this and declining water reserves, WA growers have been offloading stock with increasing urgency since late spring. WA sheep meat processors continue to be booked up to 5 to 6 weeks in advance.

The dry season in south-east Australia and the high cost of grain has also limited normal feeder demand for light WA lambs from both the east coast and WA feeders. Elders WA field staff are noting that these lambs (less than 40 kg) are particularly difficult to place.

There are two small shipments (20,000 to 30,000 head) to the Middle East (ME) scheduled for late May before the moratorium. With the moratorium on live sheep exports set to kick in June 1 through to mid-September, this will shut down this market for WA sheep and lambs.

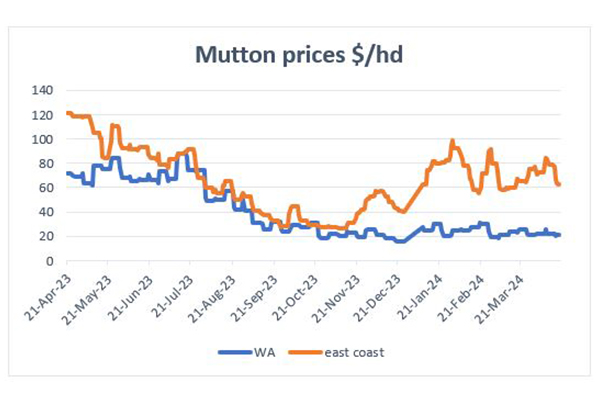

WA sheep prices have been falling since last spring with the WA mutton indicator around $20 per head after this week’s sales at Muchea and Katanning, about one-third of the value that similar sheep sold for at sales in Victoria this week.

Graph shows mutton prices for WA versus the east coast.

Graph shows mutton prices for WA versus the east coast.

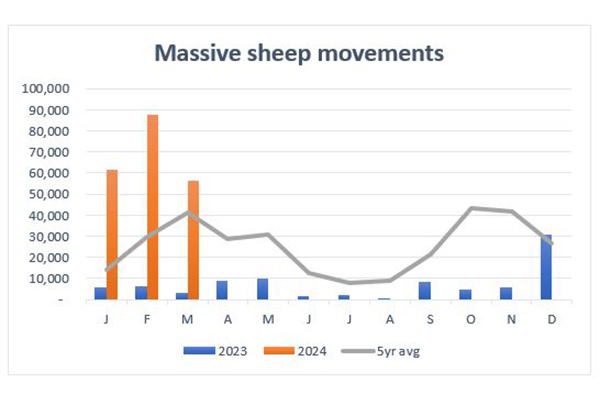

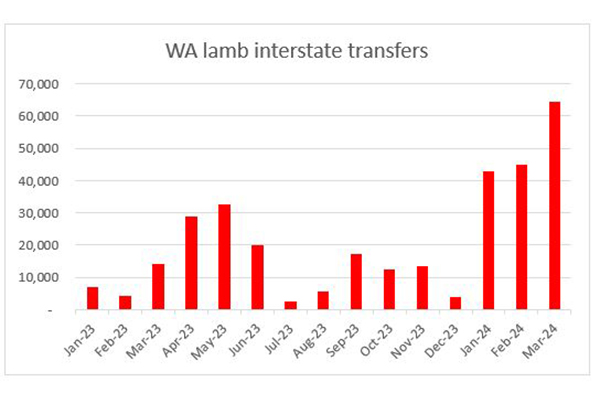

Up until the last week, the west to east coast trade was working with WA sheep costing $20 per head landing on the east coast for $50 to 60 per head, providing a $10 per head margin. This has seen massive movements of sheep to the east coast in the early part of 2024. This level of interstate transfer has not been witnessed since 2020 when nearly 1 million head (70,000 per month) were moved from WA to the east coast.

Graph shows sheep movements for 2023, 2024 and across a five year average.

Graph shows sheep movements for 2023, 2024 and across a five year average.

East coast sheep markets (light lambs and mutton) took a buffeting this week from disruptions to air freight routes into the ME as a result of the Iran/Israel conflict. This saw light lambs suitable for the mk (muslim kill) trade into the ME down between $20 to 40 per head.

WA producers will be hoping that a seasonal slow-down in supplies aids a recovery in east coast sheep prices to restore the margin for the east coast west coast trade.

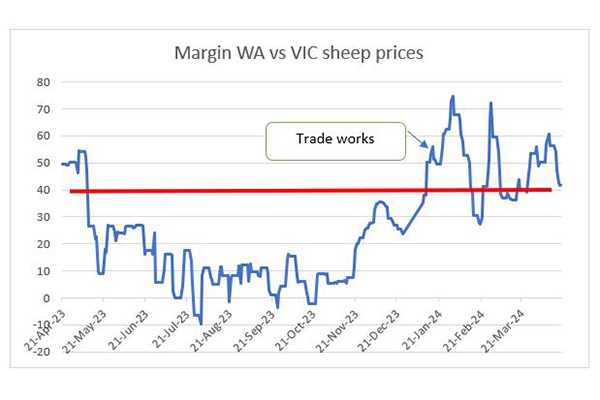

Graph shows WA versus Victorian sheep prices.

Graph shows WA versus Victorian sheep prices.

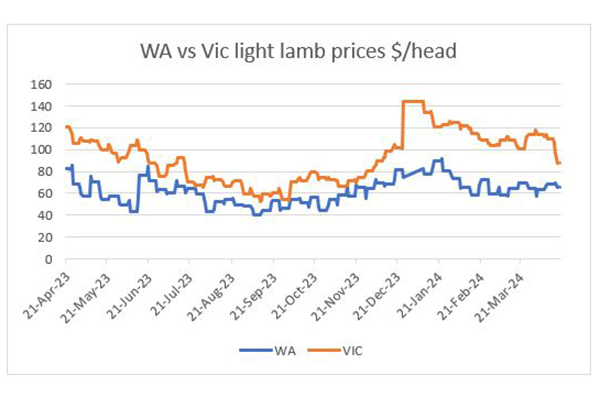

The margin between lamb prices between WA and Vic has fallen from around $50 per head to around $20 per head. This may act to start to reduce the heavy movement of lambs out of WA witnessed through the first quarter of 2024.

Graph shows West Australian versus Victorian light lamb prices.

Graph shows West Australian versus Victorian light lamb prices.

Graph shows margin WA versus Victorian sheep prices.

Graph shows margin WA versus Victorian sheep prices.

Graph shows WA lamb interstate transfers over time.

Graph shows WA lamb interstate transfers over time.