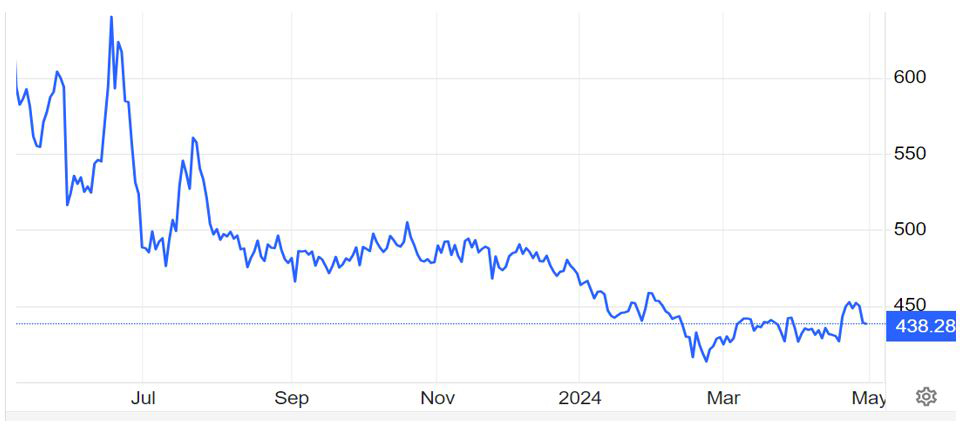

Domestic grain prices have rallied $10 to 30 per tonne in the past month driven by concerns about global wheat supplies. Over the same time, the CBOT wheat futures contract increased by 10 per cent (A$50 per tonne), snapping a 4-month downtrend.

CBOT Wheat Futures USc/bu

This chart shows the price of Chicago Board of Trade (CBOT) wheat futures contracts in USc/bu.

This chart shows the price of Chicago Board of Trade (CBOT) wheat futures contracts in USc/bu.

The northern hemisphere spring (March-May) determines the fate of around 80 per cent of all global grain production and can be a period of heightened grain market volatility. This year appears to be no different with concerns emerging on several fronts:

- Mainland Europe has been too wet and cold, reducing planted area and raising the prospects of crop abandonment (lowest crop ratings in 4 years),

- In contrast, southern Russia (accounting for 30 per cent of the Russian wheat crop) has been too dry with little spring rain so far,

- Parts of the US wheat-belt are too dry, and

- Planting conditions remain sub-optimal across SA and WA.

Also at play were market concerns over renewed Russian attacks on Ukraine grain market infrastructure and talk that India may begin importing wheat for the first time since 2017.

With a large fund short and limited grower selling (most nth hemisphere old crop has been committed), wheat futures are sensitive to the upside. However, to sustain the current rally, global crop conditions would need to worsen, putting at risk new crop supply.

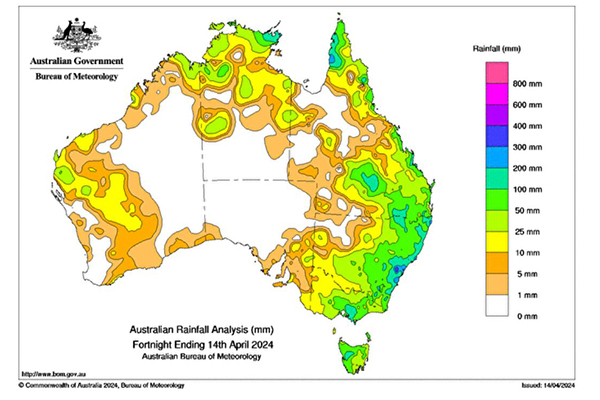

This chart shows rainfall across Australia during April.

This chart shows rainfall across Australia during April.

Australian growers have been busy planting. Across most of the east coast, crops will be planted into almost ideal conditions, but central and western Victoria and parts of central and south-west NSW are too dry (although rain forecast this week may help). Thoughts are that there will be increased chickpea and lupins plantings, given relative prices, as they work back into crop rotations after large cereal programs the last few years.

The rally in wheat prices has been met by some farmer selling on the east coast, as they become more comfortable about new season supplies. The largest price rises have been in northern markets with most activity for deferred delivery.

Feed Wheat A$/t

This chart shows feed wheat prices in A$ per tonne delivered to Darling Downs QLD. Source: Dairy Australia.

This chart shows feed wheat prices in A$ per tonne delivered to Darling Downs QLD. Source: Dairy Australia.

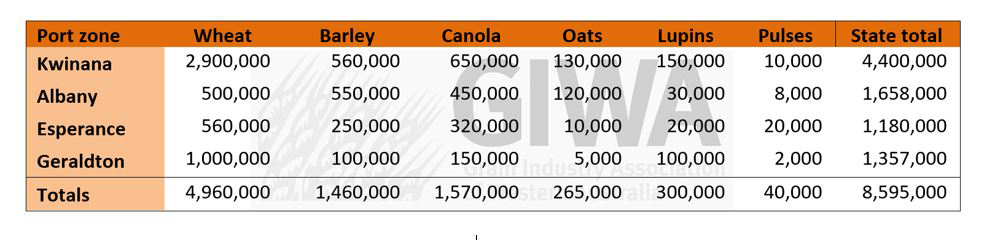

In SA and WA growers are dry sowing. Thoughts are that only 50 per cent of canola will be dry sown with the balance of plantings to occur if they receive a good season break. The expected 10 per cent increase in WA cropping area may be tempered by the season. Oats and lupins will make up a greater proportion of cropping programs this year due to stronger relative prices, although a drop in the ocean compared to planting losses on canola if we don’t receive an early break.

Feed grains

Strength in wheat futures hasn’t flowed across to corn futures with prices tempered by grower selling and a solid planting pace across the US corn belt.

Locally, feed barley followed wheat higher, however, the sorghum rally ran out of steam as harvest supplies increase and the crop escaped further downgrading.

Lachstock Consulting reports that he price spread between barley and wheat has narrowed significantly compared to historical values reflecting strong export pace, a tightening balance sheet and continued demand from both exporters and end users. The Barley S/D is tight with growers continuing to hold at current values. Prices will push higher the longer it stays dry in WA, SA and VIC as growers remain cautious sellers.

CBOT Corn USc/bu

This chart shows the price of Chicago Board of Trade (CBOT) corn futures contracts in USc/bu. Source: Chicago Board of Trade.

This chart shows the price of Chicago Board of Trade (CBOT) corn futures contracts in USc/bu. Source: Chicago Board of Trade.

Canola

Local canola prices have improved $20 to 30 per tonne over the month, despite mixed international oilseed price signals. Uncertainty over crop conditions in the EU and the size of Ukraine planted area are being offset by improved conditions in Canada and the rapidly progressing South American soybean harvest.

CBOT soybean futures USc/bu

This chart shows the price of Chicago Board of Trade (CBOT) soybean futures contracts in USc/bu

This chart shows the price of Chicago Board of Trade (CBOT) soybean futures contracts in USc/bu

Lachstock Consulting think the recent lift in local prices and improved sentiment due to the rain may lead to more canola being planted than expected across NSW and VIC.

Chickpeas

A pause in India’s import tariffs accounted for solid export movement in recent months. The end of the duty-free movement has been pushed back a few times already, but tariffs are set to go back into effect at the end of June. The trade is optimistic for another extension, but it remains to be seen what India will do.

New crop pricing has not seen the same strength as old crop, but a move by India to extend duty free pea movement beyond the end of June would push that demand into new crop territory, which would likely support yellow pea prices.

Elders’ market view

The latest rally and increased price volatility associated with the northern hemisphere spring is a good opportunity for east coast growers to price some old crop grain ahead of Graincorp storage charges kicking in 30 June.

Last week a record 55 different buyers met grower offer prices to purchase grain through Clear Grain Exchange, an independent and secure online exchange for transacting grain. Additionally, there were another 64 buyers searching for grain with more than 10,000 searches for grain made. Buyer activity is indicative of strengthening demand and prices for grain in Australia.

An effective selling method for Australian growers is to offer their grain for sale at the price they want on CGX if in warehouse, or igrain if stored on farm. This way all buyers can see it and try to buy it, and ensures growers get full value for their grain on the day. CGX also offers secure settlement.

If you would like to list your grain for sale on GCX please email elders@cgx.com or call 1800 000 410.

| 2 May | +/- Week | +/- Month | |||

| $A/$US | 65.19 | 64.21 | 65.35 | ||

| FUTURES | $A/t | CBOT Wheat | 557 | + 56 | + 54 |

| CBOT Corn | 266 | + 4 | + 9 | ||

| CBOT Soybean | 655 | + 6 | - 15 | ||

| Matif Canola | 727 | - 21 | - 5 | ||

| WHEAT | PORT | QLD | 388 | + 13 | + 23 |

| NSW | 363 | + 9 | + 16 | ||

| VIC | 348 | + 18 | + 24 | ||

| SA | 355 | + 13 | + 21 | ||

| WA | 395 | + 5 | + 10 | ||

| DEL | Goulburn Valley | 340 | + 10 | + 20 | |

| Riverina | 344 | + 12 | + 19 | ||

| Downs | 403 | + 16 | + 30 | ||

| BARLEY | PORT | QLD | 392 | + 2 | + 15 |

| NSW | 355 | + 5 | + 20 | ||

| VIC | 320 | + 5 | + 15 | ||

| SA | 308 | + 5 | + 10 | ||

| WA | 352 | +2 | + 5 | ||

| DEL | Goulburn Valley | 340 | + 8 | + 20 | |

| Riverina | 340 | + 8 | + 20 | ||

| Downs | 403 | + 3 | + 53 | ||

| CANOLA | PORT | QLD | - | - | - |

| NSW | 660 | + 10 | + 18 | ||

| VIC | 660 | + 12 | + 20 | ||

| SA | 660 | + 15 | + 21 | ||

| WA | 710 | + 10 | + 25 | ||

| SORGHUM | PORT | QLD | 357 | + 2 | + 14 |

| NSW | 358 | + 8 | + 9 | ||

| DEL | Downs | 355 | + 5 | + 5 | |

| Nth NSW | 350 | + 8 | + 7 | ||

| PEAS | PORT | QLD | 880 | n/c | - |

| NSW (Faba Beans) | 470 | n/c | - |

Source: Trade bids

Agronomy Update

Planting of pulses, canola and cereals has commenced across the Vic and southern NSW grain belts. Although there are reasonably good levels of subsoil moisture, topsoils are too dry and the crop will need moisture to ensure good germination.

Cotton harvest is underway across NSW with good results given the difficult start. Sorghum harvest is 90 per cent complete.

Rain will be causing some delays in planting winter cereals. Canola plantings may be favoured by the good break and the recent lift in prices. Chickpeas and faba bean plantings will be higher across the northern cropping belt. Some pastures needed to be replanted because of the impact of fall army worm.

NSW has contrasting conditions with wide areas needing rain to fill moisture profiles for optimised sowing conditions in central NSW. The rainfall has been very isolated and running in bands with the central Tablelands, Forbes into Mudgee and then into Dunedoo and Merriwa needing more sowing rain. Rainfall predicted this week could alleviate this.

Whereas other areas including northwest NSW have seen significant rain events of up to 45mm, delaying harvesting and sowing.

GIWA reports in its April crop report that most growers have either turned a wheel in the last week or will do so during the week leading up to Anzac Day. Apart from some canola and oats in the Hyden area sown into moisture and isolated pockets of canola further north, it is all dry sowing. With no rain on the horizon, it looks like at least a couple more weeks of dry sowing is ahead. This is not unusual for Western Australia and is not necessarily a precursor to a poor year, however, the extremely dry soil profiles are a concern and have put a dampener on the start to the 2024 growing season.

Table shows 2024 season GIWA April WA crop area estimates in hectares.

Table shows 2024 season GIWA April WA crop area estimates in hectares.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.

Read previous reports

Cropping update - April 2024

Cropping update - March 2024

Cropping update - February 2024