The market for slaughter ready cattle stabilised over the past few weeks after significant volatility in April – a result of large offerings and a succession of short processing weeks. This is a show of market strength in the face of heavy supplies - slaughter in the week ended 3 May was the highest weekly slaughter since 2021.

This chart shows Australian weekly cattle slaughter this year versus last year and the 5 year average.

This chart shows Australian weekly cattle slaughter this year versus last year and the 5 year average.

International beef prices are meeting consumer demand resistance and have stalled the past month. Cow processing margins remain solid and should underpin firm local cow prices, however, processing margins for heavy steers are easing which may see prices topping our near term.

While the market for slaughter ready cattle is holding, southern restocker cattle are trading well below year ago levels and at a solid discount to northern values, reflecting the variance in pasture conditions from north to south. Northern restocker buying activity should support southern values in the months ahead.

Strong processing margin underpin cows, Chinese market holds the key

While off their highs earlier in the month, cow beef export prices remain strong underpinned by a shortage of lean beef in the US. This should ensure firm local processing demand for cows and underpin cow values. With northern turn-off ramping up, some processors will look to add extra shifts as there is plenty of cattle ahead of them.

China could hold the key to the medium-term direction of manufacturing beef prices. Chinese demand is keeping cheap South American beef out of the US market. Any slowing in demand from China could result in increased competition in the US market from South American suppliers. The 22 per cent (pc) increase in Chinese beef imports through Q1 2024 has largely been supplied by Brazil and Argentina and Uruguay. Australian exporters have favoured the higher value US market, with Australian exports to the US almost doubling in the first 4 months of 2024, while our beef exports to China were up just 6 pc.

There is talk that the Chinese ban on 8 Australian export abattoirs stemming from a trade spat in 2020 may be lifted.

This chart shows the Australian saleyard cow indicator price vs 90CL US cow beef export price.

This chart shows the Australian saleyard cow indicator price vs 90CL US cow beef export price.

This chart shows a proxy index of the cow processing margin.

This chart shows a proxy index of the cow processing margin.

Australian cow market indicators c/kg w

| 16 May | +/- week | +/- month | +/- year | |

| 90CL cow beef export price | 919 | - 31 | n/c | + 127 |

| AUST | 442 | + 10 | - 38 | - 5 |

| QLD | 434 | + 30 | - 18 | + 10 |

| NSW | 440 | + 10 | - 42 | - 2 |

| VIC | 456 | - 8 | - 52 | - 50 |

| TAS | 302 | + 14 | - 56 | - 182 |

| SA | 446 | - 38 | - 48 | - 36 |

| WA | 348 | - 4 | + 6 | - 132 |

The table shows the cow saleyard indicator price for each state against last week, last month and last year. Source: MLA

Fed beef prices meeting resistance amid heavy US feedlot supplies

US feedlotters are front loaded with market ready cattle and may have to discount prices to get sluggish demand (high prices and cost of living pressures) moving. In our last report we suggested that strength in the manufacturing beef sector may flow into fed beef cut-out values. This hasn’t been the case, with grinding beef prices easing off near record levels.

While US lean beef supply has reduced considerably (-20 pc) this year, feedlot beef supply is +4 pc. Prices for Australian heavy steers may be topping out as local processing margins contract.

Southern processors were reportedly active in northern markets this week as the supply of market ready cattle in the south shortens up seasonally. This forced southern QLD processors to lift rates 10 to 20c/kg for grassfed heavy steers to 520 to 530c/kg with VIC/NSW processors willing to pay 30c/kg freight to get cattle home, given OTH quotes in southern markets at 560 to 570c/kg.

The mild autumn has delayed the northern turnoff, but a few frosts might solve this as will a return of industry ‘focus’ after Beef Week. In contrast to southern QLD markets, direct to works quotes were trimmed a little in central QLD.

This chart shows the heavy export steer saleyard indicator price vs the US beef cut-out price in Ac/kg which is a proxy for our north Asian beef export price.

This chart shows the heavy export steer saleyard indicator price vs the US beef cut-out price in Ac/kg which is a proxy for our north Asian beef export price.

This chart shows a proxy index of the heavy steer processing margin.

This chart shows a proxy index of the heavy steer processing margin.

Australian heavy steer market indicators c/kg lw

| 16 May | +/- week | +/- month | +/- year | |

| North Asian export indicator price c/kg | 962 | - 9 | - 39 | + 33 |

| AUST | 557 cw | + 27 | - 12 | - 10 |

| QLD | 308 | + 51 | + 34 | + 25 |

| NSW | 301 | + 9 | - 3 | + 5 |

| VIC | 311 | - 1 | - 12 | - 11 |

| TAS | 243 | + 20 | + 31 | - 16 |

| SA | 294 | - 2 | - 26 | - 76 |

| WA | 228 | + 5 | + 21 | - 68 |

The table shows the heavy weight steer saleyard indicator price for each state against last week, last month and last year. Source: MLA

EYCI solid but southern markets detach

The Eastern Young Cattle Index (EYCI) which measures a basket of young cattle types (store, feeder & processor ready) has traded in a narrow range since the end of April as supplies ease seasonally. The dry autumn experienced across Southern Australia can be seen in the detachment of these markets to the EYCI. The chart below which measures cattle indicators across each state against the EYCI, shows these markets detaching from the EYCI around the end of 2023, with WA cattle attracting the heaviest discount.

The lack of early autumn rain is going to make it difficult winter for producers in these areas.

This chart shows the Eastern Young Cattle Index (EYCI) vs number of cattle in calculation of the EYCI.

This chart shows the Eastern Young Cattle Index (EYCI) vs number of cattle in calculation of the EYCI.

This chart shows the EYCI vs state feeder steer price indicators.

This chart shows the EYCI vs state feeder steer price indicators.

EYCI c/kg cw

| 16 May | +/- week | +/- month | +/- year | |

| AUST | 605 | n/c | - 21 | - 12 |

| QLD | 601 | - 3 | - 22 | - 21 |

| NSW | 612 | + 2 | - 12 | n/c |

| VIC | 558 | + 10 | - 22 | - 67 |

| SA | 548 | n/c | + 87 | - 150 |

| WA | 510 | - 8 | - 10 | - 154 |

The table shows the EYCI (QLD, NSW, VIC) and the feeder steer (SA&WA) saleyard indicator price for each state against last week, last month and last year. Source: MLA

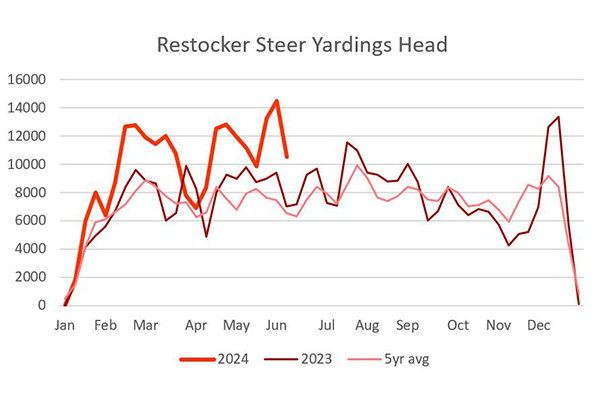

Traders to support southern restockers

The restocker market is a tale of two halves with solid values in the north but much weaker in the south.

There is a scramble for tight hay supplies from Tasmania, southwest Victoria and SA. Up to 10 B-double loads of hay are being sent weekly to Hamilton Vic, while some producers in this area are choosing to offload livestock – there is a large yarding of 1,200 pencilled in for the next Hamilton store sale. Weak prices for southern restocker cattle should see increased buying activity from northern buyers who are enjoying much better seasonal conditions.

The Elders restocker cattle index shows that restocker cattle represent value buying with store quality cattle at a solid discount to feeders.

This chart shows the Victorian state indicator price for restocker cattle vs feeder cattle.

This chart shows the Victorian state indicator price for restocker cattle vs feeder cattle.

Graph shows Elders restocker strength index.

Graph shows Elders restocker strength index.

Restocker steer indicator c/kg lw

| 16 May | +/- week | +/- month | +/- year | |

| Aust | 330 | - 1 | - 18 | - 24 |

| QLD | 336 | + 1 | - 17 | - 23 |

| NSW | 316 | - 2 | - 30 | - 22 |

| VIC | 281 | + 45 | + 13 | - 32 |

| SA | 257 | - 23 | + 11 | - 108 |

| TAS | 199 | n/c | - 22 | - 101 |

| WA | 138 | - 60 | - 84 | - 166 |

The table shows the restocker steer saleyard indicator price for each state against last week, last month and last year. Source: MLA

Sources: Price data reproduced courtesy of Meat & Livestock Australia Limited.

The information contained in this article is given for the purpose of providing general information only, and while Elders has exercised reasonable care, skill and diligence in its preparation, many factors (including environmental and seasonal) can impact its accuracy and currency. Accordingly, the information should not be relied upon under any circumstances and Elders assumes no liability for any loss consequently suffered. If you would like to speak to someone for tailored advice relating to any of the matters referred to in this article, please contact Elders.